10 minute read

Is Exness legal in Bangladesh? Review Broker

Understanding Forex Trading Regulations

Overview of Forex Trading

Forex, or foreign exchange trading, is the process of buying and selling currencies in global markets to make a profit. It is the largest and most liquid financial market in the world, with a daily trading volume of over $6 trillion. Traders and investors participate in the forex market to benefit from currency fluctuations, with popular trading pairs like EUR/USD, GBP/USD, and USD/JPY attracting significant attention. Forex trading has gained traction worldwide, and in recent years, many people in Bangladesh have shown interest in this form of online trading as a way to diversify their income sources.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

However, while forex trading is accessible in most countries, regulations can vary significantly. Different governments have implemented rules to ensure that the forex market operates in a fair, transparent, and secure manner. Understanding these regulations is crucial for traders, as it affects the legality, security, and overall experience of trading in their respective countries.

Importance of Regulatory Compliance

Regulatory compliance is essential for maintaining a safe and transparent trading environment. Regulatory bodies set guidelines to protect traders from fraud, manipulation, and excessive risk exposure. They monitor brokers to ensure they meet standards for financial integrity, client fund protection, and fair trading practices. For instance, regulated brokers must segregate client funds from operational funds, conduct regular audits, and disclose trading costs transparently.

For traders, working with a regulated broker adds a layer of security, as they can trust that the broker operates under strict oversight. In countries where forex trading is not regulated, traders risk dealing with unlicensed brokers who may not follow industry standards. In Bangladesh, forex trading operates under specific rules, and understanding these regulations helps traders make informed decisions.

Introduction to Exness

Company Background and History

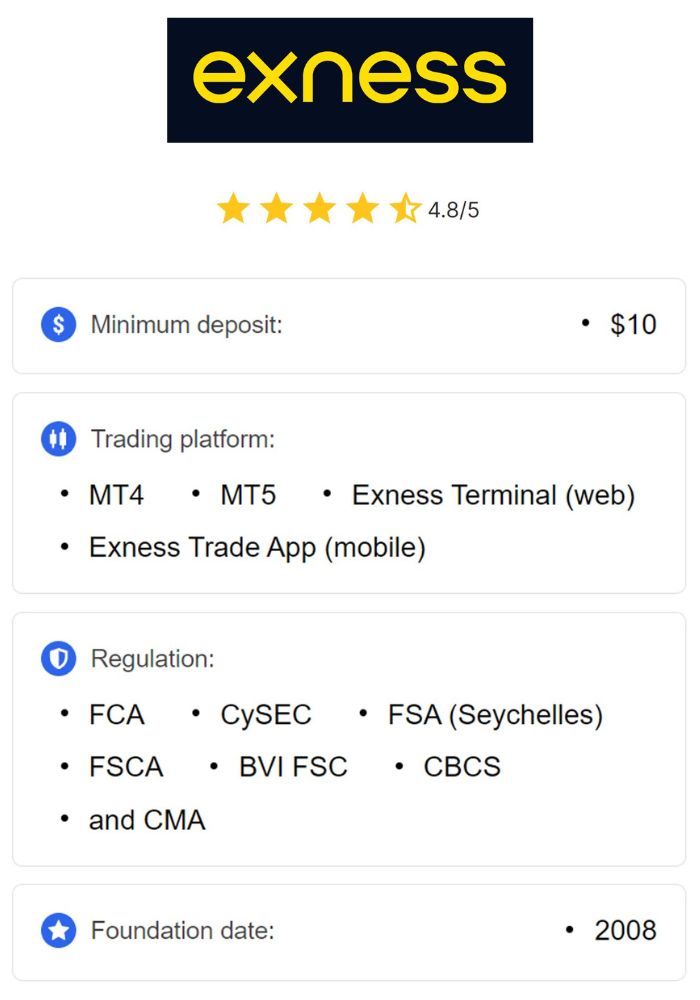

Exness is a global online brokerage founded in 2008, known for offering forex and CFD trading to millions of clients worldwide. Headquartered in Cyprus, Exness has expanded its services across various regions, including Asia, Europe, and the Middle East. The company has built a strong reputation for transparency, competitive pricing, and advanced trading technology, making it a preferred choice among traders of all experience levels.

Exness’s mission is to provide clients with a secure and transparent trading environment, achieved through innovative technology, low-cost trading conditions, and responsive customer support. Over the years, Exness has focused on building trust through strict regulatory compliance and exceptional service quality, positioning itself as a reliable broker for retail and professional traders alike.

Services Offered by Exness

Exness offers a wide range of services to meet the diverse needs of its clients, including:

Forex Trading: Exness provides access to over 100 currency pairs, allowing traders to speculate on global currency movements.

CFD Trading: Clients can trade Contracts for Difference (CFDs) on commodities, indices, cryptocurrencies, and stocks, providing opportunities to diversify their portfolios.

Advanced Trading Platforms: Exness supports MetaTrader 4, MetaTrader 5, and a proprietary mobile app, offering flexibility in how traders access the markets.

Leverage Options: With leverage up to 1:2000, Exness offers competitive margin trading for those seeking to maximize their capital.

Educational Resources: Exness provides webinars, tutorials, and articles to support beginner and intermediate traders in their learning journey.

Exness is known for its low spreads, fast execution, and secure trading environment, making it a popular choice for traders worldwide, including those in Bangladesh.

The Legal Framework for Forex Trading in Bangladesh

Role of the Bangladesh Securities and Exchange Commission (BSEC)

The Bangladesh Securities and Exchange Commission (BSEC) is the regulatory authority responsible for overseeing the securities and capital markets in Bangladesh. While the BSEC primarily focuses on stocks, bonds, and other traditional financial instruments, it has also started monitoring online trading activities, including forex trading. The BSEC’s role is to ensure a transparent and stable financial market and protect investors from fraudulent practices and excessive risk.

As forex trading grows in popularity in Bangladesh, the BSEC has become more involved in examining brokers operating in the region. However, forex trading remains a gray area in Bangladesh, with limited regulatory clarity regarding the legality and operation of foreign brokers.

Current Regulations Governing Forex Brokers

In Bangladesh, regulations surrounding forex trading are still evolving. The BSEC has not yet provided specific guidelines or licenses for forex brokers, which means that most forex brokers operating in Bangladesh do so without direct authorization. While it is not illegal for individuals in Bangladesh to engage in forex trading, they often rely on international brokers due to the absence of local options.

The lack of specific forex regulations means that Bangladeshi traders should exercise caution when choosing a broker. Many international brokers, including Exness, accept clients from Bangladesh, but traders must ensure that these brokers are regulated by reputable foreign authorities to ensure a safe trading environment.

Legitimacy of Exness in Global Markets

Licenses and Regulatory Authorities

Exness is a highly regulated broker, holding licenses from prominent authorities, including the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC) in Cyprus. Additionally, Exness is regulated by the Financial Sector Conduct Authority (FSCA) in South Africa. These licenses require Exness to adhere to stringent regulatory standards that prioritize client fund protection, transparent pricing, and ethical trading practices.

By maintaining licenses from multiple jurisdictions, Exness demonstrates its commitment to legal compliance and financial security. These regulatory measures mean that Exness is accountable to authorities that conduct regular audits and enforce strict operational standards, ensuring a safe trading environment for clients worldwide.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Reputation Among Traders Worldwide

Exness has earned a positive reputation among traders globally, known for its low-cost trading, responsive customer support, and secure trading platforms. The broker’s transparency and reliability have led to positive feedback and trust within the trading community. Exness’s reputation is also strengthened by its fast execution speeds, competitive spreads, and commitment to client satisfaction, which appeal to traders seeking a dependable and cost-effective broker.

For Bangladeshi traders, Exness’s strong international reputation and regulatory credentials provide confidence in the broker’s legitimacy and reliability.

Exness Operations in Bangladesh

Availability of Services for Bangladeshi Traders

Exness accepts clients from Bangladesh and provides them with access to all its standard services, including forex and CFD trading. Bangladeshi traders can open accounts, access trading platforms, and fund their accounts using local payment options, making Exness accessible and convenient for traders in the region.

The availability of services like high leverage, low minimum deposits, and a range of financial instruments makes Exness an attractive option for Bangladeshi traders looking for a versatile trading experience. Exness’s offerings allow traders to engage in the forex market with a broker that has a global presence and a reputation for compliance and security.

Currency Options and Payment Methods

Exness offers multiple payment methods that cater to Bangladeshi clients, including e-wallets, credit/debit cards, and local bank transfers. The broker supports various currency options, including USD and EUR, which simplifies deposits and withdrawals for Bangladeshi traders. Additionally, Exness’s quick processing times for deposits and withdrawals make transactions efficient and convenient.

By offering flexible payment options, Exness ensures that Bangladeshi traders can fund their accounts easily, enhancing the accessibility of its services. The variety of currency options also helps traders minimize conversion fees, which can be beneficial for those managing smaller accounts.

Safety and Security Features of Exness

Client Fund Protection Measures

Exness prioritizes client fund security by adhering to regulatory requirements such as fund segregation. Client funds are kept separate from the broker’s operational funds, ensuring that traders’ assets are protected even if the company faces financial difficulties. This practice is a crucial measure for ensuring client fund safety and is a standard requirement among regulated brokers.

Exness also offers negative balance protection, which prevents clients from losing more than their account balance. This feature is especially valuable for Bangladeshi traders, as it reduces the risk associated with high leverage and market volatility, providing peace of mind for those new to forex trading.

Data Security and Privacy Policies

In addition to fund protection, Exness implements advanced security protocols to safeguard client data. The broker uses encryption technology and multi-factor authentication to protect client accounts and personal information. Compliance with global data protection standards, including GDPR, ensures that Exness handles client data responsibly.

Exness’s commitment to data security and privacy is crucial for Bangladeshi traders, as it ensures that their personal and financial information is protected from unauthorized access and cyber threats.

Forex Trading Risks in Bangladesh

Market Volatility and Its Impact

Forex trading is inherently risky due to the high volatility of currency markets. Prices can fluctuate rapidly due to economic events, political changes, and global financial shifts, making forex trading challenging for beginners. Bangladeshi traders should be aware of these risks and consider using tools such as stop-loss orders to manage their exposure.

Exness provides educational resources that help traders understand market volatility and develop risk management strategies. By understanding the impact of volatility, Bangladeshi traders can make informed decisions and manage their trades responsibly.

Legal Risks Associated with Unregulated Brokers

The absence of clear forex regulations in Bangladesh creates legal ambiguity, making it important for traders to work with internationally regulated brokers like Exness. Unregulated brokers often lack fund protection measures, transparent pricing, and reliable customer support, increasing the risk of fraud or unethical practices. Bangladeshi traders should avoid unregulated brokers to protect their investments and ensure a secure trading experience.

User Experiences with Exness

Testimonials from Bangladeshi Traders

Many Bangladeshi traders have shared positive experiences with Exness, noting the broker’s competitive spreads, fast execution, and responsive customer support. Traders appreciate Exness’s easy account setup and localized payment options, which simplify the process of starting with forex trading. The availability of high leverage and educational materials has also been well-received by Bangladeshi traders looking to grow their knowledge.

Comparisons with Other Forex Brokers

Compared to other brokers operating in Bangladesh, Exness stands out for its strong regulatory background, low trading costs, and flexible account options. While some brokers offer similar services, Exness’s commitment to transparency, security, and customer satisfaction makes it a preferred choice among Bangladeshi traders seeking a reliable broker.

Alternatives to Exness for Bangladeshi Traders

Local Brokers and Their Offerings

While the forex market is still developing in Bangladesh, a few local brokers provide limited forex trading services. However, these brokers may not offer the same range of instruments, leverage, or account flexibility as Exness. Additionally, local brokers may not be as rigorously regulated, which can impact fund safety and trading transparency.

International Brokers Accepting Bangladeshi Clients

In addition to Exness, several other international brokers accept Bangladeshi clients and offer similar services, including IC Markets, FBS, and OctaFX. Each of these brokers has unique features, but Exness’s regulatory compliance, competitive spreads, and localized services make it a strong option. Bangladeshi traders should compare broker offerings to find the best fit for their trading needs.

Conclusion: The Future of Forex Trading in Bangladesh and Exness

Forex trading in Bangladesh is growing, though regulatory clarity is still needed. Exness, with its strong international regulatory status, localized services, and reputation among traders, presents a viable option for Bangladeshi traders seeking a secure and accessible forex trading platform. As the forex market continues to evolve in Bangladesh, Exness’s commitment to compliance, safety, and customer satisfaction makes it well-suited to support Bangladeshi traders in their trading journey.