12 minute read

Is Exness Regulated in Kenya? Is it Legal?

Introduction to Exness

Overview of Exness as a Forex Broker

Exness is a global Forex and CFD (Contract for Difference) broker that offers services to traders in over 180 countries. Founded in 2008, Exness has become a prominent name in the Forex industry, renowned for its user-friendly platform, low spreads, and flexible trading conditions. The broker is known for catering to a wide range of traders, from beginners to experienced professionals, offering various types of accounts, access to popular trading platforms, and a broad selection of financial instruments.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Exness provides its clients with access to Forex, commodities, metals, indices, and even cryptocurrencies, with a primary focus on providing a seamless trading experience. The broker supports two of the most popular trading platforms in the industry—MetaTrader 4 (MT4) and MetaTrader 5 (MT5)—both of which are designed to help traders with advanced charting, automated trading, and a variety of risk management tools. With a reputation for reliability, transparency, and competitive pricing, Exness has become a popular choice for traders around the world.

Key Features of Exness Trading Platform

Exness offers a variety of features that make its trading platform attractive to traders globally. Some of the key features include:

Low Spreads and Commission-Free Trading: Exness offers competitive spreads and low commissions, making it an appealing choice for traders looking for cost-effective trading.

Multiple Account Types: Exness provides several account types, including Standard, Professional, and ECN accounts, catering to different types of traders with varying needs.

Leverage and Margin: Exness offers flexible leverage options, allowing traders to increase their market exposure while managing risk effectively. Traders can access leverage up to 1:2000 on certain account types.

Wide Range of Instruments: Exness gives traders access to over 100 financial instruments, including Forex, CFDs, indices, cryptocurrencies, and commodities, allowing them to diversify their portfolios.

24/7 Customer Support: Exness provides round-the-clock customer support to help traders resolve issues and answer questions about the platform, account management, and more.

These features, combined with the broker's strong reputation and advanced tools, make Exness an attractive platform for traders worldwide, including those in Kenya.

Understanding Regulation in the Forex Industry

The Importance of Financial Regulation

Financial regulation is essential in ensuring the safety, transparency, and fairness of the financial markets. It establishes rules and guidelines that brokers must follow to protect traders and investors from fraud, manipulation, and unethical practices. Regulatory bodies around the world impose strict regulations on brokers, requiring them to maintain specific standards in terms of liquidity, transparency, and client fund protection.

For traders, choosing a regulated broker offers a level of security, as it ensures that the broker operates in accordance with the law. A regulated broker must adhere to strict requirements regarding the safety of client funds, conduct regular audits, and provide transparency about its trading conditions, fees, and charges.

How Regulation Affects Traders

Regulation plays a critical role in shaping the overall trading experience for traders. When brokers are regulated by reputable authorities, traders can rest assured that their funds are protected, their trades are executed fairly, and the broker adheres to ethical business practices. Regulatory oversight also ensures that traders have access to legal recourse in case of disputes or issues with the broker.

For instance, regulated brokers are often required to separate client funds from operational funds, ensuring that client money is protected even in the event of the broker's insolvency. Additionally, regulated brokers typically offer compensation schemes that protect traders from financial loss in case the broker fails to meet its obligations.

Exness’s Regulatory Status Globally

Regulatory Bodies Overseeing Exness

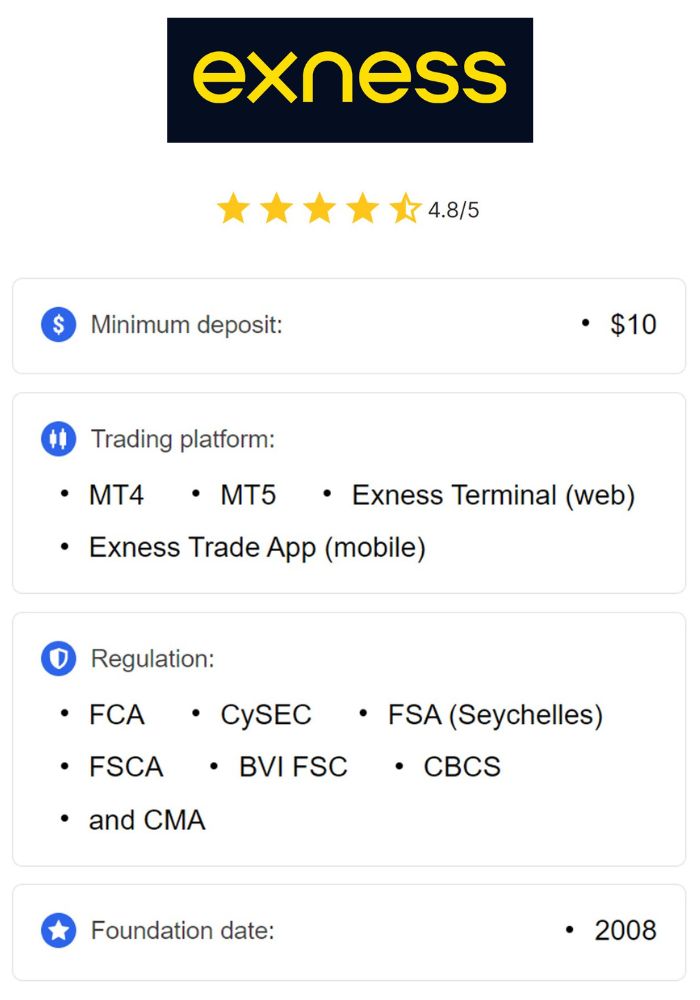

Exness is a well-regulated broker that holds licenses from multiple respected financial authorities across the world. Some of the regulatory bodies overseeing Exness's operations include:

Financial Conduct Authority (FCA) of the United Kingdom: Exness is authorized and regulated by the FCA, one of the most reputable financial authorities in the world. The FCA ensures that Exness operates in a transparent and accountable manner, providing protections for UK clients.

Cyprus Securities and Exchange Commission (CySEC): Exness is also regulated by CySEC, which governs the financial markets in the European Union. This regulation ensures that Exness meets the stringent standards required to operate within the EU.

South African Financial Sector Conduct Authority (FSCA): In South Africa, Exness is regulated by the FSCA, which ensures that the broker follows local laws and offers a secure trading environment for South African traders.

Exness's global regulatory licenses provide traders with a sense of security, knowing that the broker is held to high standards of conduct and is subject to regular oversight and audits.

Compliance with International Standards

Exness complies with international standards for financial operations, ensuring that it meets the requirements set by the regulatory bodies it is licensed by. This includes adhering to Anti-Money Laundering (AML) practices, Know Your Customer (KYC) procedures, and client fund protection policies. These measures are designed to protect traders and ensure that Exness maintains the highest level of transparency and fairness in its operations.

As Exness operates in various countries and holds multiple licenses, it must comply with the local laws and regulations of each jurisdiction in which it operates. This multi-regulatory approach ensures that Exness is trusted by traders around the world and helps it maintain its reputation as a reliable and secure broker.

The Kenyan Forex Trading Landscape

Overview of Forex Trading in Kenya

Forex trading has become increasingly popular in Kenya, with more retail traders turning to online brokers to access the global financial markets. The Kenyan forex market has grown due to the country's rising interest in international investments, as well as the increasing access to the internet and mobile technologies. Many Kenyan traders participate in Forex trading as a way to diversify their income and take advantage of currency fluctuations.

However, despite the growing popularity of Forex trading in Kenya, the industry is still in its early stages of development, and it faces several challenges related to regulation, investor protection, and the availability of licensed brokers.

Regulatory Authorities in Kenya

In Kenya, Forex trading is regulated by the Capital Markets Authority (CMA), which is the primary body responsible for overseeing the financial markets in the country. The CMA has set guidelines for Forex brokers operating within Kenya, ensuring that they adhere to the regulations designed to protect investors and maintain a fair and transparent market.

The CMA's mandate includes licensing brokers, monitoring their activities, and enforcing compliance with the relevant laws and regulations. While the CMA has taken steps to regulate the Forex industry, it is important for traders to verify whether the broker they choose is licensed by the authority, as this ensures that they are trading within a legal and secure framework.

Is Exness Regulated in Kenya?

Current Regulatory Status of Exness in Kenya

Exness is not currently regulated by the Capital Markets Authority (CMA) in Kenya. While Exness holds licenses from other reputable financial authorities such as the FCA, CySEC, and FSCA, it does not have a license to operate within Kenya. As a result, Kenyan traders who choose to trade with Exness are doing so with an offshore broker, which means they are not covered by local regulations or investor protection schemes.

While Exness is a reputable and well-regulated broker globally, it is important for Kenyan traders to understand that they are not fully protected by the laws and regulations of their home country when trading with Exness. This means that any disputes or issues with the broker may not be easily resolved through Kenyan legal channels.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Comparison with Other Brokers Operating in Kenya

Several Forex brokers are regulated by the Capital Markets Authority (CMA) and are legally allowed to operate within Kenya. These brokers are required to comply with local laws and offer a higher level of protection to Kenyan traders. Brokers such as Pepperstone and FXTM are examples of brokers that offer services to Kenyan traders while being licensed and regulated by the CMA.

When compared to Exness, brokers regulated by the CMA offer a higher level of legal security for Kenyan traders. These brokers are required to adhere to local laws and regulations, ensuring that clients' funds are protected and that traders have access to legal recourse in case of issues.

Legality of Forex Trading in Kenya

Legal Framework Governing Forex Trading

Forex trading is legal in Kenya, but it is subject to regulation by the Capital Markets Authority (CMA). Traders in Kenya are allowed to engage in Forex trading, provided they trade with a broker that is licensed by the CMA or another reputable financial authority. The CMA has set clear guidelines for Forex brokers, ensuring that they meet certain standards in terms of transparency, investor protection, and ethical business practices.

Kenyan traders should ensure that the broker they choose complies with these regulations, as trading with an unregulated broker may expose them to risks such as fraud, manipulation, or disputes without a clear resolution process.

Role of the Capital Markets Authority (CMA)

The Capital Markets Authority (CMA) is the regulatory body responsible for overseeing Forex trading in Kenya. The CMA has set up a regulatory framework that ensures brokers comply with local laws and offer a secure trading environment for Kenyan traders. The CMA’s role is to license and monitor brokers, enforce fair trading practices, and protect investors from fraudulent activities.

In Kenya, Forex traders are advised to only engage with brokers that are licensed and regulated by the CMA to ensure they are trading in a secure environment with legal protection.

Benefits of Trading with Regulated Brokers

Enhanced Security for Traders

One of the primary benefits of trading with regulated brokers is the enhanced security they provide. Regulated brokers are required to keep client funds in segregated accounts, ensuring that clients' money is protected even if the broker faces financial difficulties. Additionally, regulated brokers must comply with strict standards regarding data protection, transparency, and fair trading practices.

For Kenyan traders, choosing a broker regulated by the CMA or another reputable authority offers peace of mind knowing that their funds are secure and that the broker operates in accordance with the law.

Assurance of Fair Trading Practices

Regulated brokers must adhere to transparent and ethical trading practices. This includes providing clear information about their fees, spreads, and trading conditions. Regulated brokers are also required to execute trades fairly and without manipulation, ensuring that traders are treated with respect and that their trades are handled according to industry best practices.

By choosing a regulated broker, Kenyan traders can ensure that they are participating in a fair and transparent trading environment, which is crucial for long-term success in the Forex market.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Risks of Trading with Unregulated Brokers

Increased Chance of Fraud

One of the biggest risks of trading with unregulated brokers is the increased chance of fraud. Unregulated brokers are not held to the same standards as regulated brokers, meaning they can engage in unethical practices such as price manipulation, stop-loss hunting, or withdrawing client funds without proper authorization. Without the oversight of a regulatory body, traders have little recourse if they are scammed or cheated by the broker.

For Kenyan traders, choosing an unregulated broker like Exness means trading with an offshore entity that is not governed by Kenyan laws or regulations. This increases the likelihood of encountering fraudulent activities, making it essential for traders to carefully assess the risks involved.

Lack of Legal Recourse

When trading with an unregulated broker, Kenyan traders have limited options for legal recourse if something goes wrong. In the event of a dispute, fraud, or account mismanagement, traders may not have access to the legal protections or compensation schemes provided by regulated brokers. This can leave traders vulnerable to significant losses without any means of recovering their funds.

To mitigate these risks, Kenyan traders are advised to trade with brokers that are regulated by the CMA or other recognized authorities, as these brokers are required to offer legal protection and ensure a safe and transparent trading environment.

User Experience with Exness in Kenya

Customer Support and Services Offered

Exness offers a wide range of customer support services for Kenyan traders. The broker provides 24/7 customer service through live chat, email, and phone support. Exness also offers a comprehensive help center with educational resources, FAQs, and guides to help traders navigate the platform.

However, Kenyan traders may face challenges when trying to reach local support, as Exness is not regulated in Kenya and its support staff may not always be familiar with the specific regulations or requirements for Kenyan traders.

Payment Methods and Withdrawal Processes

Exness supports a variety of payment methods, including credit cards, e-wallets, and bank transfers. However, Kenyan traders may experience issues with local payment options, as Exness does not have a local presence in Kenya. This can result in delays or additional fees when depositing or withdrawing funds.

Traders in Kenya should ensure they are aware of the payment methods supported by Exness and be prepared for potential delays or complications when withdrawing funds.

Alternatives to Exness for Kenyan Traders

Other Regulated Brokers Available

Kenyan traders have access to several regulated brokers that operate legally within the country. These include brokers like Pepperstone, FXTM, and IQ Option, all of which are licensed by the Capital Markets Authority (CMA). These brokers provide a higher level of legal protection and operate in compliance with Kenyan regulations, ensuring that traders have access to a secure and regulated trading environment.

Pros and Cons of Alternatives

While Exness may offer attractive trading conditions, brokers regulated by the CMA offer a higher level of legal certainty and security for Kenyan traders. The main advantage of trading with a CMA-regulated broker is the assurance of consumer protection and the ability to resolve disputes through Kenyan legal channels. However, these brokers may have more stringent trading conditions and higher fees compared to offshore brokers like Exness.

Conclusion on Exness’s Regulation and Legality in Kenya

Exness is not regulated in Kenya and operates as an offshore broker. While the broker offers competitive trading conditions and a user-friendly platform, Kenyan traders face risks when trading with an unregulated entity. Trading with a regulated broker licensed by the CMA provides better legal protection, security, and recourse in case of disputes.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Kenyan traders are advised to carefully consider the risks of trading with Exness and weigh them against the benefits of trading with a regulated broker.

Read more: