13 minute read

How to Start Forex Trading in Ethiopia

from Exness Global

Forex trading, or foreign exchange trading, is gaining traction in Ethiopia as a viable avenue for financial growth. With the global forex market being the largest and most liquid financial market, trading over $7.5 trillion daily, it offers immense opportunities for individuals looking to diversify their income streams. For Ethiopians, forex trading presents a chance to engage with global markets, capitalize on currency fluctuations, and achieve financial independence, despite economic challenges like currency controls and limited local infrastructure. This guide provides a detailed, step-by-step approach to starting forex trading in Ethiopia, tailored for beginners, with practical tips to navigate the unique landscape of the Ethiopian market.

Top 4 Best Forex Brokers in Ethiopia

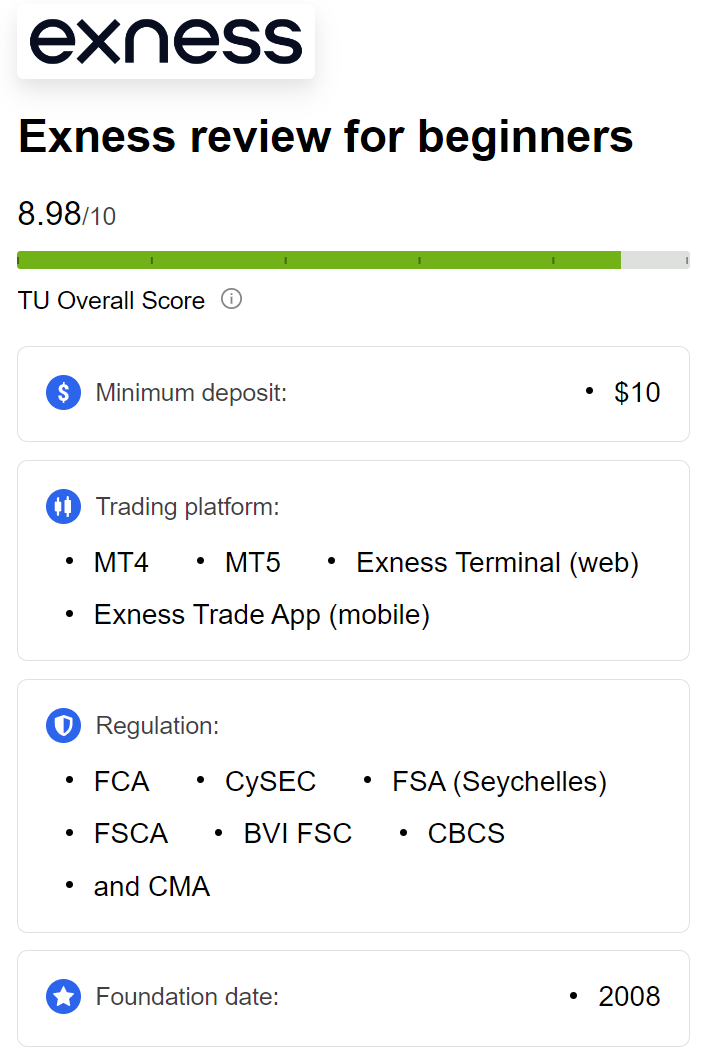

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ JustMarkets: Open An Account or Visit Brokers ✅

3️⃣ Quotex: Open An Account or Visit Brokers 🌐

4️⃣ Avatrade: Open An Account or Visit Brokers 💯

Understanding Forex Trading: The Basics

Forex trading involves buying and selling currencies in pairs, such as EUR/USD (Euro/US Dollar) or USD/JPY (US Dollar/Japanese Yen), with the goal of profiting from changes in their exchange rates. Unlike stock markets, forex operates 24 hours a day, five days a week, through a decentralized network of banks, brokers, and financial institutions. This accessibility makes it appealing for Ethiopians, who can trade at flexible hours that suit their schedules.

The forex market is driven by economic, political, and social factors, including interest rates, inflation, geopolitical events, and trade balances. For example, Ethiopia’s reliance on imports and foreign investment makes its currency, the Ethiopian Birr (ETB), sensitive to external shocks, creating both opportunities and risks for traders. Understanding these dynamics is crucial before diving into trading.

Why Forex Trading in Ethiopia?

Ethiopia’s economy is transitioning toward a market-oriented system, with growing internet penetration and a young, tech-savvy population. Despite challenges like political instability and strict currency controls, forex trading is becoming popular for several reasons:

Accessibility: Forex trading requires only an internet connection, a device, and a modest initial investment, making it accessible to many Ethiopians.

Flexibility: The 24/5 market allows trading at convenient times, ideal for those with day jobs or other commitments.

Profit Potential: With proper strategies, traders can profit in both rising and falling markets.

Global Exposure: Forex trading connects Ethiopians to international markets, broadening investment opportunities beyond local constraints.

Low Entry Barriers: Many brokers offer accounts with low minimum deposits, some as little as $10, enabling beginners to start small.

However, forex trading is not without risks. High volatility, leverage, and lack of local regulation can lead to significant losses if not approached cautiously. Education and discipline are key to success.

Is Forex Trading Legal in Ethiopia?

Forex trading is legal in Ethiopia, but the regulatory framework is still developing. The National Bank of Ethiopia (NBE) oversees foreign exchange transactions and imposes strict currency controls to prevent capital flight. While there are no local forex brokers regulated by the NBE, Ethiopian traders can legally use international brokers, provided they comply with national policies.

Key considerations include:

Currency Restrictions: Traders must use the Ethiopian Birr (ETB) as the base currency for deposits, which may require conversion to USD or other major currencies.

Taxation: Forex profits may be subject to a 30% capital gains tax, though enforcement is inconsistent. Consulting a tax professional is advisable.

Broker Regulation: Since local brokers are scarce, choose international brokers regulated by reputable authorities like the UK’s Financial Conduct Authority (FCA), Cyprus’s CySEC, or Australia’s ASIC to ensure fund security.

To stay compliant, verify that your broker accepts Ethiopian clients and adheres to anti-money laundering (AML) and Know Your Client (KYC) requirements. Avoid unregulated brokers to minimize the risk of fraud.

Step-by-Step Guide to Start Forex Trading in Ethiopia

Here’s a detailed roadmap to begin your forex trading journey in Ethiopia, designed to help beginners build a strong foundation.

Step 1: Educate Yourself on Forex Trading

Knowledge is the cornerstone of successful trading. Before risking money, invest time in learning the basics:

Understand Key Concepts: Familiarize yourself with terms like pips, spreads, leverage, margin, and lot sizes. For example, a pip is the smallest price movement in a currency pair, and spreads represent the broker’s fee.

Learn Market Analysis: Study technical analysis (using charts and indicators like Moving Averages or RSI) and fundamental analysis (evaluating economic data like GDP or interest rates).

Explore Trading Strategies: Research strategies like scalping (short-term trades), day trading, or swing trading to find what suits your goals.

Resources for Learning:

Books: “Currency Trading for Dummies” by Brian Dolan or “Technical Analysis of the Financial Markets” by John J. Murphy.

Online Courses: Platforms like Babypips.com offer free, beginner-friendly courses.

YouTube Channels: Channels like “The Trading Channel” provide practical tutorials.

Local Communities: Join forex trading groups in Ethiopia via Telegram or WhatsApp for peer support.

Aim to spend at least 1–2 months learning before trading with real money. This preparation reduces costly mistakes.

Step 2: Choose a Reliable Forex Broker

Selecting the right broker is critical, as it impacts your trading experience, costs, and fund security. Since Ethiopia lacks local brokers, focus on international brokers with the following features:

Regulation: Ensure the broker is licensed by trusted authorities (e.g., FCA, CySEC, ASIC).

Low Fees: Look for competitive spreads (e.g., 0.9 pips on EUR/USD) and low or no commissions.

Payment Methods: Choose brokers supporting Ethiopian-friendly options like bank transfers, mobile money (M-Birr, HelloCash), or e-wallets (Skrill, Neteller).

Trading Platforms: Opt for user-friendly platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5), which offer advanced charting and automation tools.

Demo Accounts: Select brokers offering demo accounts to practice trading without risk.

Customer Support: Prioritize brokers with 24/7 multilingual support to address issues promptly.

Recommended Brokers for Ethiopians:

Exness: Known for instant withdrawals and mobile money support.

XM: Offers low spreads, educational resources, and a $10 minimum deposit.

FXTM: Provides robust customer support and local payment options.

IC Markets: Ideal for advanced traders with tight spreads and MT4/MT5 compatibility.

Compare at least 3–5 brokers before deciding. Check reviews on platforms like Trustpilot to confirm reliability.

💥 Trade with Exness now: Open An Account or Visit Brokers

Step 3: Open and Verify a Trading Account

Once you’ve chosen a broker, follow these steps to set up your account:

Register: Visit the broker’s website and sign up with your name, email, and phone number.

Complete KYC: Submit identification documents (e.g., passport, national ID) and proof of address (e.g., utility bill) to comply with AML regulations.

Choose Account Type: Select an account suited to beginners, such as a micro or standard account with low minimum deposits (e.g., $10–$100).

Download Platform: Install the broker’s trading platform (e.g., MT4, MT5) on your computer or smartphone.

Verification typically takes 1–3 days. Ensure your documents are clear to avoid delays.

Step 4: Practice with a Demo Account

A demo account is a risk-free way to test your skills and strategies. Most brokers provide virtual funds (e.g., $10,000) to simulate real trading conditions. Use the demo account to:

Familiarize with the Platform: Learn how to place trades, set stop-loss orders, and analyze charts.

Test Strategies: Experiment with different trading approaches to identify what works.

Build Confidence: Practice until you achieve consistent virtual profits over 2–3 months.

Treat the demo account like real money to develop discipline. Avoid rushing to live trading prematurely.

Step 5: Develop a Trading Plan

A trading plan is your blueprint for success, outlining your goals, risk tolerance, and strategies. Key components include:

Goals: Define realistic objectives, e.g., “Earn 5% monthly returns” rather than “Get rich quick.”

Risk Management: Risk no more than 1–2% of your account per trade. For example, with a $100 account, limit losses to $1–$2 per trade.

Trading Hours: Focus on high-liquidity sessions, like the London-New York overlap (4:00 PM–8:00 PM EAT), for better opportunities.

Strategies: Choose 1–2 strategies, such as trend following or breakout trading, and master them.

Journaling: Record every trade to track performance and identify mistakes.

Review your plan weekly to stay disciplined and adapt to market changes.

Step 6: Fund Your Account

Once confident, deposit funds into your live account. Start small to minimize risk—$50–$100 is sufficient for beginners. Common deposit methods for Ethiopians include:

Bank Transfers: Supported by most brokers but may incur fees and delays.

Mobile Money: Services like M-Birr or HelloCash are fast and convenient.

E-Wallets: Skrill, Neteller, or Payoneer offer secure, international transactions.

Check your broker’s minimum deposit and withdrawal policies. For amounts exceeding $4,000, the NBE requires a customs declaration, so plan accordingly.

Step 7: Start Trading with Real Money

Begin live trading with small positions to manage risk. Follow these tips:

Use Stop-Loss Orders: Automatically close trades at a set loss level to protect your capital.

Avoid Overleveraging: Leverage (e.g., 1:100) amplifies profits and losses. Start with low leverage (1:10 or 1:20).

Focus on Major Pairs: Trade liquid pairs like EUR/USD or GBP/USD, which have tighter spreads and lower volatility than exotic pairs like USD/ZAR.

Stay Informed: Monitor economic calendars on sites like Investing.com for events impacting currency prices (e.g., US Federal Reserve decisions).

Aim for steady progress rather than quick wins. Reinvest profits to grow your account gradually.

Step 8: Manage Risks and Emotions

Forex trading is as much about psychology as it is about strategy. Common pitfalls include:

Greed: Overtrading to chase profits often leads to losses.

Fear: Hesitating to enter trades can miss opportunities.

Revenge Trading: Trying to recover losses with impulsive trades worsens outcomes.

To stay disciplined:

Stick to your trading plan, even during losing streaks.

Take breaks to avoid burnout.

Celebrate small wins to build confidence without overconfidence.

Use tools like position size calculators to align trades with your risk tolerance.

Step 9: Continuously Learn and Improve

The forex market evolves constantly, requiring ongoing education. Stay updated by:

Reading News: Follow global economic developments on Bloomberg or Reuters.

Joining Communities: Engage with traders on forums like ForexFactory or local WhatsApp groups.

Analyzing Trades: Review your trading journal to identify strengths and weaknesses.

Upgrading Skills: Take advanced courses or attend webinars offered by brokers like XM or FXTM.

Commit to learning something new weekly to refine your strategies.

Step 10: Withdraw Profits Wisely

Once you start earning, withdraw profits periodically to secure gains. Use the same payment method as your deposit for smoother processing. Be aware of:

Fees: Some brokers charge withdrawal fees, especially for bank transfers.

Currency Conversion: Converting USD profits to ETB may incur exchange rate losses.

Tax Obligations: Report profits to the Ministry of Revenues if required.

Start by withdrawing small amounts to test the process, then scale up as needed.

Best Times to Trade Forex in Ethiopia

Ethiopia operates on East Africa Time (EAT, UTC+3), aligning closely with major forex sessions. The best trading times are:

London Session (11:00 AM–7:00 PM EAT): High liquidity, especially for EUR/USD and GBP/USD.

New York Session (4:00 PM–1:00 AM EAT): Volatile due to US economic data releases.

London-New York Overlap (4:00 PM–8:00 PM EAT): Peak liquidity and volatility, ideal for day trading.

Avoid trading during low-liquidity sessions (e.g., Sydney session, 3:00 AM–12:00 PM EAT) to minimize slippage and wide spreads.

Challenges of Forex Trading in Ethiopia

While forex trading offers opportunities, Ethiopian traders face unique challenges:

Internet Connectivity: Unreliable internet can disrupt trading. Use mobile data or invest in a stable connection.

Currency Controls: Restrictions on foreign currency access complicate deposits and withdrawals.

Limited Local Support: Lack of local brokers means reliance on international platforms, which may not fully understand Ethiopian needs.

Scams: Unregulated brokers and “get-rich-quick” schemes target beginners. Stick to regulated brokers to avoid fraud.

Economic Volatility: The ETB’s fluctuations due to inflation or policy changes can affect trading strategies.

Overcome these by choosing reliable brokers, starting small, and staying informed about local regulations.

Tips for Success in Forex Trading

To thrive as a forex trader in Ethiopia, follow these practical tips:

Start Small: Begin with a micro account to limit losses while gaining experience.

Master One Pair: Focus on a single currency pair (e.g., EUR/USD) to understand its behavior deeply.

Use Risk Management: Always set stop-loss orders and avoid risking more than 1–2% per trade.

Stay Patient: Forex success takes time. Avoid chasing quick profits.

Leverage Technology: Use mobile trading apps for flexibility and set alerts for price movements.

Network Locally: Connect with Ethiopian traders for tips and moral support.

Stay Disciplined: Follow your trading plan and avoid emotional decisions.

Common Mistakes to Avoid

Beginners often fall into traps that hinder progress. Steer clear of these:

Lack of Education: Trading without understanding the market leads to losses.

Overleveraging: High leverage can wipe out accounts quickly.

Ignoring Risk Management: Not using stop-loss orders exposes you to unlimited losses.

Chasing Losses: Trying to recover losses with bigger trades compounds mistakes.

Trusting Scams: Avoid brokers promising guaranteed profits or unrealistic returns.

Tools and Resources for Ethiopian Traders

Maximize your trading potential with these tools:

Trading Platforms: MT4, MT5, or cTrader for charting and automation.

Economic Calendars: Track events on ForexFactory or Investing.com.

Charting Tools: Use TradingView for advanced technical analysis.

Mobile Apps: Download broker apps for trading on the go.

News Feeds: Follow Reuters or Bloomberg for real-time updates.

Free resources like Babypips and broker webinars are excellent for continuous learning.

The Role of Technology in Forex Trading

Technology has democratized forex trading, making it accessible to Ethiopians with smartphones and internet access. Mobile trading apps allow you to monitor markets, execute trades, and manage accounts anywhere. Automated trading tools, like Expert Advisors (EAs) on MT4, can execute strategies 24/7, though beginners should use them cautiously after thorough testing.

Ensure your device is secure with updated antivirus software to protect your trading account from cyber threats. Reliable internet is non-negotiable—consider a backup data plan for uninterrupted trading.

Building a Long-Term Forex Trading Career

Forex trading is a marathon, not a sprint. To build a sustainable career:

Set Realistic Goals: Aim for consistent 3–5% monthly returns rather than overnight wealth.

Reinvest Profits: Use earnings to grow your account while withdrawing small amounts for personal use.

Diversify Strategies: Combine technical and fundamental analysis for balanced decisions.

Stay Resilient: Losses are part of the journey. Learn from them and keep improving.

Plan for Taxes: Save for potential tax liabilities to avoid surprises.

With dedication, you can transition from a part-time trader to a full-time professional, contributing to Ethiopia’s growing financial ecosystem.

Conclusion

Forex trading in Ethiopia offers a pathway to financial empowerment, but it requires preparation, discipline, and patience. By educating yourself, choosing a regulated broker, practicing with a demo account, and following a solid trading plan, you can navigate the complexities of the forex market. Despite challenges like currency controls and limited local infrastructure, Ethiopian traders can succeed by leveraging international platforms, technology, and community support.

Start small, stay informed, and treat trading as a skill to master over time. With the right approach, forex trading can become a rewarding venture, opening doors to global opportunities from the comfort of your home in Ethiopia. Take the first step today—open a demo account, learn the ropes, and embark on your journey to financial independence.

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: