5 minute read

Best Forex Pairs With Highest Pip Value 2025

from Exness Guide

In Forex trading, every pip counts — especially when you're looking to maximize your profits with precision. But not all pips are created equal. Some currency pairs offer higher pip values due to larger contract sizes or lower quote currency value. If you’re aiming for bigger returns per movement, understanding which pairs yield the most per pip is a game-changer.

In this article, we’ll explore the best Forex pairs with the highest pip value in 2025, what affects pip value, and how to trade these powerful movers with smart strategies.

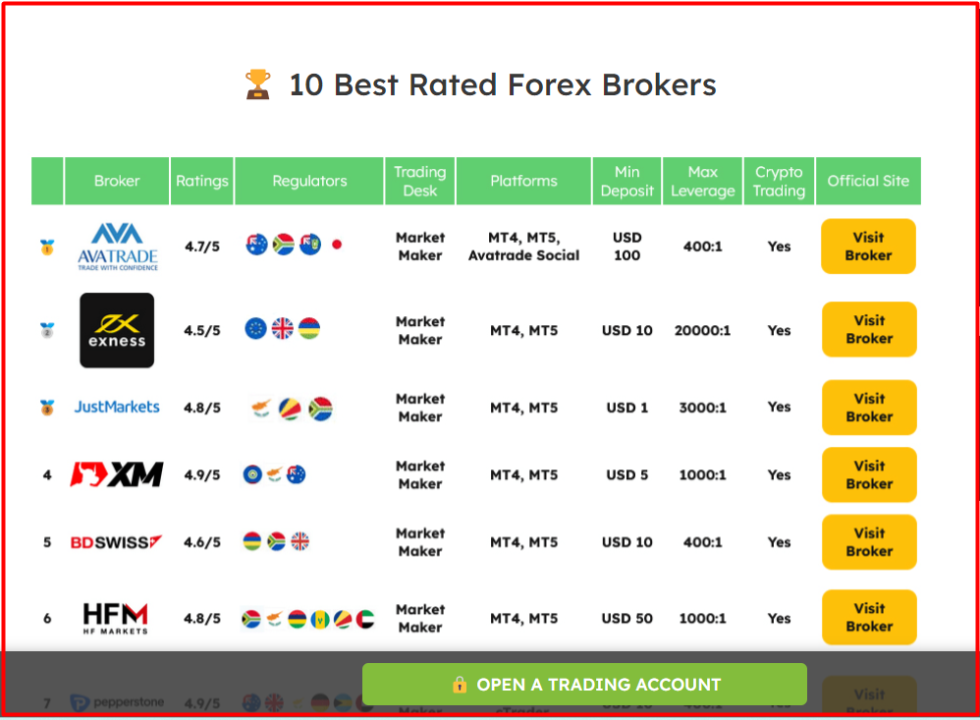

After identifying the pairs with the highest pip value, the next step is to choose a reliable broker. Here are some of the best Forex brokers in the world to help you get started.

1️⃣ Exness: Open Account | Go to Website

2️⃣ JustMarkets: Open Account | Go to Website

3️⃣ XM: Open Account | Go to Website

5️⃣Avatrade: Open Account | Go to Website

What is Pip Value in Forex?

A pip (point in percentage) is the smallest price movement in most currency pairs — typically the fourth decimal place. The pip value is the amount of money you earn or lose per pip movement per lot.

Pip Value Formula (for standard lots):Pip Value = (1 pip / exchange rate) × lot size × quote currency value

So, pip value depends on:

The currency pair you're trading

The lot size (standard, mini, micro)

The base vs quote currency

Your account currency

Why Pip Value Matters

✅ Higher pip value = more profit per movement

✅ Great for experienced traders with tight entries

✅ Increases profit potential in trending markets

✅ Helps define risk-to-reward ratio more effectively

But remember: higher pip value = higher risk if not managed correctly.

Top 7 Best Forex Pairs With Highest Pip Value in 2025

1. GBP/JPY (British Pound / Japanese Yen)

Why It Has High Pip Value:

Involves two strong, high-volatility currencies

GBP is one of the strongest base currencies

JPY is a low-value quote currency, increasing pip worth

Average Pip Value (Standard Lot): ~$9.00–$9.50Why Trade It: Big daily ranges (100+ pips), great for swing tradingTip: Use ATR and trendline strategies

2. GBP/USD (British Pound / US Dollar)

Why It Has High Pip Value:

GBP’s large price swings make pips worth more

High volatility leads to fast profits

Average Pip Value (Standard Lot): ~$10.00Why Trade It: Popular for news trading and London session scalpsTip: Use breakout strategies during UK/US overlap

3. EUR/JPY (Euro / Japanese Yen)

Why It Has High Pip Value:

Combines Eurozone strength with yen’s pip sensitivity

Moves in strong directional trends

Average Pip Value (Standard Lot): ~$8.50Why Trade It: Excellent for medium-term swing setupsTip: Use Fibonacci retracements for entries

4. EUR/USD (Euro / US Dollar)

Why It’s Still Profitable:

High liquidity, tight spreads, consistent pip structure

Though lower in value per pip, the frequency of movement increases earnings

Average Pip Value (Standard Lot): ~$10.00Why Trade It: Safe pair with the best execution environmentTip: Use RSI + MACD for trend reversals

See more: Exness broker review

5. XAU/USD (Gold / US Dollar)

Why It Has Extreme Pip Value:

Gold is not a currency, but its volatility offers huge pip gains

Even small movements can equate to $10–$20/pip

Average Pip Value (Standard Lot): ~$10–$20+ per tick (varies by broker)Why Trade It: Ideal for high-volatility, short-term tradersTip: Use lower timeframes and strong SL discipline

6. GBP/NZD (British Pound / New Zealand Dollar)

Why It Has High Pip Value:

Highly volatile exotic cross with wide ranges

Perfect for swing traders targeting large pip moves

Average Pip Value (Standard Lot): ~$9.50Why Trade It: Strong moves after news, ideal for patient tradersTip: Use daily chart zones for best entries

7. GBP/CHF (British Pound / Swiss Franc)

Why It’s a Top Contender:

GBP volatility + CHF safe-haven status = aggressive swings

Good pip potential with less competition

Average Pip Value (Standard Lot): ~$9.30Why Trade It: Clean reversals and breakout setupsTip: Combine MACD + trendline for confluence entries

How to Trade High Pip Value Pairs Successfully

✅ Use tight stop-losses and wide take-profits

✅ Master risk management — never risk more than 2%

✅ Trade during session overlaps for maximum movement

✅ Avoid overleveraging — high pip value = fast profits AND fast losses

✅ Stick to tested setups — breakouts, pullbacks, divergence

FAQs: Best Forex Pairs With Highest Pip Value 2025

1. What’s the highest pip value Forex pair?Currently, GBP/USD and XAU/USD (Gold) offer among the highest pip values.

2. Are high pip value pairs riskier?Yes, because one move can mean more profit or loss. Use tight risk controls.

3. Should beginners trade high pip value pairs?Not recommended unless on a demo or with micro lot sizes. Start slow.

4. How is pip value calculated in cross pairs?It depends on the base and quote currency relative to your account currency.

5. What lot size should I use with high pip value pairs?Start with micro lots (0.01) to manage risk.

6. Do brokers offer different pip values?Pip value is market-based, but some brokers offer fractional pip pricing (5-digit).

7. Which session is best to trade GBP/JPY?London and New York overlaps — highest movement.

8. Is XAU/USD too risky for small accounts?Yes — unless you’re using strict stop-loss and trading micro contracts.

9. Do pip values change daily?Yes — slightly, based on exchange rate fluctuations and quote currency strength.

10. How can I calculate pip value manually?Use: (0.0001 / quote currency rate) × lot size × contract size

Final Thoughts: Trade the Highest Pip Value Forex Pairs Like a Pro

The best Forex pairs with the highest pip value in 2025 offer powerful trading potential. Whether you're a short-term scalper or long-term swing trader, pairs like GBP/JPY, EUR/JPY, GBP/USD, and even XAU/USD deliver high-value movements with excellent profit potential — if traded wisely.

Trade smart. Trade disciplined. And let every pip push you closer to profit.

See more:

Best Forex Pairs to Trade for Beginners 2025

Best Forex Pairs for Scalping 2025