9 minute read

Is Exness Valid in India? Review Broker 2025

Introduction to Exness

Overview of Exness as a Trading Platform

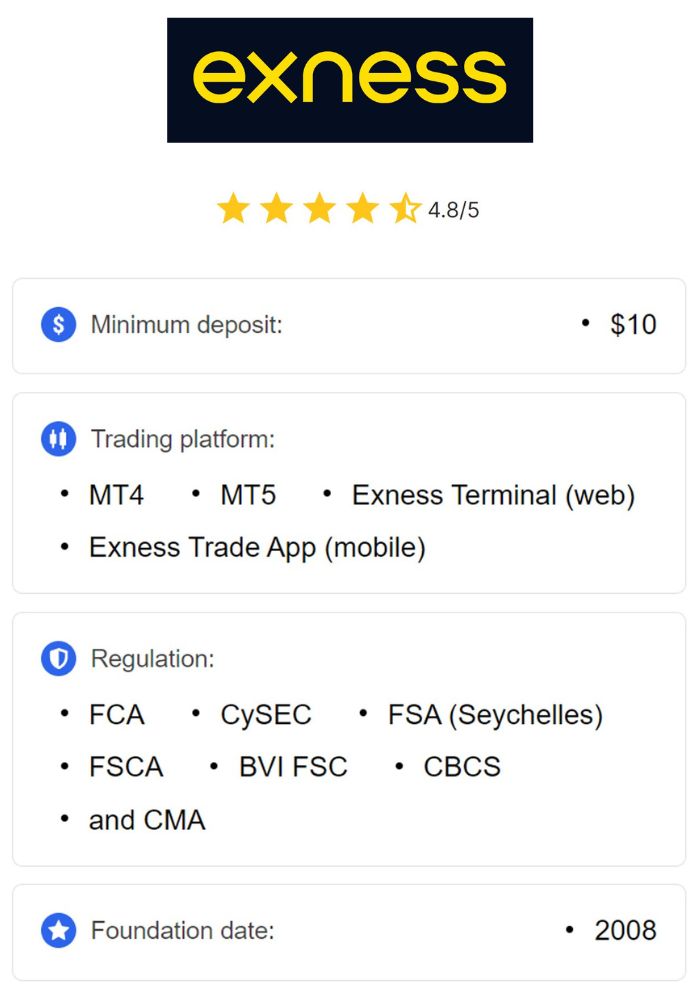

Exness is a globally recognized trading platform that has garnered immense popularity among traders worldwide. Established in 2008, the platform offers a wide array of trading services, including forex, CFDs, commodities, and cryptocurrencies. Known for its transparency, reliability, and advanced trading tools, Exness has positioned itself as a leading choice for both novice and professional traders.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

One of the standout features of Exness is its user-friendly interface, which caters to traders of all skill levels. With a variety of account types, competitive spreads, and leverage options, Exness provides a flexible trading environment that empowers users to achieve their financial goals.

History and Background of Exness

Since its inception in 2008, Exness has grown into a globally trusted brand in the trading community. Headquartered in Cyprus and supported by offices in key financial hubs, Exness serves millions of clients across the globe. The platform’s emphasis on transparency and security has been instrumental in its success, as evidenced by its strict compliance with international regulatory standards.

Exness has also made significant strides in technological innovation, offering cutting-edge tools and resources to enhance the trading experience. Its commitment to excellence is reflected in its continuously expanding user base and positive industry reputation.

Regulatory Framework for Forex Trading in India

Understanding SEBI Regulations

In India, the Securities and Exchange Board of India (SEBI) is the primary regulatory body overseeing the financial markets. SEBI enforces strict guidelines to ensure that forex trading and related activities are conducted within a secure and fair environment. Only currency pairs involving the Indian Rupee (INR) are permitted for trading under SEBI’s regulations.

These rules aim to protect traders from fraudulent activities and ensure that the Indian forex market operates within a controlled framework. Trading platforms operating in India must adhere to these regulations to remain compliant and trustworthy.

Role of RBI in Forex Trading

The Reserve Bank of India (RBI) plays a crucial role in regulating forex transactions in the country. It monitors cross-border forex trading to prevent illegal activities and capital flight. The Foreign Exchange Management Act (FEMA) governs these transactions, ensuring that Indian residents trade within the legal framework.

RBI’s guidelines primarily focus on authorized dealers and banks that facilitate forex transactions. Traders using international platforms like Exness must be aware of these regulations to avoid inadvertently breaching legal requirements.

Is Exness Regulated?

Global Regulatory Bodies Governing Exness

Exness operates under the oversight of multiple renowned regulatory bodies, including:

Cyprus Securities and Exchange Commission (CySEC)

Financial Conduct Authority (FCA) in the UK

Financial Services Authority (FSA) of Seychelles

These licenses ensure that Exness adheres to stringent financial and operational standards, providing traders with a secure and transparent trading environment. The broker’s compliance with top-tier regulators highlights its commitment to safeguarding client interests.

Comparison with Other Trading Platforms

Compared to other trading platforms available to Indian traders, Exness stands out for its competitive trading conditions, ease of use, and robust security measures. While some platforms focus solely on forex, Exness offers a diverse range of trading instruments, including CFDs and cryptocurrencies.

Exness’s transparency, evident in its regular publication of financial reports, further distinguishes it from competitors. Its blend of global regulatory compliance and user-centric features makes it a preferred choice for traders in India and beyond.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Accessibility of Exness in India

How Indian Traders Can Access Exness

Indian traders can easily access Exness by registering on its official website. The platform provides a straightforward onboarding process that includes account verification and access to demo accounts for practice. Exness’s website and trading platforms are optimized for accessibility, ensuring a seamless experience for users in India.

While Exness is not regulated by SEBI or RBI, Indian residents can still use the platform under its international regulatory licenses. However, traders must ensure that their activities align with local forex trading guidelines to avoid potential legal issues.

Payment Methods Available for Indian Users

Exness offers multiple payment methods tailored to Indian users, including:

Bank Transfers: Supports local banks for deposits and withdrawals.

Digital Wallets: Options like Skrill and Neteller for faster transactions.

Cryptocurrency Payments: Facilitates deposits and withdrawals in Bitcoin and other cryptocurrencies.

These options make it convenient for Indian traders to fund their accounts and withdraw earnings efficiently.

Account Types Offered by Exness

Overview of Different Account Types

Exness offers several account types to cater to traders with varying levels of expertise:

Standard Accounts: Ideal for beginners, with low minimum deposits and competitive spreads.

Professional Accounts: Tailored for experienced traders, offering raw spreads and commission-based pricing.

Demo Accounts: Allows traders to practice and familiarize themselves with the platform without risking real money.

Each account type is designed to meet specific trading needs, providing flexibility and control to users.

Benefits and Drawbacks of Each Account Type

Standard accounts are beginner-friendly, requiring minimal capital to start trading. However, they may lack the advanced features and tighter spreads found in professional accounts.

Professional accounts, on the other hand, are best suited for experienced traders who can handle higher risks and leverage. While these accounts offer greater flexibility, they require a deeper understanding of trading mechanics and market dynamics.

Trading Instruments Available on Exness

Currency Pairs and Forex Trading

Exness provides access to a wide range of currency pairs, including major, minor, and exotic options. Traders can diversify their portfolios and capitalize on global market trends. Popular pairs like EUR/USD, GBP/USD, and USD/JPY are available, along with INR-based pairs for compliance with SEBI guidelines.

The platform’s competitive spreads and low latency ensure that forex trading on Exness is both cost-effective and efficient.

CFDs, Stocks, and Other Assets

Beyond forex, Exness offers trading in CFDs (Contracts for Difference), stocks, indices, commodities, and cryptocurrencies. This diversification allows traders to explore various asset classes and hedge their risks.

For instance, traders can invest in gold, oil, or tech stocks to complement their forex strategies. This wide array of instruments makes Exness a versatile platform for Indian traders seeking multiple investment opportunities.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Trading Conditions on Exness

Spreads and Commissions Explained

Exness is renowned for its tight spreads, which minimize trading costs for users. The platform offers zero-spread accounts, where traders pay only a small commission per trade. This structure provides transparency and allows users to manage their trading expenses effectively.

Standard accounts typically have slightly wider spreads, which are offset by the absence of commissions. This makes them a cost-effective choice for new traders.

Leverage Options for Indian Traders

Exness provides flexible leverage options, enabling traders to maximize their market exposure with limited capital. Indian traders can access leverage of up to 1:2000 or unlimited on certain accounts, depending on the asset class and regulatory conditions.

While high leverage can amplify profits, it also increases risk. Exness equips traders with tools like margin calculators and risk management settings to mitigate potential downsides.

Platform Features and Tools

User Interface and Experience

Exness’s trading platforms, including MT4, MT5, and its proprietary solution, are designed for intuitive navigation and ease of use. The interfaces are customizable, allowing traders to create a layout that suits their preferences.

The platform’s mobile app ensures that users can monitor and execute trades on the go, making it a convenient option for busy traders in India.

Analytical Tools and Resources Provided

Exness offers a comprehensive suite of analytical tools, including charting software, technical indicators, and economic calendars. These resources empower traders to make informed decisions and refine their strategies.

Educational materials, such as webinars and tutorials, are also available, helping Indian traders enhance their knowledge and skills.

Customer Support Services

Availability of Multilingual Support

Exness provides multilingual customer support, ensuring that Indian traders can communicate effectively. Support is available in English and other languages, catering to the diverse needs of its global clientele.

The customer service team is accessible 24/7, offering prompt assistance for technical issues, account inquiries, and trading guidance.

Response Times and Channels of Communication

Exness offers multiple communication channels, including live chat, email, and phone support. Response times are typically quick, with live chat providing immediate assistance.

The availability of localized support ensures that Indian traders can resolve their queries efficiently, enhancing their overall trading experience.

Safety and Security Measures

Data Protection Protocols

Exness employs advanced encryption technology to safeguard user data and transactions. This ensures that personal and financial information remains secure from cyber threats.

The platform’s compliance with international security standards further reinforces its commitment to protecting client interests.

Segregation of Client Funds

Exness segregates client funds from its operational accounts, ensuring that traders’ capital is protected in the event of unforeseen circumstances. This practice is mandated by its regulatory authorities and underscores the broker’s focus on transparency and accountability.

Pros and Cons of Using Exness in India

Advantages for Indian Traders

Competitive spreads and flexible leverage options.

User-friendly platforms with advanced analytical tools.

Availability of local payment methods and multilingual support.

Potential Downsides and Challenges

Not directly regulated by SEBI or RBI.

High leverage options may increase risks for inexperienced traders.

Reviews and Feedback from Indian Traders

Positive Experiences Shared

Indian traders often praise Exness for its fast deposit and withdrawal processes, responsive customer support, and intuitive platform design. Many users also highlight the educational resources as a valuable tool for improving their trading performance.

Common Concerns Raised

Some traders express concerns about the risks associated with high leverage and the lack of direct regulation by Indian authorities. These issues emphasize the importance of understanding trading risks and adhering to local guidelines.

Conclusion

Exness is a globally regulated and reliable trading platform that is valid and accessible to Indian traders. While it operates under international licenses and not SEBI or RBI, its robust features, user-friendly platforms, and localized services make it a viable option for traders in India.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

However, as with any trading activity, Indian users must approach forex trading with caution, prioritize education, and ensure compliance with local regulations to maximize their success on Exness.

Read more: