5 minute read

Best Forex Pairs to Trade for Beginners 2025

from Exness Guide

If you’re just starting out in Forex, one of the most important decisions you’ll make is which currency pairs to trade. Not all Forex pairs are created equal — some are more volatile, unpredictable, and expensive to trade than others. So if you're wondering which pairs to focus on, this guide will show you the best Forex pairs to trade for beginners in 2025.

These pairs offer high liquidity, lower spreads, stable price behavior, and plenty of educational content to help you learn the ropes faster.

Why Choosing the Right Forex Pairs Matters

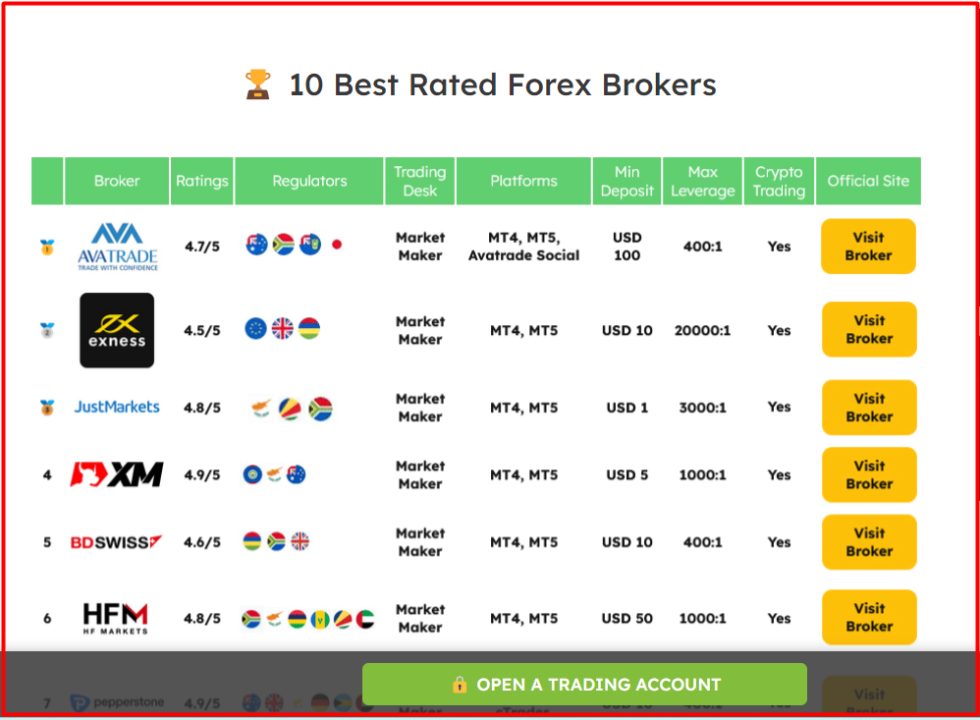

⬇️⬇️⬇️

1️⃣ Exness: Open Account | Go to Website

2️⃣ JustMarkets: Open Account | Go to Website

3️⃣ XM: Open Account | Go to Website

4️⃣Pepperstone: Go to Website

5️⃣Avatrade: Open Account | Go to Website

As a beginner, the pairs you trade can either help you learn faster — or cause frustration and losses. Here’s why pair selection matters:

Liquidity: Pairs with high trading volume (like EUR/USD) are easier to enter and exit.

Spreads: Lower spreads mean cheaper trading costs.

Volatility: Too much volatility can be risky; too little can be boring and unprofitable.

News Sensitivity: Some pairs react wildly to economic events, which may overwhelm new traders.

Beginners need pairs that are stable, predictable, and well-supported by brokers and educational platforms.

Top 7 Best Forex Pairs to Trade for Beginners in 2025

Let’s look at the most beginner-friendly currency pairs you should consider in your trading plan.

1. EUR/USD (Euro/US Dollar)

Why it’s great for beginners:

Most traded pair in the world

Extremely high liquidity

Very tight spreads

Smooth price action

Abundant educational content

This pair reacts well to technical analysis and is heavily influenced by Eurozone and US economic data. A perfect pair to master chart patterns, indicators, and trading psychology.

2. GBP/USD (British Pound/US Dollar)

Nicknamed: The Cable

Why beginners love it:

High volatility (but manageable)

Clear trend movements

Responsive to support/resistance zones

Although a bit more volatile than EUR/USD, GBP/USD offers excellent trading opportunities for those looking to develop a trend-following strategy. News from the Bank of England and UK economy plays a major role.

⬇️⬇️⬇️

EXNESS FOREX Broker Review 2025

3. USD/JPY (US Dollar/Japanese Yen)

Why it’s beginner-friendly:

Predictable behavior

Strong reaction to economic indicators

Low spreads and wide availability

USD/JPY often respects trend lines and Fibonacci levels, making it ideal for technical traders. It’s active during the Asian and New York sessions — perfect for part-time traders.

4. USD/CHF (US Dollar/Swiss Franc)

Known for: Stability and low volatility

Great for: Low-risk setups and safe haven learning

USD/CHF tends to move slowly and often in correlation with EUR/USD — but in the opposite direction. It’s an excellent pair to use for risk-off vs. risk-on environment understanding.

5. AUD/USD (Australian Dollar/US Dollar)

Why it’s valuable for beginners:

Responds to commodity prices (especially gold)

Great for swing trading

Clear breakouts and pullbacks

Traders looking to practice range and breakout strategies will enjoy AUD/USD. It often trends well and is less erratic than exotic pairs.

6. USD/CAD (US Dollar/Canadian Dollar)

What makes it unique:

Sensitive to oil prices

Reacts well to US economic data

Suitable for news-based trading

USD/CAD is a great pair for those learning correlation trading, especially with crude oil. Beginners who enjoy fundamental analysis will find value here.

7. EUR/GBP (Euro/British Pound)

Why consider this cross pair:

Low volatility

Less sensitivity to USD news

Ideal for practicing consolidation and tight range setups

This pair doesn't move wildly, which makes it suitable for beginners looking to test their patience and range strategies.

See more: How to Create Exness Real Account 2025

Tips for Beginners Choosing Forex Pairs in 2025

Stick with majors:Major pairs like EUR/USD and GBP/USD have the tightest spreads, most liquidity, and are the easiest to analyze.

Avoid exotic pairs:Pairs like USD/TRY (Turkish Lira) or USD/ZAR (South African Rand) are highly volatile and have large spreads — not ideal for learning.

Focus on 1-2 pairs:Instead of trying to trade everything, master 1 or 2 pairs. This builds confidence, clarity, and deeper market insight.

Understand time zones:Different pairs are active at different times. For example:

Asian session: USD/JPY, AUD/USD

London session: EUR/USD, GBP/USD

New York session: All majors, especially USD pairs

Choose pairs based on when you're available to trade.

Best Time to Trade Forex for Beginners

The London–New York overlap (approximately 1 PM to 5 PM GMT / 9 AM to 1 PM EST) is the most active and liquid time. Most major pairs experience strong movements during this window, offering more trading opportunities.

If you're in Africa or Asia, early morning or evening hours might suit your schedule better — choose pairs accordingly.

FAQs About Forex Pairs for Beginners

What is the safest currency pair to trade for beginners?EUR/USD is widely considered the safest due to its stability, liquidity, and minimal trading costs.

Which Forex pairs should beginners avoid?Avoid exotic pairs like USD/TRY, USD/ZAR, or EUR/SEK. They’re less liquid and carry high spreads and unpredictable price movements.

Can I trade more than one pair as a beginner?Yes, but it's better to start with one or two pairs and master them before adding more to your watchlist.

How do I choose the best pair for my time zone?Pick pairs that are most active during your trading hours. If you’re in Kenya, India, or South Africa, London session pairs like EUR/USD and GBP/USD are best.

Should I trade only USD pairs?Not necessarily. USD pairs are great for starters, but pairs like EUR/GBP or AUD/JPY can also offer good setups depending on your strategy.

Final Thoughts: Choose Wisely and Trade Smart

Picking the best Forex pairs to trade for beginners in 2025 isn’t about chasing the most profitable pair — it’s about choosing the most stable, predictable, and educationally rich options.

Stick to major pairs like EUR/USD, GBP/USD, or USD/JPY. Learn how they behave, track their economic news, and master one before jumping to others.

With the right currency pairs, smart risk management, and consistent practice — your path to Forex profitability becomes much clearer.

See more: