9 minute read

Exness App is Legal in Pakistan? A Comprehensive Guide for Traders

Forex trading has surged in popularity worldwide, and Pakistan is no exception. With an increasing number of individuals exploring financial markets, platforms like Exness have caught the attention of Pakistani traders. Known for its user-friendly interface, competitive spreads, and robust trading tools, the Exness app has become a go-to choice for many. However, a critical question remains: Exness App is Legal in Pakistan? This article dives deep into the legal landscape, regulatory framework, and practical considerations for Pakistani traders using the Exness app in 2025.

💥 Trade with Exness now: Open An Account or Visit Brokers

What Is the Exness App?

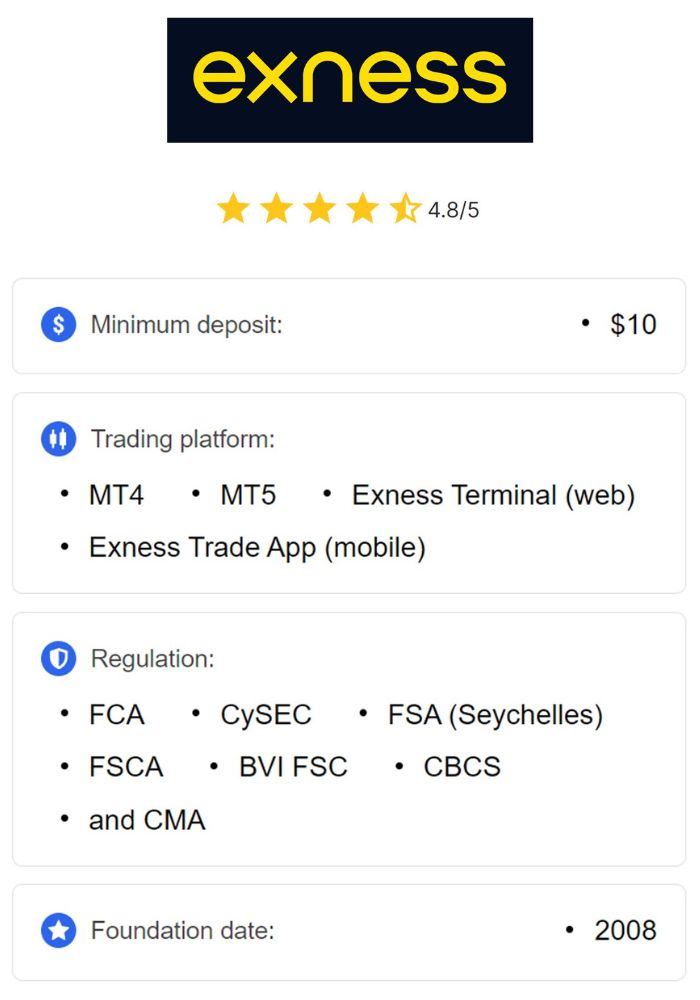

Before addressing its legality, let’s understand what the Exness app offers. Exness is a global forex and CFD (Contract for Difference) broker founded in 2008. It provides traders access to a wide range of financial instruments, including forex pairs, commodities, indices, stocks, and cryptocurrencies. The Exness app, available on Android and iOS, brings this trading experience to mobile devices, offering real-time market data, advanced charting tools, and seamless account management.

The app’s appeal lies in its simplicity and efficiency. Whether you’re a beginner testing the waters or an experienced trader executing complex strategies, the Exness app caters to all levels. Features like instant deposits, fast withdrawals, and high leverage options (up to 1:2000 in some cases) make it stand out. But legality is a crucial factor that determines whether Pakistani traders can safely use this platform.

Forex Trading in Pakistan: The Legal Landscape

To determine if the Exness app is legal in Pakistan, we must first explore the broader context of forex trading in the country. Forex trading involves speculating on currency price movements, and while it’s a global phenomenon, each country has its own regulatory framework.

Regulatory Bodies in Pakistan

In Pakistan, two key institutions oversee financial activities:

State Bank of Pakistan (SBP): The SBP regulates foreign exchange transactions, ensuring stability in the country’s financial system. It imposes rules on currency exchange, capital flows, and cross-border transactions.

Securities and Exchange Commission of Pakistan (SECP): The SECP is responsible for supervising financial markets, including forex trading, to protect investors and maintain transparency.

Forex trading itself is legal in Pakistan, but it comes with strict conditions. The SBP and SECP allow individuals to trade through brokers that comply with local regulations. However, the regulatory environment for online forex trading, especially with international brokers, remains somewhat ambiguous.

Key Regulations for Forex Trading

Authorized Brokers: Traders must use brokers licensed by the SBP or SECP. Unauthorized platforms may expose users to legal risks.

Currency Pair Restrictions: The SBP limits trading to specific currency pairs, typically those involving the Pakistani Rupee (PKR).

Taxation: Forex profits are subject to taxation under Pakistani law, and traders must report their earnings.

Capital Controls: The SBP monitors the movement of funds abroad, which can affect deposits and withdrawals with international brokers.

Given this framework, the legality of the Exness app hinges on its compliance with these rules and its regulatory status in Pakistan.

Is Exness Regulated in Pakistan?

Exness operates as an international broker with a strong global presence. It is regulated by several reputable financial authorities, including:

Cyprus Securities and Exchange Commission (CySEC): Ensures compliance with European Union standards.

Financial Conduct Authority (FCA): A top-tier regulator in the UK, known for stringent oversight.

Financial Services Authority (FSA) Seychelles: Regulates Exness’s global entity, under which Pakistani traders typically operate.

However, Exness does not hold a specific license from the SBP or SECP. This lack of local regulation raises questions about its legal status in Pakistan. While the broker adheres to international standards, it operates as an offshore entity for Pakistani users. This means that, technically, it isn’t explicitly approved by Pakistani authorities to offer services within the country.

Does This Mean Exness Is Illegal?

Not necessarily. The absence of a local license doesn’t automatically make the Exness app illegal. Forex trading with international brokers is a gray area in Pakistan. Many traders use offshore platforms like Exness without facing direct legal repercussions, as long as they comply with tax and capital control regulations. However, the lack of SECP oversight means there’s no local recourse in case of disputes, which introduces some risk.

Exness App is Legal in Pakistan?

There is no explicit ban on the Exness app in Pakistan. The SBP and SECP have not issued statements prohibiting its use, nor has Exness been flagged as an illegal platform by Pakistani authorities. This suggests that Pakistani traders can use the app, but they must navigate the regulatory gray area carefully.

Factors Supporting Legality

Global Regulation: Exness’s licenses from CySEC, FCA, and FSA provide a layer of credibility and security, even if they don’t apply directly to Pakistan.

No Restrictions: Pakistani laws don’t explicitly forbid citizens from using offshore brokers, provided they follow tax and foreign exchange rules.

User Experiences: Thousands of Pakistani traders actively use the Exness app without reported legal issues, indicating practical acceptance.

Potential Risks

Regulatory Uncertainty: The SECP could tighten regulations in the future, impacting offshore brokers like Exness.

Fund Safety: Without local oversight, resolving disputes or recovering funds may be challenging.

Compliance Issues: Traders must ensure they report earnings and adhere to SBP guidelines on international transactions.

In summary, the Exness app is not illegal in Pakistan as of now, but its legality exists in a nuanced space. Traders should proceed with caution and stay informed about regulatory updates.

💥 Trade with Exness now: Open An Account or Visit Brokers

Benefits of Using the Exness App in Pakistan

Despite the legal ambiguity, the Exness app offers compelling advantages that attract Pakistani traders.

1. Accessibility and Convenience

The app allows trading on the go, with a clean interface and intuitive design. Pakistani traders can monitor markets, execute trades, and manage funds from their smartphones, making it ideal for those with busy schedules.

2. Low Entry Barrier

Exness offers a minimum deposit as low as $1 for standard accounts, making it accessible to beginners. This is particularly appealing in Pakistan, where many traders start with limited capital.

3. Competitive Trading Conditions

Spreads: Exness provides tight spreads, starting from 0.0 pips on some accounts.

Leverage: High leverage options (up to 1:2000) amplify potential profits, though they also increase risk.

Execution Speed: The app boasts ultra-fast order execution, crucial for volatile forex markets.

4. Diverse Instruments

Traders can access over 200 instruments, including forex pairs (e.g., USD/PKR), commodities (gold, oil), and cryptocurrencies (Bitcoin, Ethereum). This variety allows portfolio diversification.

5. Local Payment Options

Exness supports deposit and withdrawal methods convenient for Pakistanis, such as local bank transfers, e-wallets (Skrill, Neteller), and cryptocurrencies. Processing is often instant and fee-free, enhancing user experience.

6. Educational Resources

The app provides tutorials, webinars, and market analysis, helping Pakistani traders improve their skills and make informed decisions.

Risks of Using the Exness App in Pakistan

While the benefits are enticing, there are risks to consider.

1. Legal Uncertainty

The lack of SECP regulation means traders operate without local protection. If Exness faces restrictions or a ban in the future, users could encounter issues.

2. Market Volatility

Forex trading is inherently risky due to rapid price fluctuations. High leverage, while profitable, can lead to significant losses if not managed properly.

3. Technical Challenges

Like any online platform, the Exness app may experience downtime or glitches, potentially disrupting trades during critical moments.

4. Taxation and Reporting

Pakistani traders must manually report forex profits to tax authorities, as Exness doesn’t integrate with local systems. Non-compliance could result in penalties.

How to Use the Exness App Safely in Pakistan

To mitigate risks and ensure a smooth experience, follow these steps:

1. Verify Your Account

Complete the Know Your Customer (KYC) process by submitting identification (e.g., passport, national ID) and proof of address (e.g., utility bill). This enhances account security and complies with Exness’s policies.

2. Understand Local Laws

Familiarize yourself with SBP and SECP guidelines. Focus on PKR-based pairs if possible, and consult a financial advisor about tax obligations.

3. Start Small

Begin with a small deposit and low leverage to test the platform. Gradually increase your investment as you gain confidence.

4. Use Risk Management Tools

Leverage Exness’s features like stop-loss orders and negative balance protection to safeguard your funds.

5. Monitor Regulatory Updates

Stay updated on forex regulations in Pakistan via SBP and SECP announcements. This ensures you adapt to any changes affecting Exness.

User Feedback from Pakistani Traders

What do Pakistani traders think of the Exness app? Online forums and reviews reveal a generally positive sentiment:

Pros: Traders praise the app’s ease of use, fast withdrawals, and educational resources.

Cons: Some express concerns about the lack of local regulation and occasional delays with local payment methods.

For example, a trader on Reddit noted, “Exness works fine in Pakistan, but I wish it had SECP approval for peace of mind.” Another user on Medium highlighted, “The low spreads and high leverage are unbeatable, but you need to be careful with risk.”

Alternatives to the Exness App in Pakistan

If the legal ambiguity of Exness concerns you, consider these regulated alternatives:

IC Markets: Known for low spreads and fast execution, it’s regulated by ASIC and CySEC.

FP Markets: Offers diverse instruments and competitive conditions, with strong regulatory backing.

XM: Popular in Pakistan, it provides local support and adheres to international standards.

Compare fees, platforms, and regulatory status to find the best fit for your needs.

Conclusion: Should You Use the Exness App in Pakistan?

So, is the Exness app legal in Pakistan? It operates in a legal gray area. While not banned or explicitly illegal, its lack of SECP regulation means traders assume some risk. However, its global licenses, robust features, and widespread use among Pakistanis suggest it’s a viable option for those willing to navigate the uncertainties.

For Pakistani traders, the decision boils down to risk tolerance and due diligence. If you prioritize convenience, low costs, and a feature-rich app, Exness is worth considering. But if local regulation is non-negotiable, explore licensed alternatives. Whatever you choose, stay informed, trade responsibly, and leverage the app’s tools to maximize your success in the forex market.

Ready to start? Download the Exness app, verify your account, and take your first step into forex trading—legally and confidently.

💥 Trade with Exness now: Open An Account or Visit Brokers

Read more: