10 minute read

Gold Forex Trading Time in India

Gold has always held a special place in India’s economy and culture, often seen as a symbol of wealth and stability. With the rise of forex trading, gold has become a popular asset for traders looking to diversify their portfolios and capitalize on price fluctuations. However, success in gold forex trading depends heavily on understanding the best trading times, market dynamics, and strategies tailored to the Indian market. In this comprehensive guide, we’ll explore the optimal gold forex trading times in India, key factors influencing gold prices, and actionable strategies to help you navigate this exciting market.

Top 4 Best Forex Brokers

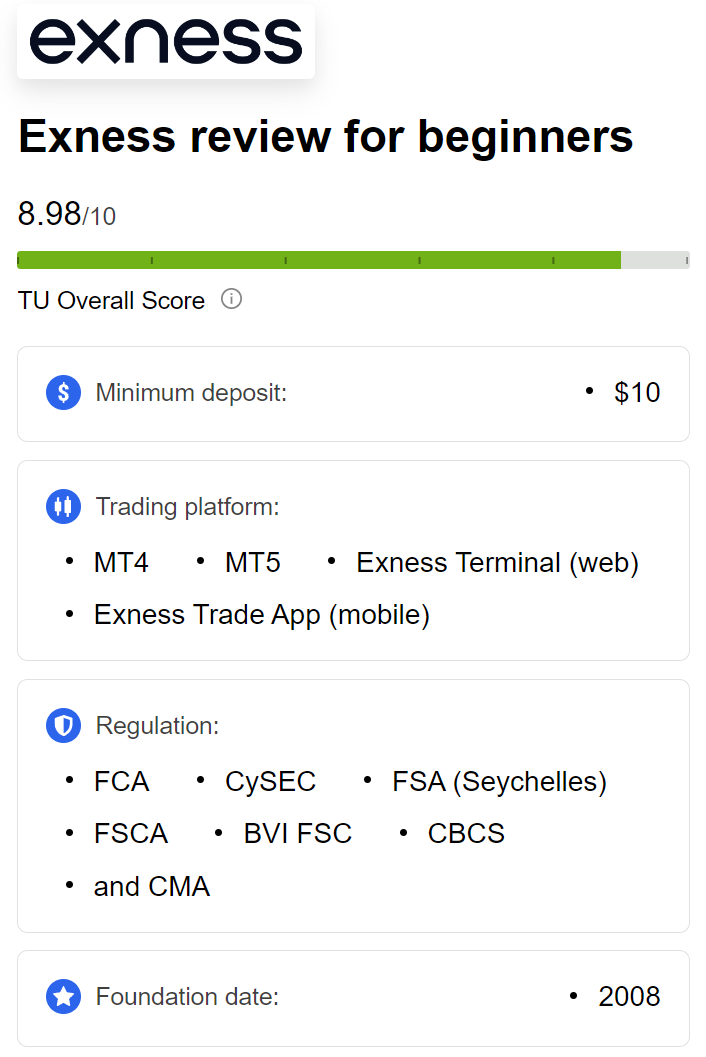

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ JustMarkets: Open An Account or Visit Brokers ✅

3️⃣ Quotex: Open An Account or Visit Brokers 🌐

4️⃣ Avatrade: Open An Account or Visit Brokers 💯

1. Introduction to Gold Forex Trading

Forex trading, or foreign exchange trading, involves buying and selling currencies or commodities like gold in global markets. Gold forex trading focuses on trading gold against major currencies, such as the US dollar (XAU/USD), in the spot forex market. Unlike traditional gold investments like jewelry or bullion, forex trading allows traders to speculate on gold price movements without physically owning the metal.

In India, gold forex trading has gained traction due to its accessibility, high liquidity, and potential for profit. With the right timing and strategies, Indian traders can take advantage of gold’s volatility to generate returns. However, the forex market operates 24/5 globally, and understanding the best trading hours for gold in India’s time zone (Indian Standard Time, IST) is critical for success.

Why Timing Matters

The forex market’s global nature means that trading sessions in different regions overlap, creating periods of high liquidity and volatility. For gold, price movements are influenced by economic data releases, geopolitical events, and market sentiment. Trading during the right hours ensures you’re active when the market is most liquid, minimizing spreads and maximizing opportunities.

2. Why Gold is a Popular Forex Trading Asset in India

Gold holds a unique position in India, both culturally and economically. Here are some reasons why gold forex trading is particularly appealing to Indian traders:

Cultural Significance: Gold is deeply ingrained in Indian traditions, from weddings to investments, making it a familiar asset for traders.

Hedge Against Inflation: Gold is often seen as a safe-haven asset, protecting against inflation and currency depreciation.

High Volatility: Gold prices can experience significant swings, offering opportunities for short-term traders.

Global Demand: As one of the world’s largest gold consumers, India’s demand influences global prices, giving local traders an edge in understanding market trends.

Accessibility: Forex brokers in India offer gold trading with low capital requirements, making it accessible to retail traders.

For Indian traders, gold forex trading combines the allure of a culturally significant asset with the flexibility of the forex market, creating a compelling opportunity.

3. Understanding Forex Market Hours

The forex market operates 24 hours a day, five days a week, across major financial centers: Sydney, Tokyo, London, and New York. These sessions create a continuous trading cycle, but not all hours are equally active for gold trading. To understand the best gold forex trading times in India, let’s break down the global forex sessions in IST:

Sydney Session: 3:30 AM – 12:30 PM IST

Tokyo Session: 5:30 AM – 2:30 PM IST

London Session: 1:30 PM – 10:30 PM IST

New York Session: 6:30 PM – 3:30 AM IST

Session Overlaps

The most active trading periods occur when sessions overlap, as this is when liquidity and volatility peak. For gold trading, the London-New York overlap (6:30 PM – 10:30 PM IST) is particularly significant, as these markets account for a large portion of gold trading volume.

4. Gold Forex Trading Time in India: The Best Hours

For Indian traders, aligning trading activities with global market hours is crucial. Gold prices are influenced by economic events, central bank policies, and market sentiment, which are most active during specific times. Here are the optimal gold forex trading times in India:

Morning Hours (5:30 AM – 8:30 AM IST)

Why It’s Good: The Tokyo session is active, and early economic data from Asia (e.g., China, Japan) can influence gold prices. India’s proximity to these markets means traders can react quickly to regional news.

What to Watch: Asian stock market openings, Chinese economic indicators, and gold demand trends.

Afternoon Hours (1:30 PM – 4:30 PM IST)

Why It’s Good: The London session begins, bringing increased liquidity. European economic data, such as inflation reports or ECB announcements, can drive gold price movements.

What to Watch: Eurozone economic releases, UK data, and early US market sentiment.

Evening Hours (6:30 PM – 10:30 PM IST)

Why It’s Good: This is the London-New York overlap, the most active period for gold trading. Major US economic data (e.g., non-farm payrolls, Fed interest rate decisions) often cause significant price swings.

What to Watch: US dollar strength, Federal Reserve statements, and geopolitical news.

Late Evening (10:30 PM – 1:30 AM IST)

Why It’s Good: The New York session continues, and late US market activity can provide opportunities for swing trading.

What to Watch: Closing trends in US equities and commodities markets.

Key Considerations for Indian Traders

Time Zone Challenges: Evening hours may be more convenient for Indian traders with day jobs, but morning sessions can offer unique opportunities for early risers.

Broker Spreads: Spreads (the difference between bid and ask prices) are typically lower during high-liquidity hours, reducing trading costs.

Volatility: High volatility during overlaps can lead to both opportunities and risks, so proper risk management is essential.

💥 Trade with Exness now: Open An Account or Visit Brokers

5. Factors Influencing Gold Prices in Forex Markets

To trade gold effectively, Indian traders must understand the factors driving its price movements. Here are the key drivers:

1. US Dollar Strength

Gold is priced in US dollars (XAU/USD), so a stronger dollar typically depresses gold prices, while a weaker dollar boosts them. Indian traders should monitor US economic indicators like GDP, inflation, and employment data.

2. Interest Rates

Central bank policies, especially from the US Federal Reserve, impact gold prices. Higher interest rates increase the opportunity cost of holding gold (a non-yielding asset), while lower rates make gold more attractive.

3. Geopolitical Events

Gold is a safe-haven asset, meaning its demand rises during geopolitical uncertainty, such as wars, trade disputes, or elections. Indian traders should stay informed about global news.

4. Inflation Expectations

Gold is often used as an inflation hedge. Rising inflation in major economies can drive gold prices higher, while deflationary pressures may suppress them.

5. Indian Gold Demand

India’s massive gold consumption for jewelry, investments, and festivals (e.g., Diwali, Akshaya Tritiya) influences global prices. Seasonal demand spikes can create trading opportunities.

6. Supply and Mining Costs

Gold production costs and supply disruptions (e.g., mine closures) can affect prices. Traders should monitor reports from major gold-producing countries like Australia and South Africa.

By staying informed about these factors, Indian traders can anticipate price movements and time their trades effectively.

6. Strategies for Gold Forex Trading in India

Successful gold forex trading requires a blend of technical analysis, fundamental insights, and disciplined risk management. Here are some strategies tailored for Indian traders:

1. Scalping During High-Volatility Hours

What It Is: Scalping involves making quick trades to capture small price movements during volatile periods, such as the London-New York overlap.

How to Do It: Use 1-minute or 5-minute charts, focus on technical indicators like Moving Averages or RSI, and set tight stop-losses.

Best Time: 6:30 PM – 10:30 PM IST.

2. Swing Trading Based on Economic Data

What It Is: Swing trading involves holding positions for hours or days to capitalize on larger price swings driven by economic events.

How to Do It: Monitor the economic calendar for US data releases (e.g., CPI, FOMC meetings) and enter trades based on expected market reactions.

Best Time: Before and after major data releases (e.g., 6:30 PM IST for US data).

3. Trend Following with Moving Averages

What It Is: This strategy identifies and follows long-term trends using indicators like the 50-day and 200-day Moving Averages.

How to Do It: Buy when the 50-day MA crosses above the 200-day MA (bullish) and sell when it crosses below (bearish).

Best Time: Any active session, but confirm trends during high-liquidity hours.

4. Breakout Trading

What It Is: Breakout trading involves entering a trade when gold prices break through key support or resistance levels.

How to Do It: Use chart patterns like triangles or channels, set entry orders above resistance or below support, and use stop-losses to manage risk.

Best Time: During session overlaps (e.g., 1:30 PM – 4:30 PM IST).

5. Hedging with Correlated Assets

What It Is: Hedging involves trading correlated assets (e.g., USD/INR or silver) to offset potential losses in gold trades.

How to Do It: If you’re long on XAU/USD, consider a short position on USD/INR to balance currency risk.

Best Time: Anytime, but monitor correlations during active sessions.

7. Tools and Platforms for Gold Forex Trading

To trade gold effectively, Indian traders need reliable tools and platforms. Here’s a rundown:

Trading Platforms

MetaTrader 4/5 (MT4/MT5): Widely used for forex trading, offering advanced charting, indicators, and automated trading options.

TradingView: Ideal for technical analysis, with cloud-based charts and a community of traders sharing ideas.

Broker-Specific Platforms: Many Indian brokers (e.g., Zerodha, ICICI Direct) offer proprietary platforms with gold trading capabilities.

Analytical Tools

Economic Calendar: Track data releases and events affecting gold prices (available on sites like Investing.com).

Technical Indicators: Use RSI, MACD, Bollinger Bands, and Fibonacci retracement for price analysis.

News Aggregators: Stay updated with real-time news from Reuters, Bloomberg, or forex-focused apps.

Choosing a Broker

When selecting a broker for gold forex trading, consider:

Regulation: Ensure the broker is regulated by SEBI or international bodies like CySEC or FCA.

Spreads: Look for low spreads on XAU/USD, especially during active hours.

Leverage: Check leverage options, but use cautiously to avoid overexposure.

Customer Support: Opt for brokers with 24/5 support, given forex market hours.

8. Risks and Challenges in Gold Forex Trading

While gold forex trading offers opportunities, it comes with risks:

High Volatility: Gold prices can swing sharply, leading to potential losses if not managed properly.

Leverage Risks: High leverage can amplify both profits and losses, especially for inexperienced traders.

Time Zone Constraints: The best trading hours may conflict with work or personal schedules for Indian traders.

Emotional Trading: Fear or greed can lead to impulsive decisions, undermining strategies.

Broker Reliability: Unregulated or unscrupulous brokers may pose financial risks.

To mitigate these challenges, practice on demo accounts, use stop-loss orders, and stick to a trading plan.

9. Tips for Indian Traders to Maximize Profits

Here are actionable tips to enhance your gold forex trading success:

Start Small: Begin with a small account to learn the ropes without risking significant capital.

Use a Trading Journal: Record your trades to analyze what works and what doesn’t.

Stay Informed: Follow global and Indian economic news to anticipate market moves.

Practice Discipline: Avoid overtrading or chasing losses, and stick to your strategy.

Leverage Technology: Use mobile apps for real-time monitoring and trade execution.

Learn Continuously: Attend webinars, read books, and follow experienced traders to improve your skills.

Manage Risk: Never risk more than 1-2% of your account on a single trade.

10. Conclusion

Gold forex trading in India offers a dynamic opportunity for traders to capitalize on one of the world’s most coveted assets. By understanding the best trading times—particularly the London-New York overlap (6:30 PM – 10:30 PM IST)—and aligning strategies with market conditions, Indian traders can maximize their chances of success. Whether you’re scalping during volatile hours, swing trading based on economic data, or following long-term trends, discipline and knowledge are key.

As you embark on your gold forex trading journey, stay informed about global and local factors influencing prices, choose reliable tools and brokers, and prioritize risk management. With patience and practice, you can navigate the gold forex market with confidence and potentially unlock significant rewards.

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: