7 minute read

How to open Exness Pro Account: A Comprehensive Guide

For forex traders looking to elevate their game, the Exness Pro Account offers a powerful blend of tight spreads, flexible execution, and advanced trading conditions. Whether you’re an experienced scalper, a day trader, or someone transitioning from a beginner account, Exness’s Pro Account is designed to meet the needs of serious traders.

But how do you get started? In this in-depth guide, How to Open an Exness Pro Account, we’ll walk you through the entire process—from registration to funding—while exploring its features, benefits, and tips to maximize your trading potential. Let’s dive in and unlock the steps to set up your Pro Account with Exness, a globally trusted broker since 2008.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Why Choose the Exness Pro Account?

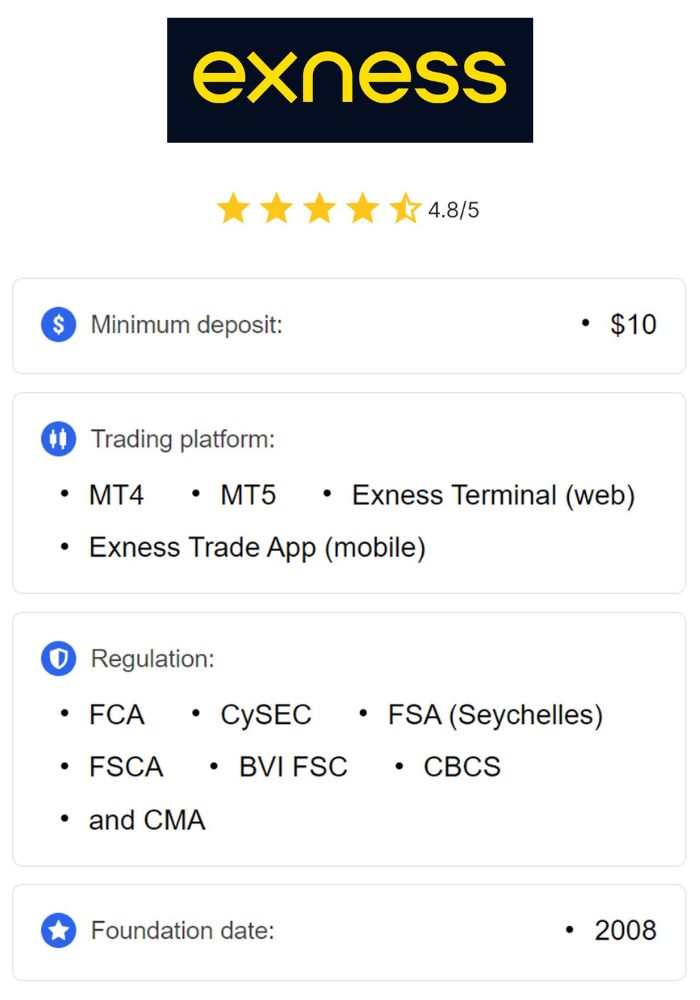

Before we outline the account-opening process, let’s understand why the Exness Pro Account stands out among the broker’s offerings—Standard, Standard Cent, Raw Spread, and Zero accounts. Exness, regulated by top-tier authorities like the FCA (UK), CySEC (Cyprus), and FSCA (South Africa), is known for its competitive pricing and robust platforms (MT4/MT5). The Pro Account, in particular, caters to traders seeking precision and flexibility. Here’s why it’s a top choice:

Tighter Spreads: Starting from 0.1 pips, lower than Standard accounts (0.3 pips).

No Commissions: Unlike Raw Spread or Zero accounts, it’s commission-free.

Execution Options: Choose between instant execution (ideal for stable markets) or market execution (for volatility).

Low Minimum Deposit: Starts at $200 (or equivalent), affordable for intermediate traders.

High Leverage: Up to 1:2000, amplifying your trading power.

For traders in India or globally, the Pro Account balances cost-efficiency with professional-grade features, making it ideal for those ready to step up from retail accounts. Now, let’s explore how to open one.

Eligibility for Opening an Exness Pro Account

Exness maintains straightforward eligibility criteria to ensure compliance and accessibility. Here’s what you need to qualify:

Age RequirementYou must be 18 or older, aligning with international financial regulations.

ResidencyExness accepts clients from most countries, including India, but restrictions may apply based on local laws (e.g., U.S. residents are excluded due to regulatory limits).

DocumentationValid identification (e.g., passport, driver’s license, or Aadhaar for Indians) and proof of address (e.g., utility bill, bank statement) are required for verification.

Agreement to TermsYou’ll need to accept Exness’s client agreement, outlining trading conditions and responsibilities.

Meeting these basics ensures you’re ready to proceed. Let’s get into the step-by-step process.

Step-by-Step Guide: How to Open an Exness Pro Account

Opening an Exness Pro Account is quick and intuitive, taking just 10–15 minutes if you have your documents ready. Follow these steps:

Step 1: Visit the Exness Website

Navigate to www.exness.com. Verify you’re on the official site by checking for the HTTPS padlock to avoid scams. Click “Register” or “Open an Account” in the top-right corner.

Step 2: Complete the Initial Registration

Country: Select your country (e.g., “India”).

Email: Provide a valid email address for account confirmation and updates.

Phone Number: Enter your mobile number (e.g., +91 for India) for SMS verification.

Password: Create a secure password (mix of letters, numbers, and symbols).

Confirmation: Check the box confirming you’re not a U.S. resident.Click “Continue” to move forward.

Step 3: Verify Your Contact Details

Email: Open your inbox, find the Exness verification email, and click the link.

Phone: Enter the SMS code sent to your number on the registration page.This dual verification secures your account from the start.

Step 4: Log Into Your Personal Area (PA)

Use your email and password to access your Exness Personal Area, the hub for managing accounts, deposits, and withdrawals.

Step 5: Select the Pro Account

In the Personal Area, click “Open New Account.”Choose “Pro Account” from the list:

Spreads: From 0.1 pips.

Commission: None.

Execution: Instant or market (select based on your strategy).

Minimum Deposit: $200 (or equivalent, e.g., ₹16,000–17,000 in India).Click “Create Account” to set it up.

Step 6: Complete Your Profile

Fill in personal details: full name, date of birth, and residential address. Ensure these match your ID documents for smooth verification.

Step 7: Verify Your Identity (KYC)

Proof of Identity (POI): Upload a clear scan/photo of your passport, driver’s license, or Aadhaar card (for Indian traders).

Proof of Residence (POR): Submit a utility bill, bank statement, or similar document (not older than 6 months) showing your name and address.

Tips: Use high-resolution images, avoid cropping edges, and ensure text is legible. Verification typically completes within hours, though it may take up to 24 hours during high demand.

Step 8: Fund Your Pro Account

Go to the “Deposit” section in your Personal Area.

Payment Options:

UPI: Instant and free (popular in India).

Net Banking: Secure, processed within hours.

Cards: Visa/MasterCard for quick deposits.

E-Wallets: Skrill, Neteller for global convenience.

Minimum Deposit: $200 (₹16,000–17,000 INR, depending on exchange rates).Select your currency (e.g., INR to avoid conversion fees) and follow the prompts.

Step 9: Download and Set Up the Trading Platform

Options: MetaTrader 4 (MT4) or MetaTrader 5 (MT5), downloadable from the Exness site or app stores (Android/iOS).Login: Use the account credentials emailed to you (account number, server, password).Customize your platform with charts, indicators, and tools.

Step 10: Start Trading

Test the waters with a demo (automatically provided with $10,000 virtual funds) or dive into live trading with your funded Pro Account.Congratulations! Your Exness Pro Account is now active.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Understanding the Exness Pro Account Features

The Pro Account is tailored for traders seeking efficiency and control. Here’s a closer look at its key attributes:

Tight Spreads (From 0.1 Pips)Lower than Standard accounts (0.3 pips), ideal for cost-conscious day traders.

No CommissionsUnlike Raw Spread ($7 round turn) or Zero (variable commissions), the Pro Account embeds costs in spreads.

Flexible Execution

Instant Execution: Orders filled at the requested price or not at all, suited for stable markets.

Market Execution: Filled at the best available price, perfect for volatile conditions (e.g., news events).

High Leverage (1:2000)Amplifies small deposits, though adjustable to manage risk (e.g., 1:100).

Wide Instrument RangeForex pairs (EUR/USD), metals (XAU/USD), cryptocurrencies, and indices.

These features make the Pro Account versatile for intermediate to advanced traders.

Who Should Open an Exness Pro Account?

Ideal Candidates

Experienced Beginners: Transitioning from Standard or Cent accounts with $200+ capital.

Day Traders: Leveraging tight spreads during active sessions (e.g., 6:30 PM–9:30 PM IST).

Scalpers: Using instant execution for quick entries/exits.

Indian Traders: Seeking cost-effective trading with INR deposits.

Who Might Look Elsewhere?

Micro-Traders: Cent Account ($10 minimum) suits smaller budgets.

Ultra-Low Spread Seekers: Raw Spread or Zero accounts offer 0.0 pips.

Funding Your Exness Pro Account: Options for Indian Traders

Exness supports localized payment methods, making deposits seamless for Indians:

UPI: Instant, no fees, via apps like Google Pay.

Net Banking: Secure, bank-specific processing times.

Cards: Visa/MasterCard, instant with possible bank fees.

E-Wallets: Skrill/Neteller, fast and global.

Funding Tips

Deposit in INR: Avoids conversion losses (e.g., $200 ≈ ₹16,000–17,000).

Meet Minimum: Ensure $200+ to activate the Pro Account.

Save Details: Store payment info for quick future deposits.

Withdrawals mirror deposit methods, processed within hours, a standout feature of Exness.

Comparing the Pro Account to Other Exness Options

Pro vs. Standard Account

Spreads: Pro (0.1 pips) vs. Standard (0.3 pips).

Deposit: Pro ($200) vs. Standard ($10).

Best For: Pro for pros; Standard for beginners.

Pro vs. Raw Spread Account

Spreads: Pro (0.1 pips) vs. Raw Spread (0.0–0.7 pips).

Commission: Pro (none) vs. Raw Spread ($7 round turn).

Best For: Pro for simplicity; Raw Spread for scalping.

Pro vs. Zero Account

Spreads: Pro (0.1 pips) vs. Zero (0.0–0.2 pips).

Commission: Pro (none) vs. Zero (variable, $7+).

Best For: Pro for cost balance; Zero for precision.

Tips to Maximize Your Exness Pro Account

Choose Execution Wisely: Instant for calm markets; market for volatile sessions.

Trade Peak Hours: London-New York overlap (6:30 PM–9:30 PM IST) for tight spreads.

Use Leverage Smartly: Limit to 1:100–1:500 to protect capital.

Practice First: Test strategies on the demo before going live.

Secure Your Account: Enable 2FA via phone or email.

Real-World Example: Trading with the Pro Account

Ravi, an Indian trader, opens a Pro Account with ₹16,500 ($200):

Deposit: Funds via UPI, instantly credited.

Trade: 1 lot EUR/USD, spread 0.2 pips ($2 cost).

Move: 20-pip gain = $20 profit.

Net: $18 after spread.

On a Standard Account, a 1-pip spread costs $10, netting $10 profit. The Pro Account’s tighter spreads boost Ravi’s returns.

Conclusion: Ready to Open Your Exness Pro Account?

This How to Open an Exness Pro Account guide has equipped you with the tools to register, verify, fund, and trade on one of Exness’s most versatile accounts. With tight spreads, no commissions, and flexible execution, the Pro Account bridges the gap between beginner and professional trading. Whether you’re in India or elsewhere, the $200 entry point unlocks a world of opportunities.

Read more: