5 minute read

Is Exness Regulated in Philippines? Is it Legal?

from Exness Blog

by Exness_India

Forex trading has gained massive popularity in the Philippines, with traders looking for reliable and regulated brokers to invest their money. Among the many brokers available, Exness stands out due to its competitive spreads, high leverage, and fast withdrawals. However, before opening an account, Filipino traders often ask:

Is Exness regulated in the Philippines?

Is forex trading legal in the country?

What are the risks of trading with Exness in the Philippines?

How does Exness compare with locally regulated brokers?

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

In this detailed guide, we will answer these questions and provide a comprehensive review of Exness in the Philippines, covering its regulatory status, safety measures, trading conditions, deposit & withdrawal options, and overall reliability.

By the end of this article, you’ll have a clear understanding of whether Exness is the right broker for you in the Philippines in 2025.

1. Is Forex Trading Legal in the Philippines?

Yes, forex trading is legal in the Philippines. The country allows individuals to trade foreign exchange, but there are certain regulations in place to protect traders and prevent financial fraud.

✅ Who Regulates Forex Trading in the Philippines?

The Securities and Exchange Commission (SEC) of the Philippines is the main regulatory body overseeing financial services, including forex trading. The SEC ensures that brokers operating in the country follow strict financial guidelines to protect traders from scams and market manipulation.

📌 Key Points About Forex Trading Regulations in the Philippines:

✔️ Individuals can legally trade forex through regulated brokers.✔️ Only brokers registered with the Philippine SEC can offer forex trading services within the country.✔️ International brokers like Exness operate in the Philippines but are not directly regulated by the SEC.✔️ Forex trading profits are subject to taxes in the Philippines.

2. Is Exness Regulated in the Philippines?

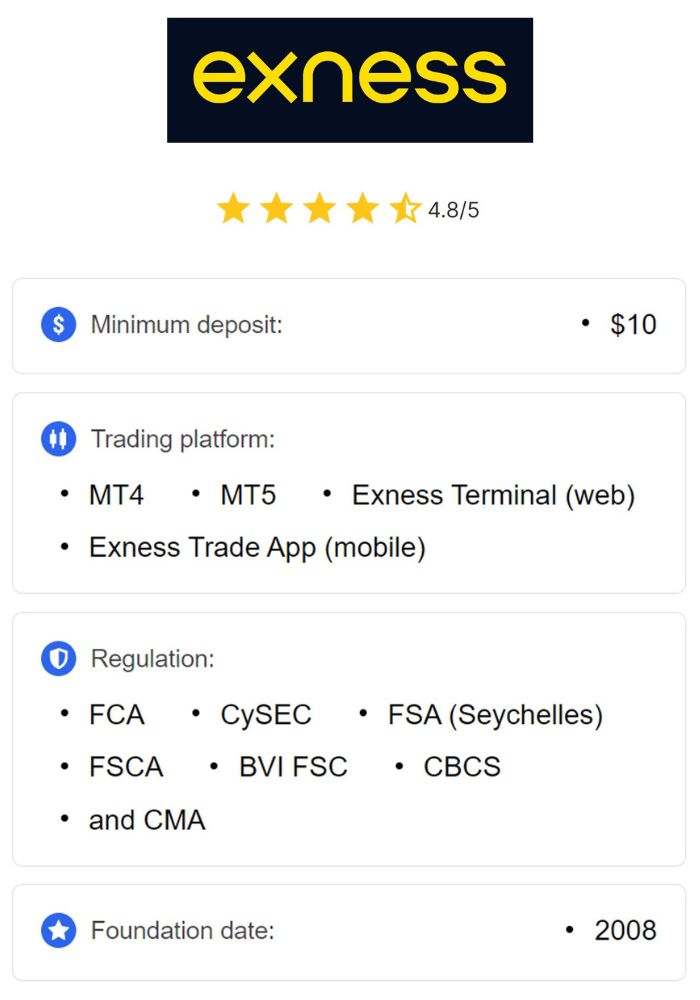

Exness is not directly regulated by the Philippine SEC but operates under multiple top-tier international regulatory licenses.

✅ Exness Regulations & Licenses

Although Exness is not registered with the SEC Philippines, it is a globally regulated broker, holding licenses from reputable financial authorities:

🔹 Financial Conduct Authority (FCA) – UK🔹 Cyprus Securities and Exchange Commission (CySEC) – Cyprus🔹 Financial Services Authority (FSA) – Seychelles🔹 Financial Sector Conduct Authority (FSCA) – South Africa🔹 Financial Services Commission (FSC) – Mauritius

📌 What Does This Mean for Filipino Traders?

✔️ Exness follows strict financial regulations under these global regulators.✔️ Client funds are protected and held in segregated accounts.✔️ Negative balance protection ensures traders don’t lose more than their deposits.✔️ Exness undergoes regular audits for transparency and fairness.

🚀 While Exness is not regulated in the Philippines, it operates under strict international regulations, making it a safe and reliable broker for Filipino traders.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

3. Is It Safe to Trade with Exness in the Philippines?

✅ Exness Safety Measures

Exness implements several security features to protect traders’ funds and personal information:

✔️ Segregated Client Funds: Traders' deposits are kept separate from company funds.✔️ Negative Balance Protection: Prevents traders from going into debt.✔️ SSL Encryption: Protects transactions and data from hackers.✔️ Transparent Operations: Exness undergoes third-party audits to ensure fairness.

📌 Exness is considered a safe broker with strong financial backing and security measures.

4. Trading Conditions & Features of Exness in the Philippines

Exness provides excellent trading conditions that cater to both beginner and professional traders.

✅ Available Trading Instruments

✔️ Forex: 100+ currency pairs (Major, Minor, Exotic)✔️ Metals: Gold, Silver, Platinum✔️ Cryptocurrencies: Bitcoin, Ethereum, Litecoin, Ripple✔️ Indices: NASDAQ, S&P 500, Dow Jones, FTSE 100✔️ Stocks: Tesla, Apple, Microsoft, Amazon✔️ Energies: Crude Oil, Natural Gas

📌 Exness provides a wide range of assets, allowing traders to diversify their portfolios.

✅ Account Types Available in the Philippines

Exness offers several account types to suit different trading styles:

✔️ Standard Account: No commission, low spreads, perfect for beginners.✔️ Standard Cent Account: Ideal for micro-trading and testing strategies.✔️ Raw Spread Account: Ultra-low spreads with a commission per lot.✔️ Zero Account: Zero spreads on major instruments, fixed commission.✔️ Pro Account: No commission, instant execution, suitable for professionals.

📌 Exness offers a variety of accounts to fit every trading strategy.

✅ Leverage & Spreads

✔️ Leverage: Up to 1:2000 (even unlimited in some cases).✔️ Spreads: Starting from 0.0 pips on Raw and Zero accounts.✔️ Commission: Applicable only on Raw and Zero accounts.

🚀 Exness provides highly competitive trading conditions for Filipino traders.

5. Deposits & Withdrawals in the Philippines

One of Exness’s biggest advantages is its instant deposit and withdrawal system.

✅ Payment Methods for Filipino Traders

✔️ GCash / PayMaya✔️ Bank Transfer (BPI, BDO, Metrobank, UnionBank, etc.)✔️ Visa / MasterCard (Credit & Debit Cards)✔️ E-wallets (Skrill, Neteller, Perfect Money)✔️ Cryptocurrency Payments (Bitcoin, USDT, Ethereum)

📌 Most withdrawals on Exness are processed instantly, which is a major benefit over other brokers.

6. Customer Support & Educational Resources

✅ Exness Support in the Philippines

✔️ 24/7 Live Chat Support (English & Filipino)✔️ Email & Phone Support✔️ Extensive Help Center & FAQs✔️ Free Trading Webinars, Guides & Tutorials

📌 Exness provides excellent customer support and trading education.

7. Pros & Cons of Trading with Exness in the Philippines

✅ Pros

✔️ Globally regulated broker with a strong reputation.✔️ Low trading costs & tight spreads.✔️ Instant deposits & withdrawals.✔️ User-friendly trading platforms (MT4, MT5, WebTrader, Mobile App).✔️ 24/7 customer support in multiple languages.

❌ Cons

❌ Not directly regulated by the Philippine SEC.❌ High leverage may be risky for beginners.❌ No local physical office in the Philippines.

📌 Despite these minor drawbacks, Exness remains a top choice for traders in the Philippines.

Final Verdict: Should You Trade with Exness in the Philippines?

🚀 Is Exness the right broker for Filipino traders?

✅ Yes! If you are looking for a reliable, well-regulated, and cost-effective broker, Exness is an excellent choice.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Who Should Use Exness?

✔️ Beginners – User-friendly platforms and low minimum deposits.✔️ Professional Traders – Low spreads and commission-based accounts.✔️ Scalpers & Day Traders – Fast execution & instant withdrawals.

Read more: