10 minute read

Is Exness Legal in Nigeria? Review Broker 2025

Forex trading has surged in popularity across Nigeria in recent years, driven by a growing interest in financial markets, increased internet access, and the promise of financial independence. Among the many forex brokers available to Nigerian traders, Exness stands out as a globally recognized name. But a critical question lingers in the minds of many: Is Exness legal in Nigeria? The short answer is yes—Exness is legal for Nigerian traders to use.

💥 Trade with Exness now: Open An Account or Visit Brokers

However, understanding the full context requires diving into the regulatory landscape, Exness’s operations, and how it aligns with Nigeria’s financial ecosystem. In this detailed guide, we’ll explore every aspect of this topic to provide clarity, dispel myths, and empower Nigerian traders with the knowledge they need to trade confidently with Exness in 2025.

What Is Exness? A Quick Overview

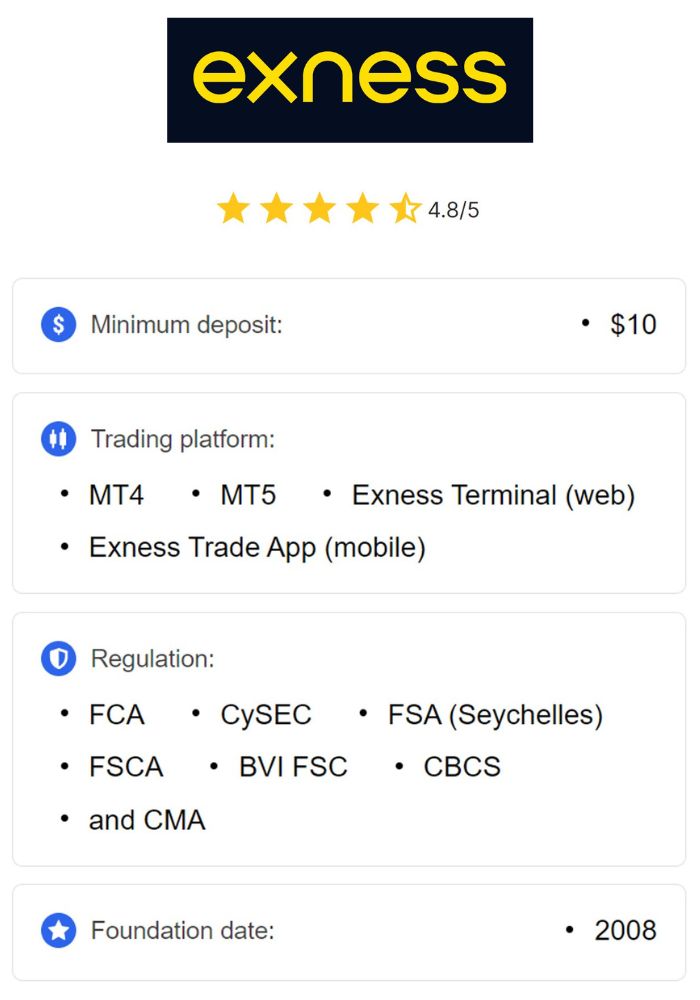

Before addressing its legality, let’s establish what Exness is. Founded in 2008, Exness is an international forex and CFD (Contracts for Difference) broker headquartered in Limassol, Cyprus. Over the past 17 years, it has grown into one of the most trusted names in online trading, serving millions of clients across more than 180 countries, including Nigeria. Exness offers a wide range of financial instruments, including forex pairs, commodities, indices, stocks, and cryptocurrencies, all accessible through popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

What sets Exness apart? It’s known for its competitive spreads (starting as low as 0.0 pips), high leverage (up to 1:2000), instant withdrawals, and a user-friendly interface. For Nigerian traders, Exness also supports local payment methods and offers account options in Nigerian Naira (NGN), making it highly accessible. But legality isn’t just about features—it’s about compliance with laws and regulations. So, let’s dive into the heart of the matter.

Forex Trading in Nigeria: The Legal Framework

To determine whether Exness is legal in Nigeria, we first need to understand the country’s stance on forex trading. Forex trading, which involves buying and selling currencies to profit from exchange rate fluctuations, is a legitimate financial activity in Nigeria. Unlike some countries where forex trading is restricted or outright banned, Nigeria permits its citizens to participate in the global forex market. However, the regulatory environment is nuanced and evolving.

The Role of the Central Bank of Nigeria (CBN)

The Central Bank of Nigeria (CBN) is the primary authority overseeing the country’s financial system, including foreign exchange activities. The CBN’s main objectives are to maintain monetary stability, manage the Nigerian Naira’s value, and regulate the flow of foreign currency in and out of the country. While the CBN imposes strict controls on foreign exchange transactions—such as limiting access to dollars through official channels—it does not prohibit individuals from trading forex through online platforms.

In fact, the CBN has acknowledged forex trading as a lawful investment opportunity. Nigerians are free to engage in forex trading as long as they comply with tax obligations and use their own funds, rather than illegally sourced foreign currency. The CBN’s focus is more on preventing illicit forex activities (e.g., money laundering) than restricting legitimate trading.

The Securities and Exchange Commission (SEC)

The Securities and Exchange Commission (SEC) is another key player in Nigeria’s financial regulatory landscape. The SEC oversees the capital markets, including securities trading and investment schemes. While its primary jurisdiction covers Nigerian-based brokers and companies offering securities, it also monitors forex-related activities to protect investors from fraud.

However, the SEC does not directly regulate international forex brokers like Exness. Instead, it focuses on locally registered entities. This creates a regulatory “grey area” for foreign brokers operating in Nigeria—a situation that affects how we assess Exness’s legality.

Is Exness Regulated in Nigeria?

Exness is not directly regulated by the CBN or SEC, nor does it hold a specific license from Nigerian authorities. At first glance, this might raise concerns. However, this doesn’t mean Exness is illegal. Many international forex brokers operate in Nigeria without local licenses, relying instead on their global regulatory credentials. Exness falls into this category, and its robust international regulation supports its legality for Nigerian traders.

Exness’s Global Regulatory Status

Exness is regulated by several top-tier and reputable financial authorities worldwide, ensuring it adheres to strict standards of transparency, security, and client protection. These include:

Financial Conduct Authority (FCA) – United KingdomThe FCA is one of the world’s most respected regulators, known for its stringent rules. Exness (UK) Ltd is licensed by the FCA, ensuring compliance with high financial standards.

Cyprus Securities and Exchange Commission (CySEC) – CyprusCySEC regulates Exness (Cy) Ltd, aligning it with European Union financial regulations. This includes client fund segregation and regular audits.

Financial Sector Conduct Authority (FSCA) – South AfricaThe FSCA oversees Exness’s operations in Africa, adding a layer of credibility for Nigerian traders due to its proximity and relevance.

Seychelles Financial Services Authority (FSA) – SeychellesNigerian clients are typically onboarded through Exness (SC) Ltd, regulated by the FSA. While Seychelles is considered an offshore jurisdiction with lighter regulation, Exness enhances trust by maintaining transparency and undergoing audits by Deloitte, a globally renowned firm.

These licenses collectively demonstrate that Exness operates under strict oversight, even if it lacks a Nigerian-specific license. For Nigerian traders, this international regulation provides assurance of safety and legitimacy.

Why Exness Is Legal in Nigeria

So, why can we confidently say Exness is legal in Nigeria? The answer lies in a combination of Nigerian law, Exness’s compliance, and practical accessibility.

1. No Prohibition on International Brokers

Nigerian laws do not explicitly prohibit citizens from trading with foreign forex brokers. The CBN and SEC regulate local financial institutions, but they do not ban Nigerians from using internationally regulated platforms like Exness. As long as traders use legitimate funds and comply with tax laws, they can legally trade with offshore brokers.

2. Exness’s Compliance with Global Standards

Exness’s multiple regulatory licenses ensure it meets international benchmarks for financial integrity. These include:

Segregation of client funds: Client money is kept separate from company funds, protecting traders if the broker faces financial issues.

Negative balance protection: Traders cannot lose more than their account balance, a crucial safeguard.

Regular audits: Independent audits by Deloitte verify Exness’s financial health and transparency.

These measures align with best practices that Nigerian regulators value, even if Exness isn’t directly under their jurisdiction.

3. Accessibility for Nigerian Traders

Exness actively caters to the Nigerian market, offering:

NGN as a base currency: Traders can open accounts in Naira, avoiding currency conversion fees.

Local payment methods: Options like bank transfers, mobile money, and e-wallets make deposits and withdrawals seamless.

24/7 customer support: Available in English and tailored to Nigerian users.

This localization demonstrates Exness’s commitment to operating lawfully and supporting Nigerian traders within the existing framework.

4. No Ban or Restrictions from Nigerian Authorities

There are no official statements from the CBN, SEC, or any Nigerian authority banning Exness or declaring its operations illegal. Without such a prohibition, Exness remains a lawful option for traders.

💥 Trade with Exness now: Open An Account or Visit Brokers

Benefits of Trading with Exness in Nigeria

Now that we’ve established Exness’s legality, let’s explore why it’s a popular choice for Nigerian traders. Its features and services make it a compelling platform in 2025.

1. Low Costs and Competitive Spreads

Exness offers some of the tightest spreads in the industry, starting at 0.0 pips on certain accounts (e.g., Raw Spread and Zero accounts). For cost-conscious Nigerian traders, this reduces trading expenses significantly. Additionally, Exness does not charge deposit or withdrawal fees for most methods, further lowering the financial barrier.

2. High Leverage Options

With leverage up to 1:2000, Exness allows traders to maximize their capital. While high leverage carries risks, it’s a powerful tool for experienced traders looking to amplify profits—a feature that resonates with Nigeria’s ambitious trading community.

3. Instant Withdrawals

One of Exness’s standout features is its instant withdrawal system. Nigerian traders can access their funds within seconds, a rarity among brokers. This reliability builds trust and ensures liquidity when needed.

4. Diverse Trading Instruments

Exness provides access to over 100 forex pairs, plus CFDs on metals, energies, stocks, indices, and cryptocurrencies like Bitcoin and Ethereum. This variety allows Nigerian traders to diversify their portfolios and tap into global markets.

5. Educational Resources

For beginners, Exness offers webinars, tutorials, market analysis, and demo accounts. In a country where forex education is still developing, these resources empower Nigerians to trade smarter.

Potential Risks and Considerations

While Exness is legal and reputable, trading with any broker involves risks. Nigerian traders should be aware of the following:

1. Lack of Local Regulation

Since Exness isn’t regulated by the CBN or SEC, disputes may need to be resolved through international channels (e.g., the FSA in Seychelles). This could complicate legal recourse compared to a locally licensed broker.

2. Forex Market Volatility

Forex trading is inherently risky due to price fluctuations. High leverage, while beneficial, can amplify losses—something all traders must manage carefully.

3. Currency Restrictions

The CBN occasionally imposes forex restrictions that could affect fund transfers. However, Exness mitigates this by offering NGN accounts and local payment options.

How to Start Trading with Exness in Nigeria

Ready to trade with Exness? Here’s a step-by-step guide for Nigerian traders in 2025:

Visit the Exness WebsiteGo to Exness now: Open An Account or Visit Brokers

Register Your AccountProvide your email, create a password, and select NGN as your base currency.

Verify Your IdentityUpload a government-issued ID (e.g., passport or driver’s license) and proof of address (e.g., utility bill). Verification typically takes a few hours.

Deposit FundsChoose a payment method—bank transfer, mobile money, or e-wallets—and fund your account. The minimum deposit is as low as $1 for some account types.

Download a Trading PlatformInstall MT4 or MT5 on your phone or computer, log in with your Exness credentials, and start trading.

Withdraw ProfitsUse the same payment methods for fast, fee-free withdrawals.

User Experiences: What Nigerian Traders Say

Nigerian traders generally praise Exness for its reliability and ease of use. On platforms like Traders Union and FX Scouts, users highlight:

Fast withdrawals: “I got my money in seconds—amazing!”

Low spreads: “Trading costs are lower than with other brokers I’ve tried.”

Support: “The team responds quickly, even on weekends.”

However, some note occasional delays during high volatility and a desire for more localized support in languages like Hausa or Yoruba. Overall, sentiment is overwhelmingly positive, reinforcing Exness’s legitimacy.

Exness vs. Other Brokers in Nigeria

How does Exness stack up against competitors like FXTM, HotForex, or OctaFX? While all are legal options, Exness excels in:

Spreads: Tighter than most competitors.

Withdrawals: Faster processing times.

Leverage: Higher maximums than many peers.

However, brokers like FXTM may offer more educational content or local offices, which some traders prefer. Your choice depends on your priorities—cost, speed, or support.

The Future of Exness in Nigeria

As Nigeria’s forex market grows, regulatory clarity may increase. The CBN and SEC could introduce stricter rules for international brokers, potentially requiring local licenses. Exness, with its strong compliance record, is well-positioned to adapt. For now, its legality remains intact, and its popularity among Nigerians is likely to rise in 2025 and beyond.

Conclusion: Yes, Exness Is Legal in Nigeria

So, is Exness legal in Nigeria? Absolutely. While it lacks direct regulation from the CBN or SEC, Nigerian laws do not prohibit trading with internationally regulated brokers like Exness. Its licenses from the FCA, CySEC, FSCA, and FSA, combined with its tailored services for Nigerians, make it a lawful and reliable choice. Whether you’re a beginner or a seasoned trader, Exness offers a secure, cost-effective platform to explore the forex market.

Ready to take the plunge? Sign up with Exness today, leverage its features, and join thousands of Nigerians thriving in the global financial markets. Forex trading is risky, but with a legal and trusted broker like Exness, you’re starting on the right foot.

Read more: