14 minute read

Exness app is legal in India? A Comprehensive Guide

Understanding Exness and Its Operations

Overview of Exness as a Forex Broker

Exness is a globally recognized online forex and CFD (Contract for Difference) trading platform, established in 2008. With headquarters in Cyprus, Exness serves millions of traders worldwide, providing a wide range of trading options, including forex, commodities, indices, stocks, and cryptocurrencies. Known for its competitive trading conditions, fast execution speeds, and secure environment, Exness has become a go-to choice for both new and experienced traders.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Exness has built its reputation by prioritizing transparency, regulatory compliance, and client satisfaction. By offering flexible account types, advanced trading tools, and accessible platforms, the broker caters to diverse trading needs and styles, making it an appealing option for traders in India as well.

Features of the Exness Trading Platform

The Exness app is designed to offer a comprehensive and user-friendly trading experience. The platform provides multiple features that make it suitable for traders at all levels:

Trading Instruments: Exness offers access to over 100 currency pairs, along with commodities, indices, cryptocurrencies, and stocks, enabling traders to diversify their portfolios.

Advanced Tools: The platform supports both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), allowing users access to sophisticated charting tools, technical indicators, and automated trading through Expert Advisors (EAs).

High Leverage: Exness provides high leverage options, up to 1:2000 for certain accounts, allowing traders to maximize their capital usage.

Mobile Trading: The Exness app is optimized for iOS and Android devices, providing traders with the flexibility to manage trades, monitor markets, and execute positions on the go.

Educational Resources: Exness offers webinars, tutorials, articles, and real-time analysis to help traders improve their skills and make informed trading decisions.

These features make Exness a robust and adaptable platform for Indian traders seeking a reliable app for online trading.

Legal Framework for Online Trading in India

Regulatory Bodies Governing Forex Trading

Forex trading in India is primarily regulated by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). The RBI oversees currency exchange regulations and controls capital flow to prevent excessive risks to the Indian economy. SEBI, on the other hand, governs securities and commodities trading to ensure fair practices and transparency within financial markets.

Both bodies work together to regulate forex trading activities, and Indian residents are permitted to trade only specific currency pairs, including USD/INR, EUR/INR, GBP/INR, and JPY/INR. For Indian residents, this means forex trading is restricted to INR-based pairs traded on authorized Indian exchanges, such as the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE).

Laws Affecting Online Trading Platforms in India

India’s foreign exchange laws, governed under the Foreign Exchange Management Act (FEMA), impose certain restrictions on forex trading. According to FEMA, Indian residents are prohibited from engaging in speculative forex trading that involves cross-currency pairs not paired with INR. This restriction is in place to control foreign currency exposure and to protect the stability of India’s economy.

As Exness is an international platform, the app provides access to many cross-currency pairs, such as EUR/USD, GBP/USD, and others that do not involve INR. This poses a legal challenge for Indian traders using the Exness app, as trading these pairs may fall outside the legal guidelines set by Indian authorities. Understanding these limitations is essential for Indian traders to ensure compliance with local laws.

Legitimacy of Exness in the Indian Market

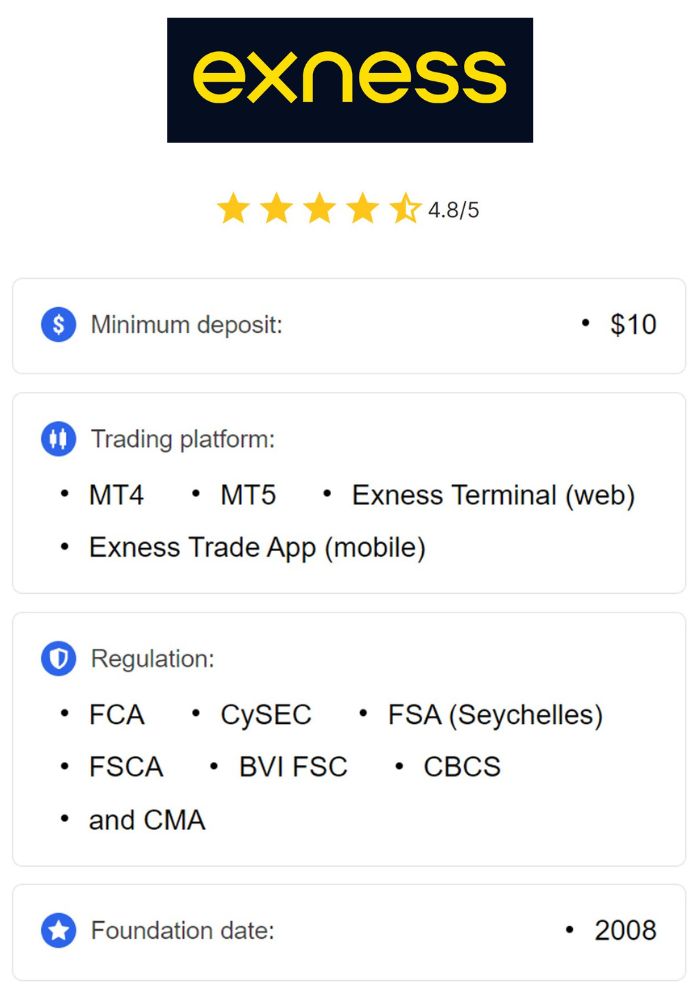

Licensing and Regulation of Exness

Exness operates under several regulatory licenses from prominent authorities, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Financial Sector Conduct Authority (FSCA) in South Africa. These licenses require Exness to maintain high standards of transparency, security, and client fund protection.

However, Exness is not directly regulated by SEBI or RBI, as it operates as an international broker. This means that while Exness is a legitimate broker globally, Indian authorities do not have jurisdiction over its activities. Indian traders who use the Exness app should be aware that they are trading with an offshore entity, which can affect the legality of certain trading activities within India’s regulatory framework.

Comparison with Other Forex Brokers in India

When compared to other brokers, Exness holds a unique position as a globally recognized platform with extensive regulatory oversight outside of India. Other brokers that specifically cater to Indian clients, such as Zerodha or Upstox, are regulated by SEBI and offer INR-based currency pairs on Indian exchanges, ensuring compliance with local laws. However, they often lack the diverse asset range, high leverage options, and advanced trading tools available on Exness.

For Indian traders who are willing to operate within certain limitations, Exness provides flexibility, competitive spreads, and the opportunity to trade in multiple asset classes that are not typically available through local brokers.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

User Experience with Exness in India

Accessibility of the Exness App

The Exness app is easily accessible in India, available for download on both Google Play Store and Apple App Store. The app is optimized for a smooth trading experience, allowing Indian users to manage their trades, monitor market trends, and deposit or withdraw funds with ease. Exness also supports multiple payment methods, including bank transfers, e-wallets, and credit/debit cards, making it convenient for Indian traders to fund their accounts.

Furthermore, the app’s user-friendly design and intuitive interface make it easy for beginners to navigate while providing advanced features for experienced traders. With customizable alerts, detailed charts, and quick execution, the Exness app offers a seamless experience for users in India.

Customer Support Services Offered

Exness provides 24/7 customer support, which is particularly beneficial for Indian traders who may require assistance at any time. The support team is accessible through live chat, email, and phone, ensuring prompt responses to queries and issues. Exness’s customer service has received positive feedback for being knowledgeable and efficient, providing reliable assistance in account setup, fund transfers, and technical support.

Additionally, Exness offers multilingual support, which includes English and other regional languages, making it easier for Indian traders to communicate effectively with the support team. This focus on customer support enhances the overall experience for users in India, contributing to the broker’s reputation for client satisfaction.

Financial Security and Safety Measures

Protection of Traders’ Funds

Exness adheres to strict protocols to ensure the safety of client funds. The broker follows segregation of client funds, meaning that traders’ deposits are kept separate from the company’s operating capital. This separation provides an added layer of protection, ensuring that client funds are safe even in the unlikely event of financial instability within the company.

Additionally, Exness offers negative balance protection, which prevents clients from losing more than their account balance. This feature is particularly valuable for Indian traders using high leverage, as it helps limit potential losses and provides financial security.

Data Security Protocols Implemented by Exness

In addition to fund protection, Exness employs advanced data security protocols to safeguard user information. The broker uses encryption technology to protect client data and ensure secure transactions. Exness also complies with global data protection standards, such as the General Data Protection Regulation (GDPR), which regulates data privacy and security.

Exness’s commitment to data security reassures Indian traders that their personal and financial information is protected from unauthorized access, enhancing trust in the platform.

Popularity of the Exness App Among Indian Traders

User Reviews and Feedback

The Exness app has gained popularity among Indian traders, with many users highlighting its low spreads, fast execution, and wide range of trading instruments. User reviews often praise the app’s intuitive design, which is suitable for both new and experienced traders, as well as the diverse asset options that allow users to diversify their portfolios.

Indian traders have also appreciated the convenience of local payment options and 24/7 customer support, which contribute to a positive experience on the platform. Many users find Exness’s educational resources, including tutorials and webinars, beneficial in building their trading knowledge and skills.

Advantages of Using Exness for Indian Traders

Competitive Trading Conditions: Exness offers low spreads and high leverage, which can enhance profitability for Indian traders.

User-Friendly Interface: The Exness app is designed for easy navigation, making it accessible for beginners.

Comprehensive Asset Range: Indian traders can access forex, commodities, stocks, and cryptocurrencies, providing opportunities to diversify.

Reliable Customer Support: Exness’s 24/7 support ensures Indian users have assistance whenever needed.

Challenges Faced by Exness in India

Regulatory Hurdles

One of the primary challenges Exness encounters in India is navigating the regulatory restrictions imposed on forex trading by Indian authorities. Under the Foreign Exchange Management Act (FEMA), Indian residents are limited to trading only specific currency pairs that involve the Indian Rupee (INR). These pairs include USD/INR, EUR/INR, GBP/INR, and JPY/INR, and they must be traded on regulated Indian exchanges such as the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE).

However, the Exness app offers a wide range of forex pairs, including cross-currency pairs like EUR/USD, GBP/USD, and AUD/JPY, which do not involve the INR. Engaging in cross-currency trading on foreign platforms like Exness is legally ambiguous under Indian law, as such trading falls outside the purview of SEBI or RBI authorization. This lack of local regulatory oversight can lead to legal concerns for Indian traders, especially regarding compliance with FEMA guidelines. As a result, traders should carefully consider these regulations and ensure they fully understand the legal implications before engaging in such activities on the Exness app.

Additionally, due to these restrictions, Exness cannot openly promote cross-currency trading within India, and Indian users are advised to consult legal counsel or financial advisors to fully understand the implications of trading cross-currency pairs on international platforms.

Competition from Local Brokers

Exness also faces stiff competition from local brokers in India, such as Zerodha, Upstox, and 5paisa, which are regulated by SEBI and authorized to operate within the country’s legal framework. These brokers primarily focus on INR-based currency pairs and Indian equities, fully complying with Indian regulations. Since they adhere to SEBI’s standards, they have a competitive advantage in terms of legal credibility, which is a significant factor for Indian traders who prioritize regulatory compliance.

Moreover, local brokers offer INR as a base currency, eliminating the need for currency conversion fees, which Exness does not currently support. This adds another layer of convenience for Indian traders who want to manage their accounts in their local currency and avoid additional costs. Although Exness offers a more extensive selection of global trading instruments and advanced trading platforms like MetaTrader, the legal legitimacy of local brokers and the ease of INR transactions give them an edge over Exness in the Indian market.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Tax Implications of Trading on Exness in India

Understanding Capital Gains Tax

For Indian residents trading on the Exness app, understanding tax obligations is crucial. Any profit earned through forex and CFD trading on the platform may be subject to capital gains tax in India. Depending on the holding period of assets, capital gains can be classified into short-term and long-term categories, with varying tax rates applicable to each.

Short-Term Capital Gains (STCG): If the holding period is less than 36 months, gains are categorized as short-term and are taxed according to the individual’s income tax slab rate.

Long-Term Capital Gains (LTCG): For holding periods over 36 months, long-term capital gains are subject to a lower tax rate. However, since forex trading typically involves frequent transactions, most gains are likely to fall under short-term capital gains.

Profits from derivatives or speculative transactions, such as those involving CFDs, are often taxed as business income. Indian traders are encouraged to consult a tax advisor to ensure compliance with tax laws and to accurately calculate any tax liability resulting from trading on Exness.

Reporting Requirements for Indian Traders

In addition to paying taxes on profits, Indian traders must adhere to reporting requirements when trading on platforms like Exness. Traders are required to disclose their trading activities and any income earned through forex trading on international platforms in their annual tax returns. Failure to report foreign income or disclose investments can lead to penalties under the Income Tax Act in India.

Furthermore, if Indian traders deposit large sums into their Exness accounts or withdraw substantial profits, they may be subject to reporting obligations under FEMA guidelines. Indian residents are expected to comply with both income tax regulations and foreign exchange reporting requirements, especially when dealing with international platforms that are not regulated locally.

Steps to Get Started with Exness in India

Creating an Account on the Exness App

For Indian traders interested in exploring Exness, the account creation process is straightforward. Here are the steps to get started:

Download the Exness App: The Exness app is available on Google Play Store and Apple App Store. Download and install the app on your mobile device to begin.

Register Your Account: Open the app and complete the registration process by providing basic information, such as your name, email address, and contact number.

Verify Your Identity: Exness requires identity verification to comply with international regulations. Indian traders can verify their identity by uploading government-issued documents like an Aadhaar card, passport, or PAN card.

Choose an Account Type: Exness offers multiple account options, including Standard, Raw Spread, and Zero accounts. Beginners can start with the Standard account, which has low minimum deposit requirements and commission-free trading.

Set Up Security Features: Exness provides various security features, including two-factor authentication (2FA), to protect user accounts. Enable 2FA to secure your account and enhance protection.

Once these steps are completed, Indian traders can access the trading dashboard, explore available markets, and begin trading on Exness.

Funding Your Exness Trading Account

After setting up an account, Indian traders can fund their Exness trading accounts to start trading. Exness supports multiple payment methods, including:

Bank Transfers: Exness allows users to deposit funds via local bank transfers, providing convenience for traders in India.

E-Wallets: Popular e-wallets like Skrill and Neteller are available, which offer fast processing times and secure transactions.

Credit and Debit Cards: Exness accepts major credit and debit cards, including Visa and Mastercard, making it easy to add funds.

Deposits are typically processed instantly or within a few hours, depending on the payment method chosen. Withdrawal times may vary, with some methods offering same-day processing. Exness charges minimal fees on deposits and withdrawals, though third-party providers may apply transaction fees, especially for currency conversions from INR to supported base currencies.

Conclusion on the Legality of Exness in India

The Exness app offers Indian traders a wide array of trading instruments, user-friendly platforms, and competitive trading conditions, making it a popular choice in the global trading community. While Exness holds licenses from reputable regulatory authorities like the FCA, CySEC, and FSCA, it is not directly regulated by SEBI or RBI, which means it operates outside the purview of Indian financial authorities.

Indian traders should understand that while Exness is a legitimate and internationally regulated broker, its legality within the Indian context is nuanced. Due to FEMA restrictions, Indian residents are limited to trading INR-based pairs on locally regulated exchanges. Trading cross-currency pairs on platforms like Exness may fall into a legal gray area, so traders must weigh the potential risks and take necessary precautions.

For those willing to navigate these challenges, Exness provides a range of advantages, including low spreads, advanced trading tools, and round-the-clock customer support. However, traders must also consider tax obligations, reporting requirements, and compliance with local laws. Consulting with financial and legal advisors can provide further clarity, ensuring that traders make informed decisions.

As India’s regulatory environment for forex trading evolves, Indian traders must stay updated on any changes that may impact their ability to trade on international platforms. Exness remains a viable option for Indian traders, offering global access and security, yet the responsibility of staying compliant lies with the traders themselves.

Read more: