4 minute read

EXNESS Review Nigeria: Pro, Cons, Legit Legal, Safe, a good broker 2025?

from Exness Guide

Choosing a reliable forex broker is crucial for Nigerian traders looking to succeed in the competitive forex market. Exness has gained significant attention globally for its user-friendly platforms, diverse account types, and competitive trading conditions. But how well does it cater to Nigerian traders specifically? In this review, we’ll analyze whether Exness is a good broker for Nigeria, its legality, and its pros and cons.

2. Overview of Exness

Exness broker was established in 2008 and has since become a global leader in online trading. Known for its transparency and cutting-edge technology, Exness offers services in over 100 countries. With platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary WebTrader, Exness provides a robust trading ecosystem for all levels of traders.

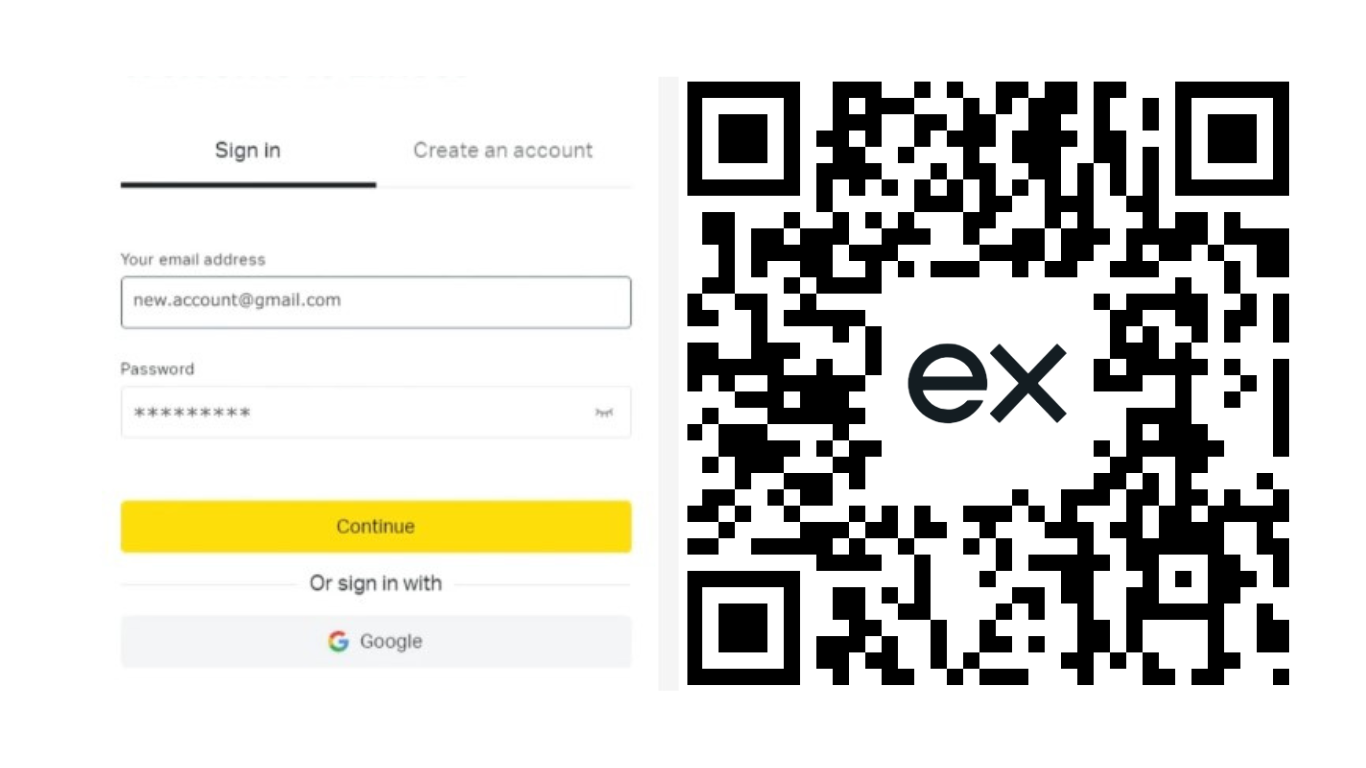

Start Exness Trade: Open Exness Account and Visit site

Key Features:

Wide range of trading instruments including forex, commodities, cryptocurrencies, and indices.

High-speed order execution and competitive spreads.

Multiple account options to suit beginners and professionals alike.

3. Regulation and Legitimacy

One of the most critical aspects of any broker is its regulation. Exness is regulated by several top-tier authorities, ensuring its global trustworthiness.

Global Regulation:

Financial Conduct Authority (FCA) in the UK.

Cyprus Securities and Exchange Commission (CySEC).

Financial Sector Conduct Authority (FSCA) in South Africa.

Nigeria:While Exness is not directly regulated by the Securities and Exchange Commission (SEC) Nigeria, it complies with international standards and accepts Nigerian traders. This raises some concerns but doesn’t necessarily indicate a lack of safety.

See more: Exness review 2025

4. Account Types Offered by Exness

Exness account offers a range of account types tailored to meet diverse trading needs:

Standard Accounts:

Ideal for beginners.

Low spreads starting at 0.3 pips.

No commission on trades.

Professional Accounts:

Includes Raw Spread, Zero, and Pro accounts.

Tight spreads starting from 0.0 pips.

Commission-based trading for Raw Spread and Zero accounts.

Faster execution speeds.

Start Exness Trade: Open Exness Account and Visit site

Cent Accounts:

Designed for new traders to practice with small amounts.

Trades in cents instead of dollars, reducing risk.

Islamic Accounts:

Swap-free accounts available for traders adhering to Sharia law.

5. Trading Platforms

Exness supports some of the best trading platforms in the industry, offering flexibility and advanced tools.

MetaTrader 4 (MT4):

Ideal for beginners and experienced traders.

Customizable indicators and tools.

MetaTrader 5 (MT5):

Advanced features for professional traders.

Supports more instruments and complex trading strategies.

Exness WebTrader:

Accessible via any browser.

User-friendly interface.

Exness Mobile App:

Designed for trading on the go.

Offers full functionality with a simple interface.

Start Exness Trade: Open Exness Account and Visit site

6. Trading Instruments

Exness provides a diverse range of instruments, ensuring traders can diversify their portfolios.

Forex: Major, minor, and exotic currency pairs.

Commodities: Gold, silver, oil, and more.

Indices: Global indices like NASDAQ and S&P 500.

Cryptocurrencies: Bitcoin, Ethereum, and others.

7. Trading Conditions

Spreads and Commissions:

Spreads start from 0.0 pips on professional accounts.

No commission on Standard accounts; low commission rates on Raw Spread and Zero accounts.

Leverage:

Offers high leverage up to 1:2000, allowing traders to maximize their capital.

Execution Speed:

Fast order execution with minimal slippage.

8. Payment Methods for Nigerians

Exness offers a variety of payment methods, making it easy for Nigerian traders to deposit and withdraw funds.

Deposit Methods:

Bank transfers via local Nigerian banks.

Mobile money services.

E-wallets: Skrill, Neteller, and more.

Cryptocurrencies like Bitcoin.

Withdrawal Methods:

Same options as deposits, ensuring convenience.

Fast processing times (most transactions processed within 24 hours).

No hidden fees.

9. Education and Resources

Exness offers educational resources to help traders improve their skills:

Free webinars and tutorials.

Market analysis tools.

Economic calendars and trading calculators.

Demo accounts for risk-free practice.

Start Exness Trade: Open Exness Account and Visit site

10. Customer Support

Evaluation of support quality:

Languages supported (English, Hausa, Yoruba, etc.).

Contact channels: Chat, email, local phone support.

Availability: 24/7 or limited hours.

11. Exness Pros

Tailored for Nigerian traders.

Low transaction costs and fees.

Strong platform options and resources.

12. Exness Cons

Areas for improvement:

Platform issues.

Regulatory gaps in Nigeria (if any).

13. Safety and Security

How Exness protects user funds:

Segregated accounts, encryption, and insurance.

Handling fraud and complaints.

14. Is Exness a Good Broker for Nigerians?

Comparative analysis with other brokers.

Recommendations based on trading goals (e.g., beginners vs. advanced traders).

15. Conclusion

Summarize findings and key points.

Encourage users to start with a demo account or explore their options further.

This outline includes a more detailed evaluation of account types, trading platforms, and other factors. Would you like me to start drafting this version, or do you have specific factors you'd like more emphasis on?

See more:

Is EXNESS legit or scam? EXNESS broker review 2025

Exness Account Types Review: Standard, Raw Spread, Zero, Pro