10 minute read

Exness India Review 2025: Is it the Right Broker for You?

The world of online trading is booming, and India is no exception. With millions of traders seeking reliable platforms to grow their wealth, choosing the right broker has never been more critical. Among the top contenders in the global forex and CFD trading space is Exness, a broker that has gained significant traction among Indian traders. But is Exness the right choice for you in 2025? In this comprehensive Exness India Review 2025, we’ll dive deep into its features, benefits, drawbacks, and everything else you need to know to make an informed decision.

💥 Trade with Exness now: Open An Account or Visit Brokers

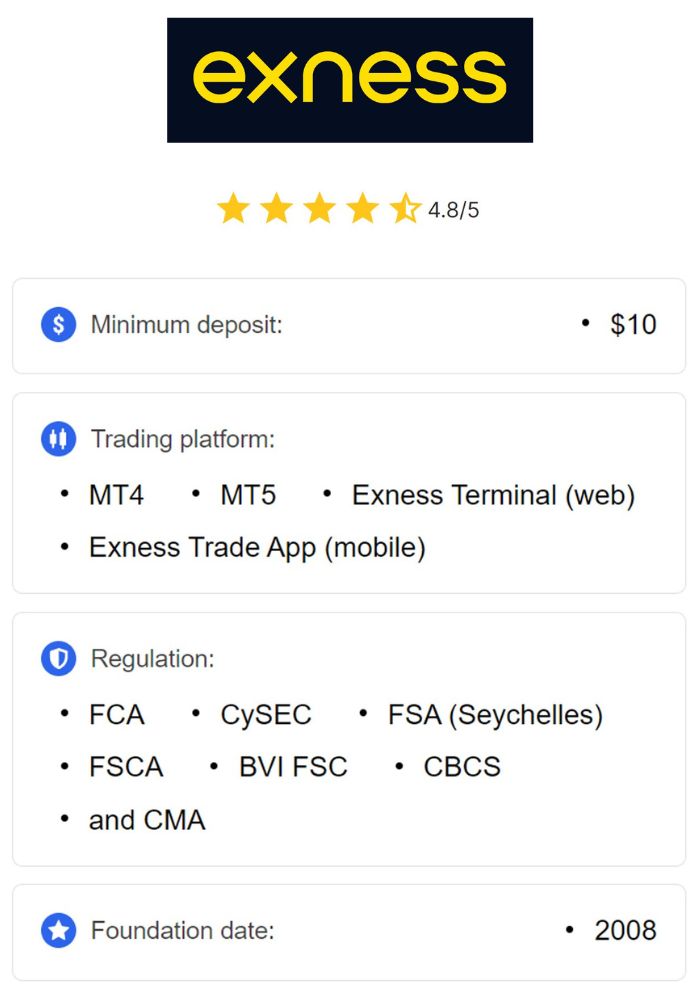

Founded in 2008, Exness has built a reputation as a trusted, innovative broker with a global presence. For Indian traders, it promises low-cost trading, high leverage, instant withdrawals, and a user-friendly experience. However, forex trading in India comes with its own set of challenges, including regulatory nuances and market-specific needs. This review will explore how Exness stacks up for Indian users, whether you’re a beginner or an experienced trader, and whether it aligns with your trading goals in 2025.

What is Exness? An Overview for Indian Traders

Before diving into the nitty-gritty, let’s start with the basics. Exness is a multi-asset broker headquartered in Cyprus, offering trading in forex, cryptocurrencies, commodities, indices, and stocks via Contracts for Difference (CFDs). Since its inception, Exness has grown into one of the world’s largest retail forex brokers, boasting over 1 million active clients and a staggering $4 trillion in monthly trading volume as of recent years.

For Indian traders, Exness stands out due to its accessibility and tailored offerings. It supports popular trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), alongside its proprietary Exness Terminal and mobile app. Whether you’re trading INR-based forex pairs or exploring global markets, Exness aims to provide a seamless experience. But how does it fare in the Indian context? Let’s break it down.

Is Exness Legal in India? Understanding the Regulatory Landscape

One of the first questions Indian traders ask is: Is Exness legal in India? The short answer is yes, but with some caveats. Forex trading in India is governed by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). According to the Foreign Exchange Management Act (FEMA), Indian residents can legally trade forex, but only under specific conditions:

Trading must involve INR-based currency pairs (e.g., USD/INR, EUR/INR).

Transactions must occur through SEBI-regulated exchanges like the National Stock Exchange (NSE) or Bombay Stock Exchange (BSE).

Exness, however, is an international broker not regulated by SEBI or RBI. Instead, it operates under multiple global licenses, including:

Cyprus Securities and Exchange Commission (CySEC) – License No. 178/12

Financial Conduct Authority (FCA) – UK

Financial Sector Conduct Authority (FSCA) – South Africa, FSP No. 51024

Financial Services Authority (FSA) – Seychelles

For Indian traders, this means Exness operates as an offshore broker. While there’s no explicit law prohibiting Indian residents from using offshore brokers like Exness, trading non-INR pairs or assets outside Indian exchanges falls into a legal gray area. Many Indian traders use Exness without issues, but it’s wise to consult a legal expert to ensure compliance with FEMA regulations.

Safety and Security Features

Beyond legality, safety is paramount. Exness prioritizes client security with:

Segregated Accounts: Client funds are kept separate from company funds, reducing the risk of misuse.

Negative Balance Protection: Traders can’t lose more than their deposit, a crucial feature for high-leverage trading.

SSL Encryption: Protects your personal and financial data from cyber threats.

With oversight from top-tier regulators like CySEC and FCA, Exness adheres to strict financial standards, making it a secure choice for Indian traders despite the lack of SEBI oversight.

Exness Trading Conditions: What’s in it for Indian Traders?

Exness is renowned for its competitive trading conditions, which appeal to traders worldwide. Here’s how they translate for Indian users in 2025:

1. Spreads and Fees

Exness offers some of the tightest spreads in the industry, starting from 0.0 pips on its Raw Spread and Zero accounts. For Standard accounts, spreads begin at 0.3 pips for major pairs like EUR/USD. This is a boon for cost-conscious Indian traders.

No Deposit Fees: Exness doesn’t charge fees for deposits, though your payment provider might.

No Withdrawal Fees: Withdrawals are free via most methods, with instant processing in many cases.

Commission Structure: Standard accounts are commission-free, while Raw Spread and Zero accounts charge a small commission (e.g., $3.5 per lot).

Compared to competitors like OctaFX or XM, Exness’s fee structure is highly competitive, especially for high-volume traders.

2. Leverage

Exness offers unlimited leverage on some accounts, subject to conditions (e.g., trading a minimum number of lots). For most accounts, leverage goes up to 1:2000, far higher than what SEBI-regulated brokers provide (typically capped at 1:50). This high leverage can amplify profits but also increases risk, making it essential for Indian traders to use it wisely.

3. Account Types

Exness caters to diverse trading styles with multiple account options:

Standard Cent: Ideal for beginners, with a low minimum deposit (e.g., $10) and micro-lot trading.

Standard: Commission-free with moderate spreads, perfect for casual traders.

Pro: Market execution with tighter spreads, suited for experienced traders.

Raw Spread: Ultra-low spreads with a small commission, great for scalpers.

Zero: Near-zero spreads on major pairs, designed for high-frequency trading.

Indian traders can choose an account that matches their experience level and budget, with the flexibility to switch as their skills grow.

4. Trading Instruments

Exness offers a wide range of assets:

Forex: Over 100 currency pairs, including INR-based pairs like USD/INR.

Cryptocurrencies: Bitcoin, Ethereum, and more.

Commodities: Gold, silver, oil.

Indices: S&P 500, NIFTY 50, etc.

Stocks: CFDs on global companies like Apple and Tesla.

This diversity allows Indian traders to diversify their portfolios beyond forex, a feature not all local brokers offer.

Deposit and Withdrawal Options for Indian Traders

A broker’s payment system can make or break the trading experience. Exness excels here, offering localized options for Indian users:

Deposit Methods

UPI: Fast and widely used in India (e.g., Google Pay, PhonePe).

Net Banking: IMPS, NEFT, RTGS via major Indian banks.

Credit/Debit Cards: Visa, MasterCard.

E-Wallets: Skrill, Neteller, Perfect Money.

Cryptocurrency: Bitcoin, USDT, Ethereum.

The minimum deposit is as low as $10 (around ₹800), making Exness accessible to beginners. Deposits are typically instant, ensuring you can start trading without delay.

Withdrawal Methods

Exness is famous for its instant withdrawals, a rare feature among brokers. Options mirror deposit methods, and most withdrawals are processed within seconds to a few hours. For example:

UPI withdrawals: Instant to 24 hours.

Bank transfers: 1-3 business days.

Crypto: Near-instant with blockchain confirmation.

There are no withdrawal fees from Exness, though third-party providers may charge a small amount. This efficiency gives Exness an edge over competitors like IC Markets or FBS, where withdrawal times can stretch to days.

💥 Trade with Exness now: Open An Account or Visit Brokers

Trading Platforms: MT4, MT5, and More

Exness supports a variety of platforms to suit different trading preferences:

1. MetaTrader 4 (MT4)

Industry-standard platform.

Supports automated trading via Expert Advisors (EAs).

User-friendly for beginners.

2. MetaTrader 5 (MT5)

Advanced features like additional timeframes and indicators.

Ideal for multi-asset trading.

Faster execution than MT4.

3. Exness Terminal

Web-based, no download required.

Lightweight with 50+ drawing tools and 100+ indicators.

Perfect for traders on the go.

4. Exness Trade App

Mobile trading for iOS and Android.

Real-time quotes, instant deposits/withdrawals, and copy trading.

Highly rated by Indian users for its simplicity.

For Indian traders, the availability of INR as a base currency across these platforms eliminates conversion fees, enhancing cost-efficiency. Whether you prefer desktop trading or mobile flexibility, Exness has you covered.

Customer Support: How Does Exness Serve Indian Traders?

Reliable customer support is a must, especially in a market like India where traders may need assistance in local languages. Exness offers 24/7 support via:

Live Chat: Quick responses, available in English and Hindi.

Email: Detailed queries resolved within 24 hours.

Phone: Dedicated Indian number for direct assistance.

While support isn’t available in all regional languages (e.g., Tamil or Bengali), the inclusion of Hindi is a significant plus. The FAQ section on the Exness website also covers common issues like account verification and withdrawals, reducing the need to contact support.

Compared to brokers like OctaFX, which offer multilingual support, Exness could improve by adding more Indian languages. However, its round-the-clock availability ensures you’re never left in the dark.

Pros and Cons of Exness for Indian Traders in 2025

Pros

Low Trading Costs: Tight spreads and no deposit/withdrawal fees.

High Leverage: Up to 1:2000 or unlimited, offering flexibility.

Instant Withdrawals: Rare and highly valued feature.

Localized Payment Options: UPI, Net Banking, and INR support.

Robust Regulation: Trusted globally with CySEC, FCA licenses.

Diverse Assets: Forex, crypto, stocks, and more.

Cons

Not SEBI-Regulated: Legal gray area for non-INR trading.

Limited Educational Resources: Less content for beginners compared to rivals.

High Leverage Risks: Can lead to significant losses if mismanaged.

No Physical Office in India: May concern some traders.

How Does Exness Compare to Other Brokers in India?

To determine if Exness is right for you, let’s compare it to popular alternatives in India:

Exness vs. OctaFX

Spreads: Exness offers tighter spreads (0.0 pips vs. 0.4 pips on OctaFX).

Leverage: Exness’s 1:2000 trumps OctaFX’s 1:500.

Withdrawals: Exness’s instant withdrawals beat OctaFX’s 1-3 day processing.

Exness vs. IC Markets

Regulation: Both are globally regulated, but IC Markets has ASIC oversight, considered stricter than FSA Seychelles.

Fees: Exness has no withdrawal fees; IC Markets charges for some methods.

Platforms: Both offer MT4/MT5, but Exness adds its proprietary Terminal.

Exness vs. Local SEBI Brokers

Leverage: SEBI brokers cap at 1:50; Exness offers up to 1:2000.

Assets: Local brokers focus on INR pairs; Exness provides global markets.

Costs: Exness’s spreads are lower than most SEBI-regulated platforms.

Exness shines for its cost-efficiency and flexibility, making it a strong contender for Indian traders seeking international exposure.

Who Should Use Exness in 2025?

Beginners

Why: Low minimum deposit ($10), Standard Cent account, and demo accounts for practice.

Caution: High leverage requires careful risk management.

Experienced Traders

Why: Pro, Raw Spread, and Zero accounts with tight spreads and fast execution.

Benefit: Ideal for scalping and high-volume trading.

Crypto Enthusiasts

Why: Access to popular cryptocurrencies with competitive spreads.

Advantage: Instant crypto withdrawals.

If you value low costs, fast withdrawals, and global market access, Exness is a compelling choice. However, if SEBI regulation is non-negotiable, you might prefer a local broker.

Tips for Using Exness in India in 2025

Start with a Demo Account: Practice risk-free before going live.

Leverage Wisely: High leverage can amplify both gains and losses.

Verify Your Account Early: KYC compliance ensures smooth withdrawals.

Use INR Payments: Avoid conversion fees with UPI or Net Banking.

Stay Informed: Monitor RBI/SEBI updates on forex trading rules.

Conclusion: Is Exness the Right Broker for You in 2025?

After exploring Exness from every angle, it’s clear why it’s a favorite among Indian traders. Its low trading costs, instant withdrawals, high leverage, and user-friendly platforms make it a standout choice in 2025. The broker’s global regulation and focus on security further enhance its appeal, even without SEBI oversight.

However, it’s not perfect. The lack of local regulation and limited educational resources might deter some, especially beginners or those prioritizing compliance with Indian laws. Ultimately, whether Exness is right for you depends on your trading goals, risk tolerance, and preference for international vs. local brokers.

For Indian traders seeking a reliable, cost-effective platform with global reach, Exness is hard to beat. Ready to give it a try? Sign up for a demo account today and see if it’s the perfect fit for your 2025 trading journey.

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: