5 minute read

Best Forex Pairs to Trade During Sydney Session 2025

from Exness Guide

The Sydney session marks the official start of the Forex trading day. Although it’s the smallest in terms of volume compared to London and New York, the Sydney session sets the tone for upcoming price movement, especially in AUD and NZD pairs.

If you're an early riser or based in the Asia-Pacific region, learning which pairs perform best during this window can give you a consistent trading edge. In this guide, we reveal the best Forex pairs to trade during the Sydney session in 2025, plus strategies, session times, and key tips.

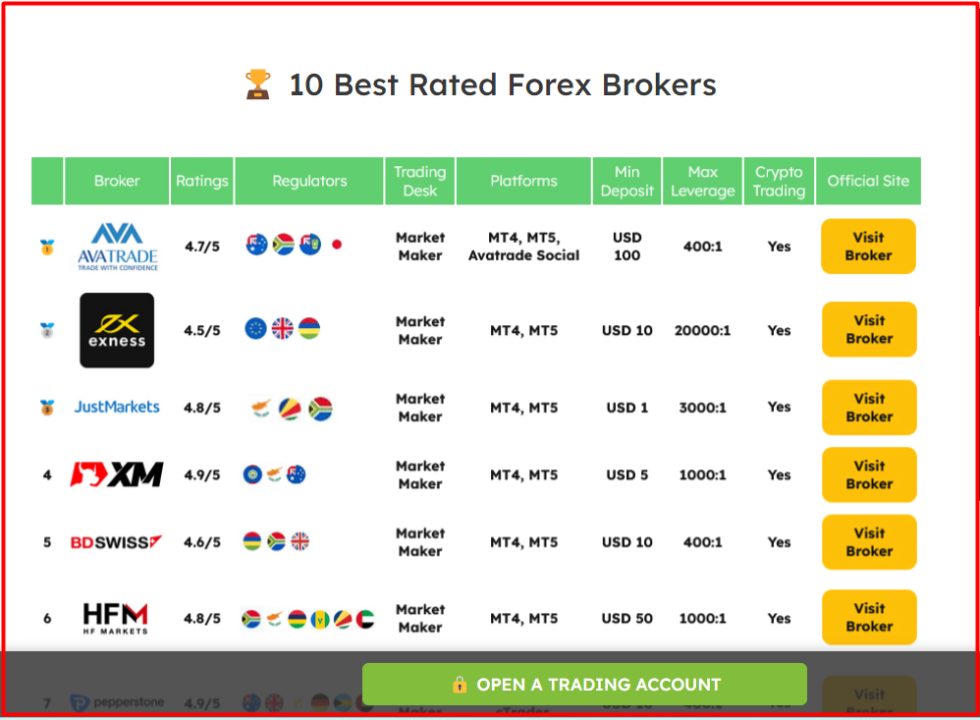

Bes Forex Broker in the world 👇👇👇

1️⃣ Exness: Open Account | Go to Website

2️⃣ JustMarkets: Open Account | Go to Website

3️⃣ XM: Open Account | Go to Website

5️⃣Avatrade: Open Account | Go to Website

When Does the Sydney Session Start?

Opening Time: 10:00 PM GMT (7:00 AM AEST)

Closing Time: 7:00 AM GMT (4:00 PM AEST)

Overlap: Early part overlaps with Tokyo session (from 12:00 AM GMT)

Although trading volume is initially low, liquidity increases as Tokyo opens, creating solid setups for range and breakout traders.

Why Trade the Sydney Forex Session?

✅ Great for traders in Australia, New Zealand, and Asia

✅ Early moves in AUD and NZD pairs before Tokyo data

✅ Low spreads during calm periods

✅ Less noise, better for technical trading

✅ Ideal for practicing patience and discipline

If you're looking for low-stress, structured trading opportunities, the Sydney session is a great place to start.

Top 5 Best Forex Pairs to Trade During Sydney Session 2025

1. AUD/USD (Australian Dollar / US Dollar)

Why It’s Ideal:

AUD is directly influenced by early Aussie market flows

Reacts strongly to Sydney stock market and economic releases

Tight spreads and steady price action

Best Strategy:Simple moving average crossovers or pullback entries

Pro Tip:Monitor Australian economic calendar — RBA announcements and CPI releases often drive movement.

2. NZD/USD (New Zealand Dollar / US Dollar)

Why It’s Ideal:

Active in early hours due to New Zealand’s timezone advantage

Responds to local macro news (GDP, jobs, dairy exports)

Often mirrors AUD/USD with subtle differences

Best Strategy:Support and resistance trading, Bollinger Band squeezes

Pro Tip:NZD/USD moves quietly but predictably — ideal for low-volatility scalping.

3. AUD/JPY (Australian Dollar / Japanese Yen)

Why It’s Ideal:

Combines two of the most active currencies in Asia-Pacific

Often moves in response to commodity news and Nikkei 225 performance

Moderate volatility, perfect for early-session trends

Best Strategy:Trend-following with EMA (20/50) and RSI filters

Pro Tip:AUD/JPY reflects market risk sentiment early in the day — bullish if Asia equities rise.

1️⃣ Exness: Open Account | Go to Website

4. NZD/JPY (New Zealand Dollar / Japanese Yen)

Why It’s Ideal:

Strong correlation with Asia-Pacific economic conditions

Moves cleanly with reduced slippage during Sydney open

Less volatile than AUD/JPY, easier for beginners

Best Strategy:Price action trading with pivot points

Pro Tip:Look for carry trade opportunities if interest rate spreads are favorable in 2025.

5. EUR/AUD (Euro / Australian Dollar)

Why It’s Ideal:

Sensitive to late European sentiment and early Aussie flows

Offers larger moves during volatile Sydney openings

Provides contrast between Europe and Asia-Pacific economic data

Best Strategy:Fibonacci retracement after Sydney data releases

Pro Tip:Be cautious during low volume; wait for Tokyo overlap to confirm direction.

Best Times to Trade During the Sydney Session

10:00 PM – 12:00 AM GMT: Early movement, low volume (use caution)

12:00 AM – 3:00 AM GMT: Overlap with Tokyo session, increased volatility

3:00 AM – 6:00 AM GMT: Best for trend continuation or reversal setups

After 6:00 AM GMT: Momentum slows as session nears London open

Effective Strategies for the Sydney Session

1. Range ScalpingBest used early in the session when price moves within narrow bands. Use RSI, Bollinger Bands, or pivot points.

2. Trend ContinuationIdentify momentum moves post-news or from previous sessions. Use 20 EMA + MACD confirmation.

3. Breakout StrategyLook for price breaking Asian highs/lows during Tokyo overlap. Set tight stop-loss, wait for candle close confirmation.

Key Sydney Session Economic Events to Watch

RBA Cash Rate decisions

Australian Employment Change & Unemployment Rate

New Zealand GDP & CPI figures

Asia-Pacific equity performance

Chinese macro data (indirectly affects AUD & NZD)

Use an updated Forex calendar to stay ahead of key releases.

FAQs: Best Forex Pairs to Trade During Sydney Session

1. What is the most active pair during the Sydney session?AUD/USD is the most active and widely traded pair in this session.

2. Can I trade GBP or EUR pairs during Sydney hours?You can, but spreads are often wider and volatility is low. Focus on AUD and NZD pairs.

3. Is the Sydney session good for scalping?Yes, especially for low-volatility scalping in the first 1–2 hours.

4. What’s the best time to trade during Sydney session?From 12:00 AM – 3:00 AM GMT, when Tokyo joins and volume increases.

5. Which indicators work best during the Sydney session?Bollinger Bands, RSI, EMA, and Stochastic are ideal for short-range analysis.

6. Do spreads widen during Sydney open?Sometimes in the first 10–15 minutes. Wait for spreads to stabilize before entering trades.

7. Should I trade gold during the Sydney session?Gold is quieter but tradable. Use range-based strategies or wait for London session.

8. Can I trade during holidays in Sydney or Wellington?Expect ultra-low volume and erratic movement. Avoid trading on public holidays.

9. What lot size is best for the Sydney session?Use smaller lots (e.g., 0.01–0.05) due to tighter ranges and limited volatility.

10. Can I make consistent profits trading only the Sydney session?Yes — with discipline, proper strategy, and a focus on AUD/NZD pairs.

Final Thoughts: Maximize the Sydney Session in 2025

The Sydney session offers a unique advantage for early-morning traders and those in the Asia-Pacific region. While it may not deliver explosive moves like London or New York, it provides low-spread, high-accuracy setups in pairs like AUD/USD, NZD/USD, and AUD/JPY.

By choosing the right pairs, avoiding fakeouts, and trading with precision, you can consistently capitalize on one of the calmest but most reliable sessions in Forex.

See more:

Best Forex Pairs to Trade for Beginners 2025

Best Forex Pairs for Scalping 2025