11 minute read

How to get unlimited leverage on Exness

Forex trading offers incredible opportunities for profit, but it also comes with significant risks. One of the most powerful tools in a trader’s arsenal is leverage, which allows you to control large positions with a relatively small amount of capital. Among the many brokers offering leverage, Exness stands out with its unique unlimited leverage feature—a game-changer for experienced traders looking to maximize their market exposure. But how exactly can you get unlimited leverage on Exness, and what does it take to use it effectively? In this in-depth guide, we’ll walk you through everything you need to know: from understanding leverage and Exness’s offerings to meeting the requirements, managing risks, and optimizing your trading strategy.

💥 Trade with Exness now: Open An Account or Visit Brokers

What Is Leverage in Forex Trading?

Before diving into the specifics of unlimited leverage on Exness, let’s establish a clear understanding of what leverage means in forex trading. Leverage is essentially a loan provided by your broker that amplifies your trading power. It’s expressed as a ratio, such as 1:100, 1:500, or in Exness’s case, 1:Unlimited. This ratio represents how much larger your position can be compared to your actual account balance.

For example, with a 1:100 leverage ratio, a $100 deposit allows you to control a $10,000 position. In forex, where currency pairs often move in tiny increments (measured in pips), leverage makes it possible to generate significant profits from small price changes. However, the flip side is that losses are equally magnified, making leverage a double-edged sword.

Exness takes this concept to the next level by offering unlimited leverage, a feature that removes traditional caps and lets traders control massive positions with minimal capital. But accessing and using this feature requires meeting specific conditions and mastering risk management. Let’s explore how you can unlock this powerful tool.

Why Choose Exness for Unlimited Leverage?

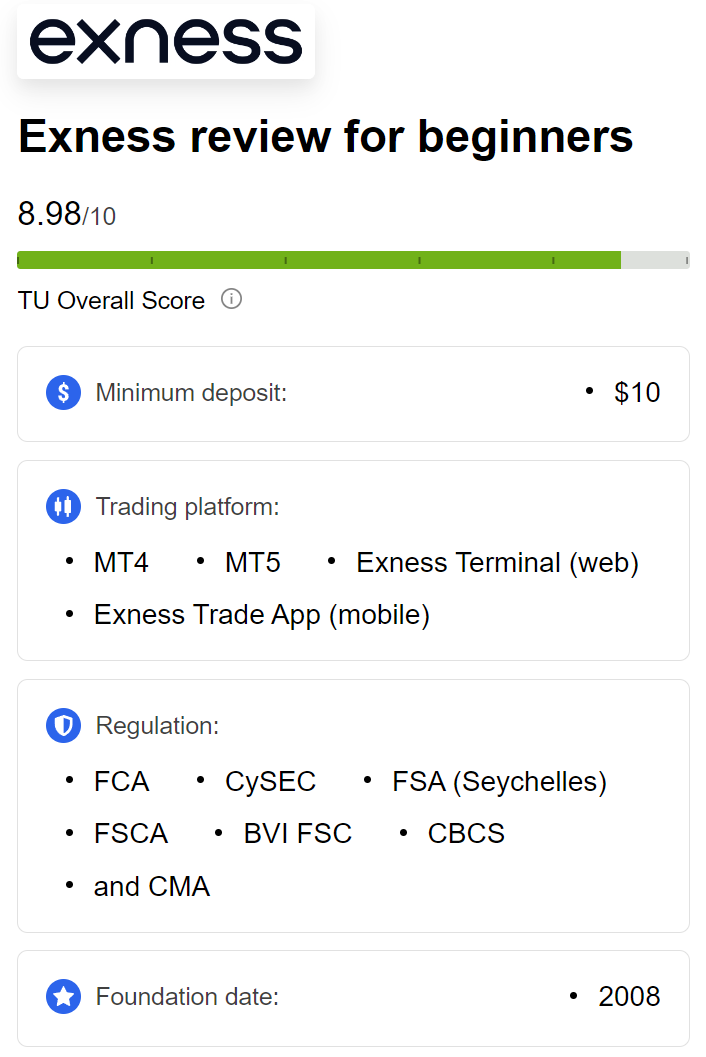

Exness, founded in 2008, has grown into one of the most trusted forex brokers globally, serving millions of traders with its innovative features and transparent policies. Regulated by top-tier authorities like the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC), Exness ensures a secure trading environment. What sets it apart from competitors is its flexibility in leverage options, culminating in the coveted unlimited leverage offering.

Here’s why Exness is a top choice for traders seeking high leverage:

Unlimited Leverage Option: Unlike most brokers that cap leverage at 1:30, 1:500, or 1:1000, Exness allows qualifying traders to use unlimited leverage, amplifying their trading potential.

Variety of Account Types: From beginner-friendly Standard accounts to professional Raw Spread and Zero accounts, Exness caters to all levels of traders.

Fast Withdrawals: Exness is renowned for processing withdrawals in minutes, ensuring you have quick access to your funds.

Low Margin Requirements: With unlimited leverage, the margin needed to open positions is minimal, freeing up capital for more trades.

Robust Support: 24/7 multilingual customer service and extensive educational resources help traders navigate the platform and leverage effectively.

These features make Exness an attractive platform for traders who want to push their strategies to the limit with unlimited leverage. But how do you actually get it?

Understanding Unlimited Leverage on Exness

Unlimited leverage on Exness means there’s no upper limit to the leverage ratio you can apply to your trades. While traditional leverage might stop at 1:1000 (allowing you to control $1,000,000 with $1,000), unlimited leverage theoretically lets you control positions worth millions with just a few dollars. In practice, Exness sets this at a maximum ratio of 1:2,100,000,000, an astronomical figure that offers unparalleled flexibility.

This feature is available on several Exness account types, including:

Standard Account: Ideal for beginners with low costs and no commissions.

Standard Cent Account: Perfect for testing strategies with micro-lots.

Pro Account: Designed for experienced traders with tighter spreads.

Raw Spread and Zero Accounts: Tailored for professionals with minimal spreads and commission-based pricing.

However, unlimited leverage isn’t handed out freely—it comes with specific prerequisites to ensure it’s used responsibly. Let’s break down how to access it.

How to Get Unlimited Leverage on Exness: Step-by-Step Guide

Unlocking unlimited leverage on Exness is straightforward if you meet the broker’s requirements. Here’s a detailed step-by-step process to get started:

Step 1: Open an Exness Account

If you don’t already have an account, visit the official Exness website: Open An Account or Visit BrokersChoose your preferred account type based on your trading experience and goals. For unlimited leverage, options like the Standard, Pro, or Raw Spread accounts are eligible.

Registration: Provide your email, phone number, and personal details.

Verification: Submit identification documents (e.g., passport or ID) and proof of address (e.g., utility bill) to verify your account. This typically takes 24 hours.

Step 2: Meet the Eligibility Criteria

Exness imposes conditions to ensure unlimited leverage is used by traders who understand its risks. For real accounts, you must satisfy the following:

Equity Below $5,000: Your account balance (equity) must be less than $5,000 USD. This limit encourages smaller, controlled trades.

Trading History: Close at least 10 orders (excluding pending orders) across all real accounts in your Personal Area (PA).

Minimum Volume: Achieve a cumulative trading volume of 5 lots (or 500 cent lots) across your real accounts.

For demo accounts, the process is simpler:

Set your equity to less than $5,000 (e.g., $4,999.99 or lower), and the unlimited leverage option will unlock automatically.

Step 3: Adjust Your Leverage Settings

Once you meet the criteria, follow these steps to enable unlimited leverage:

Log in to your Exness Personal Area (PA).

Select the trading account you want to apply unlimited leverage to.

Go to the “Account Settings” or “Leverage” section.

Choose “Unlimited” from the leverage options dropdown. If it’s grayed out, double-check that you’ve met all prerequisites.

Confirm the change. Note that leverage adjustments may take up to 24 hours to take effect.

Step 4: Start Trading with Unlimited Leverage

With unlimited leverage activated, you can now open positions with minimal margin. For example, with just $10 in your account, you could theoretically control a position worth millions, depending on market conditions and your strategy.

Prerequisites and Rules for Unlimited Leverage

While the process is simple, Exness enforces rules to balance the benefits and risks of unlimited leverage. Here’s what you need to know:

Equity Threshold: As your account equity grows beyond $5,000, the maximum leverage automatically adjusts downward (e.g., 1:2000 for $5,000–$14,999, 1:1000 for $15,000–$29,999, etc.). This protects you from overexposure as your capital increases.

Instrument Restrictions: Unlimited leverage doesn’t apply to all instruments. Exotic currency pairs, cryptocurrencies, stocks, indices, and energies have fixed margin requirements unaffected by leverage settings.

Regional Limits: Traders in certain regions (e.g., Kenya, where the max is 1:400) may face regulatory restrictions on leverage.

No Stop Out Protection: Accounts with unlimited leverage may not qualify for Exness’s Stop Out Protection, increasing the risk of liquidation during volatile markets.

Understanding these rules is critical to using unlimited leverage safely and effectively.

Benefits of Unlimited Leverage on Exness

Why pursue unlimited leverage? Here are the key advantages that make it a compelling choice for seasoned traders:

Maximized Profit Potential: Control massive positions with minimal capital, amplifying returns on even small price movements.

Low Margin Requirements: Open large trades without tying up significant funds, freeing capital for diversification.

Strategic Flexibility: Experiment with multiple positions or aggressive strategies like scalping without leverage caps holding you back.

Accessibility for Small Accounts: Traders with limited starting capital can still participate in high-volume trading.

For example, imagine trading a 50-lot position on EUR/USD with just $50 in your account. A 10-pip move in your favor could yield hundreds of dollars in profit—an impossible feat with standard leverage limits.

Risks of Unlimited Leverage and How to Manage Them

Unlimited leverage is a high-risk, high-reward tool. Without proper management, it can wipe out your account in seconds. Here are the primary risks and strategies to mitigate them:

Risks

Magnified Losses: A small adverse move can exceed your account balance, leading to rapid liquidation.

Margin Calls: With low margin requirements, even minor volatility can trigger a margin call or stop-out.

Emotional Pressure: The potential for huge gains or losses can cloud judgment, leading to impulsive decisions.

Risk Management Strategies

Use Stop-Loss Orders: Set tight stop-losses to limit losses on every trade. For instance, a 5-pip stop-loss on a high-leverage trade can cap your downside.

Trade Small Positions: Start with micro-lots to test your strategy before scaling up.

Monitor Volatility: Avoid trading during high-impact news events when spreads widen, and prices swing unpredictably.

Maintain Discipline: Stick to a trading plan and avoid overleveraging just because it’s available.

Leverage Calculators: Use Exness’s trading calculator to assess margin and risk before entering a trade.

By combining unlimited leverage with disciplined risk management, you can harness its power while minimizing its dangers.

Comparing Exness Unlimited Leverage to Other Brokers

How does Exness stack up against competitors? Most brokers cap leverage at 1:30 (e.g., under EU regulations) or 1:1000 (common among offshore brokers). Here’s a quick comparison:

Exness vs. XM: XM offers up to 1:1000 leverage, but it lacks an unlimited option, limiting flexibility for high-risk traders.

Exness vs. IC Markets: IC Markets caps leverage at 1:500, with stricter margin requirements compared to Exness’s negligible margins.

Exness vs. Deriv: Deriv provides 1:1000 leverage, but its unlimited leverage is less accessible and lacks Exness’s robust platform features.

Exness’s unlimited leverage, combined with its competitive spreads and fast execution, gives it an edge for traders seeking maximum exposure.

Practical Tips for Trading with Unlimited Leverage

To succeed with unlimited leverage on Exness, you need more than just access—you need a strategy. Here are actionable tips from experienced traders:

Focus on High-Liquidity Pairs: Trade major pairs like EUR/USD or USD/JPY, which have tighter spreads and lower volatility.

Scalping Opportunities: Use unlimited leverage for short-term trades (e.g., 1-5 pips) to capitalize on quick market moves.

Test on Demo First: Practice with a demo account set to unlimited leverage to refine your approach risk-free.

Monitor Account Equity: Keep your balance below $5,000 to maintain unlimited leverage eligibility.

Stay Informed: Follow economic calendars to avoid trading during volatile periods unless your strategy thrives on news events.

For example, a scalper might open a 20-lot position on GBP/USD with $20, aiming for a 3-pip gain. With unlimited leverage, the margin is negligible, and a successful trade could net $60—a 300% return on capital.

Real-World Examples of Unlimited Leverage in Action

Let’s look at two scenarios to illustrate how unlimited leverage works on Exness:

Scenario 1: Small Account Growth

Account Balance: $100

Trade: 10 lots on EUR/USD

Pip Value: $100 per pip

Outcome: A 5-pip move in your favor yields $500, a 500% profit. A 5-pip loss wipes out your account.

Scenario 2: Aggressive Scalping

Account Balance: $50

Trade: 25 lots on USD/JPY

Pip Value: $250 per pip

Outcome: A 2-pip gain earns $500, a 10x return. A 1-pip loss cuts your balance in half.

These examples highlight the potential and peril of unlimited leverage. Success hinges on precision and control.

Exness Tools and Resources to Enhance Your Leverage Experience

Exness provides a suite of tools to help you make the most of unlimited leverage:

Trader’s Calculator: Calculate margin, pip value, and profit/loss before trading.

Economic Calendar: Stay ahead of market-moving events.

MT4/MT5 Platforms: Access advanced charting and automated trading with unlimited leverage settings.

Educational Content: Webinars, tutorials, and articles on leverage and risk management.

24/7 Support: Get instant help via live chat or email for leverage-related queries.

Leveraging these resources ensures you’re well-equipped to handle the intensity of unlimited leverage trading.

Common Mistakes to Avoid with Unlimited Leverage

Even experienced traders can stumble when using unlimited leverage. Avoid these pitfalls:

Overtrading: Opening too many positions increases exposure and risk.

Ignoring Margin Levels: Failing to monitor margin can lead to unexpected stop-outs.

Neglecting Risk Management: Trading without stop-losses or a plan is a recipe for disaster.

Chasing Losses: Doubling down after a loss often amplifies damage with high leverage.

By steering clear of these errors, you can maintain control and protect your capital.

Is Unlimited Leverage Right for You?

Unlimited leverage isn’t for everyone. It’s best suited for:

Experienced Traders: Those with a proven track record and strong risk management skills.

Scalpers and Day Traders: Short-term traders who thrive on small, frequent gains.

Risk-Tolerant Individuals: Traders comfortable with the possibility of losing their entire balance.

If you’re a beginner, start with lower leverage (e.g., 1:100) and gradually work up as you gain confidence and expertise.

Conclusion: Mastering Unlimited Leverage on Exness

Getting unlimited leverage on Exness is a straightforward process: open an account, meet the eligibility criteria, and adjust your settings. But mastering it requires more—discipline, strategy, and a deep understanding of the risks and rewards. With the ability to control massive positions using minimal capital, unlimited leverage offers unparalleled opportunities for profit. Yet, it demands respect and caution, as the potential for loss is just as great.

By following this guide, leveraging Exness’s tools, and applying sound risk management, you can unlock the full potential of unlimited leverage. Whether you’re scalping for quick gains or building a small account into a fortune, Exness provides the platform—and the power—to make it happen. Ready to take your trading to the next level? Sign up with Exness today and start exploring the world of unlimited leverage.

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: