5 minute read

Best Forex Pairs With High Volatility 2025

from Exness Guide

Volatility in Forex trading is a double-edged sword — it can bring massive profits but also significant risk. For skilled traders who thrive on momentum, breakout setups, or short-term scalping, high volatility is not a threat — it’s an opportunity.

In this guide, we reveal the best Forex pairs with high volatility in 2025, why they matter, and how to trade them safely for maximum gains.

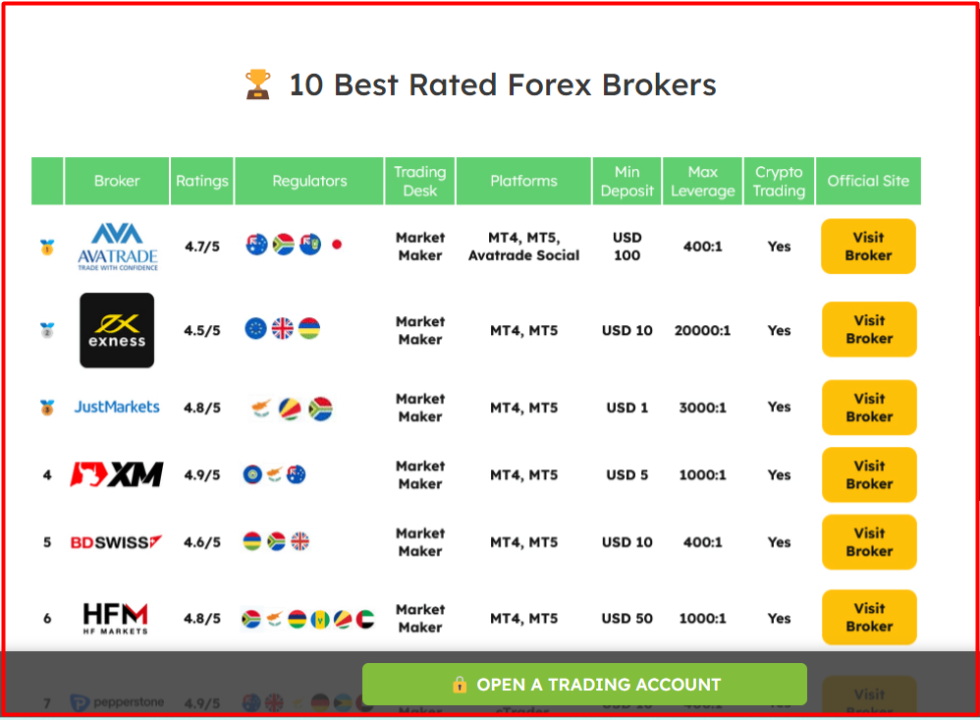

➡️➡️➡️ After identifying the most volatile pairs for trading, the next step is to choose a reliable broker. Here are some of the best Forex brokers in the world to help you get started.

1️⃣ Exness: Open Account | Go to Website

2️⃣ JustMarkets: Open Account | Go to Website

3️⃣ XM: Open Account | Go to Website

5️⃣Avatrade: Open Account | Go to Website

What Is Volatility in Forex?

Volatility refers to how much the price of a currency pair fluctuates within a given period. High volatility means bigger price swings, which creates more opportunities for:

Scalping profits in minutes

Breakout trades around news events

Trend moves across multiple sessions

However, it also means you must manage risk carefully and use tighter stop-loss strategies.

Factors That Drive High Volatility

Economic News Releases (e.g., NFP, CPI, Interest Rate decisions)

Political Uncertainty

Market Sentiment Shifts

Central Bank Policies (Fed, BoE, BoJ, etc.)

Time of Day and Trading Sessions

Best High-Volatility Forex Pairs in 2025

1. GBP/JPY – The Volatility King

This pair combines the aggressive nature of the British pound with the sharp reversals of the Japanese yen.

Average daily range: 100–180+ pips

Great for scalping and liquidity sweeps

Often forms sharp wicks, ideal for reversal traders

Best Time to Trade: London open and New York overlap

2. GBP/USD – Powerful Moves, Especially Around News

"The Cable" is a go-to pair for traders who love strong momentum.

Reacts violently to UK and US news releases

Huge liquidity — but also prone to fakeouts

Perfect for breakout and structure-based setups

Best Time to Trade: London to New York sessions

3. EUR/JPY – Clean but Active Mover

Less erratic than GBP/JPY, but still volatile enough for solid intraday trades.

Good for structured price action

Moves 80–120 pips per day

Often trends strongly after the Tokyo session opens

Best Time to Trade: Asian session and London crossover

Is EXNESS a good trading platform?

4. USD/TRY – Exotic Pair, Wild Swings

The Turkish lira is known for sharp, unpredictable moves.

Can move hundreds of pips daily

Not ideal for beginners due to sudden spikes

Requires wider stop-loss and caution

Best Time to Trade: NY session or post-economic announcements

5. XAU/USD (Gold) – Not a Currency, But Extremely Volatile

Gold is the top choice for many advanced traders due to:

Daily ranges over 300 pips

Excellent response to imbalance, OB, and FVG setups

Heavy reaction to news and geopolitical tension

Best Time to Trade: NY AM session (8:30–11:00 EST)

6. EUR/AUD – News-Driven & Trendy

This cross-pair can be highly volatile when economic data from Europe or Australia drops.

Wide moves on interest rate news

Trend-following setups work well

Can be volatile even outside normal hours

Best Time to Trade: London and early NY sessions

7. GBP/NZD – For Advanced Traders Only

A cross between two volatile currencies, this pair can explode in either direction.

Extreme pip moves (up to 250–300 per day)

Unpredictable unless closely tracked

Best for short-term swing or breakout strategies

How to Trade High Volatility Pairs Safely

Use tight but logical stop-losses — avoid emotional sizing

Always trade with a clear risk-reward ratio (minimum 1:2)

Focus on session timing: trade during peak liquidity

Reduce lot size to manage higher pip exposure

Use structured entries: FVGs, OBs, BOS, and clean support/resistance

How to login EXNESS Trading platform

Tools for High Volatility Trading

Want to sharpen your volatility strategies?

👉 Check out: Exness Trading

This hub includes daily breakdowns, trading eBooks, market news, and guides on how to handle high-impact market conditions — especially during volatile sessions.

FAQs: Best Forex Pairs With High Volatility 2025

1. What is the most volatile Forex pair in 2025?GBP/JPY continues to be one of the most volatile and widely traded for aggressive strategies.

2. Is Gold (XAU/USD) a good substitute for volatile pairs?Yes, gold is extremely volatile and acts like a high-speed currency pair.

3. Are exotic pairs worth trading for volatility?Yes, but only for experienced traders due to higher spread and slippage.

4. When is volatility highest during the day?During London and New York overlaps, and around major news events.

5. Should I use indicators for volatility trades?Price action, market structure, and liquidity tools (like OB/FVG) are more effective.

6. Are volatile pairs good for beginners?Not recommended unless you're using small lot sizes and strong risk control.

Final Thoughts: Ride the Waves of Volatility

If you're a trader who thrives on market movement, these high volatility Forex pairs are your playground in 2025. From GBP/JPY’s sharp runs to XAU/USD’s explosive reactions, there's no shortage of opportunity — if you trade with discipline.

See more:

how to create account in exness

How To place a trade on EXNESS