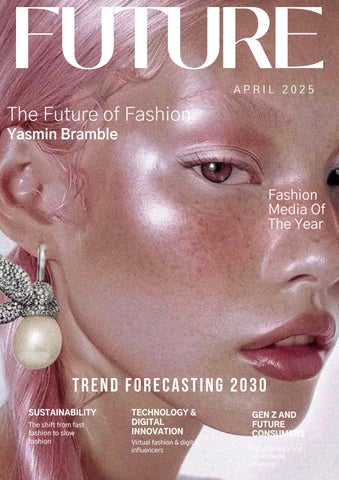

C O N T E N T S

C O N T E N T S

The purpose of this report is to explore the future of fashion by forecasting key trends expected to shape the industry by 2030 In an increasingly fast-paced and digitally driven environment, trend forecasting has become a critical tool for brands, retailers, and creatives to stay ahead of consumer demands, market shifts and cultural evolution. This report aims to identify emerging changes across the fashion landscape and provide insights that will help businesses remain competitive and innovative over the next decade

The analysis focuses on four core themes: Consumer behaviour, technological advancement, sustainability and the evolution of retail. Understanding how consumers will think, shop, and engage with fashion is key to predicting future trends. The rise of conscious consumption, digital fashion experiences, and demand for inclusivity is already affecting the traditional model Technology, from AI and AR to virtual clothing and blockchain, is expected to transform design, production, and the consumer journey. Simultaneously, sustainability will no longer be optional; regulations, climate pressure, and ethical expectations will make circular models, biodegradable materials, and supply chain transparency the norm. Finally, retail is evolving into an experience- led omnichannel ecosystem where physical and digital merge seamlessly.

To explore these themes, this report uses both primary and secondary research. Primary research includes a survey to capture consumer expectations Secondary sources involve trend reports, academic literature, and market data to give context and support findings.

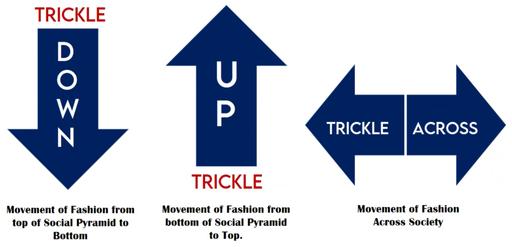

A range of theoretical frameworks have been applied to structure the research. The Trickle- Down, Trickle-Up and Trickle-Across theories help explain how fashion trends spread across different demographics and markets. A PESTLE analysis assesses the external forces likely to influence the industry. Porters Five Forces is used to evaluate future competition and market dynamics. The Consumer Decision-Making Process model explores how purchasing habits may evolve. Finally, the Fashion Cycle theory is applied to understand how trends may rise and fall in a hyper connected, digital world.

Together, this research provides a snapshot of where fashion is heading, and the strategies brands will need to adopt to stay relevant by 2030.

02 02 02

Technology will be one of the most disruptive and defining forces shaping the fashion industry by 2030. Rapid advancements in AI, virtual fashion, and immersive retail experiences are transforming how consumers discover, interact with, and purchase fashion. These innovations are not just enhancing operational efficiency but also directly influencing consumer behaviour and reshaping the competitive landscape.

AI- driven trend forecasting is becoming increasingly accurate and essential. Platforms like WGSN are already using predictive analytics to forecast future consumer preferences with high precision, allowing brands to design and produce more efficiently and sustainably (WGSN, 2023). McKinsey & Company (2022) highlights how AI tools are being integrated into design and merchandising, enabling companies to respond faster to market shifts while reducing waste. This automation is enhancing creativity and helping brands stay ahead in a fast-paced environment

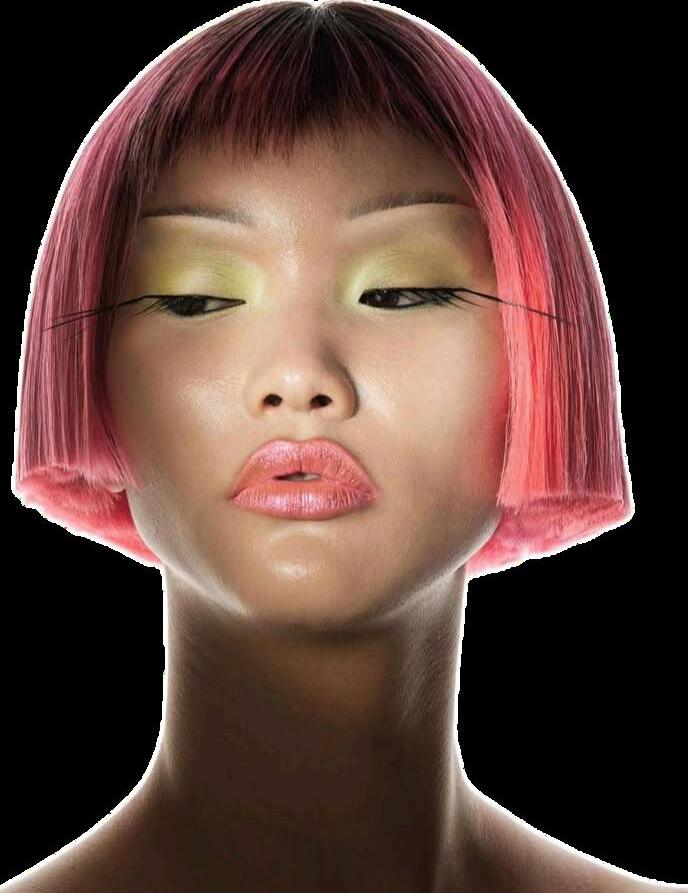

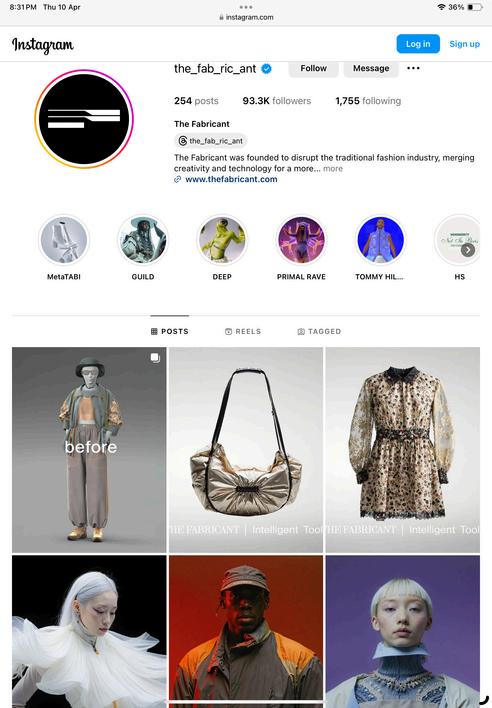

Virtual fashion and digital influencers are also emerging. Digital garments worn in virtual environments, such as on Instagram or in the metaverse, are gaining traction - especially among Gen Z and Gen Alpha. Platforms like DressX and The Fabricant are pioneering this movement, proving that fashion consumption is no longer limited to physical garments.

“47%OF CONSUMERSARE INTERESTEDIN DIGITAL CLOTHESWITH 87%HAVING ALREADY PURCHASED SOMEFORMOF DIGITAL FASHION.”

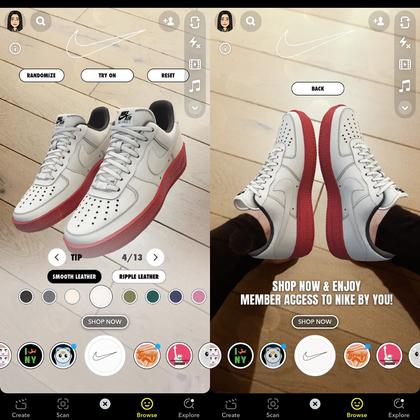

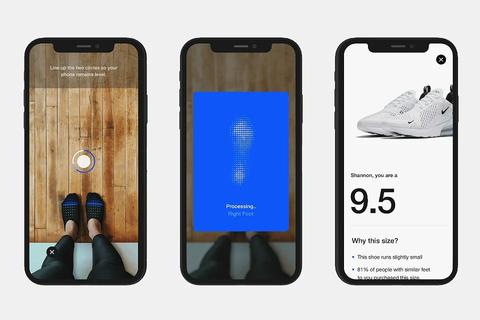

g y ( ) and AI-powered retail experiences are reshaping the shopping journey. Brands such as Nike (pg 11) have invested in immersive AR shopping features, while Amazon uses AI to personalise the user journey - from product recommendations to virtual try-ons (Forbes, 2030) These innovations reflect growing demand for seamless, hyper personalised retail experiences that reduce uncertainty and drive conversion.

This shift aligns with the Consumer Decision-Making Process model, where consumers are moving from problem recognition to purchase more fluidly due to digital tools that enhance evolution and reduce postpurchase dissonance. Porters Five Forces highlights how buyer power is pressuring brands to offer personalised, tech-driven experiences. The rise of AI and digital fashion is a direct response to consumers expecting more control, choice and relevance in their fashion interactions. Brands that fail to adapt risk being outpaced by more agile, tech-enabled competitors.

D I G I T A L R E T A I L D O M I N A N C E

ike is redefining how fashion brands interact with consumers and maintain relevance in an increasingly competitive market. Using advanced technologies to strengthen its direct-toconsumer (DTC) strategy, personalise retail experiences, and enhance consumer trust By integrating AI, AR and blockchain technology, Nike has become a leader in digital innovation within the fashion and sportswear industry.

One of Nike’s most significant advancements has been its shift towards DTC, which enables the brand to establish deeper consumer relationships and gather real-time behavioural data. The Nike Membership platform, combined with the SNKRS app and Nike Live stores, allows the company to offer tailored product recommendations, early access to exclusive releases, and location-based experiences (Nike, 2022) This approach strengthens customer loyalty and supports long-term brand engagement, essential in an era where consumer attention is increasingly dismissed Nike has also leveraged AR and AI to enhance the in-store and online shopping experience Through features such as Nike Fit, which scans a user’s feet to recommend the most suitable size and model, the company reduces uncertainty and product returns (CNBC, 2023). Additionally, virtual try-on tools provide immersive retail experiences that align with evolving consumer expectations for convenience and interactivity.

In the resale-heavy landscape of 2030, authenticity is important. Nike leverages blockchain tech to tag sneakers with digital certificates of ownership, cutting down on counterfeits and fuelling the resale economy Through partnerships with marketplaces, verified provenance will now be a standard - protecting brand value and consumer trust.

Nike’s dominance in AI-powered retail gives it a competitive edge over newer DTC disruptors. Its ability to seamlessly integrate emerging tech with brand loyalty and scale is why it continues to lead the global market As shown through Porters Five Forces, Nike’s digital innovation is a key defence against increasing buyer power, DTC saturation and aggressive competition.

By 2030, sustainability will no longer be a niche it will become the default. Consumers are moving away from fast fashion and choosing brands aligned with ethical production, environmental accountability and circular systems.

This shift is mirrored by industry-wide transformations, with second-hand rental, and regenerative models becoming mainstream. Platforms such as ThredUP have reported that the global second-hand market is expected to double in value by 2030, reaching $350 billion (ThredUp, 2023). Similarly, fashion rental platforms like HURR and By Rotation are gaining traction, especially among younger consumers who value access over ownership. Meanwhile, regenerative practices - from carbon-neutral production to compostable materials - are reshaping how garments are designed, produced, and disposed of.

Transparency has also become non-negotiable Consumers increasingly expect brands to provide detailed supply chain information, fair labour practices, and measurable sustainability goals. A 2023 McKinsey & BoF report found that 66% of consumers globally want more information about a products environmental impact before purchase (McKinsey & BoF, 2023)

These changes can be understood through the Fashion Life Cycle theory, where traditional short product cycles are being replaced by longer-lasting, circular designs. Additionally, the Zeitgeist Theory offers a deeper explanation, reflecting how todays cultural mood - shaped by climate anxiety, social justice movements, and anti-waste mindsets - is directly influencing consumer values and fashion consumption patterns.

In 2030, Gen Z will represent over 30% of global consumers, driving radical change in how fashion is marketed, designed, and sold (McKinsey, 2023) Raised in a fully digital world, this generation’s fluency in technology and social media reshapes the path to purchase. Social commerce platforms such as TikTok Shop and Instagram Checkout are now major retail channels, with data from Statista showing that more than 50% of Gen Z purchased directly via social media in 2024.

Digital influence isn’t just about convenience it’s about culture. Influencers, creators, and peer communities hold more sway than traditional advertising. Micro-influencers and UGC (usergenerated content) are considered more authentic, reflecting a deep desire among Gen Z for realness over perfection. Brands like SKIMS have successfully captured this audience through inclusive campaigns, diverse casting and transparent messaging; building a loyal base that values representation and relatability over prestige (Vogue Business, 2024).

Luxury fashion, once considered inaccessible, is also adapting. Brands like ALAIA have gained Gen Z appeal through a mix of timeless design and digital-first storytelling (pg.17). Collaborations with stylists and creators, plus visibility on resale and archive platforms, have made heritage luxury feel current and culturally relevant to younger audiences.

The Trickle-Across Theory helps explain this shift. In today’s media-saturated environment, trends move from elite to mass quickly - they spread laterally and instantly across all consumer segments through platforms like TikTok, where high fashion and streetwear are showcased side by side. This rapid diffusion creates a demand for brands to be agile, responsive, and culturally in touch.

As Gen Z continues to set new standards for brand values, communication and identity, the most successful fashion brands in 2030 will be those that engage with this and the new generations consistently.

ALAIA has been synonymous with minimalist elegance, and this continues to shape its future strategy. As the brand prepares for 2030 it is increasingly focusing on a tech-driven, sustainable vision while staying true to its heritage of timeless design. ALAIA’s approach combines innovation with craftmanship; integrating cutting edge technologies such as 3D printing and AI-design to create pieces that are both iconic and forward-thinking. This strategy enables the brand to streamline its production process, reduce waste, and meet the growing demand for personalised, high-tech luxury fashion. ALAIA’s future lies in blending minimalism with modernity, ensuring its designs resonate with a younger, tech-savvy audience while preserving its legacy.

On the other end of the spectrum, ZARA is positioning itself as a leader in sustainability, as well as introducing tech features into their stores, embracing the circular economy as a core pillar of its strategy for 2030. The brand has committed to reducing its environmental footprint by promoting the reuse, recycle and repurposing of materials ZARA is working towards creating clothing lines using sustainable fabrics and implementing close-looped systems, where products can be fully recycled or upcycled at the end of their life cycle. This focus on circularity not only aligns with consumer expectations but also helps ZARA stay competitive in a mass-market andscape increasingly focused on sustainability By embedding eco-conscious practices into its operations, ZARA is ensuring its relevance well into the next decade.

This report has explored the shifts set to reshape the fashion industry by 2030, spotlighting four key drivers: digital innovation, evolving consumer behaviour, sustainability and the transformation of retail. Across all findings, it shows that to be the most successful in the future of fashion, brands will have to embrace change, advocate authenticity and move with cultural momentum rather than against it.

From the rise of AI-driven personalisation to the mainstreaming of circular fashion systems, the future fashion landscape demands more than trend adoption and needs strategic reinvention Gen Z and Gen Alpha will continue to redefine what fashion means, expecting brands to be tech integrated, led by values and transparent. Retail will not be a place but an experience blending the digital with the physical in personalised ways. Meanwhile, brands that fail to build sustainability into their DNA risk cultural and commercial irrelevance

Looking ahead, trend forecasting must evolve into a more predictive model using technologies like quantum computing (MIT Tech Review, 2024), using bio fabrications with companies exploring lab-grown materials that reduce environmental impact (Forbes, 2023), and Neuro designs (Dezeen, 2024) which will allow brands to better anticipate consumer behaviour and streamline production and design.

At the same time, the growing influence of fluid identities-across gender, culture and expression - demands that fashion reflects deeper inclusivity in marketing and in production development (WGSN,2024) As well, the rise of digital ownership through NFTs and virtual fashion - will reshape how we assign value to garments, both online and offline (BoF,2024)

Overall, fashion in 2030 isn’t just about clothes - it’s about culture and connection, with only those who build community and pushing boundaries that will thrive.

Investintechinfrastructure to staycompetitiveintheAI market

pRethinkproductdesignand roductionwithcircularity atthecore

Prioritiseauthentic, inclusivestorytelling thatresonateswiththe nextgeneration consumer

Buildflexible, omnichannelretail ecosystemsthat areasimmersive astheyare accessible