10 minute read

Is Forex Trading Profitable in Uganda? A Comprehensive Guide

Forex trading, or foreign exchange trading, has gained significant traction globally, and Uganda is no exception. With its promise of financial freedom and the allure of high returns, many Ugandans are curious about whether forex trading can be a profitable venture. But is forex trading truly profitable in Uganda, or is it just another risky gamble? In this in-depth guide, we’ll explore the opportunities, challenges, and realities of forex trading in Uganda, providing actionable insights for beginners and seasoned traders alike.

Top 4 Best Forex Brokers in Uganda

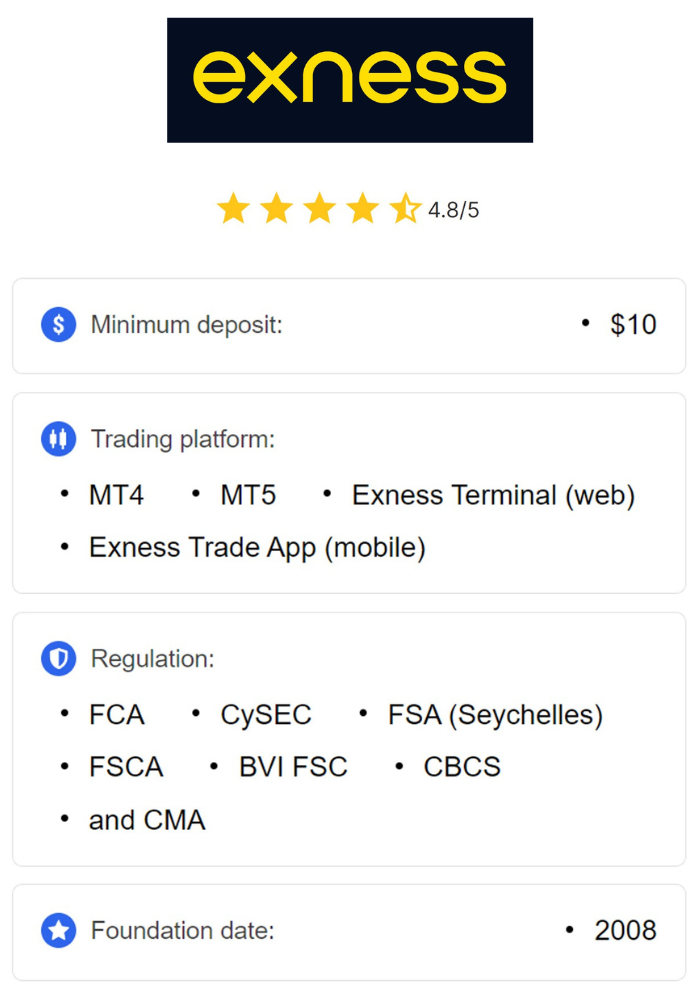

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ JustMarkets: Open An Account or Visit Brokers ✅

3️⃣ Quotex: Open An Account or Visit Brokers 🌐

4️⃣ Avatrade: Open An Account or Visit Brokers 💯

What is Forex Trading?

Forex trading involves buying and selling currencies to profit from fluctuations in their exchange rates. The forex market is the largest financial market in the world, with a daily trading volume exceeding $7 trillion. Unlike stock markets, forex operates 24 hours a day, five days a week, offering flexibility for traders worldwide, including those in Uganda.

In Uganda, forex trading has become increasingly popular due to improved internet access, affordable smartphones, and growing financial literacy. But profitability depends on several factors, including knowledge, strategy, discipline, and market conditions. Let’s dive into whether forex trading can be a viable income source for Ugandans.

The Appeal of Forex Trading in Uganda

1. Accessibility and Low Entry Barriers

One of the biggest draws of forex trading in Uganda is its accessibility. You don’t need a large capital to start—many brokers allow traders to open accounts with as little as $10. Leverage, a tool that lets you control larger positions with smaller capital, further lowers the entry barrier. For example, with 1:100 leverage, a $100 deposit allows you to trade $10,000 worth of currency.

This accessibility is particularly appealing in Uganda, where economic opportunities can be limited for many. With just a smartphone and an internet connection, anyone can start trading, making forex a potential side hustle or full-time career.

2. Flexible Trading Hours

The forex market’s 24/5 operation suits Uganda’s diverse lifestyles. Whether you’re a student, a professional, or a small business owner, you can trade at your convenience. The London-New York session overlap (3:00 PM–7:00 PM EAT) is particularly active, offering high liquidity and trading opportunities for Ugandan traders.

3. Potential for High Returns

Forex trading offers the potential for significant profits, especially when using leverage. For instance, a 1% movement in a currency pair like EUR/USD can yield substantial returns if you’ve leveraged your position. Success stories of traders like David Birungi, often cited as one of Uganda’s most successful forex traders, inspire many to explore this market.

4. Growing Forex Community

Uganda has a vibrant forex trading community, with workshops, online courses, and social media groups dedicated to sharing knowledge. Platforms like HFM and Exness offer copy trading features, allowing beginners to follow experienced traders’ strategies, further fueling interest in forex.

Challenges of Forex Trading in Uganda

While the potential for profit exists, forex trading is not a get-rich-quick scheme. Several challenges can impact profitability, especially for Ugandan traders.

1. High Risk and Leverage

Leverage, while powerful, is a double-edged sword. It amplifies both profits and losses. A small market movement against your position can wipe out your account if you over-leverage. In Uganda, where disposable income is often limited, such losses can be devastating.

2. Lack of Local Regulation

Forex trading in Uganda is legal, overseen by the Capital Markets Authority (CMA) and the Bank of Uganda (BoU). However, there’s no robust local regulation for forex brokers, leading many traders to use offshore brokers. While reputable brokers regulated by bodies like the FCA (UK) or ASIC (Australia) are safe, unregulated brokers pose risks of fraud or fund mismanagement.

3. Limited Financial Literacy

Many Ugandans enter forex trading without adequate knowledge, lured by promises of quick wealth. Understanding technical analysis, fundamental analysis, and risk management requires time and effort. Without this foundation, traders are more likely to incur losses.

4. Economic and Infrastructure Challenges

Uganda’s economy, while growing at 5.3% in FY 2022/23, faces challenges like high debt (47.3% of GDP) and reliance on agriculture. Currency pairs involving the Ugandan Shilling (UGX), such as USD/UGX, are less liquid, limiting trading options. Additionally, unreliable internet and power outages can disrupt trading activities.

5. Hidden Costs

Trading costs, including spreads, commissions, and swap fees, can eat into profits. For example, the average spread on EUR/USD is around 1 pip, but exotic pairs like USD/UGX may have higher spreads. Ugandan traders must choose brokers with competitive fees to maximize profitability.

Can Forex Trading Be Profitable in Uganda?

The profitability of forex trading in Uganda hinges on several key factors. While it’s possible to make money, success is not guaranteed. Here’s a breakdown of what determines profitability:

1. Education and Skill Development

Knowledge is the cornerstone of profitable forex trading. Understanding currency pairs, chart patterns, and economic indicators like inflation or GDP growth is essential. For instance, if the U.S. Federal Reserve raises interest rates, the USD may strengthen, impacting pairs like USD/UGX or EUR/USD.

In Uganda, free resources like YouTube tutorials, webinars, and demo accounts offered by brokers like XM or FxPro can help beginners learn. Joining local trading communities or enrolling in courses, such as those by Forex School Uganda, can also accelerate skill development.

2. Risk Management

Effective risk management separates profitable traders from those who lose money. Key practices include:

· Setting Stop-Loss Orders: Automatically close losing trades to limit losses.

· Position Sizing: Risk only 1–2% of your account per trade.

· Avoiding Over-Leverage: Use leverage conservatively to protect your capital.

For example, if you have a $500 account, risking $5–$10 per trade ensures you can withstand multiple losses without blowing your account.

3. Choosing the Right Broker

A reliable broker is critical for profitability. Look for brokers with:

· Regulation: Licensed by top-tier authorities like FCA, CySEC, or FSCA.

· Low Fees: Tight spreads and minimal commissions.

· Local Support: Payment methods like mobile money (e.g., MTN or Airtel) for easy deposits/withdrawals.

· Trading Platforms: User-friendly platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5).

Popular brokers in Uganda include Exness, Plus500, and IC Markets, known for competitive fees and robust platforms.

💥 Trade with Exness now: Open An Account or Visit Brokers

4. Developing a Trading Strategy

A well-tested trading strategy aligns with your goals and risk tolerance. Common strategies include:

· Day Trading: Opening and closing trades within a day to capitalize on short-term price movements.

· Swing Trading: Holding trades for days or weeks to profit from larger trends.

· Scalping: Making multiple quick trades to capture small price changes.

For instance, a Ugandan trader might use technical indicators like Moving Averages or RSI on EUR/USD during the London session to identify entry and exit points.

5. Emotional Discipline

Trading psychology plays a huge role in profitability. Fear and greed can lead to impulsive decisions, such as chasing losses or overtrading. Keeping a trading journal to track performance and sticking to your plan fosters discipline.

Success Stories: Forex Trading in Uganda

While exact figures are hard to verify due to the private nature of forex trading, several Ugandan traders have reportedly achieved success. For example:

· David Birungi: Often cited as Uganda’s richest forex trader, Birungi combines technical and fundamental analysis to achieve consistent returns. He also mentors aspiring traders, contributing to the growth of Uganda’s forex community.

· Michael Ssemakula: Known for profiting from macroeconomic trends, Ssemakula emphasizes education and risk management.

· James Opio: A prominent figure who shares strategies through workshops, helping beginners navigate the market.

These traders highlight that profitability is possible with dedication and the right approach.

Economic Factors Impacting Forex Trading in Uganda

Uganda’s economic landscape influences forex trading profitability. Key factors include:

1. Currency Volatility

The Ugandan Shilling (UGX) is an exotic currency with lower liquidity, making pairs like USD/UGX volatile. Global events, such as U.S. interest rate hikes or oil price changes, can affect UGX’s value, creating opportunities and risks.

2. Economic Growth

Uganda’s GDP grew by 5.3% in FY 2022/23, driven by services (42.6% of GDP) and agriculture (24%). Strong growth can strengthen the UGX, impacting forex pairs. However, high debt and inflation (projected at 5–7% in 2025) may weaken it.

3. Global Trade

Uganda’s top trading partners—China, UAE, and India—drive currency demand. For instance, a surge in exports to South Sudan ($606 million in 2022) can boost UGX’s value, affecting forex trades.

Practical Steps to Start Forex Trading in Uganda

Ready to explore forex trading? Follow these steps to maximize your chances of profitability:

1. Educate Yourself

Start with free resources:

· Books: “Currency Trading for Dummies” or “The Little Book of Currency Trading.”

· Online Courses: Platforms like Babypips.com offer beginner-friendly lessons.

· YouTube Channels: Channels like “The Trading Channel” provide technical analysis tutorials.

2. Choose a Reputable Broker

Compare brokers based on regulation, fees, and platforms. Top options for Ugandans include:

· Exness: Low spreads (0.1–0.2 pips on major pairs) and mobile money support.

· Plus500: Regulated by ASIC and CySEC, with an intuitive platform.

· XM: Offers over 1,000 instruments and educational resources.

3. Practice with a Demo Account

Most brokers provide demo accounts to practice trading without risking real money. Use this to test strategies and familiarize yourself with MT4 or MT5.

4. Develop a Trading Plan

Your plan should outline:

· Goals: Monthly profit targets (e.g., 5–10% return).

· Risk Management: Maximum risk per trade and leverage limits.

· Strategy: Preferred currency pairs (e.g., EUR/USD, USD/JPY) and indicators.

5. Start Small

Begin with a small deposit ($50–$100) to minimize risk. As you gain experience, you can scale up your capital.

6. Stay Informed

Follow global economic news via platforms like Bloomberg or Reuters. Local sources like New Vision or Daily Monitor can provide insights into Uganda’s economy.

Common Mistakes to Avoid

To ensure profitability, steer clear of these pitfalls:

· Overtrading: Taking too many trades can lead to losses.

· Ignoring Risk Management: Not using stop-loss orders or risking too much per trade.

· Chasing Losses: Trying to recover losses with impulsive trades.

· Lack of Patience: Expecting quick profits without proper learning.

Taxation and Legal Considerations

Forex trading profits in Uganda are taxable as personal income, with rates up to 40% depending on your income bracket. If trading through a registered company, profits face a 30% corporate tax. Keep accurate records of trades and consult a tax professional to comply with Uganda Revenue Authority (URA) rules.

While forex trading is legal, the lack of local broker regulation means you must choose international brokers wisely. Verify their licenses on regulators’ websites (e.g., FCA, CySEC) to avoid scams.

Is Forex Trading Worth It in Uganda?

Forex trading can be profitable in Uganda, but it’s not for everyone. Success requires education, discipline, and a realistic mindset. While stories of traders like David Birungi inspire, statistics show that 60–90% of retail traders lose money due to poor strategies or emotional decisions.

For Ugandans, forex offers a chance to diversify income in a growing economy. With the right approach—learning, practicing, and managing risks—you can turn forex trading into a profitable venture. However, it’s crucial to start small, choose regulated brokers, and avoid the hype of overnight riches.

Conclusion: Your Path to Profitable Forex Trading

Forex trading in Uganda holds immense potential but comes with significant risks. By investing in education, choosing a reliable broker, and practicing disciplined trading, you can increase your chances of profitability. Uganda’s growing forex community and improving infrastructure make it an exciting time to explore this market.

Whether you’re in Kampala, Gulu, or Mbale, forex trading offers a gateway to financial opportunities. Start with a demo account, build your skills, and approach trading as a long-term journey. With patience and persistence, you might just find forex trading to be a rewarding endeavor.

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: