5 minute read

Best Forex Pairs to Trade During Asian Session 2025

from Exness Guide

The Asian trading session is the first market to open each day in the Forex world, setting the tone for what’s to come. While it may not be the most volatile session, it offers predictable movements, tight spreads, and ideal setups for traders who prefer precision and patience.

In this guide, you’ll discover the best Forex pairs to trade during the Asian session in 2025, including why these pairs work well, what strategies to use, and how to trade them for consistent profit.

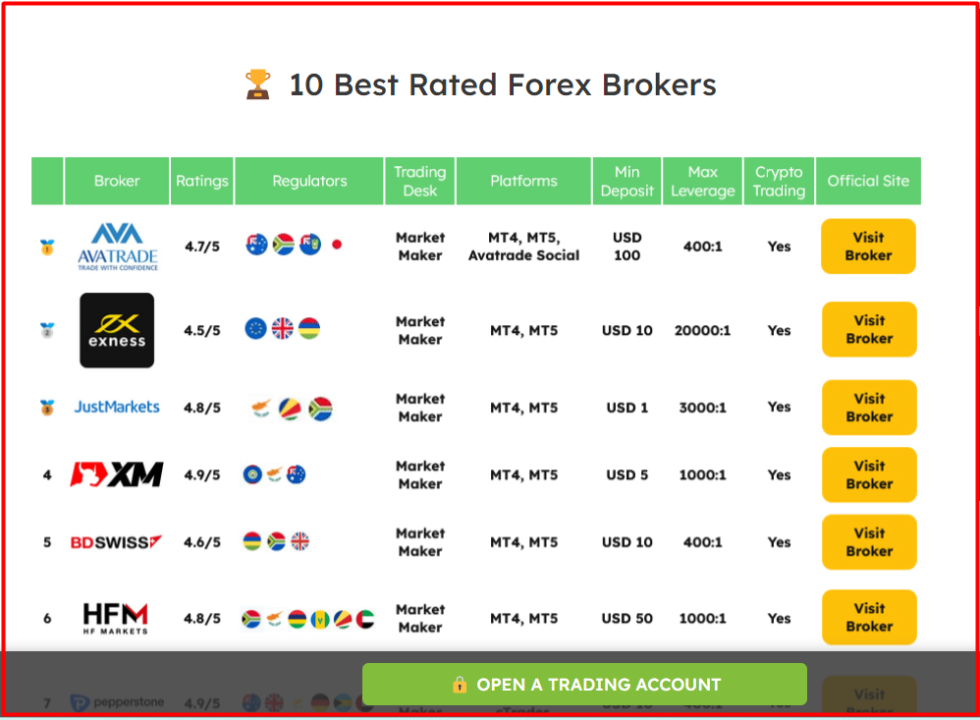

Best Forex Broker in the World ⬇️⬇️⬇️

1️⃣ Exness: Open Account | Go to Website

2️⃣ JustMarkets: Open Account | Go to Website

3️⃣ XM: Open Account | Go to Website

5️⃣Avatrade: Open Account | Go to Website

Understanding the Asian Trading Session

The Asian Forex session runs approximately from 12:00 AM to 9:00 AM GMT (7:00 AM to 4:00 PM in Tokyo).

Key characteristics include:

Lower volatility compared to London/New York

Tighter spreads in certain currency pairs

Clear technical levels for range trading and breakouts

Influence from Asian news, particularly from Japan, Australia, and New Zealand

The major financial center in this session is Tokyo, followed by Sydney, Hong Kong, and Singapore.

Why You Should Trade the Asian Session

✅ Ideal for calm, structured strategies

✅ Works well for traders in Asia-Pacific time zones

✅ Pairs show less slippage and clear price ranges

✅ Many pairs consolidate before the London breakout — perfect for setup traders

Let’s now look at the top pairs to trade during this session.

Top 5 Best Forex Pairs to Trade During the Asian Session in 2025

1. USD/JPY (US Dollar / Japanese Yen)

Why It Works:

Highly liquid during Asian hours

Reacts directly to Japanese economic news

Tends to respect support and resistance levels

Best Strategy:Range trading, breakout after news events

Bonus Tip: Watch for Tokyo stock market opening — it can drive USD/JPY direction.

2. AUD/JPY (Australian Dollar / Japanese Yen)

Why It Works:

Both currencies are regionally active during Asian session

Moves with risk sentiment and commodities

Offers wider daily ranges than USD/JPY

Best Strategy:Pullback entries using EMA or Bollinger Bands

Bonus Tip: Use this pair for carry trade strategies thanks to interest rate differences.

3. AUD/USD (Australian Dollar / US Dollar)

Why It Works:

Responds to Australian data releases (GDP, RBA, employment)

Stable movement with minimal spread

Excellent pair for trend continuation in early Asian hours

Best Strategy:Trend-following with moving averages, news scalping

Bonus Tip: Check the China economic calendar — AUD often reacts to Chinese industrial and trade data.

how to open exness real account

4. NZD/USD (New Zealand Dollar / US Dollar)

Why It Works:

Active during Asian session, especially after RBNZ announcements

Less volatile than AUD/USD

Easy for beginners to trade

Best Strategy:Support-resistance zones, EMA crossover

Bonus Tip: Pairs well with AUD/USD for correlation trades.

5. EUR/JPY (Euro / Japanese Yen)

Why It Works:

Offers a blend of European trend with Asian liquidity

Active when the session overlaps with late Europe

More volatile than USD/JPY

Best Strategy:Intraday reversals, Fibonacci retracement

Bonus Tip: Keep an eye on ECB news late in the session, especially if there's early volatility.

Best Trading Strategies for Asian Session Forex Pairs

1. Range Trading:The Asian session is famous for sideways movement. Use RSI and Bollinger Bands to trade reversals inside a defined price channel.

2. News Scalping:During economic releases from Japan, Australia, or New Zealand, trade short bursts of volatility using pending orders or tight spreads.

3. Trend Continuation:Use the early hours to ride carryover trends from the previous New York session using EMA or price action.

4. Correlation Trading:Trade AUD/USD and NZD/USD in opposite or same directions depending on divergence or convergence of their movement.

Tips for Successful Asian Session Trading

✅ Use tight stop-losses due to lower volatility

✅ Avoid exotic pairs — focus on regional majors

✅ Trade only the first 4 hours of the session (Tokyo open to early morning)

✅ Combine economic calendar with technical levels

✅ Test your strategy on a demo account first

FAQs: Best Forex Pairs to Trade During the Asian Session

1. What is the most active Forex pair during the Asian session?USD/JPY is the most active and liquid pair during the Tokyo hours.

2. Are exotic pairs good for the Asian session?No. Stick to major pairs with low spreads and predictable movement.

3. Can I scalp during the Asian session?Yes, but only on highly liquid pairs like AUD/JPY or USD/JPY.

4. What time is best to start trading in the Asian session?The best time is from 12:00 AM to 3:00 AM GMT, when Tokyo opens and volume begins to rise.

5. Do Asian session pairs move more slowly?Yes. Expect smaller moves but more technical respect to support/resistance.

6. Is the Asian session good for beginners?Absolutely. It's slower and more structured, ideal for learning price action.

7. Can I trade gold or crypto during the Asian session?Yes, but volatility is often low. Better to trade these in the London or New York sessions.

8. Is AUD/JPY risky to trade in Asian hours?It can be volatile, but also very rewarding with the right setup.

9. Do I need special indicators for Asian session trading?No. Simple tools like RSI, Moving Averages, and Bollinger Bands work best.

10. What’s the average daily range for Asian pairs?Ranges can be 30–80 pips depending on the pair and day’s news.

Final Thoughts: Make the Most of the Asian Session

The Asian Forex session in 2025 offers unique opportunities for traders who value structure, discipline, and technical setups. With pairs like USD/JPY, AUD/JPY, and AUD/USD, you get liquidity, clarity, and predictable movement.

Whether you're a beginner building confidence or a scalper hunting early moves, the Asian session is a goldmine — if you know which pairs to focus on and how to trade them.

Start with a solid trading plan, practice on demo, and step into the markets fully prepared.

See more:

Best Forex Pairs to Trade for Beginners 2025

Best Forex Pairs for Scalping 2025