10 minute read

Is Exness Illegal in India? A Comprehensive Guide for Traders

Forex trading has surged in popularity across India in recent years, with countless individuals seeking financial opportunities in the global currency markets. Among the plethora of trading platforms available, Exness stands out as a globally recognized forex broker, celebrated for its competitive spreads, high leverage, and user-friendly interface. However, a pressing question looms large for Indian traders: Is Exness illegal in India? The answer isn’t a simple yes or no—it’s nuanced, rooted in India’s complex regulatory landscape, and dependent on how traders use the platform. In this in-depth guide, we’ll explore Exness’s legal status in India, dissect the regulations governing forex trading, and provide actionable insights for Indian traders looking to navigate this space responsibly.

💥 Trade with Exness now: Open An Account or Visit Brokers

What Is Exness? An Overview of the Platform

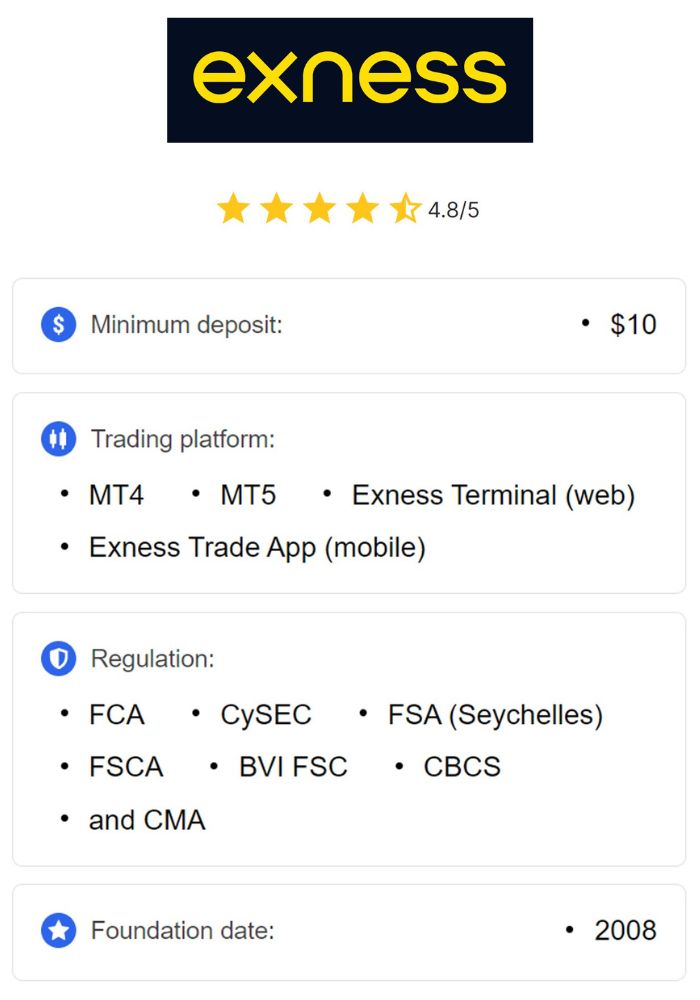

Before diving into the legality question, let’s establish what Exness is and why it’s gained traction among traders worldwide, including in India. Founded in 2008, Exness is a Cyprus-based multi-asset brokerage that has grown into a powerhouse in the forex and CFD (Contracts for Difference) trading industry. With operations spanning over 190 countries and a monthly trading volume exceeding $4 trillion, Exness caters to more than 700,000 active clients globally.

Exness offers a robust suite of trading tools and features:

Forex Trading: Access to a wide range of currency pairs, including major, minor, and exotic pairs.

CFD Trading: Opportunities to trade commodities (like gold and oil), indices, stocks, and cryptocurrencies.

Trading Platforms: Support for MetaTrader 4 (MT4) and MetaTrader 5 (MT5), industry-standard platforms known for their reliability and advanced features.

Low Spreads: Starting at 0.0 pips on premium accounts, reducing trading costs.

High Leverage: Up to 1:2000, allowing traders to amplify their positions with minimal capital.

Localized Support: 24/7 customer service in multiple languages, including Hindi, and payment options tailored for Indian users, such as UPI and bank cards.

For Indian traders, these features make Exness an attractive option. But legality isn’t determined by a broker’s offerings—it hinges on compliance with local laws. So, is Exness illegal in India? Let’s break it down.

Forex Trading in India: The Legal Framework

To determine whether Exness is illegal in India, we first need to understand the regulatory environment governing forex trading in the country. India has a stringent yet structured framework designed to protect its financial system and retail investors. The two primary authorities overseeing forex activities are:

Reserve Bank of India (RBI): The central bank regulates foreign exchange transactions under the Foreign Exchange Management Act (FEMA), 1999. The RBI ensures that forex trading aligns with India’s economic policies and prevents unauthorized capital outflows.

Securities and Exchange Board of India (SEBI): SEBI oversees securities markets, including forex trading on recognized Indian exchanges like the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE).

Under FEMA, forex trading is legal in India, but it comes with strict conditions:

INR-Based Currency Pairs Only: Indian residents can only trade currency pairs involving the Indian Rupee (INR), such as USD/INR, EUR/INR, GBP/INR, and JPY/INR. Trading non-INR pairs (e.g., EUR/USD or GBP/USD) is prohibited unless conducted through SEBI-regulated exchanges.

Authorized Platforms: Forex trading must occur through brokers or platforms registered with SEBI or approved by the RBI.

Payment Restrictions: Deposits and withdrawals must use RBI-approved methods, such as bank transfers, UPI, or debit/credit cards, ensuring transparency and compliance.

Tax Compliance: Profits from forex trading are taxable under Indian law, classified as either “Income from Business or Profession” or “Capital Gains,” depending on trading frequency.

These rules create a clear boundary: forex trading is legal when it adheres to RBI and SEBI guidelines. But where does Exness fit into this framework?

Is Exness Regulated in India?

Exness operates under a robust international regulatory framework, holding licenses from several reputable financial authorities:

Cyprus Securities and Exchange Commission (CySEC): License No. 178/12.

Financial Conduct Authority (FCA), UK: License No. 730729.

Financial Sector Conduct Authority (FSCA), South Africa: License No. 51024.

Seychelles Financial Services Authority (FSA): License No. SD025.

These licenses ensure that Exness adheres to global standards for transparency, client fund protection (via segregated accounts), and fair trading practices. However, Exness is not registered with SEBI or the RBI, meaning it lacks direct regulatory oversight from Indian authorities.

Does this make Exness illegal in India? Not necessarily. The absence of SEBI or RBI regulation doesn’t equate to an outright ban. Instead, it places Exness in a gray area: it’s an offshore broker accessible to Indian traders, but its legality depends on how it’s used. If Indian traders use Exness to trade INR-based pairs and comply with FEMA guidelines, they can operate within the law. Trading non-INR pairs, however, could violate Indian regulations, regardless of the broker’s international legitimacy.

Is Exness Illegal in India? The Definitive Answer

So, is Exness illegal in India? Here’s the definitive answer:

Exness itself is not illegal: The platform isn’t explicitly banned by Indian authorities, and it operates legally under its international licenses. Indian traders can open accounts with Exness and use its services without violating any laws—provided they follow FEMA restrictions.

Illegal usage is possible: If traders use Exness to trade non-INR currency pairs (e.g., EUR/USD), they breach FEMA regulations, making their actions illegal, not the platform itself.

Compliance is key: Trading INR-based pairs (e.g., USD/INR) through Exness, using approved payment methods, and reporting profits for tax purposes keeps activities legal.

In short, Exness is legal in India when used responsibly within the boundaries of local laws. The platform’s lack of SEBI registration doesn’t render it illegal—it simply means Indian traders must exercise caution and diligence to stay compliant.

💥 Trade with Exness now: Open An Account or Visit Brokers

Why the Confusion Around Exness’s Legality?

The question “Is Exness illegal in India?” persists due to widespread misconceptions and regulatory complexities. Let’s address some common sources of confusion:

Offshore Broker Status: Many Indian traders assume that any broker not regulated by SEBI is illegal. While SEBI oversight offers additional protection, offshore brokers like Exness aren’t inherently unlawful.

Non-INR Pair Trading: Exness offers a vast array of currency pairs, including non-INR options like EUR/USD. Traders unfamiliar with FEMA may unknowingly violate regulations by trading these pairs, fueling the perception that Exness itself is illegal.

SEBI Warnings: In 2019, SEBI issued warnings against unregulated forex brokers operating in India, including mentions of platforms like Exness. However, these warnings targeted unauthorized activities, not the brokers’ existence.

Lack of Awareness: Forex trading is relatively new to many Indians, and the nuances of FEMA compliance aren’t widely understood, leading to uncertainty about platforms like Exness.

By clarifying these points, we can see that Exness’s legality hinges on trader behavior, not the platform’s operations.

Benefits of Trading with Exness for Indian Traders

Assuming traders stay compliant, Exness offers compelling advantages for Indian users:

Cost Efficiency: With spreads starting at 0.0 pips on certain accounts, Exness minimizes trading costs, a boon for budget-conscious traders.

High Leverage: Leverage up to 1:2000 allows small capital to control large positions, amplifying potential profits (though it also increases risk).

User-Friendly Platforms: MT4 and MT5 provide advanced charting, automation, and mobile trading, catering to both novices and experts.

Localized Features: Support for Hindi, UPI payments, and fast withdrawals make Exness accessible and convenient for Indian users.

Global Reach: Access to diverse markets beyond forex, including commodities and cryptocurrencies, broadens trading opportunities.

These benefits explain why Exness remains popular in India, despite its unregulated status locally.

Risks of Trading with Exness in India

While Exness offers advantages, there are risks to consider:

Regulatory Risk: Without SEBI oversight, Indian traders lack local recourse in disputes, relying instead on international regulators.

Legal Risk: Trading non-INR pairs could lead to penalties or legal action under FEMA.

Market Volatility: Forex trading is inherently volatile, and high leverage can magnify losses, especially for inexperienced traders.

Technical Issues: Though rare, platform outages or connectivity problems could disrupt trading, a risk with any online broker.

To mitigate these risks, traders must prioritize education, compliance, and risk management strategies.

How to Trade Legally with Exness in India

For Indian traders keen on using Exness, here’s a step-by-step guide to staying legal:

Open an Account: Sign up on the Exness website, providing accurate personal details and completing KYC verification.

Fund Your Account: Use RBI-approved methods like UPI, bank transfers, or debit/credit cards to deposit funds.

Trade INR Pairs: Focus exclusively on INR-based pairs (e.g., USD/INR, EUR/INR) to comply with FEMA.

Monitor Tax Obligations: Keep records of trades and profits, reporting them as taxable income to the Income Tax Department.

Withdraw Funds: Repatriate earnings to an Indian bank account via approved channels.

By following these steps, traders can leverage Exness’s features while adhering to Indian laws.

Exness vs. SEBI-Regulated Brokers: A Comparison

How does Exness stack up against SEBI-regulated brokers? Here’s a breakdown:

Regulation: SEBI brokers are locally licensed, offering greater legal protection; Exness relies on international oversight.

Currency Pairs: SEBI brokers restrict trading to INR pairs; Exness offers a broader range, tempting some to trade illegally.

Costs: Exness typically has lower spreads and fees than many SEBI brokers.

Leverage: Exness’s 1:2000 leverage far exceeds the conservative limits of SEBI-regulated platforms.

Flexibility: Exness provides more account types and global market access.

For compliance-focused traders, SEBI brokers may be safer. For those seeking flexibility and cost savings—and willing to stay within INR pair limits—Exness is a viable option.

User Experiences: What Indian Traders Say About Exness

Indian traders’ feedback on Exness is mixed but insightful:

Positive: Many praise the platform’s fast execution, low spreads, and ease of withdrawals. “I’ve used Exness for two years, sticking to USD/INR, and never had issues,” says one trader on a forex forum.

Negative: Some report concerns about the lack of SEBI regulation. “I worry about fund safety if something goes wrong,” notes another user.

Neutral: Others acknowledge the legal gray area but continue trading responsibly. “It’s fine if you know the rules,” a trader comments.

These experiences highlight the importance of informed decision-making when using Exness in India.

Expert Opinions on Exness’s Legality

Financial experts offer balanced perspectives:

Pro-Exness: “Exness is a legitimate broker globally. Indian traders can use it legally by sticking to INR pairs,” says a forex analyst.

Cautionary: “Without SEBI oversight, there’s a risk gap. Traders must self-regulate to avoid trouble,” warns a regulatory consultant.

Practical: “It’s not illegal, but it’s not foolproof. Education and compliance are non-negotiable,” advises a trading coach.

The consensus? Exness isn’t illegal, but it demands vigilance from Indian users.

Common Myths About Exness in India

Let’s debunk some myths:

Myth: “Exness is banned in India.”Truth: No explicit ban exists; it’s about how you trade.

Myth: “All forex trading is illegal in India.”Truth: INR-pair trading is fully legal on authorized platforms.

Myth: “Profits from Exness aren’t taxable.”Truth: All forex earnings must be reported and taxed.

Clearing up these misconceptions helps traders approach Exness with confidence and clarity.

The Future of Exness in India

Exness remains a popular choice for Indian traders, but its future could shift. If India tightens forex regulations or Exness seeks SEBI registration, the landscape might change. For now, its legality rests on traders’ adherence to existing rules. Staying informed about regulatory updates is crucial for anyone using Exness or similar platforms.

Conclusion: Is Exness Illegal in India?

So, is Exness illegal in India? No—it’s a legitimate, globally regulated broker that Indian traders can use legally by trading INR-based pairs, using approved payment methods, and fulfilling tax obligations. The platform’s lack of SEBI registration places responsibility on traders to ensure compliance with FEMA, but it doesn’t render Exness unlawful.

For Indian forex enthusiasts, Exness offers a gateway to global markets with competitive features. However, legality and safety demand diligence. Whether you’re a beginner or a seasoned trader, prioritize education, stick to INR pairs, and trade responsibly. By doing so, you can harness Exness’s potential without crossing legal lines.

Ready to explore forex trading with Exness? Start with a demo account, research the rules, and trade smart. The opportunity is yours—legally and profitably.

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: