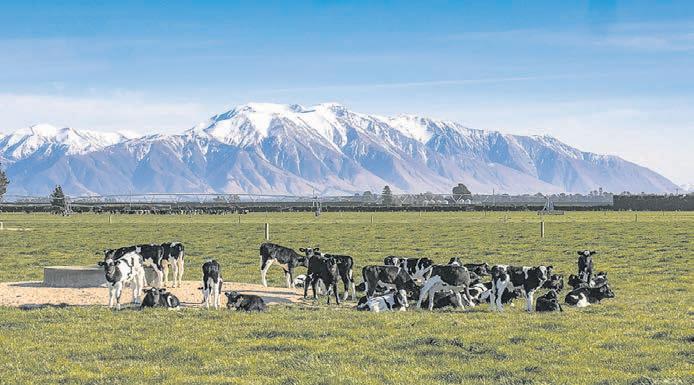

SHEEP and beef farm profits are forecast to transform from among the lowest in 40 years to two of the best years.

Beef +Lamb New Zealand’s new season outlook says continued global supply shortages will keep beef and lamb prices elevated for at least the coming year. It will be a remarkable transformation for the sector.

In 2023-24, 40% of farmers made a loss and the average farm profit before tax was just $18,914, cited as the toughest year since the 2007-08 global financial crisis.

This year BLNZ is forecasting an average farm profit before tax of $138,600, rising to $166,500 next year.

Inflation has eroded some of that spending power and the report forecasts expenditure to increase 2.8% to $615,700 per farm, a slower rate than revenue growth.

Guy Melville, who farms the 1100 hectare Puketotara Station near Huntly, has a list of “to do” items that will easily soak up any increase in income.

Fencing, applying fertiliser, riparian planting and a new roof for a cottage will account for any cash left over after several lean years and rising costs.

“We’re getting the business back

Neal Wallace NEWS Sheep and beef Continued page 3

up and running so we are ready for the next hurdle,” he said.

He notes that high livestock prices have traditionally been followed by a sharp drop and also wonders if high meat prices will prompt consumers to look for cheaper alternative protein.

AgriHQ senior analyst Mel Croad cannot recall BLNZ forecasts of $10/kg or more for lamb.

A year ago lamb was worth $7.20/kg. Today it is $10.25-$10.35/ kg.

These prices are driven by strength in our traditional United States, European and United Kingdom markets, while China remains relatively sedate, although still a key outlet for certain cuts.

“We are nowhere near as reliant on China as we once were and it will be a bonus if we see some upside in pricing,” Croad said.

She notes the BLNZ forecasts were based on a NZ-US dollar exchange rate of US63c, US4c above the average for 2024-25.

Exporters potentially could face some headwinds such as consumer resistance to high prices especially for lamb, considered a luxury item, and addressing excess processing capacity.

The BLNZ report forecasts a lift in per-head prices between 202324 and 2025-26 for lamb of $130 to $180, steer and heifer $1701 to $2151, cow $829 to $1056 and bull $1802 to $2269.

Tasman farmers Andrew Fry and his father Kevin say productive land on their farm was overrun by the raging Motupiko River earlier this year. Paddocks were left littered with tonnes of rocks, gravel and silt, fences were ripped out and sheds engulfed in water.

Claims new national plant biosecurity centre is a white elephant.

3

Shirley-Ann and Rick Mannering run a productive dairy, sheep and beef operation near Auckland, where they’ve also started an ecological revolution – with traps, tech and a full-time farm ranger.

DAIRY 20-27

Govt slammed over plans to cut agribusiness from school curriculum.

9

Facebook is quietly limiting our movements, says Ben Anderson.

OPINION 19

Bryan Gibson | 06 323 1519

Managing Editor bryan.gibson@agrihq.co.nz

Craig Page | 03 470 2469 Deputy Editor craig.page@agrihq.co.nz

Claire Robertson

Sub-Editor claire.robertson@agrihq.co.nz

Neal Wallace | 03 474 9240

Journalist neal.wallace@agrihq.co.nz

Gerald Piddock | 027 486 8346

Journalist gerald.piddock@agrihq.co.nz

Annette Scott | 021 908 400 Journalist annette.scott@agrihq.co.nz

Hugh Stringleman | 027 474 4003

Journalist hugh.stringleman@agrihq.co.nz

Richard Rennie | 027 475 4256

Journalist richard.rennie@agrihq.co.nz

Nigel Stirling | 021 136 5570

Journalist nigel.g.stirling@gmail.com

PRODUCTION

Lana Kieselbach | 027 739 4295 production@agrihq.co.nz

ADVERTISING MATERIAL

Supply to: adcopy@agrihq.co.nz

SUBSCRIPTIONS & DELIVERY

0800 85 25 80 subs@agrihq.co.nz

PRINTER

Printed by NZME

Delivered by Reach Media Ltd

Andy Whitson | 027 626 2269

Sales & Marketing Manager andy.whitson@agrihq.co.nz

Janine Aish | 027 300 5990

Auckland/Northland Partnership Manager janine.aish@agrihq.co.nz

Jody Anderson | 027 474 6094

Waikato/Bay of Plenty Partnership Manager jody.anderson@agrihq.co.nz

Palak Arora | 027 474 6095

Lower North Island Partnership Manager palak.arora@agrihq.co.nz

Andy Whitson | 027 626 2269 South Island Partnership Manager andy.whitson@agrihq.co.nz

Julie Hill | 027 705 7181

Marketplace Partnership Manager classifieds@agrihq.co.nz

Andrea Mansfield | 027 602 4925 National Livestock Manager livestock@agrihq.co.nz

Real Estate | 0800 85 25 80 realestate@agrihq.co.nz

Word Only Advertising | 0800 85 25 80 Marketplace wordads@agrihq.co.nz

Dean and Cushla Williamson Phone: 027 323 9407 dean.williamson@agrihq.co.nz cushla.williamson@agrihq.co.nz

Farmers Weekly is Published by AgriHQ PO Box 529, Feilding 4740, New Zealand Phone: 0800 85 25 80 Website: www.farmersweekly.co.nz

ISSN 2463-6002 (Print) ISSN 2463-6010 (Online)

ONLINE: Hawke’s Bay farmer Ingrid Smith has built an online business selling makeup, helping to supplement the farm income as she and her husband build equity and work towards their ultimate goal of farm ownership.

P10

Alliance will hold 24 shareholder meetings in nine days to discuss the proposed capital raise involving Irish company Dawn Meats.

The meetings start in Tuatapere, Southland, on September 29. The roadshow heads as far north as Dannevirke before ending in Middlemarch in Otago on October 14. There are 20 meetings in the South Island and four in the North Island.

The New Zealand Merino company has returned to profitability, reporting a net profit after tax of $160,000 for the year to June – reversing the $3.29 million loss of a year earlier.

The improved result reflected an earnings before interest and tax (EBIT) of $1.23m, up $3.86m on 2024, which, according to a company statement on the Unlisted Exchange, was driven by supply-chain improvements and cost management.

After a two-year break, Future Beef NZ is relaunching the Hoof and Hook competition in 2026 – an event organisers say is vital for nurturing the next generation of beef industry leaders.

The event, hosted by the Stratford showgrounds, combines practical stock handling and judging with a variety of educational modules to give youngsters aged eight to 25 the opportunity to learn more about the beef industry.

Two months after 2025 Young Farmer of the Year Hugh Jackson lifted the trophy in July, preparations are already underway for the next round in the competition.

Registrations are now open for the FMG Young Farmer of the Year Season 58 district contests.

Marking the start of one of New Zealand’s most iconic agricultural competitions, they will take place in October and November 2025.

Richard Rennie NEWS Horticulture

ASTATE-of-theart national plant biosecurity centre planned by the Ministry for Primary Industries for Auckland has been slammed by industry players and labelled a white elephant, as its foundation concrete is poured.

Estimated to cost between $500 million and a billion dollars, the Mount Albert based Plant Health and Environment Capability (PHEC) facility is hailed by Crown Infrastructure Delivery as a piece of critical investment in New Zealand’s biosecurity and horticulture future.

The multimillion-dollar project had a relatively low profile amid a rash of project announcements made by Infrastructure Minister Chris Bishop in late July. But claims about whether the centre is fit for purpose are swirling just as it passes a cabinet business case test. The centre is scheduled for completion by 2029.

The claims come as the horticultural sector also raises concerns over governmentimposed costs and delays it says limit the sector’s ability to meet

Continued page 1

BLNZ chair Kate Acland attributed the turnaround to improved confidence and reinvestment due to lower interest costs, strong livestock prices, better seasonal conditions and more fertiliser applied in 2024-2025.

However export volumes are picked to fall this year, with lamb back 1.5%, mutton 3.8% and beef 1.5%.

Acland said there are still global headwinds and risks.

The 15% tariff on all NZ exports into the US could strip nearly $500 million from red meat sector earnings each season.

We have had no problems running the offshore model with potatoes. It would be easy to replicate.

Chris Claridge Potatoes NZ

the goal of doubling export values within 10 years.

Chris Claridge, plant geneticist and ex-CEO of Potatoes NZ, told Farmers Weekly that NZ has

Acland said there are also unknowns from the global fallout from protectionist trade policies from the US, and China’s economy continuing to struggle.

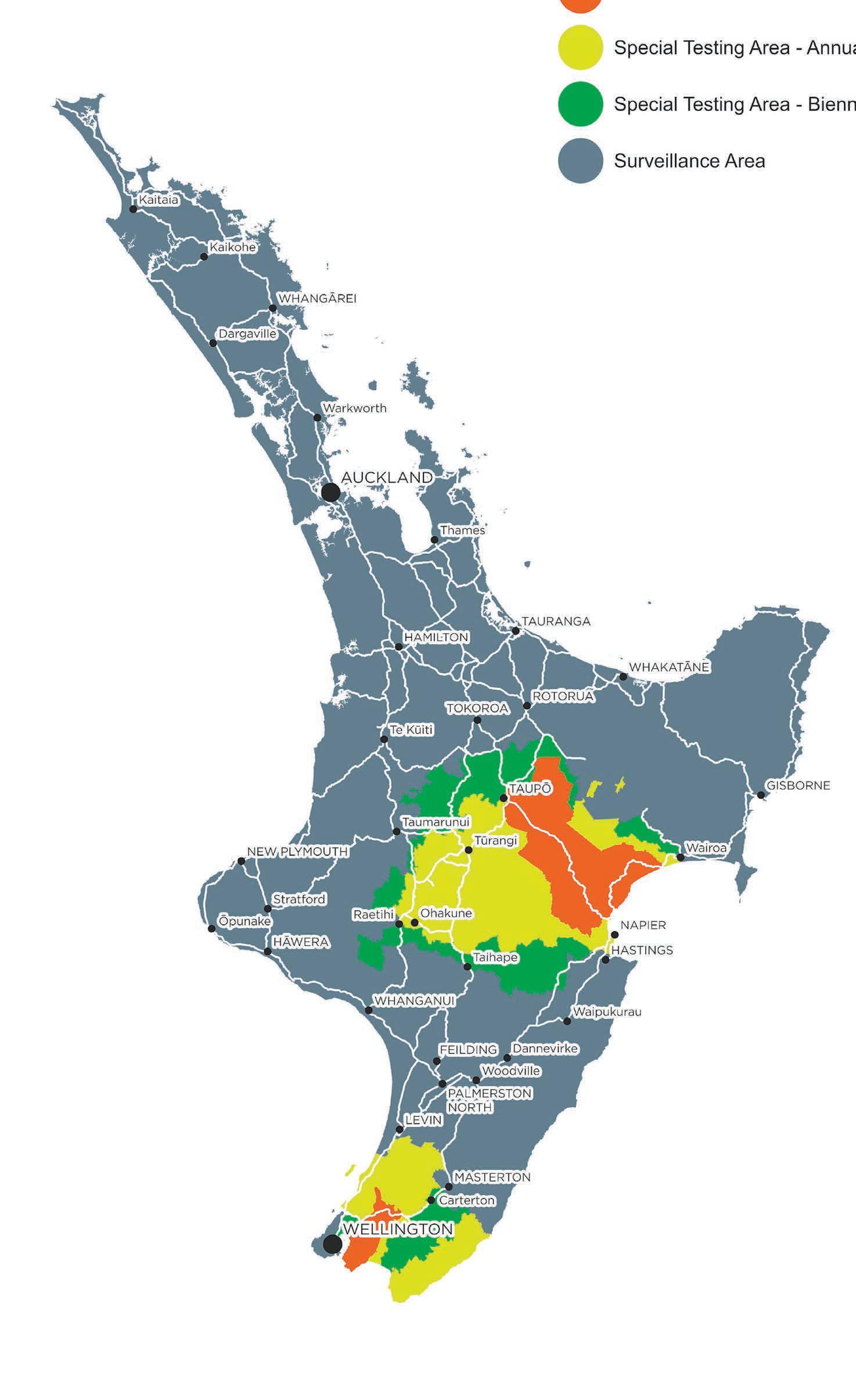

The US lamb industry is pushing for higher tariffs on NZ imports, while Chinese authorities are undertaking a safeguard investigation into our beef imports, assessing whether they are damaging domestic production.

Other risks include a stronger forecast for the NZ dollar and the continued loss of productive farmland to carbon forestry.

“Tariffs, currency swings, and ongoing land-use change to

effectively shut the gate on new plant material imports, such are the challenges of bringing material in.

He said the PHEC will do little to change that, instead imposing a significant capital and operating cost burden on the industry, and NZ.

But Biosecurity NZ deputy director-general Stuart Anderson said the agency is committed to delivering a world-class facility to strengthen New Zealand’s biosecurity system, covering needs for the next 50 years.

forestry could all chip away at the gains,” said Acland.

Alliance Group’s global sales director, James McWilliam, said the subdued Chinese market is entering a traditional peak consumption period and exporters will get a clearer picture of demand.

“The European Union market is strong but has likely reached its peak, while United Kingdom demand is firm as retailers secure leg supply for Christmas and Easter 2026.

“North America remains solid, despite tariffs, and the Middle East is showing gradual improvement.”

“We are not simply planning for the next incursion or today’s growers,” he said.

“The new facility at Mt Albert is required because MPI’s existing Plant Health and Environment Laboratory (PHEL) and Post Entry Quarantine (PEQ) facilities are nearing the end of their useful life and constrain our ability to meet growing biosecurity demands and manage large, complex incursions.”

He also pointed out the post entry quarantine aspect of the facility for high value crop importation is likely to be only 10% of its overall build cost.

“The main function of the new facility is providing enhanced diagnostic testing for plant pests and diseases to support surveillance and response activities, and trade assurance.”

The bulk of the cost is incurred through structural and mechanical features like airtight containment and pressure areas, all used to support surveillance and response to disease outbreaks.

But Claridge said this does not necessarily mean a facility of this scale is required for quarantine here.

He pointed to the system Potatoes NZ uses as a more streamlined, low-cost and equally safe

pathway to bring in new varieties into NZ for commercialisation.

“Potatoes NZ found the pathway to new germplasm throttled by MPI’s approach.

“To get around it we got an offshore germplasm facility to bring in safe tissue culture for our growers here.”

That facility is the United Kingdom Potato Quarantine Unit, based in Scotland.

“We spend between $30,000 and $50,000 every few years for accreditation. And that is compared to $500 million on an entire new facility here.

“We have had no problems running the offshore model with potatoes. It would be easy to replicate – you’d have to ask why has it not?”

Anderson agreed a Potatoes NZtype offshore quarantine system could be replicated by other plant types, if biosecurity measures are met.

In response to industry concerns over the high quarantine costs, he said such centres are expensive to operate and MPI’s prices reflect the costs of providing the services. Even at $6500 per greenhouse per month, MPI is not fully recovering those costs.

MORE: See page 8

Neal Wallace NEWS Forestry

THE government says continued large-scale conversion of farmland to forestry will end when new regulations come into effect on October 31.

Forestry Minister Todd McClay said this year’s plantings were the tail effect of properties bought and consented before the government tightened restrictions last December.

“Transitional exemptions mean some of those projects can still proceed, which is why conversions are visible in places,” he said.

Legislation will be passed in the next month and take effect from October 31 2025.

But Beef+Lamb New Zealand and the Meat Industry Association are not convinced.

Their joint submission before the Environment Select Committee on forestry conversions earlier this year estimated that a further 50,000 hectares of farmland could be converted before the new rules come into effect.

The new regulations place a moratorium on whole-farm

forestry conversions on land use Classes 1-5 land and establish an annual ballot to allocate a 15,000ha quota of planting on Class 6 land.

There are no restrictions on Class 7 or Class 8.

A ballot to allocate the 15,000ha quota is scheduled for mid-2026.

BLNZ and MIA submitted that the 15,000ha quota is just 6713ha less than the 21,713ha average converted for each of the past eight years.

We are planting away our future.

James Hunter Hawke’s Bay

Hawke’s Bay farmer James Hunter said New Zealand is covering the core of its sheep and cattle breeding country in pine trees.

“We are planting away our future, destroying the ability to settle families because of the price of land and we have locked out young people from a farming future.

“What are we doing?”

He knows of investors buying a farm, planting it in trees and

selling it a year later to foreign buyers as an established forest, doubling their money in the process.

This leaves neighbours to deal with pests and the risk of fire and no one to contact, said Hunter.

“When a fire escapes, who pays for it, who bears the cost?”

A Land Information NZ spokesperson said it is investigating one case where a New Zealander may have bought land with the financial backing of an overseas investor.

It is aware of the risk of farms being bought for planting in forestry with offshore financial backing, but whether that would be a breach of the Overseas Investment Act depends on the circumstances.

“The key is whether the New Zealander is an associate of an overseas person, as both overseas persons and their associates need consent under the Act.”

Requiring an associate to get consent prevents an overseas person from circumventing the Act by having a third party, normally a New Zealander, buy on their behalf, the spokesperson said.

Between 2011 and 2025, 157 foreign buyers bought 118,133ha

of existing forestry or farmland for planting in forestry.

Fire and Emergency New Zealand national manager for risk reduction, Morgana Te Pauae, said while landowners have the legal responsibility for fire risk, the fire service works with forest owners to manage their fire risk.

That includes the development and amendment of fire plans which are consulted on publicly and tailored to each local area.

Formal agreements set out shared responsibilities and resource commitments during fire events.

The Fire and Emergency New Zealand Act 2017 does not provide for general cost recovery and there are no plans to review this.

This week’s poll question:

Do the impending changes to regulations on farmland forestry planting go far enough?

Have your say at farmersweekly.co.nz/poll

Staff reporter NEWS Land

PĀMU has unveiled a new equity partnership initiative to help create pathways to farm ownership for young farmers.

The country’s largest farmer is now taking expressions of interest for Mahiwi Farm, a 708-effective hectare medium-rolling hill country farm 35 minutes west of Wairoa.

The partnership would require a minimum investment of $250,000 to be considered, with details of the role – including the partnership structure, terms and expectations for both parties –open to negotiation.

With Mahiwi being Crownowned land, Pāmu cannot sell an interest in it; but the partner would grow their equity through the income generated on the farm

Pāmu CEO Mark Leslie said it is more than just a farm opportunity.

“It’s a strategic shift in how we support the next generation of livestock farmers. Mahiwi represents our commitment to unlocking equity pathways and backing high-performing operators with real skin in the game.

“Mahiwi offers a strong balance of breeding and finishing country and scope for improved performance. This model is about empowering skilled operators to take the reins, build equity, and shape the future of farming with

accountability and ambition.”

The equity partnership for livestock comes after last year’s introduction of contract farming options for dairy farmers, including sharemilking and contract milking, across four farms: Quarry and Otago in the Central Plateau, Waimakariri in Canterbury, and Ruru on the West Coast.

Mahiwi is the first livestock farm being offered up by the stateowned farmer under this model.

The farm is 1755ha in total,

runs 7000 stock units and has 90 paddocks averaging 7.9ha each.

The farm currently runs as a breeding-finishing farm with 3500 ewes and 650 beef cows, wintering 10 stock units per hectare. Its infrastructure includes houses, a woolshed, two sets of cattle yards and one satellite set, one set of sheep yards and three satellite sets, reticulated water system across 70% of the farm and a central lane running through the property.

Fiona Terry NEWS Weather

WHENEVER it rains, Jason Diack and wife Maree watch the Motueka River take more of their land. It now runs for 300m through their property, instead of along the boundary, and fields that were previously prime grazing are now unusable.

“Before the floods, you’d get well over 100 bales of winter feed from one of the lower paddocks and you could have landed an airplane on it, it was that flat, not a stone to be seen,” said Diack.

“Now, what hasn’t washed away is unusable, buried underneath rocks, sand and gravel.”

Their farm was one of those severely impacted by the two Tasman flood events of June and July, which saw a State of Emergency declared.

Two months on and farmers across in the region are now juggling the clean-up with lambing and calving.

At the Diack’s 52 hectare

property in Kohatu, during the flood, 17-20ha was under water. Troughs and gateways disappeared and irrigation hydrants were destroyed.

Despite trying to lift his deer fencing – at times Diack was waist-deep in water – the force of the flooding destroyed 3.2km of it, including wiping out posts that had been standing solid for 43 years.

It was all very tidy before – we had fruit trees along the river ... we’d spent a lot of money down there but that’s all gone.

Jason Diack Kohatu

“Everything’s buggered,” Diack said.

“It was all very tidy before – we had fruit trees along the river, and I’d made banks and put up fences so stock couldn’t touch it – we’d spent a lot of money down there but that’s all gone, and land’s still being washed away.”

Dairy cows that used to graze the property needed relocating and the couple have 50 ewes in lamb, and 53 heifers and steers grazing, but luckily have some higher ground.

“We’re cleaning up bits as we can but replacing the deer netting alone will cost around $17k, and that’s without the posts.”

Volunteers from Lincoln University helped put up a temporary boundary fence and the couple have applied to the Ministry for Primary Industries for help with bulldozers and diggers.

“I’ve done what I can but it needs the big equipment so I’m hoping for some help with that otherwise the river’s going to keep chipping away and taking more.”

The Diacks aren’t alone, said Kerry Irvine, Federated Farmers Nelson president.

“In multiple places the river changed course through farms so people have lost land,” said Irvine.

“It’s literally been washed away. The clean-up will take years.”

Irvine’s farm boundaries the Motueka River and flooding on his property took fences and dumped debris in paddocks, but

he considers himself fortunate he didn’t lose land itself.

Now busy with lambing and calving on 700ha, with a lease block of 50ha, there’s little time for clean-up and repairs.

“It’s made stock management for those impacted much harder,” said Irvine, who runs 1000 ewes, 150 cattle and 200 winter trade lambs.

“Some of the fences aren’t there anymore and if they are they’re likely damaged or not stock proof.”

Federated Farmers was among those organisations contributing funds to the clean up effort, as

In multiple places the river changed course through farms so people have lost land.

Kerry Irvine Federated Farmers

were HortNZ, the government, and Rural Women New Zealand through its Adverse Events Relief Fund.

A Mayoral Fund reached $477,000 and saw 258 applications requesting help totalling $3.6m. The Primary Sector Recovery Fund of $340,000 saw 62 applications requesting help totalling nearly $2.6 million.

Top of the South Rural Support Trust has experienced an increase in people needing access to emotional support.

“Some are really struggling,” said chair Richard Kempthorne.

“We have a trained counsellor who is involved with several people and can help others coming through too.

“There is still a lot to do. The clean-up is happening gradually –it’s a matter of taking one bite at a time.”

Continued page 7

The latest Federated Farmers podcast, hosted by Ben ChapmanSmith, features an interview with me. You can listen to it here: fedfarm.org.nz/podcast

We discuss the challenge to maintain quality rural communications and journalism, especially in support of advocacy.

Our support for farmer-led, well-organised, membership-powered advocacy is as strong today as it was when we established our partnership with Feds nearly two years ago.

Unfortunately, we still see social media-powered noise masquerading as farmer advocacy, and there is still a disproportionate amount of attention given to the people behind those social media pages.

But social media is a powerful beast. Which is why the work we do is as important today as ever, if not more so.

Our team at Farmers Weekly is proud of the support we give to the farmers who invest their money into membership of Federated Farmers, and to the leaders who invest their precious time into running Federated Farmers at regional and national levels. The industry is better for it, and the hardworking farmers certainly are too.

Visibility of the Feds work has built trust at all levels, and it rewards those generous and courageous people leading Feds for the good work they do on behalf of their fellow farmers.

I hope you can find time to listen to the podcast, and then take up a voluntary subscription. The bright future of rural media depends on your support. It’s a team game.

I welcome your feedback.

Kind regards,

Dean Williamson – Publisher dean.williamson@agrihq.co.nz 027 323 9407

Start your voluntary annual subscription today. $120 for 12 months. This is a voluntary subscription for you, a rural letterbox-holder already receiving Farmers Weekly every week, free, and for those who read us online.

Choose from the following three options:

Scan the QR code or go to www.farmersweekly.co.nz/donate

Email your name, postal address and phone number to: voluntarysub@farmersweekly.co.nz and we’ll send you an invoice

Call us on 0800 85 25 80

Note: A GST receipt will be provided for all voluntary subscriptions.

Community events have helped buoy spirits. Local company

RePost has been supplying free fence posts, and a Rapid Relief team also donated fencing supplies. Supplement feed has been sent to the district, donated by contractors in Canterbury and boosted by a contribution from Young Farmers.

Members of the Student Volunteer Army have been rolling up their sleeves, Taskforce Kiwi is also mucking in, and crews from Enhance Taskforce Green are still in full operation.

“They are all doing such marvellous work and are so appreciated by the people they’re helping,” said Kempthorne.

“At this stage there’s a contract for Enhanced Taskforce Green through to early October and we’re hoping that will be extended.”

One farmer on the list for help from Enhanced Task Force Green is Andrew Fry, whose 41ha property in Motupiko was shattered when the river it had previously bordered spilled over, leaving a trail of destruction.

What used to be productive land for baleage, maize, grazing and hops was overrun by the raging river, which spewed thousands of tons of rocks, gravel and silt, ripping out fencing, and flooding the sheds of his agricultural contracting business.

A successful attempt by Fry and his team to re-route the river to its

original course following the first floods took 10 days. Their efforts were destroyed, though, when the second flood occurred less than two weeks later.

With the river now having permanently changed course across his block, the battle is on to prevent more erosion and devastation, said Fry.

“We’ve lost $150,000 worth of land here. The riverbed’s now really shallow and it’s getting worse.

“I expect to lose a bit of fencing on the riverside, but we lost the fence right to the road – 1.3km of it in total.”

In addition, the irrigation system was impacted, with a pump shed lost.

“Our financial loss is currently around $116,000, with hired help, including paying someone to do the stopbank for us, but that’s not including our own gear and maintenance costs and my own staff because we’ve all been working flat-out on the clean-up since the floods.”

So far he’s shifted 12,000 tonnes of gravel and rocks into piles at his Motupiko paddocks, with much more still left to go.

“It’s a bit scary rolling into next season without the money to do maintenance because that’s all been eroded by the erosion!”

The Fry family has been farming in Tasman for six generations and has other properties in the Motueka Valley, where Andrew grows maize. At one 20ha block

I expect to lose a bit of fencing on the riverside, but we lost the fence right to the road – 1.3km of it in total.

Andrew Fry Motupiko

the floodwater reached two metres high, swamping a combine harvester that still bears the water marks.

“All we’ve been doing since the first event is cleaning up. It makes me want to give up but then what do you do? We’re just lucky we know enough people and we’ve got some ability – and if we don’t do it, the farm’s useless.”

Looking after yourself means looking after your farm.

We’re proudly partnering with Farmstrong to scuss the little things that bring us happiness, e this warm jersey on a chilly day or the simple pleasure of a coffee break to connect with thers Farmstrong’s 5 Ways to Wellbeing are mple, daily habits to help you stay well on farm

To

out what works for you, visit www farmstrong.co.nz

Minister for Biosecurity

Andrew Hoggard has acknowledged commercial importers’ concerns over costs and pathways but says the new quarantine centre has a wider role than catering to their needs alone

Richard Rennie NEWS Horticulture

BIOSECURITY NZ deputy directorgeneral Stuart Anderson says the agency is committed to delivering a world-class facility to strengthen New Zealand’s biosecurity system, covering its needs for the next 50 years.

“We are not simply planning for the next incursion or today’s growers,” he said.

“The new facility at Mount Albert is

required because MPI’s existing Plant Health and Environment Laboratory (PHEL) and Post Entry Quarantine (PEQ) facilities are nearing the end of their useful life and constrain our ability to meet growing biosecurity demands and manage large, complex incursions.”

He is confident that test demand for post entry and plant health services will continue to grow with the growing threat of significant pests and diseases in this region.

He said the centre will be able to deal with two major outbreaks simultaneously.

The post-entry quarantine aspect of the facility for high value crop importation is likely to be only 10% of its overall build cost.

The bulk of the cost is incurred through structural and mechanical features like airtight containment and pressure areas, all used to support surveillance and response to disease outbreaks.

In response to importers’ claims they were not heard at workshops held around NZ, Anderson said they had had about 60 attendees to discuss reform of a plant import system he acknowledged was overly complex and inefficient.

He said to ensure a redesigned import system that works for all users, a wide range of opinions were sought.

It is a system that does have major problems, and we are trying to fix them.

He confirmed MPI engaged broadly through one-on-one discussions, including those using the proposed new facility for material imports.

No commercially sensitive information was required to be divulged.

“While we believe the workshops were structured to avoid such concerns, we have always encouraged and continue to encourage stakeholders to engage directly if they prefer to share their views in private.”

He agreed a Potatoes NZ-type offshore quarantine system could be replicated by other plant types, if biosecurity measures are met.

In response to industry concerns over the high quarantine costs, he said such centres are expensive to operate and MPI’s prices reflect the costs of providing the services. Even at $6500 per plant batch per month, MPI is not fully recovering those costs.

Minister for Biosecurity Andrew Hoggard said he appreciates importers’ concerns about the centre, but pointed to their use of it being only a fraction of the facility’s total campus.

“The current facilities are simply no longer fit for purpose.

“This facility will be much like the Wallaceville facility is for animal diseases and quarantine. The standard of engineering required to prevent disease escape is significant in such designs, and expensive.”

He said scientists are currently working in the equivalent of 1960s polytech-like buildings and they need new facilities.

He acknowledged importers’ concerns at quarantine costs but said Crown subsidies still only covered 50% of them.

Work is also underway to examine overseas quarantine arrangements and ways to further reduce quarantine costs.

“It is a system that does have major problems, and we are trying to fix them.”

Gerald Piddock NEWS Education

GRI education leader

AKerry Allen has slated the government for not including agribusiness in new curriculum changes to be phased in from 2028.

The changes for Year 11-13 include curriculum-based subjects around science, technology, engineering and mathematics (STEM) with students being able to specialise in areas including Earth and space science, statistics and data science, and electronics and mechatronics.

There will also be a range of new specialist maths subjects including further maths. Other new subjects include civics, politics and philosophy, media, journalism and communications, Te Mātai i te Ao Māori, Pacific studies and music technology.

But agribusiness, agriculture and horticulture science will not be a standalone curriculum subject and will be taught as an industry-led subject.

The changes were announced by Education Minister Erica Stanford.

She said the industry-led subjects will be tertiary aligned so they meet what is expected in the professional world, making staying at school relevant for every child,

no matter what their career pathway.

“This will enable students to leave school with a secondary and a tertiary qualification. We’re having one integrated system where all subjects, whether Ministry led or industry led, are equal.”

The decision astonished Allen, who is the agribusiness curriculum director for the Agribusiness in Schools programme and treasurer of the New Zealand Horticulture and Agriculture Teachers Association (HATA).

If it’s not a subject then technically agribusiness no longer exists.

Kerry

Allen Agribusiness in

Schools

She is also the head of the agribusiness department at St Paul’s Collegiate School in Hamilton.

“Not to be academic subjects I think is very naive. It’s the basis of New Zealand’s economy and while we do need vocational (industryled) pathways, it is not the only pathway into the primary sector.

“It will have a flow-on effect, that being we won’t get some going through into universities and there might not be the

academic breadth that they need to be able to run multimilliondollar businesses.”

Having agriculture as an industry-led subject means the subject matter being taught tends to be more practical and hands-on, building to management type of subjects.

Agribusiness is currently taught by achievement standards and unit standards, which are more vocational pathways, giving students the option for both.

Schools will offer these as a mix or sometimes one or the other.

“To remove the academic pathway I think is not allowing those type of students to now access that. They might not want to go down a vocational pathway, which is more hands-on practical skills.”

According to the latest Situation and Outlook for the Primary Industries report released at this year’s Fieldays, the sector employs 360,000 people as of March 2023, or 12.4% of the New Zealand workforce.

“It’s what drives our economy. I’m just floored,” Allen said. It will have huge repercussions for the Agribusiness in Schools programme, which celebrated its 10th anniversary in 2023.

“If it’s not a subject then technically agribusiness no longer exists.”

Last year, nearly 3500 students went through the agribusiness programme and 20,000 students have gone through it over the past eight years.

“If they are not doing it in schools, will they pick it up somewhere else?”

Similarly, there are 351 schools that teach ag and horticultural science either as a unit or achievement standard. Out of that, nearly 100,000 students took it in the past eight years and 11,000 last year.

NAIVE: Agribusiness in Schools curriculum director Kerry Allen says the government’s decision not to include agribusiness as a subject for Year 11-13 students is naive, given the importance the primary sector has to the economy.

“Not all of them will want to do a vocational pathway.”

It could also impact the programme’s funding and resources.

St Paul’s programme only offers achievement standards and not unit (industry-based) standards and the decision will have a huge knock-on effect, Allen said.

“Potentially as in teachers will no longer have jobs.”

Allen said the immediate step will be lobbying the minister to get the decision reversed.

Rebecca Greaves PEOPLE Farm management

WEARING lipstick while bringing the lambs in, why not?

Hawke’s Bay farmer

Ingrid Smith, aka The Made Up Farmer, is inspiring Kiwi women to look good, feel good and hold their own on the farm.

Ingrid has built a large following on social media with her witty content, showcasing life on the farm. She also happens to wear make-up while doing so.

She and husband Rowland and their three children, Callie, 11, Sia, 9, and Lincoln, 7, live on their 25 hectare block at Maraekakaho in Hawke’s Bay. Their farming operation comprises a further 675ha in leased land across three properties.

The system is mostly trade lambs, but they have recently increased their fattening heifer numbers and added breeding ewes to the mix.

They also operate a contracting business, doing peas for McCain and baleage, though this is being scaled back as their farming enterprise has grown.

As well as working on the farm, Ingrid has built a successful online business selling make-up, helping to supplement their farm income as they build equity and work towards their ultimate goal of farm ownership.

Ingrid grew up on a sheep, beef and deer farm near Wairoa and, while she always thought she’d have a career in agriculture, she didn’t picture herself practically farming. She studied animal science at university and worked for Rissington Breedline and Wagyu Breeders, as well as working in banking and for Ravensdown.

Rowland is well known in the shearing world, winning numerous open Golden Shears titles and the World Championship in 2014, and Ingrid is no slouch on the handpiece either.

The couple met through shearing, when both were

competing on the shearing circuit. After university, Ingrid travelled the world shearing in the United States, United Kingdom and Australia. In 2009 she and her mother, Marg Baynes, set the women’s eight-hour two stand lamb shearing world record, something Ingrid rates as one of her proudest moments.

When the couple started a family, Ingrid found herself at home with young children and a husband who worked extremely long hours. She wanted to contribute financially, too.

“I went from earning quite a good paycheque to nothing. Rowly was working really hard, he’d get up at 2am and shear here, come in for a shower at 6am and then go off shearing elsewhere for the day. While I was doing an important job raising children, I wanted to contribute financially to make things easier for us.”

She came across a lipstick product a friend was showcasing in the US and her interest was piqued by the claim that it wouldn’t come off.

could bring my everyday life into my content and started posting more farming stuff.”

She found the farming content resonated with her audience, more so than make-up.

“I started leaning more into the farming side, while wearing make-up.”

ONLINE: Hawke’s Bay farmer Ingrid Smith has built an online business selling makeup, helping to supplement the farm income as she and her husband build equity and work towards their ultimate goal of farm ownership.

Photos: Supplied

FARMING: Ingrid Smith grew up on a sheep, beef and deer farm near Wairoa. While she always thought she’d have a career in agriculture, she didn’t picture herself practically farming.

“I thought that couldn’t be true, but I tried it and thought wow, she’s right. I emailed the CEO of the company to ask if I could sell the products here but she turned me down.”

Eventually, her persistence paid off and, when the company launched in New Zealand, Ingrid started her own make-up business, Kiwi Kisses. Initially, she thought of herself as a make-up business owner who happened to be a farmer. Over time, this has flipped on its head, and she now sees herself as a farmer who also sells make-up.

“As our farming enterprise has grown, I’ve found I identify more as a farmer. I was never one to do glam looks or tutorials, as it wasn’t my skillset. I thought about how I

People say ‘Who wears lipstick farming?’ I say, why not?

Ingrid Smith The Made Up Farmer

That’s when she changed her business name to The Made Up Farmer.

“I farm, I wear make-up, but I also feel like I have total imposter syndrome and I’m making it up as I go along,” she said.

“Hence, The Made Up Farmer.”

Her hilarious reels have attracted a loyal following, and she enjoys making people laugh.

“I love entertaining and I wanted to show the reality of farming. Anything can be content, everywhere I go I think about content and giving farming ladies a bit of light hearted entertainment.”

Wearing make-up and nail polish on the farm does attract negative comments, mostly from men, but Ingrid takes it all in her stride, often turning them into humorous videos roasting her detractors.

“People say ‘You can’t farm with nails like that’ or ‘Who wears lipstick farming?’ I say, why not? What is a little bit of mascara or lipstick going to stop me from doing? Not a single thing.”

Putting on make-up makes her feel confident, something she carries into her day.

“I might put on a bit of lip-gloss and think, wow, that really makes my eyes shine, or it matches my top.

“They say if you look good, you feel good. It’s something that gives me inner confidence.”

Of course, there’s the skincare aspect that comes from working outside, and sunscreen or tinted moisturiser is a must, to help protect her skin from the harsh elements.

“We save all the good clothes and make-up for special occasions. Why can’t being alive today be a special occasion? If it makes you feel good, why not? I do believe in empowerment and I believe I’m trying to show that by my actions, rather than actually saying it.”

Hugh Stringleman MARKETS Livestock

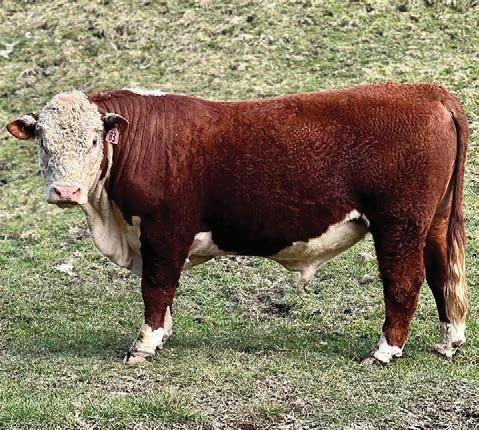

YEARLING beef bulls continued to sell for up to $1000 higher on average than last spring in the first two weeks of North Island sales.

Hereford averages are around $4000 and Angus averages have been closer to $5000, with complete or nearly full clearances of stud catalogues.

Craigmore Polled Herefords at Ōhaupō, Waikato, sold 85 out of 96 offered and had a top price of $12,200 for Craigmore Routeburn 24263, paid by a commercial buyer.

Vendors David and Sue Henderson averaged $4072 compared with $3037 last year and had stud transfers to Bluff, Maru, Ōtaki and Kaipara Herefords (twice).

Maranui Herefords and Angus at Waihi had full clearances of 25 and 12 bulls respectively with an average of $3952 for the Herefords and $5168 for the Angus.

Top price at $13,500 was paid by Te Atarangi Angus, Northland.

The top price in the Herefords was $10,200 for vendors Graeme and Rachel Brown, celebrating their 50th anniversary of breeding Herefords.

Bluff Herefords, Glenbrook, sold all 50 bulls with an average of $4396, compared with $3389 last

year, and had a top price of $5800.

Waitangi Angus, Bay of Islands, sold 87 from 90 with a top price of $12,000 and a good average of $5456, compared with $4050 last year.

Lot 7 was transferred to Matapara Angus for $8500.

Piquet Hills Angus sold all 29 bulls with an average of $4162 and a top of $5200.

Colraine Herefords, Ōhaupō, sold all 14 bulls, averaging $3621 with a trop of $4900 paid by Tawanui Herefords.

Kanuka Polled Herefords sold 7 out of 8, averaging $4314 with a top of $5100, and Arabica Herefords sold 11 from 12, averaging $3690 with a top of $5000 paid by Red Oak Herefords.

Gerhard Uys

FEDERATED Farmers says Southland farmers are being invoiced for winter grazing compliance checks where no problems are found, but Environment Southland says it is not the case.

In a statement, Federated Farmers Southland president Jason Herrick said Southland farmers have contacted him saying

they are being invoiced as much as $4000 following Environment Southland’s winter grazing compliance checks.

Herrick said following Environment Southland aerial checks, officers have been visiting some farms to confirm compliance with environmental regulations.

Farmers told him they were being invoiced even if they did not breach any rules and received little to no notice of the visits.

Farmers have also been caught out by a change in the Water and Land Plan, which increased the fencing setback for waterways from 3m to 5m, he said.

Environment Southland compliance manager Donna Ferguson said cost recovery invoices are only issued to farmers where there has been a confirmed breach of a rule.

“We undertake cost recovery so that ratepayers do not pay for the cost of investigating and

undertaking enforcement action where non-compliance occurs,” Ferguson said.

“This year, 75 incidents had been logged, of which 49 have been fully investigated by warranted compliance officers.

“Of the completed investigations, 28 farmers were contacted and advised that no further action or cost recovery was required.

“Another 21 incidents have been investigated where non-

compliances were confirmed.

“Outcomes have ranged from advisory letters to more formal enforcement.

“The remaining 26 incidents are still under investigation.

“When monitoring compliance of winter grazing, particularly around required buffer distances, most cases lead to advice and education.”

Ferguson said winter grazing rules have not come out of the blue.

Neal Wallace NEWS Energy

ABOUT 10% of New Zealand’s electricity needs could be met if 30% of farms ran largerscale solar generation system supported by batteries, research has shown.

The Energy Efficiency and Conservation Authority (EECA) said farmers could halve their energy costs while also earning income.

It is seeking farmers and growers to take part in a project that involves the installation of solar and battery systems.

The cost is subsidised and performance monitored.

Insights are shared, particularly when it comes to battery use.

“By showcasing real-world results across different farming systems, this programme will give the sector confidence about what solar and battery technology can deliver,” said Megan Hurnard, EECA’s manager of Insights, Data and Communication.

EECA’s early modelling indicates that if 30% of NZ farms installed systems, of the size erected on some farms already, they could generate as much

as 10% of the country’s current electricity demand.

“We are looking for a broad range of different farm types, dairy, sheep and beef, horticulture and poultry, and a spread of locations across NZ,” said Hurnard.

We are looking for a broad range of different farm types and a spread of locations across NZ.

Megan Hurnard Energy Efficiency and Conservation Authority

EECA will provide funding support of up to 40% for inverters and batteries, and up to 20% for solar panels, with farms becoming case studies to shape best-practice advice for the whole sector.

She said the five-year programme aims to determine how solar and battery systems perform on different farm types, how resilient they are and to provide information for sharing with other farmers.

“If you are keen to get involved, we would love to hear from you,” said Hurnard.

Gerhard Uys NEWS Horticulture

PGG Wrightson has launched an internal qualification to recognise the title “agronomist” in the horticultural sector.

The national technical manager at PGG Wrightson, Milton Munro, told Farmers Weekly that while internationally agronomists must hold a recognised qualification, no such requirement exists in New Zealand, meaning anyone can claim the title.

Agronomists make critical decisions that determine the success of a crop and a local qualification is therefore essential, he said.

PGG Wrightson worked with Primary ITO and drew existing unit standards into a micro credential programme, he said. The course focuses on practical, hands-on skills, and participants do not need any formal background qualifications to enrol.

Modules cover topics such as plant physiology, weed identification, integrated pest management and developing weed control programmes.

Munro said the programme aims to develop critical thinking, with agronomists, for example, not simply deciding what spray to use, but being able to see how cultural control, sprays and biological controls fit into a system, or fit into the systems that countries New Zealand exports to require.

The NZQA-approved programme will first be open to PGG Wrightson Fruitfed Supplies technical horticultural representatives, to

align them with international certification programmes.

Eight participants have already signed up, Munro said. Anyone who completes the programme will have to commit to ongoing professional development to maintain the qualification, he said.

He hopes the industry will get behind the course so it can be opened up to the wider public in future.

Gerhard Uys NEWS Food and fibre

KIWIS are wasting less of their food than they were two years ago, but there are concerns that economic pressures mean they also have less healthy diets.

The 2025 Rabobank-KiwiHarvest Food Waste survey has found the average New Zealand household reported wasting 10.9% of the food it bought each week, down from 12.2% in the 2023 survey. This fall drove a drop in annual food waste per household, down to $1364 from $1510 in 2023.

New Zealand’s overall food waste bill fell to $3 billion per annum from $3.2bn billion, despite marginal increases in weekly household food spend and the number of households.

Rabobank head of sustainable business development Blake Holgate told Farmers Weekly that the average weekly household spend on groceries between 2023 and 2025 went up by only $2, from $238 to $240.

their food than they were two years ago, but there are concerns that economic pressures mean they are also eating less healthy diets.

Food inflation was high during that period, which means people were purchasing less food and being more selective about what they bought, Holgate said.

The CEO at Eat New Zealand,

Angela Clifford, said there has been a significant drop in the amount of whole foods New Zealanders are buying.

Clifford referred to data from chartered financial analyst

Staff reporter NEWS Dairy

NEW data from DairyNZ’s plantain programme has confirmed that modest levels of plantain in pastures reduce nitrogen leaching.

With three years now complete, preliminary findings from the Lincoln University farmlet trial show 26% reduction in nitrate (N) leaching with an average of 17% Ecotain plantain in the pasture.

Results from the Massey farmlet trial show over four years, N leaching was reduced on average by 26% where Ecotain plantain made up an average 25% in the pasture.

Monitoring on four midCanterbury farms shows that an

average of 10-15% plantain across the whole farm is achievable by including plantain as part of the seed mix at pasture renewal and by broadcasting seed across the whole farm with fertiliser. The highest levels (20-40% plantain) are achieved in new swards 1-2 years after establishment.

Kate Fransen, DairyNZ’s plantain programme lead, said the programme continues to show that plantain is a low-cost option to achieve significant reductions in N leaching without impacting the farm system.

“Nitrogen leaching is an issue for many dairy catchments, so we need practical, affordable solutions. Including plantain in your pasture is ‘low-hanging fruit’ for reducing N leaching – and we

now know you don’t need to have 30% plantain in your pasture to have the positive effect,” Fransen said.

“Research shows that 17% plantain across the farm is enough to make a sizeable difference to N leaching, and that between 10 and 20% plantain across the farm is achievable and practical for many farmers,” she said.

The final year of data collection is underway at the Lincoln site, while at Massey data collection is complete and final analysis is underway.

The programme now turns its focus to adoption of plantain in targeted N sensitive catchments.

The Plantain Potency Programme is a seven-year research initiative led by DairyNZ

Shamubeel Eaqub showing fewer people are buying fresh food, such as fruit, vegetables and meat, because they cannot afford it.

I’m really concerned that what we’re seeing is a significant decline in access to fresh food.

Angela Clifford Eat New Zealand

“We’re seeing a reduction in the amount of vegetables wasted, but is that because New Zealanders aren’t eating as much vegetables anymore?”

She said when families are unable to afford food, then ultraprocessed foods, which are more shelf stable, are less risky.

“Overall, the fact that we’re wasting less food is awesome, but is that because we’re eating less fresh food overall?

“I’m really concerned that what we’re seeing is a significant decline in access to fresh food.

“We don’t have access because

we can’t afford it,” Clifford said.

KiwiHarvest CEO Angela Calver said it is encouraging to see food waste trending lower.

“However, this year’s estimated food waste, valued at $3bn, is still too high,” she said.

“At an average annual waste of 10.9% per household, Kiwi households are effectively throwing away nearly six weeks’ worth of groceries each year.”

The survey showed 35% of Kiwis say they are wasting less food than they did a year ago with only 5% saying their food waste has increased.

Food going off or reaching its best-before date before you can eat it is the reason most frequently cited for food waste.

The survey found the foods most regularly wasted are vegetables, bread and fruit.

Certain behaviour changes have led to less food waste, with 56% of respondents saying they cook with or encourage their family to cook using all the edible parts of vegetables, up from 53% in the last survey.

and

Agricom’s

THE timber industry has taken government goals of doubling exports within a decade to heart with its own action plan to turn $5.7 billion of exports a year to

over $11bn by growing the valueadded products sector.

Wood Manufacturers and Processors Association (WMPA)

CEO Mark Ross said in a sector where almost two-thirds of its production is sold as unprocessed logs, it has to move harder and faster to drive more value into processed products.

“The log trade return is really always going to be lower value and pretty flat. The only way we can grow is through increased value, processed here in NZ.”

The report has identified that adding $5.75bn in added value exports from the sector will require a quadrupling of current processing capacity.

But it also notes the wood to be sold as value-add in 2034 is halfway through its growth cycle.

It notes that timber is likely to be of smaller quantity than present, of lesser quality, and harvested at greater distance from port and processors.

Ross pointed to distinct premiums opening in European and United States markets for NZ’s value-added timber sector to capitalise on in coming years.

“We have China generating about $370 per cubic meter for

sawn pinus radiata, compared to $2227 a cubic meter in the United States and $1187 in the Netherlands, all for the same grade timber.

“Asian markets are not necessarily the strongest but are still where a lot of our product is going.”

A key area the sector wants to work on with the government is boosting the knowledge and presence of forest product trade experts in overseas posts, helping link processors with potential customers seeking high value niche timber products.

“And we need to work better as an industry across all the supply chain to better understand those markets and tell the NZ story more clearly.”

He acknowledged the sector’s tendency to work through markets on a company-by-company basis, rather than collectively. This was something the plan aims to change.

The plan comes at a time when there have been a number of mill closures in recent months. But Ross is optimistic about what he sees at mills still operating nationally.

“We are seeing a lot of re-

adopting AI tech for more productive throughput.

We have China generating about $370 per cubic meter for sawn pinus radiata, compared to $2227 a cubic meter in the United States.

investment still going ahead in mills, a million spent here, a million there. We are seeing new kilns being installed, mills

“A number also have additional capacity to ramp up production if they work to growing their valueadded output.”

He said the recent announcement of a collaborative project between Taranaki Pine and Techlam in Levin was a positive sign of how companies can advance their respective strengths to take on high value overseas market opportunities.

The action plan is set for a formal launch at Wood Processors and Manufacturers conference in early October.

•

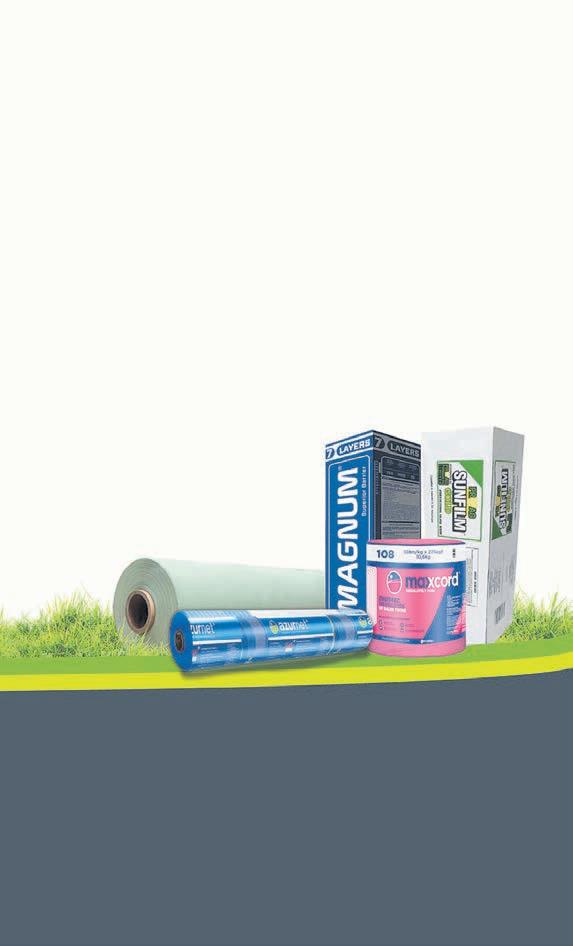

W ith these big pas ture per formers, led by Ma xsyn, New Zealand’s top - selling perennial r yegrass. Now that ’s huge!

A sk your resellers, or lea rn more at Ba renbrug.co.nz /spring -2025

Maxsyn Perennial

The nex t generation Perennial legend with NE A4 and now with NE A12 for superior per sis tence and summer grow th.

Array Perennial

The super s t ar perennial, delivering high int ake, Y ield, N upt ake and per sis tence The diploid of the f uture!

Grow wit h Confidence

4front Perennial

The benchmark in tetraploid perennials Grow s longer, is good for the environment and animals love it

The phenomenal 3 - 5 year pas ture W ith environment al benefit s, delivers per formance your neighbour s will env y Forge 3 -5 year s

Available with NE A and supercharged NE A12 Shogun 1-3 year s

The out s t anding hy brid, s till set ting the s t andard for 1-3 year pas ture

Gerhard Uys NEWS Production

ANEW Waikato-based mobile abattoir is giving farmers the option to process stock on farm, cutting out stressful transport to distant works and opening fresh market channels for premium, locally raised meat.

Founded by Cambridge farmer and product designer Logan Wait, Earth First is the first fully certified mobile abattoir of its kind in New Zealand.

Wait said the unit allows animals to be humanely harvested in their familiar environment. The carcases are then broken down into quarters, chilled and transported directly to butchers or clients the farmer has arranged.

Wait said the idea is about rebalancing the food system so farmers can keep more value on farm while giving consumers greater choice.

“Anyone who has put stock on a truck knows it can be a traumatic experience. Animals get stressed in transport, and that stress shows in the production of cortisol and

in the quality of the meat. With our system they don’t, and that’s better for both the animal and the consumer,” he said.

For most farmers, once stock leaves the gate, so does much of the margin. Large processors and supermarkets capture the premium while farmers remain price takers, Wait said.

We can provide premium quality because the animals aren’t stressed.

Logan Wait Earth First

“Earth First flips that script. By harvesting on farm, Earth First enables farmers to sell beef and lamb directly to households, or supply local butchers and restaurants who want to showcase ethical, high-quality, traceable meat.”

The mobile unit can process up to 10 cattle or 50 sheep a day, providing enough carcases to keep several butchers or foodservice customers stocked.

Early trials suggest margins are

significantly higher than those in conventional schedules, he said. The system is designed with regenerative and organic producers in mind. Wait believes these farmers deserve recognition for the additional effort they put into land care and animal welfare.

For regenerative farmers, premiums can make lower stocking rates financially sustainable.

Operating under approval from the Ministry for Primary Industries, the Earth First unit can legally supply into retail and hospitality, something previously only possible through centralised works.

The mobile facility is a fully contained environment with a steel floor, crane and curtains.

A meat inspector is present at every slaughter. Organs are checked, and samples are sent to the lab.

“We can provide premium quality because the animals aren’t stressed. Everyone who has grown up in the country knows home kill meat tastes better. The difference here is we can now do it legally for the public,” Wait said.

At present Earth First operates a single unit, but the vision is for

a nationwide network of regional mobile abattoirs.

Earth First co-founder Ben Ridler said their vision is to have regional units that can back each other up, support local economies, and give farmers more control.

“It’s about building a collective of regenerative farmers, butchers and conscious consumers who believe food production can be done differently,” Ridler said.

CHECKED: An MPI-certified meat inspector or vet inspects every carcase. With organs checked and samples tested, a fully contained mobile abattoir can process up to 10 cattle or 50 sheep a day.

“It also provides a shared brand identity that butchers, chefs and retailers can use to tell the story of meat grown and harvested with care.”

Each carcase is tagged with full traceability, including NAIT number and farm of origin. QR codes are being developed for packaging so customers can scan and see exactly where and how the animal was raised.

“That’s powerful for regenerative and organic farmers. It means their story can be told right there in the butcher’s shop or on the restaurant menu,” Ridler said.

Research suggests around 30% of shoppers now consider themselves conscious consumers and are willing to pay more for products that are better for animals and the environment, he said.

Ridler said farmers still send the bulk of their stock to traditional works, but are asking Earth First for more capacity.

Neal Wallace Senior reporter

THE goal of doubling exports by 2034 is one of the few policies retained by successive governments.

By its very size, primary production will be the principal driver of efforts to achieve that growth, but, given declining or static stock numbers and production, it will not be reached by exporting more volume.

Forecast prices for this export year are bullish: dairy returns to rise 16% to $27 billion, meat $1.4bn to $10.5bn and horticulture to increase 19% to $8.5bn.

These elevated prices currently reflect global demand exceeding supply, but is that a sustainable recipe for doubling the value of exports when they are mostly commodity products?

Ten years ago, then prime minister John Key’s government set a goal of growing exports from $65bn to $130bn by 2025, or 40% of GDP.

Exports in 2024 were worth $95bn and

the current administration has reset its doubling of exports aspiration to be reached by 2034.

Achieving that requires an average compound annual growth rate of 7.2%.

The last time we were anywhere near that was 2021-22, when the economy grew at between 4.5% and 6.2%.

Improving returns by adding value has been seen as the holy grail for the primary sector with Fonterra and Tatua leading the way through their consumer branded products.

Our major meat companies are less involved although Silver Fern Farms and ANZCO are trying to grow their branded business, and some smaller processors have carved out niche markets for their products.

Doubling export returns from selling predominantly commodities will be challenging.

Nuffield scholar David Kidd saw an opportunity to grow value for the red meat industry by leveraging increased consumer awareness of the environment as well as a desire to understand how their food is produced and to connect with growers.

The reality is that winning consumer loyalty is costly, time consuming and comes at a significant risk.

The legacy of two of Fonterra’s oldest

MORE than 66% of voters do not believe the recent takeovers of dairy processors lessen competition in New Zealand’s dairy sector.

“Short term, maybe less,” one said, “but long term, efficient companies give long-term surety to dairy farmers. Just look at the history of smaller legacy dairy companies – apart from Tatua, the rest were struggling.”

Another said: “The [takeovers] make complete commercial sense. There is plenty of competition for NZ milk currently. Talley’s are a smart-run businesses. They are margin traders, they don’t do fancy niche stuff.”

One voter believed the smaller companies can only compete by producing high value products: “Both the Miraka and MVM deals take out weaker players in the market and highlight the need for Fonterra’s competitors in milk supply to be at scale and very efficient.

Milk powder is a commodity product so lowest cost is vital from a production point of view ... Tatua can survive because it does not produce low cost, high volume commodities. The only way smaller players can compete is to be producers of high value milk products.”

brands, Anchor, founded in 1886, and Mainland, established in 1954, provides some context of the time it takes to establish brands and connect with consumers who today have multiple choices.

Fonterra shareholders will soon vote on whether to sell its consumer branded business to French giant Lactalis.

Lactalis earns the majority of its €30.3bn (NZ$55.1bn) annual turnover from global brands that include President, launched in 1968, Galbani, founded in 1882, and Parmalat, established in 1961; operating more than 260 factories worldwide; and selling its brands in more than 90 countries.

Fonterra’s consumer sales have always been a relatively minor part of its business.

All this raises questions about how are we to double the value of our exports from what are, or are about to be, primarily commodity-based products.

Moves such as eliminating non-tariff barriers, reducing regulation, investment in product development, using new technology and improved infrastructure will help.

New products such as Fonterra’s quickfrozen mozzarella cheese and better use from the fifth meat quarter have and will provide higher returns.

Doubling export returns from selling predominantly commodities will be challenging, but New Zealand dairy and meat have attributes desired by consumers.

We have to find a way to retain, promote and differentiate those.

Last week’s question: In your view, do the recent takeovers of dairy processors lessen competition in New Zealand’s dairy sector?

Nic Lees

Senior lecturer, Lincoln University

FONTERRA’s sale of its consumer dairy business to Lactalis is a clear sign of the co-operative’s failure to compete in the branded consumer market.

Despite owning iconic New Zealand brands like Anchor, Mainland and Perfect Italiano, Fonterra has been unable to compete in the global consumer market.

The loss to foreign ownership of these well-known local brands is a tough pill to swallow for New Zealand consumers, but it highlights a reality: the small markets of New Zealand and Australia could never match the scale and reach of Lactalis and other dairy giants such as Danone and Nestlé.

The reality is that consumer sales were always a minor part of Fonterra’s business, making up less than 10% of its $25 billion annual revenue.

Most of its business is in ingredients and foodservice.

By contrast, Lactalis earns the majority of its €30.3bn (NZ$55.1bn) turnover from global consumer brands including Président, launched in 1968, Galbani, founded in 1882, and Parmalat, established in 1961.

The company operates more than 260 factories worldwide and sells its brands in more than 90 countries.

The contrast is not only about scale but also about history. Lactalis’s flagship brands have been building consumer loyalty for decades, in some cases for more than a century.

Lactalis itself was founded in 1932; Fonterra, by comparison, was formed only in 2001 through the merger of New Zealand’s dairy co-operatives and the Dairy Board.

In consumer branding terms, Fonterra entered the game late, facing competitors with much longer legacies and deeper roots in global markets. Anchor is its most recognised global brand, inherited from the New Zealand Dairy Board; it has existed since 1886. However, Fonterra has struggled to take the brand beyond Australasia, Britain and some select Asian countries.

Fonterra’s core business has always been in dairy ingredients, processing around 16 billion litres of milk each year. Competing in the consumer market, where margins are thin, marketing costs are high, and brand loyalty is deeply entrenched, has drained Fonterra’s resources and attention.

Lactalis, however, has long been structured to succeed in this space.

For Fonterra, exiting consumer brands is a strategic move back to its strengths. For Lactalis, the acquisition adds trusted Australasian names to a strong portfolio of established brands in North America and Europe.

This week’s poll question (see page 4):

Do the impending changes to regulations on farmland forestry planting go far enough?

Ben Anderson

Ben Anderson lives in central Hawke’s Bay and farms deer, cows and trees. eating.the.elephant.nz@gmail.com

AWHILE ago I called tech support. It was a call I had put off making, partly because I hate sitting behind a computer, and mostly because I didn’t want some invisible spotty know-it-all charging me an exorbitant hourly rate while indirectly telling me I was an idiot. At the end of the call my computer issue was resolved, and my pride was battered. The techie summed up my issue well. He said I was a PICNIC. “A what?” I said. “A P.I.C.N.I.C,” he said. “Problem In Chair Not In Computer.” “Oh,” I said.

To be fair, when operating in accordance with my wishes, computers are excellent. When connected to the internet they are even better.

When the internet was first explained to me by a patient mate of mine, I was mesmerised.

Imagine having all that information at your fingertips. Imagine a common well of knowledge that everyone could draw from. Imagine the problems that could be resolved by everyone having access to a singular point of truth.

But instead of becoming more enlightened, we’re becoming more biased and more misinformed. If you need an example of this, look on Facebook. Here you will find a vast ocean of users, all huddled in various echo chambers, blowing kisses and making angry faces at each other, happily naive to the fact that their behaviour is being driven and reinforced by an algorithm that is making money off their vanities and outrage.

Companies like Facebook and YouTube make money by making you click, and nothing makes people click more than feeling angry or righteous.

To maximise their profits these companies now use artificial intelligence to direct a steady stream of self-reinforcing and increasingly extreme information to its users.

The result is communities of

people that don’t talk to each other, each living their own version of reality, and completely unaware that another version even exists. When this happens, we lose the middle ground. We lose perspective and we cease to practice common sense.

Just as farmers are putting collars on their cows to control their movements for maximum productivity, Facebook is quietly doing exactly the same thing to us.

Agricultural emissions is an excellent example of how this plays out, regardless of which side of the fence you’re on. Farming in New Zealand contributes around half of the country’s greenhouse gas output, largely methane from livestock and nitrous oxide from fertiliser use.

Policymakers have focused proposals – such as the He Waka Eke Noa partnership and emissions pricing mechanisms – to bring agriculture into the nation’s climate commitments.

These proposals were always going to be contentious. Farmers fairly worry about profitability, competitiveness and fairness, while environmental groups understandably push for faster and stronger action.

But what should have been a constructive national conversation has become a political bunfight, and social media algorithms have poured fuel on the fire.

sense that farmers are under siege.

What should have been a constructive national conversation has become a political bunfight.

EXCELLING: When operating in accordance with Ben Anderson’s wishes, computers are excellent. When connected to the internet they are even better.

Photo: Pexels

On Facebook, posts opposing emissions pricing attract passionate engagement from rural communities. The more angry or emotional the comments, the more likely the platform is to spread the post further. Soon, farmers scrolling their feeds are inundated with stories and memes painting climate policy as an existential threat to their livelihoods.

Meanwhile, environmental activists and urban audiences are served a very different feed – one highlighting stories of climate urgency and portraying farmers as environmental vandals.

On YouTube the same pattern plays out. Someone searching for information on emissions policy may start by finding a balanced news item, but within a few clicks the recommended videos are likely to include highly critical commentary, often drawing from overseas channels with little relevance to NZ’s unique situation.

This imported outrage skews the debate further, reinforcing the

The net effect is that both sides become more entrenched. Farmers feel vilified and misunderstood, while environmentally aligned audiences come to see us farmers as stubborn and naive. The middle ground, where practical sciencebased solutions could emerge, gets drowned out.

When leaders try to address the problem, they struggle to achieve a consensus because each side in the debate is convinced – by the evidence in their news feed – that the other side is being unreasonable.

Both social media and the internet as a whole have and will be incredibly valuable to farmers. They connect us to our markets, allow us to do business efficiently and have the potential to create value chains far more valuable to those of us who live behind the farm gate.

What we need to be careful of, however, is ensuring that our need to exercise common sense is not being hijacked by the bank account of yet another one of those invisible spotty know-it-alls, this time in Silicon Valley.

Anna Bracewell-Worrall ON FARM Predators

SHIRLEY-Ann and Rick Mannering run a productive sheep, beef and dairy operation just south of Auckland.

Alongside that, they’re leading a quiet ecological revolution – with traps, tech, and a full-time farm ranger.

When the Mannerings first brought their Paparimu farm in 1991, one night’s shooting would turn up 120 possums, over just a few paddocks.

Three decades later, they’re not just managing possums – they’re running a tech-savvy campaign to remove all introduced predators threatening their bush, wetlands and birdlife.

Waytemore Farms has won too many awards to list, mostly for their environmental efforts, including a New Zealand Farm Environment Trust supreme award.

But the real rewards are in the benefits to the farm itself.

“We’ve gradually progressed from shooting and poisoning on our own property to having a more formal eradication plan for pests on both properties that we now run,” said Rick, referring to their home farm and a second nearby farm they inherited from ShirleyAnn’s parents.

But they didn’t get there overnight.

Their home farm backs onto the Hunua Ranges Regional Park, home to Auckland’s only kōkako population.

In 2018, a large-scale 1080

operation knocked back the Hunua possum population. Auckland Council then installed a network of Philproof bait stations through Shirley-Ann and Rick’s bush block.

“You’d go out and you might only find a dozen, half a dozen or so [possums], so that was a bit of a game changer for this farm,” Rick said.

Seeing the difference the Auckland Council made motivated Shirley-Ann and Rick to intensify their efforts.

They now have a network of bait stations alongside automatic resetting and manual traps. They have also employed a farm ranger

As soon as something stops eating the trees, all the leaves come out on them.

Rick Mannering Waytemore Farms

in charge of maintaining traps, revegetating the farms, and restoring their wetlands.

Years ago, the couple fenced off their native bush, but watched it continue to suffer despite the exclusion of cows and sheep.

With help from a QEII National Trust Auckland Fund grant, the Mannerings installed a suite of additional bait stations, DOC 200 and 250 traps, and 12 AT220 selfresetting traps.

The early results were promising: chew card monitoring showed the possum numbers had halved.

So, they applied for the grant again, this time for their other, larger farm. They followed a similar plan, but doubled the number of AT220s they bought.

At $565 a pop, the AT220s are much pricier upfront than manual traps.

“But the beauty of them is they just keep working. It’s a graveyard underneath the trap,” Rick said.

Technology makes the job easier, and Rick’s keen to see where

it goes next. He has his eye on remote monitoring technology, especially for live-capture traps, which must be checked daily by law.

But more gear meant more maintenance, so the couple made a bold move: they hired a full-time farm ranger to oversee trapping and restoration.

“You can’t farm unless you are a bit of an ecologist at heart ... If you pug every paddock and wreck every hillside, the grass doesn’t grow, you’re not getting good production out of your animals, and it just doesn’t work.

“Everyone cares, and it’s just people’s ability to work on it that varies, and some people can only do a small amount, and some people can do a lot more. Everything counts.”

Rick and Shirley-Ann say once you start on predator control, it’s so rewarding, it becomes addictive.

They recommend starting with fencing off some bush, preventing stock from grazing. Then “chuck in” some traps. Take photos of the same vegetation every six months and “you’re away laughing”.

The rewards will be almost

immediate. They saw this first in the canopy of their native bush.

“As soon as something stops eating the trees, all the leaves come out on them,” Rick said. It’s not just the native bush flourishing at Waytemore Farms, it’s also the birds and farmland.

“When you get a family of seven or so fantails fluttering around, that’s just ... it,” Shirley-Ann said. – Originally published by