5 minute read

Best Forex Pairs for ICT 2025

from Exness Guide

The Inner Circle Trader (ICT) strategy — developed by Michael J. Huddleston — has become one of the most respected trading methodologies for understanding institutional price delivery, liquidity grabs, and order flow. For ICT to work effectively, however, you need the right Forex pairs — pairs that respect structure, show clear liquidity pools, and move with institutional patterns.

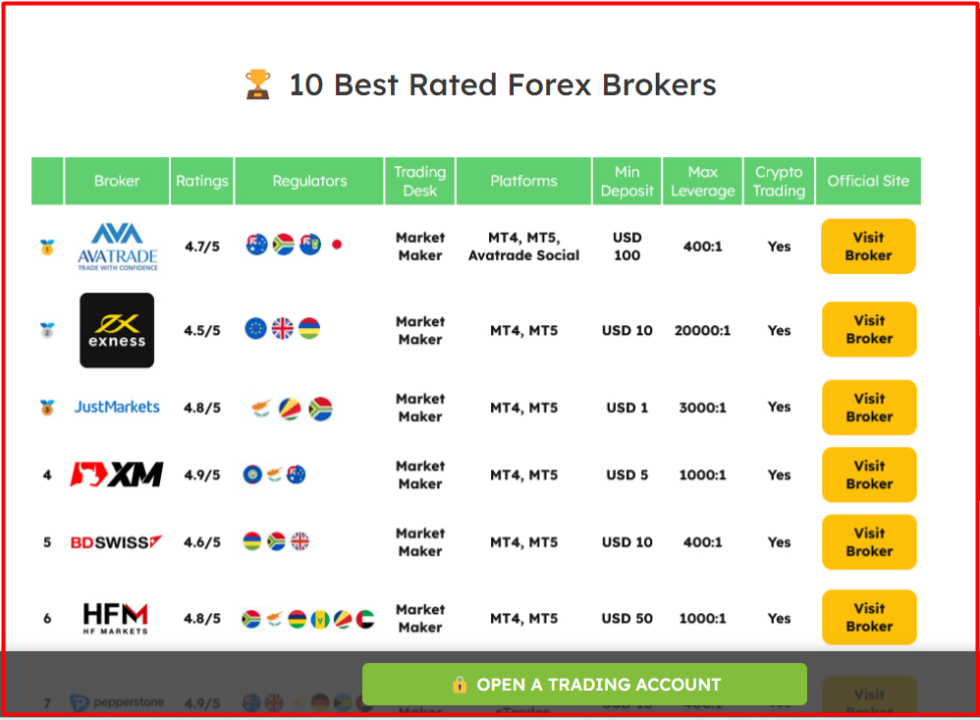

"Knowing the right pairs is crucial, but your trading success also depends on your broker. Find the perfect fit with our list of the best Forex brokers in the world."

1️⃣ Exness: Open Account | Go to Website

2️⃣ JustMarkets: Open Account | Go to Website

3️⃣ XM: Open Account | Go to Website

5️⃣Avatrade: Open Account | Go to Website

In this article, you’ll discover the best Forex pairs for ICT in 2025, and how to align them with smart money concepts like Fair Value Gaps (FVGs), Order Blocks (OBs), Market Structure Shifts (MSS), and Time of Day models.

Why the Right Forex Pair Matters in ICT

ICT is built on anticipating where institutional traders (smart money) will enter and exit. Therefore, ideal pairs for ICT must:

Exhibit clear market structure

React well to liquidity pools and imbalance zones

Move cleanly during London and New York sessions

Support precise entries during Kill Zones

Have high liquidity and low spread

Best Forex Pairs for ICT 2025

Here are the top pairs that consistently align with ICT concepts:

1. EUR/USD – The ICT Classic

EUR/USD is the most traded pair globally and an ICT favorite for many reasons.

Respects daily highs/lows and FVGs

Clear inducement moves followed by reversals

Best traded during London and NY session overlap

Perfect for liquidity sweep and OB models

Best for: Beginners to advanced ICT traders

2. GBP/USD – High Volatility, High Reward

GBP/USD provides more aggressive moves, ideal for break of structure (BOS) and Judas swings.

Larger ADR (Average Daily Range) than EUR/USD

Frequently forms perfect SMT divergences with EUR/USD

Great for NY session raids and reversals

Tip: Use this pair in conjunction with EUR/USD for SMT confirmation

3. GBP/JPY – Volatile and Precise

Known for its massive volatility, GBP/JPY can be risky but highly rewarding.

Excellent for advanced ICT setups like FVG + OB entries

Delivers deep liquidity raids

Strong price delivery during London and New York overlap

Note: Requires tighter risk control due to its movement speed

4. USD/JPY – Tokyo’s Institutional Favorite

USD/JPY aligns well with Asian session ICT models, especially liquidity runs before the New York open.

Reacts sharply to macro news and imbalance cleanups

Suitable for time and price delivery models

Offers stable structure with regular stop hunts

Pro Tip: Use 15M or 5M charts for Kill Zone entries

5. EUR/JPY – A Strong Correlation Trade

EUR/JPY is great for ICT’s correlated pair analysis, particularly in the London AM session.

Delivers clean pullbacks into OBs

High correlation with EUR/USD

Best for bias confirmation and SMT setups

Why Trade It: Combines the best of Euro structure and JPY volatility

6. XAU/USD (Gold) – Advanced ICT Setup Playground

Though not a currency pair, Gold is heavily traded by ICT practitioners.

Respects daily highs/lows with extreme precision

Excellent for FVG + OB sniper entries

Moves strongly in the New York AM session

Caution: Gold is not beginner-friendly, but highly profitable with strict discipline

How to Trade ICT Pairs Effectively

Start with Daily BiasMark out previous day’s high/low, draw on liquidity zones, and map imbalance areas.

Use Time-of-Day ModelsFocus on London Open, NY AM session, and NYPM session for entry opportunities.

Mark Fair Value Gaps and Order BlocksUse 1H and 15M for confirmation, and 5M for sniper entries.

Watch for Liquidity RaidsLook for stop hunts above highs or below lows before reversals.

Apply SMT DivergenceCompare EUR/USD vs GBP/USD for smart money divergence setups.

⬇️⬇️⬇️

Best Time to Trade ICT Forex Pairs in 2025

London Open (7:00–9:00 AM GMT): Strong inducement and Judas swings

New York AM Session (8:30–11:00 AM EST): Liquidity grabs and real moves

NY PM Session (1:00–3:00 PM EST): Continuation or reversal setups

Asian Session (for JPY pairs): Clean structure and liquidity runs

FAQs: Best Forex Pairs for ICT 2025

1. Which pair is best for ICT beginners?EUR/USD — it’s the cleanest and most stable for learning ICT setups.

2. Is Gold good for ICT trading?Yes, but only for experienced traders due to high volatility and fast execution needs.

3. Can I use exotic pairs with ICT?Not recommended. They lack the liquidity and structure required for ICT precision.

4. What’s the best timeframe for ICT entries?1H for bias, 15M for confirmation, 5M for sniper entries.

5. What is SMT Divergence in ICT?It’s Smart Money Technique where correlated pairs move differently, signaling trap or manipulation.

6. Is GBP/JPY too volatile for ICT?No, it’s ideal for high-RR ICT trades — but use tight stop-losses.

Final Thoughts: Master ICT by Trading the Right Pairs

Trading the best Forex pairs for ICT in 2025 is crucial for consistent success. The strategy is incredibly powerful — but it only works if you're using pairs that respect liquidity grabs, order blocks, and smart money behavior.

To recap:✅ Start with EUR/USD and GBP/USD

✅ Add USD/JPY or EUR/JPY for structure

✅ Explore Gold or GBP/JPY if you’re experienced and disciplined

Combine market structure, time of day, and smart money concepts, and you’ll be trading the ICT model with precision.

See more:

how to open exness real account

how to open exness demo account on mt5

How to get demo account on Exness?