10 minute read

Is Exness Banned by RBI in India? Review Broker

The world of forex trading has exploded in popularity over the past decade, and India is no exception. With millions of traders seeking platforms to speculate on currency movements, international brokers like Exness have caught the attention of Indian users. However, a persistent question lingers: Is Exness banned by the Reserve Bank of India (RBI) in India? This topic remains a hotbed of curiosity, confusion, and debate among traders. In this in-depth guide, we’ll explore the legal status of Exness in India, dissect the RBI’s stance on forex trading, and provide clarity for Indian traders looking to navigate this complex landscape.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

If you’re an Indian trader considering Exness—or already using it—this article will arm you with the knowledge you need to trade confidently and legally. From regulatory frameworks to practical tips, let’s dive into the truth behind Exness and its relationship with the RBI.

What Is Exness? A Quick Overview

Before tackling the question of whether Exness is banned in India, it’s worth understanding what Exness is and why it’s so popular. Founded in 2008, Exness is a globally recognized online brokerage firm specializing in forex trading, contracts for difference (CFDs), commodities, indices, and cryptocurrencies. Headquartered in Cyprus, the broker has grown exponentially, serving millions of clients across 180+ countries, including India.

Exness stands out for several reasons:

Competitive Spreads: Low trading costs make it attractive for cost-conscious traders.

High Leverage: Options up to 1:2000 amplify potential profits (and risks).

User-Friendly Platforms: It supports MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary app.

Instant Withdrawals: Fast processing, including local payment methods like UPI and Netbanking in India.

Global Regulation: Licensed by reputable bodies like the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC).

For Indian traders, Exness offers a blend of accessibility and advanced features, making it a go-to choice. But does its global reputation align with India’s strict financial regulations? That’s where the RBI comes into play.

The Role of the RBI in Forex Trading

To determine whether Exness is banned by the RBI, we first need to understand the Reserve Bank of India’s role in regulating forex trading. The RBI is India’s central bank, tasked with maintaining financial stability, controlling monetary policy, and overseeing foreign exchange transactions. Forex trading falls under its purview because it involves the exchange of currencies—an activity that can impact India’s foreign reserves and economic health.

The RBI operates under the Foreign Exchange Management Act (FEMA), 1999, a legal framework designed to regulate foreign exchange activities in India. FEMA outlines strict rules for forex trading, including:

Permitted Currency Pairs: Indian residents can only trade currency pairs involving the Indian Rupee (INR), such as USD/INR, EUR/INR, GBP/INR, and JPY/INR.

Authorized Platforms: Forex trading must occur through RBI-approved entities, such as recognized stock exchanges (e.g., NSE, BSE) or authorized dealers.

Restrictions on Offshore Brokers: Trading with international brokers not regulated by Indian authorities falls into a regulatory grey area.

The RBI’s primary goal is to prevent illegal capital outflows, protect traders from fraud, and maintain economic stability. To enforce these rules, the RBI periodically updates its Alert List, which identifies unauthorized entities and platforms involved in forex trading. So, where does Exness fit into this framework?

Is Exness Banned by the RBI? The Straight Answer

Exness is not explicitly banned by the RBI in India. It does not appear on the RBI’s Alert List of unauthorized forex trading platforms, which currently includes entities like OctaFX, Alpari, and AnyFX. However, this doesn’t mean Exness operates with full legal clarity in India. The situation is nuanced, and here’s why:

Lack of Local Regulation: Exness is not regulated by the RBI or the Securities and Exchange Board of India (SEBI), India’s primary securities regulator. Instead, it operates under international licenses from bodies like the FCA, CySEC, and the Financial Services Authority (FSA) in Seychelles. While these credentials enhance its global credibility, they don’t automatically make it compliant with Indian laws.

FEMA Compliance: Indian traders can legally use Exness, but only if they adhere to FEMA guidelines. This means restricting trades to INR-based currency pairs and using RBI-approved payment methods for deposits and withdrawals. Trading non-INR pairs (e.g., EUR/USD, GBP/USD) on Exness could violate FEMA, putting traders at risk of legal repercussions.

No Outright Ban: The RBI has not issued a specific directive banning Exness or prohibiting Indian residents from using it. However, the central bank has cautioned against engaging with unauthorized platforms, emphasizing that traders do so at their own risk.

In short, Exness isn’t banned, but its use in India exists in a regulatory grey area. Indian traders can access the platform, but compliance with local laws is their responsibility. Let’s break this down further.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Why the Confusion Around Exness and the RBI?

The uncertainty about Exness’s status stems from several factors:

1. Strict Forex Regulations in India

Unlike countries with liberal forex markets (e.g., the US or UK), India imposes tight controls. The RBI restricts trading to INR pairs to prevent capital flight and speculative losses. International brokers like Exness, which offer a wide range of non-INR pairs, don’t fit neatly into this framework.

2. RBI’s Crackdown on Unauthorized Platforms

In recent years, the RBI has intensified efforts to combat illegal forex trading. In 2023, it added 75 entities to its Alert List, targeting platforms promoting unauthorized transactions. While Exness hasn’t been named, the crackdown has fueled speculation about all offshore brokers.

3. Misinformation Online

Social media and forums often spread conflicting narratives. Some traders claim Exness is “banned” based on hearsay, while others argue it’s fully legal. This lack of clarity amplifies confusion.

4. Payment Method Challenges

Indian banks, under RBI oversight, occasionally flag transactions with offshore brokers, leading to delays or rejections. Traders misinterpret these hiccups as evidence of a ban.

To cut through the noise, let’s examine Exness’s operations in India and how they align with RBI policies.

How Exness Operates in India

Exness has tailored its services to appeal to Indian traders while navigating the country’s regulatory landscape:

INR Support: It offers INR-based currency pairs like USD/INR, aligning with FEMA requirements.

Local Payment Options: Traders can deposit and withdraw funds via UPI, Netbanking, and Indian bank accounts—methods compliant with RBI guidelines.

Accessibility: The platform is fully accessible online, with no geo-restrictions for Indian users.

Customer Support: Exness provides 24/7 support in English and other languages, addressing queries specific to India.

However, Exness also offers non-INR pairs (e.g., EUR/USD), which are popular globally but restricted for Indian residents. The broker doesn’t explicitly prohibit Indian users from trading these pairs, leaving compliance up to the individual trader. This flexibility is both a strength and a potential pitfall.

The Legal Risks of Using Exness in India

While Exness isn’t banned, using it carries risks if traders stray from RBI guidelines:

Trading Non-INR Pairs: Engaging in EUR/USD or GBP/USD trades violates FEMA, potentially leading to penalties or account freezes.

Lack of Local Oversight: Since Exness isn’t SEBI- or RBI-regulated, Indian traders have limited recourse in disputes.

Banking Issues: Some Indian banks may block transactions with offshore brokers, complicating deposits and withdrawals.

Tax Implications: Profits from forex trading must be reported to the Income Tax Department. Non-compliance could trigger audits or fines.

To stay safe, traders should:

Stick to INR-based pairs.

Use transparent, RBI-approved payment channels.

Consult a financial advisor to ensure tax compliance.

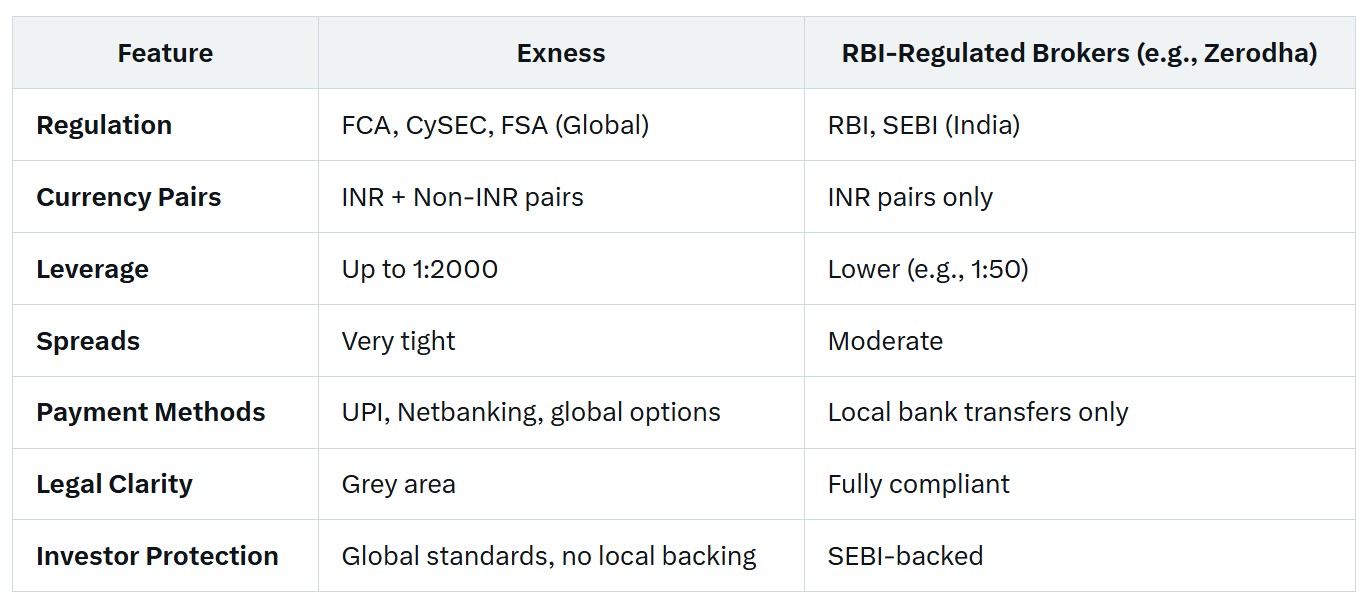

Exness vs. RBI-Regulated Brokers: A Comparison

How does Exness stack up against brokers regulated by the RBI or SEBI? Let’s compare:

What Indian Traders Say About Exness

To get a real-world perspective, let’s look at feedback from Indian traders using Exness in 2025:

Positive Experiences: Many praise its low spreads, fast withdrawals (often within 24 hours), and intuitive platform. “I’ve been trading USD/INR on Exness for two years—no issues so far,” says Ravi, a Mumbai-based trader.

Challenges: Some report delays in bank transfers due to RBI scrutiny. “My withdrawal got stuck for a week because my bank flagged it,” notes Priya from Delhi.

Regulatory Concerns: A few traders worry about the lack of SEBI oversight. “It’s great, but I’m always paranoid about FEMA violations,” admits Arjun from Bangalore.

Overall, Exness enjoys a solid reputation among Indian users, provided they stay within legal boundaries.

How to Trade Legally with Exness in India

If you’re set on using Exness, here’s how to do it safely and legally:

Open an Account: Sign up on the Exness website, complete verification, and fund your account with INR via UPI or Netbanking.

Stick to INR Pairs: Focus on USD/INR, EUR/INR, etc., to comply with FEMA.

Monitor RBI Updates: Check the RBI’s Alert List and advisories regularly.

Keep Records: Document all trades and transactions for tax purposes.

Start Small: Use a demo account to test the platform before committing real funds.

By following these steps, you can leverage Exness’s features while minimizing legal risks.

The Future of Exness in India

Looking ahead, will Exness face an RBI ban? It’s unlikely unless the broker explicitly violates Indian laws or appears on the Alert List. However, several scenarios could shape its future:

Tighter Regulations: The RBI may impose stricter rules on offshore brokers, forcing Exness to adapt or exit the market.

Local Partnership: Exness could seek SEBI registration or partner with an Indian broker to gain legitimacy.

Trader Education: As Indian traders become savvier about FEMA, demand for compliant platforms may rise.

For now, Exness remains a viable option, but its long-term status hinges on regulatory shifts.

FAQs: Clearing Up Common Questions

1. Is Exness on the RBI Alert List?

No, Exness is not listed. The Alert List targets explicitly unauthorized platforms, and Exness’s global regulation keeps it off this radar—for now.

2. Can I Trade Non-INR Pairs on Exness?

Technically, yes, but it’s illegal for Indian residents under FEMA. Stick to INR pairs to stay compliant.

3. Are My Funds Safe with Exness?

Yes, Exness segregates client funds and adheres to strict global standards. However, without SEBI oversight, local protections are limited.

4. What Happens If the RBI Bans Exness?

If banned, Indian traders might lose access, and funds could be frozen. This is speculative, as no ban exists currently.

Conclusion: Is Exness Worth It for Indian Traders?

So, is Exness banned by the RBI in India? The answer is no—not. It operates legally for Indian traders who stick to INR-based pairs and follow FEMA guidelines. While its lack of local regulation creates a grey area, Exness’s global credibility, competitive features, and accessibility make it a compelling choice.

That said, caution is key. Forex trading carries inherent risks—market volatility, leverage losses, and, in India, legal uncertainties. If you value flexibility and low costs over local oversight, Exness is worth exploring. But if legal clarity is your priority, RBI-regulated brokers might be a safer bet.

Ultimately, the decision is yours. Stay informed, trade responsibly, and consult a financial expert if in doubt. Have you used Exness in India? Share your experience in the comments—I’d love to hear your take!

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: