14 minute read

Is forex trading legal in Mauritius? A Comprehensive Guide

from Exness Global

Forex trading, the act of buying and selling currencies on the global market, has grown into one of the most accessible and dynamic financial markets worldwide. With a daily trading volume exceeding $7 trillion, it attracts millions of retail and institutional traders. Among the many jurisdictions fostering this industry, Mauritius stands out as a burgeoning hub for forex trading in Africa and the Indian Ocean region. But a question often arises for aspiring traders: Is forex trading legal in Mauritius?

Top 4 Best Forex Brokers in Mauritius

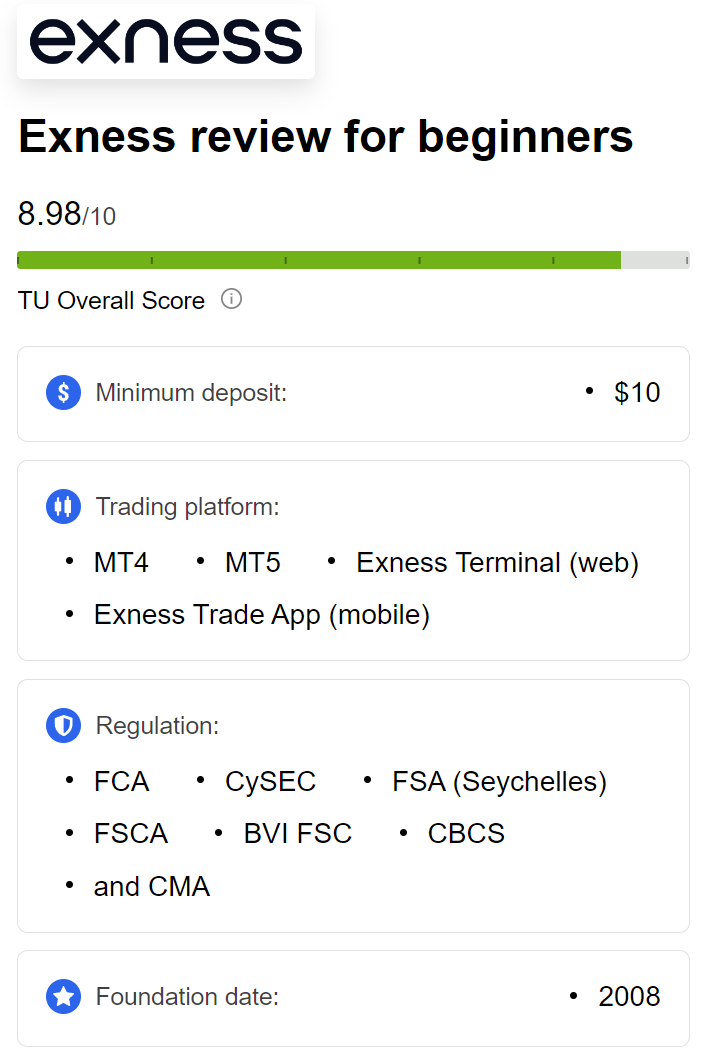

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ JustMarkets: Open An Account or Visit Brokers ✅

3️⃣ Quotex: Open An Account or Visit Brokers 🌐

4️⃣ Avatrade: Open An Account or Visit Brokers 💯

In this in-depth guide, we’ll explore the legality of forex trading in Mauritius, the regulatory framework, licensing requirements, tax implications, and practical tips for traders. Whether you’re a beginner looking to start trading or a seasoned investor considering Mauritius as a base, this article will provide clarity and actionable insights.

Understanding Forex Trading: A Brief Overview

Before diving into the legalities, let’s clarify what forex trading entails. Forex, short for foreign exchange, involves speculating on the price movements of currency pairs, such as EUR/USD (Euro vs. US Dollar) or GBP/JPY (British Pound vs. Japanese Yen). Traders aim to profit from fluctuations in exchange rates, leveraging tools like technical analysis, fundamental analysis, and trading platforms such as MetaTrader 4 (MT4) or MetaTrader 5 (MT5).

The forex market operates 24/5, is decentralized, and includes participants like central banks, commercial banks, hedge funds, corporations, and retail traders. Its accessibility—requiring only an internet connection and a trading account—has made it particularly appealing to individuals in countries like Mauritius, where financial services are rapidly developing.

Is Forex Trading Legal in Mauritius?

The short answer is yes, forex trading is legal in Mauritius for both retail and institutional traders. The country has established itself as a reputable financial hub, offering a well-regulated environment that balances investor protection with business-friendly policies. The legality of forex trading is underpinned by a robust regulatory framework overseen by the Financial Services Commission (FSC), the primary authority for non-banking financial services in Mauritius.

Key Points About Forex Trading Legality:

Regulated Activity: Forex trading is permitted as long as traders and brokers comply with FSC regulations.

Licensing Requirement: Forex brokers must obtain an Investment Dealer License or a Global Business License (GBL) from the FSC to operate legally.

Retail Trading: Individual traders can engage in forex trading through licensed brokers without needing a personal license.

Investor Protection: The FSC enforces strict guidelines to ensure transparency, fairness, and security in financial markets.

Mauritius’s legal framework is designed to attract foreign investment while maintaining high standards of compliance with international norms, such as anti-money laundering (AML) and know-your-customer (KYC) regulations.

The Role of the Financial Services Commission (FSC)

Established in 2001 under the Financial Services Act, the FSC is the cornerstone of Mauritius’s financial regulatory system. It oversees a wide range of non-banking financial activities, including forex trading, securities, insurance, and global business companies. The FSC’s mission is to promote market integrity, protect investors, and foster a stable financial environment.

How the FSC Regulates Forex Trading:

Licensing Brokers: Forex brokers must apply for an Investment Dealer License, which involves rigorous checks on financial stability, operational capabilities, and compliance with AML/KYC standards.

Client Fund Protection: Licensed brokers are required to segregate client funds from company assets, reducing the risk of fraud or mismanagement.

Transparency: Brokers must provide clear information about fees, spreads, leverage, and risks associated with trading.

Compliance Monitoring: The FSC conducts regular audits and investigations to ensure brokers adhere to regulations.

The FSC’s oversight has helped Mauritius gain recognition as a trusted jurisdiction for forex trading, attracting both local and international brokers.

The Legal Framework Supporting Forex Trading

Forex trading in Mauritius is governed by several key pieces of legislation that create a transparent and secure environment for traders and brokers. These include:

Financial Services Act (2007): This act outlines the regulatory framework for financial services providers, including forex brokers. It establishes the FSC’s authority to license and supervise firms.

Securities Act (2005): This legislation covers forex derivatives and contracts for difference (CFDs), expanding the range of financial instruments available to traders.

Companies Act: Governs the incorporation and operation of businesses, including forex brokerages, in Mauritius.

Anti-Money Laundering Laws: Mauritius complies with international AML standards set by the Financial Action Task Force (FATF), ensuring that forex trading does not facilitate illicit activities.

These laws collectively create a structured environment where traders can operate with confidence, knowing that their interests are protected.

The Bank of Mauritius: A Supporting Role

While the FSC is the primary regulator for forex trading, the Bank of Mauritius (BoM), the country’s central bank, plays a complementary role. The BoM focuses on monetary policy, banking regulation, and maintaining the stability of the Mauritian rupee (MUR). It collaborates with the FSC to ensure a cohesive financial ecosystem.

For forex traders, the BoM’s influence is indirect but significant:

Currency Stability: The BoM may intervene in the forex market to stabilize the MUR, impacting currency pairs involving the rupee.

Banking Infrastructure: The BoM oversees banks that facilitate forex transactions, ensuring secure and efficient payment systems.

Together, the FSC and BoM create a balanced regulatory environment that supports forex trading while safeguarding the broader economy.

Licensing Requirements for Forex Brokers

To operate legally in Mauritius, forex brokers must obtain a license from the FSC. The licensing process is thorough, ensuring only reputable firms can offer trading services. Below are the main types of licenses relevant to forex brokers:

Investment Dealer License:

Allows brokers to offer forex trading, CFDs, and other investment services to retail and institutional clients.

Requires a minimum capital of approximately MUR 10 million (around USD 270,000), depending on whether underwriting is included.

Brokers must submit a detailed business plan, AML/KYC policies, and proof of financial stability.

Global Business License (GBL):

Designed for companies operating primarily outside Mauritius but benefiting from its regulatory framework.

Suitable for international brokers targeting global clients.

Requires compliance with tax regulations and FSC oversight.

Steps to Obtain a Forex License:

Incorporate a Company: Register a legal entity, such as a Global Business Company (GBC), in Mauritius.

Prepare Documentation: Submit a business plan, financial statements, AML/KYC policies, and details of directors/shareholders.

Apply to the FSC: File the application with all required documents and pay the applicable fees (ranging from USD 15,000 to USD 20,000).

Undergo Review: The FSC evaluates the application, which may take several weeks to months.

Receive Approval: Once approved, the broker can begin offering forex trading services.

The licensing process, while rigorous, is relatively streamlined compared to jurisdictions like the EU or US, making Mauritius an attractive destination for forex brokers.

💥 Trade with Exness now: Open An Account or Visit Brokers

Tax Implications for Forex Traders in Mauritius

One of Mauritius’s key advantages as a forex trading hub is its favorable tax environment. Understanding the tax implications is crucial for traders and brokers alike.

For Individual Traders:

Income Tax: Profits from forex trading are subject to personal income tax, which is capped at 15% in Mauritius—a relatively low rate compared to many countries.

Tax Filing: Traders must declare their trading profits to the Mauritius Revenue Authority (MRA) and file annual tax returns.

No Capital Gains Tax: Mauritius does not impose a capital gains tax, which can benefit traders holding positions for longer periods.

For Forex Brokers:

Corporate Tax: Licensed brokers operating as GBCs may qualify for tax exemptions or reduced rates, with standard corporate tax at 15%.

Double Taxation Agreements (DTAs): Mauritius has DTAs with over 40 countries, preventing traders and brokers from being taxed twice on the same income.

VAT and Stamp Duty: Certain transactions may incur value-added tax (VAT) or stamp duty, but these are minimal in the forex context.

The combination of low taxes and DTAs makes Mauritius an appealing jurisdiction for both retail traders and brokerage firms.

Why Mauritius Is a Forex Trading Hub

Mauritius has emerged as a leading destination for forex trading due to several strategic advantages:

Strategic Location: Situated in the Indian Ocean, Mauritius serves as a bridge between Africa, Asia, and Europe, offering access to diverse markets.

Business-Friendly Environment: The country ranks highly in international business indices, such as the World Bank’s Ease of Doing Business report.

Modern Infrastructure: Mauritius boasts advanced telecommunications and banking systems, facilitating seamless forex transactions.

Political Stability: A stable government and transparent legal system foster confidence among investors.

Cost-Effective Operations: Compared to jurisdictions like the UK or Australia, setting up a forex brokerage in Mauritius is more affordable.

These factors, combined with the FSC’s robust regulation, make Mauritius a magnet for forex brokers and traders worldwide.

Choosing a Forex Broker in Mauritius

For retail traders, selecting a licensed and reputable broker is critical to a safe and successful trading experience. Here are key factors to consider when choosing a forex broker in Mauritius:

Regulation: Ensure the broker is licensed by the FSC or other reputable authorities (e.g., CySEC, ASIC, FCA) for added security.

Trading Platform: Opt for brokers offering user-friendly platforms like MT4, MT5, or proprietary systems with advanced charting tools.

Spreads and Fees: Compare spreads, commissions, and overnight swap fees to minimize trading costs.

Leverage Options: Mauritius brokers often offer flexible leverage (e.g., 500:1), but choose a level that aligns with your risk tolerance.

Customer Support: Look for brokers with responsive support via live chat, email, or phone, ideally available 24/7.

Account Types: Check for account options catering to beginners (e.g., micro accounts) or advanced traders (e.g., ECN accounts).

Educational Resources: Reputable brokers provide tutorials, webinars, and demo accounts to help traders learn and practice.

Popular Brokers Operating in Mauritius:

Exness: Regulated by multiple authorities, offering over 55 currency pairs and MT4/MT5 platforms.

HotForex (HF Markets): Known for competitive spreads and Islamic accounts compliant with Sharia law.

FXTM: Offers fast execution, low spreads, and extensive educational content for beginners.

BDSwiss: Regulated by the FSC, with a low minimum deposit and access to MT4/MT5.

Always verify a broker’s FSC license through the commission’s public registry to avoid unregulated or fraudulent platforms.

Risks of Forex Trading in Mauritius

While forex trading is legal and well-regulated in Mauritius, it carries inherent risks that traders must understand:

Market Volatility: Currency prices can fluctuate rapidly due to economic events, geopolitical developments, or central bank policies.

Leverage Risks: High leverage can amplify profits but also lead to significant losses, especially for inexperienced traders.

Broker Fraud: Although rare with FSC-regulated brokers, unregulated platforms may engage in scams or manipulative practices.

Lack of Compensation Scheme: Unlike some jurisdictions (e.g., the UK’s FSCS), Mauritius does not offer a retail investor compensation fund.

Emotional Decision-Making: Trading without a solid strategy can result in impulsive decisions and financial losses.

To mitigate these risks, traders should educate themselves, use demo accounts, implement risk management strategies (e.g., stop-loss orders), and trade only with licensed brokers.

Practical Tips for Forex Trading in Mauritius

Whether you’re a Mauritian resident or an international trader considering Mauritius-based brokers, here are actionable tips to succeed in forex trading:

Start with Education: Learn the basics of forex trading through online courses, books, or broker-provided resources. Understand terms like pips, lots, and margin.

Develop a Trading Plan: Define your goals, risk tolerance, and trading strategy (e.g., scalping, day trading, or swing trading).

Practice on a Demo Account: Test your strategies in a risk-free environment before trading with real money.

Manage Risk: Risk only 1-2% of your capital per trade and use tools like stop-loss and take-profit orders.

Stay Informed: Follow economic news, such as interest rate decisions or GDP reports, that impact currency prices.

Choose a Regulated Broker: Verify the broker’s FSC license and read reviews from other traders.

Keep Records: Track your trades and review performance to identify strengths and weaknesses.

Avoid Overtrading: Stick to your plan and avoid chasing losses or trading emotionally.

By adopting a disciplined approach, traders can navigate the forex market with greater confidence and consistency.

Islamic Forex Trading in Mauritius

Mauritius is home to a significant Muslim population (approximately 17.3%), and many traders seek Sharia-compliant forex accounts. Islamic forex trading, also known as swap-free trading, eliminates interest-based overnight fees (swaps) to comply with Islamic finance principles.

Many FSC-regulated brokers, such as HotForex and XM, offer Islamic accounts with the following features:

No Swap Fees: Positions held overnight do not incur interest charges.

Transparent Pricing: Brokers may charge an administration fee instead of swaps to cover costs.

Same Trading Conditions: Islamic accounts provide access to the same currency pairs, leverage, and platforms as standard accounts.

Traders interested in Islamic accounts should confirm the broker’s compliance with Sharia law and review any additional fees.

Comparing Mauritius to Other Forex Jurisdictions

How does Mauritius stack up against other popular forex jurisdictions? Here’s a brief comparison:

United States: The US has strict regulations (e.g., NFA, CFTC) with low leverage (50:1) and high compliance costs. Mauritius offers more flexible leverage and lower operational costs.

United Kingdom: The UK’s FCA is highly respected, but licensing is expensive and time-consuming. Mauritius provides a cost-effective alternative with similar investor protections.

Seychelles: Seychelles offers simpler licensing but less stringent oversight than Mauritius, which may raise concerns about broker reliability.

Cyprus: Cyprus (CySEC) is popular in Europe, but Mauritius’s tax advantages and strategic location make it competitive for African and Asian markets.

Mauritius strikes a balance between regulatory rigor and business friendliness, making it ideal for brokers and traders seeking a stable yet affordable base.

Common Misconceptions About Forex Trading in Mauritius

Despite its growing popularity, forex trading in Mauritius is subject to several myths. Let’s debunk them:

Myth: Forex Trading Is Illegal in MauritiusReality: Forex trading is fully legal under FSC regulation, provided traders use licensed brokers.

Myth: You Need a License to Trade ForexReality: Only brokers need a license; retail traders can trade through regulated platforms without one.

Myth: Mauritius Is an Unregulated Offshore HavenReality: Mauritius is a well-regulated jurisdiction compliant with international AML and KYC standards.

Myth: Forex Trading Guarantees ProfitsReality: Forex trading is high-risk, and most retail traders lose money without proper education and risk management.

Myth: All Mauritius Brokers Are TrustworthyReality: While FSC regulation is robust, traders must verify a broker’s license and reputation to avoid scams.

Clearing up these misconceptions helps traders make informed decisions and approach the market realistically.

The Future of Forex Trading in Mauritius

Mauritius is poised to strengthen its position as a forex trading hub in the coming years. Several trends and developments suggest a bright future:

Technological Advancements: Increased adoption of mobile trading apps and AI-driven trading tools will make forex more accessible to Mauritians.

Regulatory Enhancements: The FSC continues to align with global standards, boosting Mauritius’s reputation as a trusted jurisdiction.

Growing Retail Participation: Rising financial literacy and internet penetration are driving more Mauritians to explore forex trading.

Attracting Global Brokers: Low operational costs and tax incentives will draw more international brokers to establish operations in Mauritius.

Sustainable Finance: The FSC is exploring green and sustainable financial products, which could integrate with forex markets.

As Mauritius invests in its financial infrastructure and regulatory framework, it will likely remain a top choice for traders and brokers alike.

Conclusion: Is Forex Trading Right for You in Mauritius?

Forex trading is not only legal in Mauritius but also thrives within a well-regulated and supportive environment. The Financial Services Commission ensures that brokers adhere to high standards, protecting traders while fostering innovation. With low taxes, strategic advantages, and a growing financial sector, Mauritius offers a compelling destination for both retail traders and brokerage firms.

However, forex trading is not without risks. Success requires education, discipline, and a commitment to risk management. By choosing a reputable FSC-regulated broker, developing a solid trading plan, and staying informed, you can navigate the forex market with confidence.

If you’re considering forex trading in Mauritius, start by researching licensed brokers, practicing on a demo account, and building your knowledge. The opportunities are vast, but so are the challenges—approach them with preparation and caution.

Have you traded forex in Mauritius or considered it? Share your thoughts in the comments below, and let’s discuss how to make the most of this dynamic market!

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: