12 minute read

Is Exness Registered in UAE? Review Broker 2025

Exness is one of the most prominent names in the forex trading world, attracting traders from all over the globe due to its competitive offerings and user-friendly platform. As the forex industry grows in popularity, the importance of understanding the regulatory environment in which brokers operate becomes even more critical for traders. This article will explore whether Exness is registered in the UAE, a crucial question for traders considering whether to choose this platform for their trading needs in the region.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Introduction to Exness

Overview of Exness as a Forex Broker

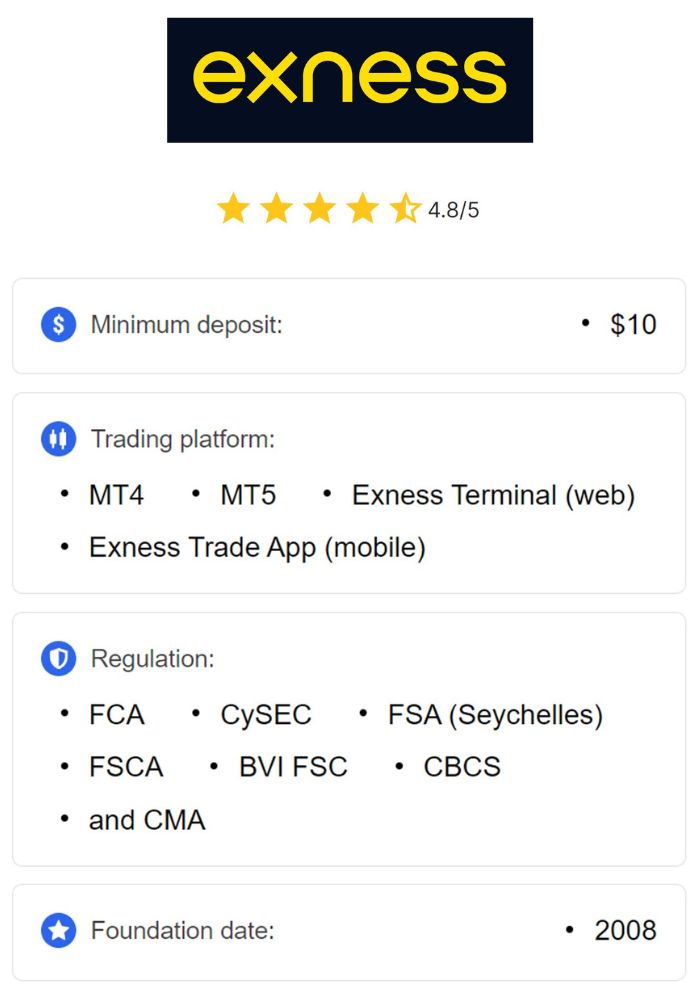

Exness, established in 2008, is a global forex and CFD broker known for its robust trading platform and wide range of financial instruments. It offers services across various markets, including forex, stocks, indices, and commodities. Exness's user-friendly interface and advanced trading tools make it a preferred choice for traders at all levels. The broker is well-regarded for its transparency, competitive spreads, and excellent customer support.

With a focus on both retail and institutional clients, Exness offers a variety of account types designed to suit different trading styles. These accounts provide different leverage options and conditions, ensuring flexibility for traders. The broker’s technological infrastructure supports both novice and advanced traders, providing a solid foundation for success in the forex market.

Services Offered by Exness

Exness provides a wide range of trading services, including forex trading, CFDs on stocks, commodities, and cryptocurrencies. It offers both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, two of the most popular tools among traders globally. Exness allows traders to access real-time market data, advanced charting tools, and automated trading systems, making it easier for traders to implement various strategies.

The broker offers several account types, including Standard, Pro, and Zero accounts, each tailored to specific needs. Traders can choose based on their trading volume, preferences for leverage, and cost structures. With its global presence and multilingual support, Exness caters to traders worldwide, ensuring a reliable and accessible trading environment.

Regulatory Framework for Forex Brokers in UAE

Authorities Governing Forex Trading in UAE

Forex trading in the UAE is regulated by several key authorities, with the UAE Central Bank (CBUAE) and the Securities and Commodities Authority (SCA) playing central roles. The CBUAE ensures overall financial stability and oversees banking activities, while the SCA specifically handles the regulation of financial markets, including forex trading. The Dubai Financial Services Authority (DFSA) regulates brokers operating within the Dubai International Financial Centre (DIFC), ensuring a distinct legal framework.

These regulatory bodies are responsible for overseeing financial practices and ensuring that brokers comply with the country’s laws. They enforce transparency, fair trading practices, and the protection of traders’ funds. For traders in the UAE, dealing with a regulated broker ensures they are protected under local laws, which helps foster confidence in the financial system.

Importance of Regulation for Traders

Regulation is essential for traders as it ensures that brokers are held to high standards of transparency and financial responsibility. A regulated broker must adhere to strict guidelines, including maintaining capital adequacy and implementing risk management practices. This gives traders peace of mind that their investments are safe and that brokers are financially stable.

Moreover, trading with a regulated broker provides a layer of legal protection. If traders experience issues such as fraud or disputes, they can seek help from regulatory authorities. This ensures that brokers are held accountable for their actions, creating a safer environment for traders.

Exness's Global Presence

Countries Where Exness Operates

Exness operates in numerous countries worldwide, including Europe, Asia, and the Middle East, with a significant presence in many regions. The broker is licensed in various jurisdictions, including Cyprus, the UK, and South Africa. These licenses allow Exness to serve clients across different markets, offering its services globally while complying with local regulatory standards.

Despite its global reach, Exness's operations in certain regions, such as the UAE, are somewhat limited due to local regulations. Traders in countries where Exness is not directly regulated may be subject to different protections and legal conditions. Understanding these nuances is crucial for traders considering whether to engage with the broker in specific regions.

Regulatory Bodies Involved with Exness

Exness is regulated by multiple international financial authorities, ensuring that it adheres to strict operational standards. Key regulators include the Cyprus Securities and Exchange Commission (CySEC), the UK’s Financial Conduct Authority (FCA), and the South African Financial Sector Conduct Authority (FSCA). These regulatory bodies help ensure that Exness operates with the highest standards of transparency, security, and financial stability.

While Exness holds several licenses across different regions, it is not regulated by UAE authorities. This means that traders in the UAE may not receive the same level of local legal protection as those in other jurisdictions where Exness is licensed. Therefore, UAE traders must be aware of the potential risks involved when trading with Exness.

Exness Registration in UAE

Current Status of Exness Registration

Exness is not currently registered or licensed by UAE authorities, such as the UAE Central Bank or the SCA. While it operates globally, including in many regions with strict regulatory oversight, it does not have an official license to operate in the UAE. This means that UAE-based traders using Exness are technically dealing with an unlicensed offshore entity.

Despite this, Exness still provides its services to traders in the UAE, allowing them to open accounts and trade. However, without local regulatory oversight, traders in the UAE may not have access to the same protections and recourse options that would be available if they traded with a broker licensed by local authorities.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

License Requirements for Forex Brokers in UAE

For forex brokers to be fully licensed in the UAE, they must meet strict requirements set by local regulatory bodies, such as the SCA and the CBUAE. These requirements include maintaining a minimum level of capital, ensuring transparency in financial reporting, and implementing strong risk management practices. Brokers must also adhere to local laws regarding anti-money laundering (AML) and know your customer (KYC) regulations.

The licensing process ensures that brokers operating in the UAE are financially sound and follow ethical practices. This level of regulation provides traders with additional security and peace of mind, knowing that their funds are protected under UAE law. Without such a license, brokers are not required to meet these stringent standards, which can expose traders to additional risks.

Benefits of Trading with a Registered Broker

Enhanced Security for Traders

When trading with a regulated broker, traders benefit from increased security for their funds. Regulated brokers are required to follow strict financial standards, including holding clients' funds in segregated accounts to protect them in case of insolvency. This ensures that traders’ funds are separate from the broker’s operating capital, minimizing the risk of loss due to the broker’s financial issues.

Additionally, regulated brokers are subject to regular audits, which helps maintain transparency and accountability. This transparency builds trust between the broker and its clients, ensuring that the broker operates fairly and responsibly. Traders can have more confidence in the safety of their investments when dealing with a licensed broker.

Legal Protections and Compliance

Regulated brokers are also required to comply with local laws and regulations that protect traders. For example, regulatory authorities can step in to mediate disputes between traders and brokers, offering a level of protection that unregulated brokers may not provide. If a trader faces issues such as withdrawal problems or unfair practices, they can report the broker to the regulatory authority, which will investigate the matter.

Additionally, regulation helps ensure that brokers operate with ethical standards. They are required to provide accurate information about their products, fees, and services, and to adhere to best practices in handling clients’ funds. This level of oversight helps prevent fraudulent activities, protecting traders from unscrupulous behavior.

Potential Risks of Unregulated Trading

Understanding Financial Risks

Trading with an unregulated broker poses significant financial risks. These brokers are not required to adhere to local regulatory standards, which means they may lack the financial stability to protect clients' funds. In the worst case, unregulated brokers can engage in unethical practices, such as delaying withdrawals or even disappearing with traders' funds.

Moreover, unregulated brokers are not subject to regular audits or financial oversight, which increases the likelihood of fraud or insolvency. Traders who choose to trade with an unregulated broker may find themselves with limited recourse if something goes wrong, making it harder to recover their funds or seek legal remedies.

Consequences of Trading with Unverified Brokers

The consequences of trading with an unverified broker can be severe, ranging from financial losses to legal challenges. Without the protection of regulatory authorities, traders are left vulnerable to unfair practices, such as market manipulation, hidden fees, or sudden changes in trading conditions. In many cases, traders may find it difficult to withdraw funds or resolve disputes with the broker.

Trading with an unregulated broker also means there are no guarantees that the broker will meet financial obligations. In the event of the broker’s insolvency, traders may not be able to recover their funds. This makes it crucial for traders to carefully assess the risks before deciding to engage with an unregulated broker.

Comparison of Exness with Other Brokers in UAE

Similarities with Competitors

Exness shares several similarities with other global brokers operating in the UAE. Like many competitors, Exness offers a variety of account types, low spreads, and a wide range of financial instruments. The broker also provides access to popular trading platforms like MT4 and MT5, which are favored by traders worldwide for their advanced tools and ease of use.

In addition, Exness offers competitive leverage and flexible trading conditions, which are common features among forex brokers. These similarities make Exness an attractive option for traders looking for a comprehensive trading solution. However, the lack of local regulation in the UAE sets it apart from some competitors who are fully licensed by UAE authorities.

Key Differences in Regulation

The key difference between Exness and some of its competitors in the UAE lies in its regulatory status. While other brokers in the region may be fully licensed by the SCA or the CBUAE, Exness operates without a UAE license. This lack of local regulation means that traders in the UAE may not have access to the same legal protections and dispute resolution options that they would with a licensed broker.

Competitors who are licensed by UAE regulators are subject to stricter oversight, ensuring that they follow local laws and safeguard traders' interests. In contrast, Exness, despite being regulated in other regions, does not offer the same level of local protection for UAE traders. As a result, traders must carefully consider the risks involved when trading with an unregulated broker.

User Experience with Exness in UAE

Customer Feedback and Reviews

Traders in the UAE have varied experiences with Exness. Many appreciate the broker's user-friendly platform, fast trade execution, and competitive spreads. Exness has earned positive reviews for its comprehensive customer support, offering assistance in multiple languages and providing resources to help traders improve their skills.

However, some traders express concerns about the lack of local regulation, citing the potential risks of trading with an unlicensed broker. These traders often highlight the importance of legal protections and feel uneasy about the absence of local regulatory oversight. Overall, the feedback is mixed, with many traders weighing the benefits of Exness's offerings against the risks of its unregulated status in the UAE.

Support Services Available for UAE Clients

Exness provides excellent customer support to its UAE clients, with 24/7 assistance available via live chat, email, and phone. The broker’s support team is responsive and capable of handling a wide range of issues, from technical questions to account management inquiries. This level of support is one of the key reasons why Exness is popular among traders in the UAE.

Additionally, Exness offers educational materials and resources, including webinars and tutorials, to help traders improve their trading skills. This support is particularly useful for novice traders, providing them with the knowledge they need to make informed decisions. Despite concerns about regulation, Exness's customer support is a strong point that adds to the overall positive user experience.

Trading Conditions Offered by Exness

Account Types and Features

Exness offers several account types designed to meet the needs of different traders. These include Standard accounts, Pro accounts, and Zero accounts, each with varying conditions such as spreads, commissions, and leverage. The Standard accounts are ideal for beginners, offering low spreads and no commissions, while the Pro and Zero accounts cater to more experienced traders seeking tighter spreads and lower trading costs.

Each account type comes with its own set of features, allowing traders to choose the best option based on their trading volume and preferences. Additionally, Exness offers a demo account, allowing traders to practice without risking real money. This is an excellent way for traders to familiarize themselves with the platform before engaging in live trading.

Spreads, Leverage, and Commissions

Exness offers competitive spreads that can be as low as 0.0 pips, depending on the account type. The broker provides a high level of flexibility in terms of leverage, allowing traders to use leverage up to 1:2000, which can amplify potential profits (and losses). The broker’s commission structure varies by account type, with zero commissions on Standard accounts and low commissions on Pro and Zero accounts.

Traders can choose the leverage and account type that best suits their trading style, making Exness a versatile platform for various levels of traders. The ability to customize spreads, leverage, and commissions ensures that traders can optimize their trading costs and conditions, depending on their individual strategies.

Conclusion on Exness's Registration Status in UAE

While Exness offers a wide range of attractive features for forex traders in the UAE, it is not officially registered or licensed by local regulatory authorities. Traders in the UAE should carefully weigh the risks and benefits of trading with an unregulated broker. While Exness is regulated in other regions, such as Cyprus and the UK, it does not offer the same level of local protection for UAE traders.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

As such, it is recommended that UAE traders consider all available options, including brokers that are fully licensed and regulated by UAE authorities, to ensure they are trading in a secure and legally compliant environment.

Read more: