5 minute read

Best Forex Pairs for Small Account 2025

from Exness Guide

Trading with a small Forex account in 2025 is not only possible — it can be surprisingly profitable if done with discipline and the right currency pairs.

Small accounts require smarter risk management, low spread pairs, and consistent setups to survive and grow. Choosing the wrong pair can wipe out your balance in a single trade. But with the right Forex pairs, you gain control, reduce slippage, and maximize your small capital’s potential.

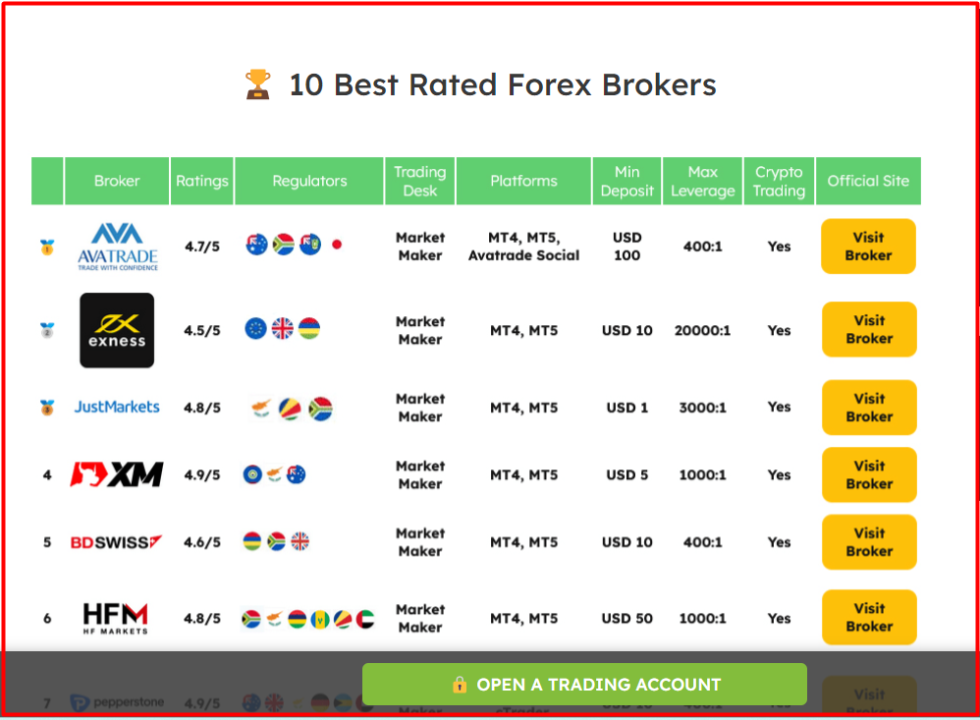

After identifying the best pairs for your small account, the next step is choosing a reliable broker. Here are some of the best Forex brokers in the world to help you get started.

1️⃣ Exness: Open Account | Go to Website

2️⃣ JustMarkets: Open Account | Go to Website

3️⃣ XM: Open Account | Go to Website

5️⃣Avatrade: Open Account | Go to Website

In this guide, we’ll reveal the best Forex pairs for small accounts in 2025, why they’re ideal for low-capital traders, and how to use them for slow, sustainable profit.

What Makes a Forex Pair Good for Small Accounts?

Not every pair is suitable when trading with a small balance. The ideal currency pair for a small account should have:

✅ Low spreads

✅ Low volatility (not too wild)

✅ High liquidity

✅ Consistent movement

✅ Available in micro lot sizes

Top 6 Best Forex Pairs for Small Account Trading in 2025

1. EUR/USD (Euro / US Dollar)

Why It’s Perfect:

Lowest spread among all Forex pairs

Highly liquid and easy to enter/exit

Predictable with strong reaction to economic events

How to Use:Scalp or day trade with 0.01 lots and 1–2% risk per trade

Strategy Tip:Use RSI + Moving Averages for clean intraday setups

2. USD/JPY (US Dollar / Japanese Yen)

Why It’s Perfect:

Very tight spreads and high liquidity

Stable movements, especially in Asian and U.S. sessions

Low margin requirements with many brokers

How to Use:Swing or intraday trades with wide stop-loss and small lot size

Strategy Tip:Look for pullbacks to trendline support/resistance zones

3. GBP/USD (British Pound / US Dollar)

Why It’s Still Good:

Slightly more volatile but excellent for fast gains

Ideal for traders who’ve learned proper risk control

Offers breakout potential even with small lots

How to Use:Short-term breakout trades during London session

Strategy Tip:Use Bollinger Bands for volatility-based entries

See more: EXNESS Trader App Review

4. AUD/USD (Australian Dollar / US Dollar)

Why It’s Great for Small Accounts:

Low spread and stable price flow

Moves well during Sydney and early Asia sessions

Reacts clearly to macroeconomic releases

How to Use:Focus on news trades or range strategies with clear stop-loss

Strategy Tip:Combine price action with support/resistance confirmation

5. NZD/USD (New Zealand Dollar / US Dollar)

Why It’s Safe:

Lower volatility compared to other majors

Often mimics AUD/USD for confirmation trades

Less aggressive, ideal for beginners

How to Use:Trade during NZD or AUD economic reports for best results

Strategy Tip:Use Stochastic + EMA for slow trend scalping

6. USD/CHF (US Dollar / Swiss Franc)

Why It’s a Hidden Gem:

Stable, slow-moving pair ideal for patient traders

Tight spreads and easy to manage risk

Great for avoiding stop-hunting moves

How to Use:Low-leverage swing trades using 0.01 lot size and trailing stops

Strategy Tip:Support/resistance and RSI divergence are effective here

Tips for Growing a Small Forex Account in 2025

✅ Use Micro Lots (0.01) – Trade small to preserve capital

✅ Avoid Exotic Pairs – Too risky and high spread for small balances

✅ Set Realistic Goals – Aim for 2–5% monthly, not overnight riches

✅ Stick to 1–2 Pairs Only – Master a few rather than watching all

✅ Risk Only 1–2% Per Trade – Protect your account from emotional decisions

✅ Use Demo Before Going Live – Test strategies without risk

✅ Focus on Session Overlaps – Best movement = more opportunity

FAQs: Best Forex Pairs for Small Account 2025

1. Can I trade with $100 or less in Forex?Yes. Many brokers allow micro lot trading and leverage to support small accounts.

2. Which pair has the lowest spread for small traders?EUR/USD and USD/JPY typically have the tightest spreads in 2025.

3. Should I avoid GBP pairs with a small account?Not necessarily — they’re great for fast profits but need strict risk control.

4. What’s the best time to trade small accounts?London–New York overlap and early Tokyo session offer ideal volatility.

5. Is it better to scalp or swing with a small account?Scalping offers quick gains, but swing trading is safer for beginners.

6. What leverage is safe for small accounts?Use 1:100 or less. High leverage can destroy small accounts quickly.

7. Can I trade gold or crypto with a small account?It’s risky. Gold has high volatility and crypto is often too unpredictable for low capital.

8. How long does it take to grow a $100 account?With 2–5% monthly growth, compounding can scale the account over months.

9. What lot size should I start with?Always start with 0.01 lots on a small account until consistent.

10. Is demo trading helpful for small account traders?Absolutely — it builds confidence and lets you test without risk.

Final Thoughts: Build Big Results from a Small Forex Account

Trading with a small account in 2025 isn’t a disadvantage — it’s a training ground for discipline, risk control, and smart pair selection.

Start with EUR/USD, USD/JPY, AUD/USD, and NZD/USD to grow gradually. Stay patient, follow your strategy, and remember: small consistent wins are the foundation of long-term trading success.

Read more:

Best Forex Pairs to Trade During Sydney Session 2025

Best Forex Pairs to Trade at Night 2025