Table of Contents

Homeowners 62 and over in the U.S. have experienced impressive growth in home equity

Homeowners 62 and over in the U.S. have experienced impressive growth in home equity

If you own your home and are in or nearing retirement, you likely regard your decision to become a homeowner as one of the smartest financial decisions you’ve made.

Your home serves as your safe haven and comfort zone—a place for you to live and enjoy life with family and friends. It’s where some of your fondest memories were and continue to be made. It’s also where you’ve directed a significant portion of your hard-earned money, in the form of home equity.

With all of the perks that come from being a homeowner, including certain tax benefits, it’s easy to overlook that your home doubles as a forced savings account—an asset that you regularly contribute toward and that, generally speaking, appreciates over time. In fact, for most homeowners 62 and over, the home is their single largest source of savings.

For many of today’s retirees, the use of home equity is no longer a question of if—rather it’s a question of when and how. Even if you have no immediate need for an infusion of cash, now may be the best time to establish a cash inflow and outflow bridge between your housing wealth and your wallet.

Home Equity Conversion Mortgage (HECM) loans, commonly called reverse mortgage loans, are designed specifically to help homeowners 62 and older to age in place and enjoy a better, more secure retirement. If being able to borrow from your housing wealth and defer repayment of the loan balance until a later date arouses your curiosity, keep reading.

“I’m retired now. Didn’t want that mortgage hanging over my head.

I had to buy a car. And that just wasn’t in the retirement budget. By doing a [HECM] with Fairway, it lifted the burden of a monthly mortgage payment. [Must pay property-related taxes, insurance and upkeep expenses.] . . . Fairway definitely made it possible for me to keep my family’s home.”

— Gary Peterson

Conversion Mortgage and it’s a loan product reserved for American homeowners who are 62 or older. HECMs are insured by the federal government and are only available through a Federal Housing Administration (FHA)-approved lender like Fairway.

At Fairway, we think of these loans as “retirement mortgages,” because of the possible financial advantages that a HECM can provide for most homeowners 62 and older. Let’s take a look at three big advantages .

A HECM enables the borrower to access a percentage of their home equity as cash or a line of credit, without having to take on a monthly mortgage payment (though the borrower must live in the home and pay the property charges, like taxes and insurance).

HECM borrowers have several options for how they can receive loan proceeds:

• A single-disbursement lump-sum payout

• Fixed monthly advances (for a set number of months or for the life of the loan)

• A line of credit to use as needed

• A combination of fixed monthly advances and a line of credit

The HECM loan proceeds are not subject to income tax1 and can be used for any purpose.

Refinance an existing traditional mortgage

Many homeowners aged 62+ are still carrying a traditional mortgage. The cash outlay from the required monthly principal and interest mortgage payments can add up over time and diminish cash flow during a phase in their life when income tends to be significantly less than it was during their prime working years.

By using HECM proceeds to refinance (pay off) a traditional mortgage, borrowers are essentially turning their monthly-payment-required mortgage into a monthly-payment- optional mortgage. They are still responsible for paying the property-related charges, like taxes and insurance.

Many borrowers work with financial advisors to strategically use home equity to enhance a sound retirement plan. For example, when there’s a downturn in the equity markets, you could decide to draw from your HECM line of credit to help fund your retirement lifestyle for a period of time, as opposed to selling investments at lower prices. This strategy could give your portfolio time to recover without negatively impacting retirement cash flow, potentially resulting in greater net worth in the long run2 .

Many older Americans don’t qualify for (or are priced out of) Long-term Care Insurance (LTCI). Some borrowers are using the HECM line of credit to help self-fund any future need for their own long-term care. Others are using it to pay for the cost of monthly LTCI premiums.

Eligible homebuyers 62 and over can combine proceeds of a home sale with financing from a Home Equity Conversion Mortgage for purchase (H4P) loan to buy a new home with more purchasing power than they could otherwise afford. You could potentially double your purchasing power3 to buy your dream home.

Like a standard HECM that a borrower takes out against their current home, when an H4P is used to purchase a new home, the homebuyer will not have any required monthly mortgage payments so long as they live in the new home, maintain it and pay the property charges, like taxes and insurance.

Whether the loan proceeds are used to pay for a new car, travel or something on your bucket list, a HECM can help you enjoy a better retirement.

A HECM line of credit is a good way to create a stand-by emergency fund. While there are initial costs to establish the HECM line of credit, unused funds in the line of credit do not accrue interest or fees.

It’s important for you to make sure your home is safe to age in place. Sometimes that means costly home renovations, such as installing a ramp or walk-in tub, or remodeling a kitchen. A HECM could be the right solution for you to finance such costs.

2This booklet does not constitute financial advice. Please consult a financial advisor regarding your specific situation.

3The required down payment on your new home is determined on a number of factors, including your age (or eligible non-borrowing spouse’s age, if applicable); current interest rates; and the lesser of the home’s appraised value or purchase price.

Of course, a HECM is not free money. Just like a traditional mortgage, with a HECM the borrower must repay the borrowed amount, plus interest and fees. However, a HECM offers the borrower much greater repayment flexibility compared to a traditional mortgage—a feature that can help the borrower increase their cash flow in retirement.

The HECM borrower has no monthly principal and interest repayment obligation. That’s right, the borrower can choose to pay as much or as little toward the HECM loan balance each month as they would like, or, as most borrowers do, they can make no monthly mortgage payment Of course, they must occupy the home as their primary residence and pay the property-related taxes, insurance and upkeep expenses.

So, it’s easy to see why a HECM is also known as a reverse mortgage. With a traditional mortgage, the flow of funds generally moves from the borrower’s bank account to the lender. Naturally, as the borrower makes payments, the loan balance decreases over time. With a HECM, the flow of funds is typically reversed— the lender or servicer is the one making the payments to the borrower. A good way to think of it is that lender is giving you an advance on your home’s equity.

The HECM loan won’t become due and payable until one of the following maturity events occur:

• The property is no longer the principal residence of at least one borrower. For example, a HECM becomes due if the last remaining borrower passes away or permanently moves to a nursing home. (Note: The due and payable status of the loan may be deferred in certain situations in which an eligible non-borrowing spouse still living in the home is involved.)

• A borrower does not fulfill their obligations under the terms of the loan. For example, a HECM may become due if the borrower fails to pay their property taxes in a timely manner—a requirement for compliance with the loan terms.

#3 Never owe more than the home is worth when the home is sold4

When the HECM loan becomes due and payable, it is typically satisfied through the sale of the home on the open market. If the price that the home sells for is not enough to pay back the loan balance, the FHA guarantees that neither the borrower nor their heirs will be personally liable to pay the difference. This is known as the loan’s non-recourse feature. On the flip side, if the home sells for more than the loan balance, the borrower (or the heirs) can pocket the difference. Or, the heirs can choose to keep the home by paying the lesser of the full loan balance or 95% of the home property’s appraised value. If the heirs don’t want to keep the home, and the HECM balance is higher than the value of the home, the heirs can sign a deed-in-lieu of foreclosure that allows them to turn the home over to the lender and walk away from it without being stuck with a bill.

“I heard about the [HECM] and decided that would be probably the best alternative for me.

Well, it freed up the money that I’d have coming in every month. Now I don’t have to put it toward the mortgage payments. It allows me to do the repairs I have put off. Gives me the peace of mind. There’s just so many things that I can do that I just wasn’t able to before.”

— Kathleen Scarcelli

18 to 62 Years Old

62+ Years Old PRE -Retirement

Don't outlive your money, leave a legacy. POST-Retirement

There’s an idea that retirement’s “Holy Grail” is paying off your mortgage and sitting on your home equity. Some people even wait until their home is paid off before they feel safe to retire. We get it — people lost their homes in the depression era of the ‘30s and even as recently as 2008 during the latest housing foreclosure crisis. But is it the best plan for your retirement?

Home equity is important but not always the most significant source of funds because it’s not liquid. You would traditionally need to sell the house to use the cash in your home. Could it be better to have your equity in a form that you can control (cash) instead of relying on uncontrollable factors like changing home prices and unexpected expenses?

If you think about your finances as three “buckets” – Monthly Income (Bucket 1), your Nest Egg (Bucket 2) and Home Equity (Bucket 3) — you’ll quickly understand that while home equity is good in retirement, cash is better.

During our earning years, we take money from Bucket 1 (Monthly Income) and put it into Bucket 2 (Retirement Nest Egg). Most of us also put quite a bit of our income into Bucket 3 (Home Equity) — purchasing it, making payments, improving it, etc.

When we retire, most of us start drawing money from Bucket 2 (and stop contributing). Meanwhile, Bucket 1 decreases into (possibly) just Social Security and pension income. These changes happen in the face of new retirement risks, like stock market volatility, spending surprises and soaring inflation.

Rather than creating that vital bridge between their home equity and retirement wallets to help meet their spending goals and take pressure

off their nest egg, most older homeowners continue putting money into Bucket 3 (Home Equity) when they don’t necessarily need to. With a HECM line of credit, you can draw from home equity to supplement cash flow, fund your desired retirement lifestyle and hedge against retirement risks.

We get it – this is a big mental shift. But retirement is a different game and has different rules – from taxes to home equity to longterm care issues – very different from what happened during your earning years. The better you understand these rules, the better your retirement cash flow can be. Research by Texas Tech and Boston College for Retirement Research demonstrates that by combining Buckets 2 & 3, your retirement funds will give you more income and be far more likely to outlast you!

Reverse mortgage rules can end up working for you. With a reverse mortgage, you have no monthly re-payment and no risk of foreclosure as long as you live in the home as your primary residence. You must also pay critical property charges, like taxes and insurance, just like a traditional mortgage.

So, if you can use your Bucket 3 (income taxfree5) and have no risk of foreclosure from missing monthly mortgage payments, then the old rule of having a paid-off home to be secure may no longer be the best option.

At the end of the day, even though your home is a great place to store your memories, it’s not the greatest place to store your assets.

The most popular way HECM borrowers choose to access their loan proceeds is via a line of credit. Below are some ways the HECM line of credit can be utilized for smart financial planning.

The HECM line of credit cannot be capped, reduced, frozen or eliminated, so long as the borrower complies with the loan terms. For example, even if market conditions deteriorate, or if the borrower’s financial situation suddenly changes, the borrower can rest easy knowing their available funds in the HECM line of credit will be there as needed.

2. It is OPEN-ENDED CREDIT.

Like a credit card, funds can be borrowed from the line as needed, paid back, then borrowed again.

3.

The unused funds available in the line of credit grow at the same compounding rate as the loan balance. In other words, the borrower will have greater borrowing capacity over time, regardless of swings in the value of the home. Also, whenever you make a voluntary prepayment toward the loan balance, the line of credit increases dollar-for-dollar when the payment posts, allowing that portion of the line of credit to again grow over time as borrowing capacity. It can be advantageous to establish the HECM line of credit sooner rather than later because of the growth feature. If you are using the HECM line of credit in a financial planning sense—establishing the variable rate line of credit before it’s needed, not drawing from it (or strategically drawing from it) and letting the unused balance grow—you would benefit from a rising interest rate environment, since higher interest rates increase your borrowing capacity at a faster rate.

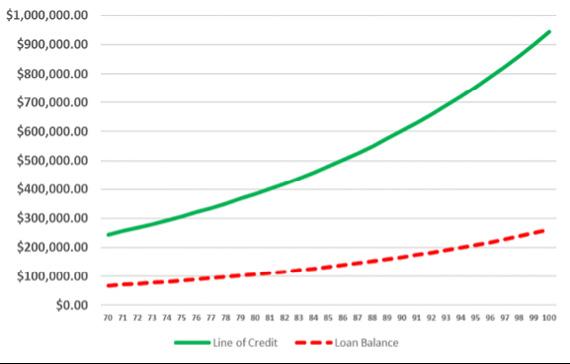

This chart illustrates how an unused line of credit could grow over time versus a loan balance in which no voluntary prepayments are made:6

Home Value: $600,000

Age: 70

Expected Interest Rate: 6.625%

Initial Principal Limit: $249,800

Initial Loan Balance: $68,000 including payoffs and closing costs

Initial Line of Credit: $198,800

Like any mortgage, a HECM loan has qualifications and requirements that the prospective borrower must meet.

Even though a HECM loan doesn’t require monthly principal and interest payments, the borrower must have the ability to pay the ongoing property charges, such as taxes and insurance. Failure to meet those mandatory obligations may cause the borrower to default on the mortgage.

That said, it’s generally easier for an older-adult homeowner to qualify for a HECM, as compared to a traditional forward mortgage, traditional cash-out refinance, home equity line of credit or home equity loan. With a HECM, there is no minimum credit score requirement; however, the lender will conduct a financial assessment of your credit history, property charge history and monthly residual income when deciding whether to approve your loan.

The home must be the borrower’s principal residence.

Generally Eligible:

• Single-family residences

• Two- to four-unit properties, as long as the borrower occupies one unit

• Condos in an FHA-approved condominium project

• Condos that qualify for single-unit approval (SUA)

• Modular homes

• Manufactured homes that meet FHA requirements

The borrower(s) must be 62 or older.

The borrower must be the homeowner Generally, the borrower must either own the home free and clear or have significant equity (about 50% or more). For a prospective borrower who does not have quite enough equity in their home to qualify, they can bring funds to closing to satisfy a shortfall.

The borrower must attend a counseling session The main objectives of the session are to make sure you fully understand the loan program and to help you determine if it’s a good fit for you. Counseling is conducted by U.S. Department of Housing and Urban Development (HUD)approved independent third parties. The session can be done in person or over the phone.

Laura, an 82-year-old widow, lost her husband six months ago. Having been the primary manager of finances throughout their marriage, she continued working after his passing, earning just over $100,000 in the past year. She owns a home in Miami, Florida, valued at $800,000, with a $300,000 mortgage balance remaining after five years into a 15-year mortgage. Her required monthly principal and interest payment is $3,139. Despite her age, she is healthy, energetic, and determined to stay in her home long-term.

Home Value: $800,000

Mortgage Balance: $300,000

Assets: $675,000 in 401(k), savings, and mutual funds

Social Security Income: $2,150/month

Income: $100,000+ per year, but Laura wishes to retire

Laura wants to retire, travel, spend more time with family, and embrace a slower pace of life while safeguarding her savings. Her longterm goal is to leave a meaningful legacy for her three sons.

1. Continue working to cover the mortgage payments.

2. Stop working and aggressively withdraw from retirement accounts to sustain her lifestyle and pay the mortgage. Estimated annual distribution: $85,000–$90,000 per year.

3. Refinance with a HECM reverse mortgage, paying off the $300,000 mortgage balance, receiving an additional $50,000 at closing, and eliminating the $3,139/month mortgage payment. Laura would continue to pay required property charges, like taxes and insurance.

Summary

By refinancing her existing mortgage into a HECM, Laura was able to eliminate her $3,139 monthly mortgage payment. This freed up significant cash flow, enhancing her financial flexibility and allowing her to retire comfortably. By adjusting her asset withdrawals more conservatively, she increased the likelihood of preserving her savings throughout retirement. The HECM gave Laura the opportunity to retire and focus on her goals: traveling, spending time with family, and leaving a legacy for her children.

TOTAL MONTHLY CASH FLOW SAVINGS: $3,139 (eliminating mortgage payments).

Note:

A Home Equity Line of Credit (HELOC) is another option for older adult homeowners, as it also allows the borrower to use funds drawn from a home-secured line of credit for any purpose. However, a HELOC and HECM work in different ways and have different implications. As you can see from the chart below, a HECM line of credit offers some distinct advantages over a HELOC.

Do I own the home and remain on title?

As an adult, is there a minimum age that I need to be?

Do the unused funds in the line of credit accrue interest?

Are there required monthly principal and/or interest mortgage payments?

Does the unused portion of the line of credit grow over time to produce greater borrowing capacity?

Is it a non-recourse loan? (never owe more than home is worth when home is sold)8 No Yes

Are the draw periods limited?

Yes, typically there’s a 5- or 10-year draw period (time frame depends on product) No

Are there any prepayment penalties? Depends on product No

Which product is generally easier for 62+ homeowners to qualify for? More difficult Easier

Can the line of credit be frozen, reduced or canceled based on market conditions?

6This information is provided as a guideline and does not reflect the final outcome for any particular homebuyer or property. The actual reverse mortgage available funds are based on current interest rates, current charges associated with loan, borrower date of birth (or non-borrowing spouse, if applicable), the property sales price and standard closing cost. Interest rates and loan fees are subject to change without notice. Following the closing of the home purchase, no further principal or interest payments will be required as long as one borrower occupies the home as their primary residence and adheres to all HUD guidelines of loan. Borrower must remain current on property taxes, homeowners insurance (and homeowner association dues, if applicable), and home must be maintained.

7Must pay the property charges, like taxes and insurance.

8There are some circumstances that will cause the loan to mature and the balance to become due and payable. Borrower is still responsible for paying property taxes and insurance and maintaining the home. Credit subject to age, property and some limited debt qualifications. Program rates, fees, terms and conditions are not available in all states and subject to change.

Myth #1: Your home will be taken away when you pass away and your family loses the right to the property.

FACT: When you permanently move out of the home, whether you sell it or pass away, neither you, your estate nor your heirs are responsible for paying the deficit if the balance owed on your HECM exceeds the home value. However, should your heirs want to keep the home, they can pay the lesser of the loan balance due or 95% of the current appraised value of the home.

Myth #2: The safest thing is a house “free and clear.”

FACT: In the event of an extended nursing home stay or a lawsuit, you can lose all of the home equity you spent your whole life creating. A HECM loan can unlock that equity and allow you to properly manage it for the benefit of your family. Talk to your financial advisor about how a HECM can help you do this.

Myth #3: I will be giving up the deed to my own home and I will not own it anymore.

FACT: The deed is still in your name, so you can move whenever you want. As long as you pay your property taxes, homeowners insurance and maintain your home, you cannot be foreclosed on. We must honor this commitment for life or as long as you live in your home. However, you are allowed to change your mind and sell the house whenever you want. Only you will make the decision, not the lender or the government.

Myth #4: HECMS are too expensive.

FACT: While HECMs may be more expensive than a traditional mortgage, they may provide you with more options, such as no monthly mortgage payments (borrower is still responsible for paying taxes and insurance and maintaining the home), an increasing line of credit option on unused funds and a federally insured non-recourse feature.

Myth #5: My children could get stuck with a big mortgage debt if I live too long.

FACT: Since a HECM is a non-recourse loan, even if your home value decreases, you and your children can never be liable for any amount over the value of the home because the loan is guaranteed by the FHA Mortgage Insurance Fund (FHA/HUD).

Myth #6: A HECM should only be considered as a loan of last resort .

FACT: Now more than ever, financial advisors and consumers are viewing the HECM in a financial planning sense because of the long-term financial planning opportunities its growing line of credit presents. A HECM can allow you to potentially avoid future problems by creating more cash flow efficiencies among key retirement assets and keeping your home safe as you “age in place.” While it can be a great way to add cash flow for a borrower 62 and older that has fallen on hard times, a HECM is also an appealing option when used earlier in retirement.

• You are not obligated to make a monthly mortgage payment, so long as you live in the home, maintain it and pay the property charges, like taxes and insurance.

• The HECM funds generally are not considered income and therefore are not taxed as such. 9

• You retain the title to your home for so long as you meet your loan obligations. As the homeowner, you can remodel or even sell the home at any time—just like you can with a traditional forward mortgage.

• The HECM loan proceeds can be used for just about any purpose. Common uses are to supplement monthly income, establish an emergency fund, refinance an existing mortgage and pay for long-term care or home renovations.

• A HECM generally does not affect Social Security or Medicare benefits.

• Almost all of the upfront costs, including closing costs and ongoing fees, can be rolled into the HECM.

• The unpaid HECM loan balance grows over time as interest and fees get tacked on.

• You are drawing down on your home equity. In most cases, that means your heirs would have less money (or no money at all) coming to them from that particular asset. However, by strategically tapping home equity first, you may be able to extend the life of your other productive assets, potentially leading to you having greater net worth to leave to your family.9

• Your eligibility to qualify for needs-based programs—such as Medicaid—may be affected.

• The upfront costs tend to be higher for a HECM than a traditional mortgage, home equity line of credit or home equity loan.

• A HECM must be in the first lien position. Any existing mortgage on your home must be paid off in full prior to taking out a HECM. Note: A borrower can use HECM loan proceeds to pay off an existing forward mortgage at closing.

Can you sell your house if you have a HECM?

Yes. You own your home and can sell it at any time you choose. When you sell your home, the loan balance becomes due and payable, and you’ll need to satisfy the loan at that time.

What is the maximum amount for a HECM?

Will I have a Mortgage Insurance Premium (MIP)?

With a HECM, you will be required to pay upfront and ongoing mortgage insurance premiums. These premiums are usually financed into the loan and not paid out of pocket. Their purpose is to fund the nonrecourse feature, which protects you or your heirs from being stuck with a bill if your loan balance is higher than what your home sells for when the loan matures and is due and payable.

Is a HECM considered an asset for Medicaid?

While loan proceeds from a HECM are generally not considered income, Medicaid is implemented by each state, and each state has asset thresholds. Draws from a HECM, placed in the borrower’s bank account, could jeopardize his or her benefit.

For a HECM, there is a cap (called the Maximum Claim Amount, or MCA) on the home value that can be used to calculate the principal limit or the amount of money available to the borrower. The MCA is the home’s appraised value up to the HECM limit, which is currently $1,209,750.

Can a HECM be used to purchase a home?

Yes. You can buy a new primary residence by putting as little as 45% to 70%10 of the purchase price down from your own funds, with the remainder funded by the HECM for Purchase (H4P) loan. Once the H4P loan is established, it is essentially the same as a traditional HECM.

If one spouse wants the home, and one spouse wants to leave, taking out a HECM can provide the buyout for the departing spouse without disrupting either retirement plan. Alternatively, the home could be sold with the proceeds split. Each of the ex-spouses could use his or her half of the home equity to buy a new home financed with a HECM for Purchase (H4P) loan.

Proprietary reverse mortgages are private loans backed by the companies that develop them and are generally similar to a HECM but differ in some ways.

No proprietary reverse mortgages are insured by the FHA, whereas all HECMs are. Proprietary reverse mortgages may finance condo units that are not FHA-approved (with HECMs, the condo complex must be FHA-approved).

They may also better serve borrowers who own higher-priced homes (over $1.3 million) by allowing them to borrow more against their home’s equity compared to a HECM.

Some proprietary reverse mortgages also allow for borrowers slightly younger than 62. Contact Fairway to explore options for proprietary reverse mortgages in greater detail.

See how Fairway customers have used HECM for Purchase (H4P) loans to improve their financial future, secure their dream homes and enjoy a more fulfilling retirement:

https://qr1.be/LZ0I

https://qr1.be/X67S

https://qr1.be/JT2Y

At Fairway Independent Mortgage Corporation, customer service is our way of life. #FairwayNation mortgage loan officers are dedicated to finding great rates and loan options for our customers while offering some of the fastest turn times in the industry. Our goal is to act as a trusted mortgage advisor, providing highly personalized service and helping you through every step of the loan process—from application to closing and beyond. It’s all designed to exceed expectations, provide satisfaction and

earn trust. We are also highly committed to improving the way retirement is done in this country by helping older Americans use their home equity via HECMs or other home loan products so they can enjoy the retirement they desire and deserve.

Start a Conversation!

AT FAIRWAY, our goal is to help you enjoy a more fulfilling retirement lifestyle, while you continue to live in and own your home.

Copyright©2025 Fairway Independent Mortgage Corporation (“Fairway”) NMLS#2289. 4750 S. Biltmore Lane, Madison, WI 53718, 1-866-912-4800. All rights reserved. Fairway is not affiliated with any government agencies. These materials are not from HUD or FHA and were not approved by HUD or a government agency. Reverse mortgage borrowers are required to obtain an eligibility certificate by receiving counseling sessions with a HUD-approved agency. The youngest borrower must be at least 62 years old. Monthly reverse mortgage advances may affect eligibility for some other programs. This is not an offer to enter into an agreement. Not all customers will qualify. Information, rates and programs are subject to change without notice. All products are subject to credit and property approval. Other restrictions and limitations may apply. Equal Housing Opportunity. AZ License #BK-0904162. Licensed by the Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act, License No 41DBO-78367. Licensed by the Department of Financial Protection and Innovation under the California Financing Law, NMLS #2289. Loans made or arranged pursuant to a California Residential Mortgage Lending Act License. www.nmlsconsumeraccess.com.