8 minute read

EXNESS vs Deriv: An In-Depth Comparison 2025

EXNESS vs Deriv - Which is better Broker is a critical topic for anyone interested in the world of online trading. Both EXNESS and Deriv are prominent players in the brokerage industry, offering a wide range of trading services and platforms to their clients. Determining which broker is the better option can be a complex decision, as it depends on individual trading needs, preferences, and risk tolerance.

EXNESS vs Deriv: An In-Depth Comparison

When it comes to choosing a broker, investors and traders must consider a variety of factors, including trading platforms, fees, customer support, regulation, and overall user experience. In this comprehensive article, we will delve into a detailed comparison of EXNESS and Deriv, exploring their key features, strengths, and weaknesses to help you make an informed decision.

Understanding EXNESS and Deriv: Key Features

EXNESS is a global brokerage firm that has been in operation since 2008. It offers a diverse range of trading instruments, including forex, CFDs, cryptocurrencies, and commodities. EXNESS is known for its competitive spreads, fast execution, and advanced trading platforms. The broker is regulated by reputable financial authorities, such as the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA) in the UK.

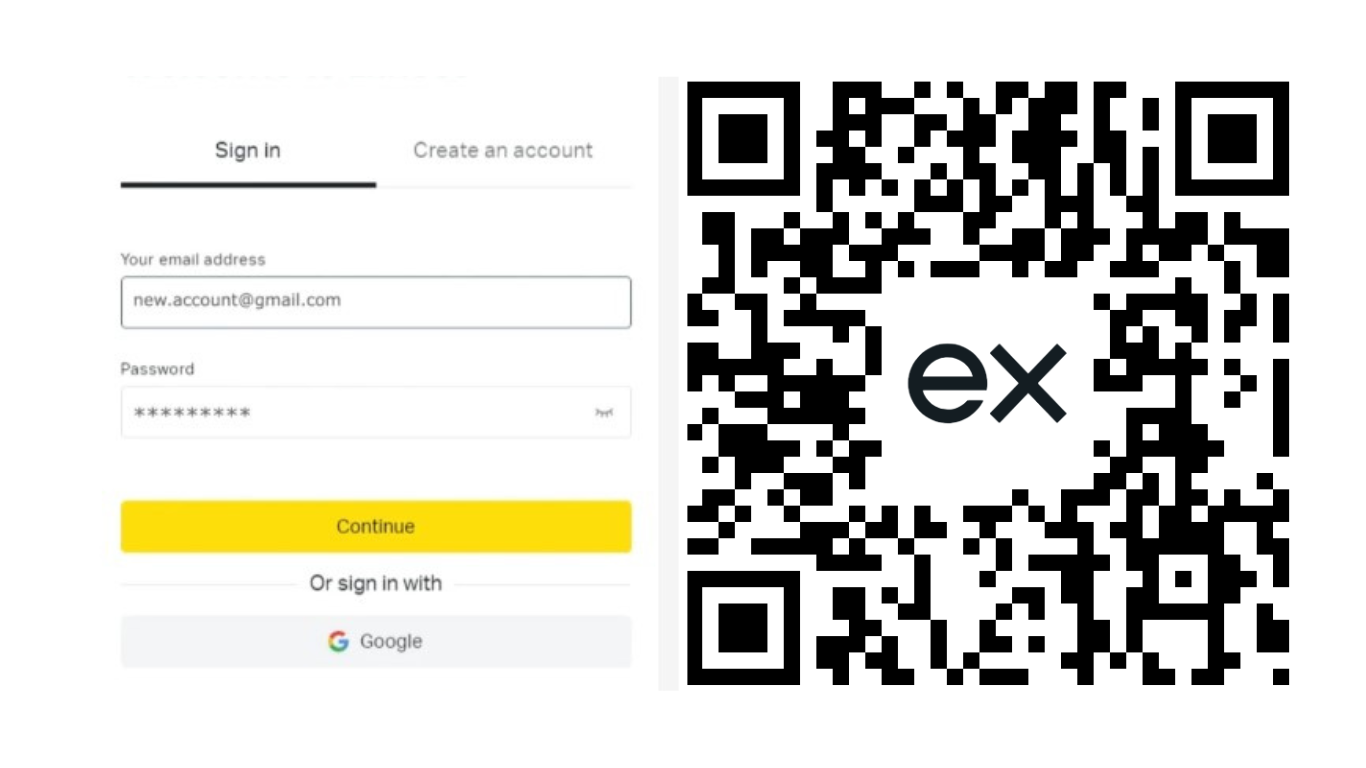

Start Exness Trade : Open Exness Account and Start Trade

Deriv, on the other hand, is a relatively newer player in the brokerage industry, having been established in 2019. It is a subsidiary of Deriv Group, a financial technology company that operates in multiple countries. Deriv specializes in offering a range of binary options, digital options, and multiplier (synthetic) contracts, catering to traders who prefer more specialized and innovative trading instruments.

Trading Platforms of EXNESS vs Deriv

EXNESS offers its clients access to a variety of trading platforms, including the widely-used MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These platforms provide a comprehensive suite of trading tools, advanced charting capabilities, and automated trading functionalities. EXNESS also offers its proprietary web-based and mobile trading platforms, which are designed to be user-friendly and accessible across devices.

See more: Exness review 2025

Deriv, on the other hand, has developed its own proprietary trading platforms, which are available in both web-based and mobile versions. These platforms are designed to cater to the specific needs of traders who are interested in binary options, digital options, and multiplier contracts. Deriv's platforms offer a range of advanced features, including customizable layouts, real-time market data, and automated trading tools.

Fees and Commissions: EXNESS vs Deriv Analysis

One of the critical factors in choosing a broker is the fees and commissions associated with trading. EXNESS is known for its competitive spreads, which can vary depending on the trading instrument and market conditions. The broker also offers a range of account types, each with its own fee structure, allowing clients to choose the option that best suits their trading needs.

Start Exness Trade : Open Exness Account and Start Trade

Deriv, in comparison, has a more straightforward fee structure. The broker charges a fixed spread on its binary options and digital options, while the multiplier contracts have a variable spread. Deriv also offers a commission-free trading environment, which may be appealing to traders who prefer a simpler fee structure.

Customer Support: EXNESS vs Deriv

Effective and responsive customer support is essential for traders, especially when dealing with complex trading scenarios or technical issues. EXNESS is known for its comprehensive customer support, with a team of knowledgeable representatives available 24/7 via various channels, including live chat, email, and telephone.

Deriv also places a strong emphasis on customer support, with a dedicated team of representatives available to assist clients. The broker offers a range of support channels, including live chat, email, and a comprehensive knowledge base. However, some traders have reported varying levels of responsiveness and consistency in the quality of support provided by Deriv.

Regulation and Safety: EXNESS vs Deriv

Regulation and safety are critical considerations when choosing a broker, as they ensure the protection of client funds and the overall integrity of the trading environment. EXNESS is regulated by reputable financial authorities, such as CySEC and FCA, which require the broker to adhere to strict compliance standards and maintain high levels of client fund segregation and financial stability.

Deriv, in comparison, is primarily regulated by the Labuan Financial Services Authority (LFSA) in Malaysia and the Vanuatu Financial Services Commission (VFSC). While these regulatory bodies provide a level of oversight, some traders may prefer brokers that are regulated by more well-known and globally recognized financial authorities.

User Experience: EXNESS vs Deriv Reviews

The overall user experience is an essential factor in choosing a broker, as it can impact the efficiency and enjoyment of the trading process. EXNESS is generally praised for its user-friendly trading platforms, intuitive interface, and comprehensive educational resources. Many traders have reported a positive experience with EXNESS, citing the broker's reliable execution, fast order processing, and responsive customer support.

Deriv, on the other hand, has received mixed reviews from traders regarding its user experience. While some have praised the innovative trading instruments and customizable platform features, others have reported challenges with the platform's learning curve and occasional technical glitches. The broker's customer support has also received varied feedback, with some traders expressing concerns about the consistency and responsiveness of the support team.

Account Types Offered by EXNESS and Deriv

Both EXNESS and Deriv offer a range of account types to cater to the diverse needs of their client base. EXNESS provides several account options, including Standard, Pro, and Micro accounts, each with its own minimum deposit requirements, leverage, and fee structures. This flexibility allows traders to choose the account that best suits their trading style and risk tolerance.

Deriv, in comparison, offers a more streamlined account structure, with a focus on its specialized trading instruments. The broker's main account types include Options, Multipliers, and Synthetics, each designed for specific trading strategies and risk profiles. While this targeted approach may appeal to traders looking for specialized trading products, it may not provide the same level of flexibility as the account options offered by EXNESS.

Market Access: EXNESS vs Deriv Trading Options

When it comes to market access, EXNESS and Deriv offer different trading opportunities. EXNESS provides a diverse range of trading instruments, including forex, CFDs, commodities, and cryptocurrencies, allowing traders to diversify their portfolios and explore various market opportunities.

Deriv, on the other hand, specializes in binary options, digital options, and multiplier (synthetic) contracts, catering to traders who prefer these more specialized and innovative trading instruments. While this focus on niche products may appeal to certain traders, it may not be as appealing to those seeking a broader range of traditional trading instruments.

Which Broker is Better for Beginners: EXNESS or Deriv?

Determining which broker is better for beginners can be a subjective decision, as it depends on the individual trader's level of experience, trading goals, and risk tolerance. However, when considering the factors discussed in this article, EXNESS may be the more suitable choice for beginners.

EXNESS offers a more comprehensive range of trading instruments, including the widely-used MetaTrader platforms, which are known for their user-friendly interfaces and extensive educational resources. The broker's diverse account options and competitive fee structure may also be more accessible and appealing to novice traders.

Deriv, on the other hand, may be better suited for more experienced traders who are interested in specialized trading instruments, such as binary options and multiplier contracts. While Deriv's platforms are designed to be user-friendly, the learning curve for these unique trading products may be steeper for beginners.

Conclusion

In the highly competitive world of online trading, both EXNESS comparison Deriv have their own unique strengths and weaknesses. EXNESS offers a more traditional and diverse range of trading instruments, robust regulation, and a proven track record, making it a solid choice for traders of all experience levels.

Deriv, on the other hand, caters to traders seeking more specialized and innovative trading products, such as binary options and multiplier contracts. While this approach may appeal to experienced traders, it may not be the best fit for beginners.

Ultimately, the choice between EXNESS and Deriv will depend on your individual trading needs, preferences, and risk tolerance. It is essential to thoroughly research and compare the two brokers, considering factors such as trading platforms, fees, customer support, regulation, and user reviews, to determine which one aligns best with your trading goals and investment strategy.

See more: