12 minute read

Is Exness Regulated by Sebi? Review Broker

Introduction to Exness

Overview of Exness as a Forex Broker

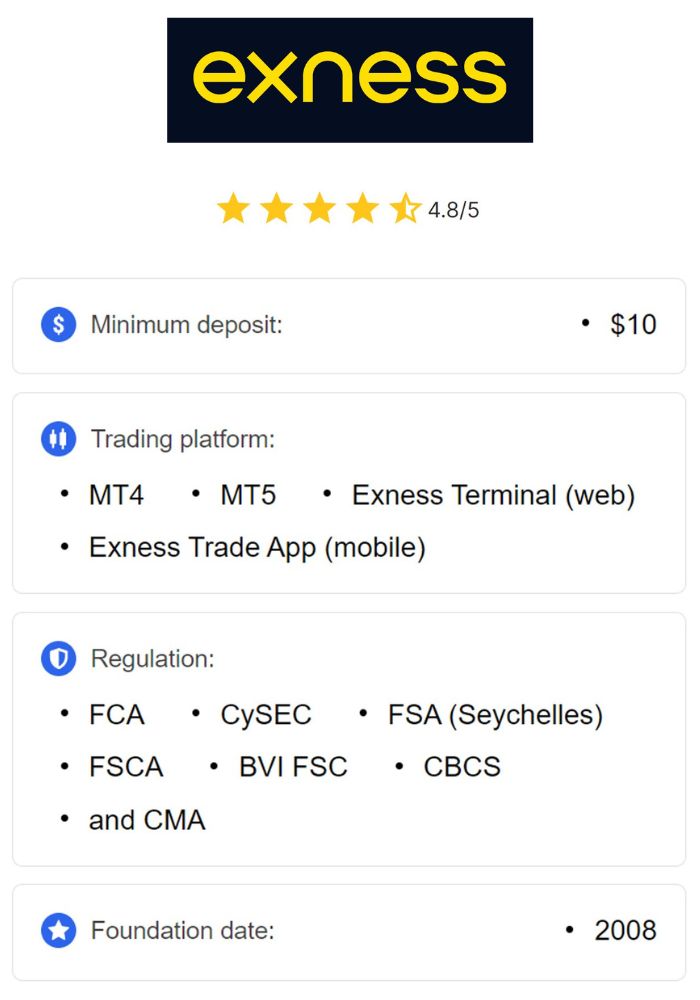

Exness is a globally recognized forex and CFD broker, established in 2008, that provides a wide range of financial instruments, including currency pairs, commodities, indices, and cryptocurrencies. Known for its competitive pricing, user-friendly trading platforms, and commitment to transparency, Exness has gained the trust of millions of traders worldwide. With advanced tools, accessible services, and a robust infrastructure, Exness caters to both novice and professional traders across multiple regions.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Operating with a high standard of transparency and reliability, Exness is committed to maintaining security for client funds and providing high-quality customer service. Exness’s approach is heavily focused on compliance with international standards, and the broker is regulated by several well-respected global financial authorities.

History and Growth of Exness

Since its founding, Exness has expanded rapidly, evolving into one of the largest brokers in the world. Exness’s growth can be attributed to its focus on providing a transparent and regulated trading environment, high leverage options, tight spreads, and advanced trading platforms like MetaTrader 4 and MetaTrader 5. The broker has also introduced unique features, such as negative balance protection, risk management tools, and comprehensive educational resources, making it a popular choice among traders globally.

Exness has a reputation for adopting cutting-edge technology, offering real-time market data, and supporting traders with 24/7 customer service. This growth and commitment to quality have positioned Exness as a significant player in the forex industry.

Understanding Regulation in Financial Markets

Definition of Financial Regulation

Financial regulation refers to the oversight of financial institutions by regulatory authorities to ensure market stability, transparency, and the protection of investors. Regulatory bodies set standards for brokers, banks, and other financial firms, enforcing rules that govern their operations. These standards include requirements for fund segregation, capital adequacy, and transparent reporting.

For brokers, compliance with financial regulation is essential to operate legally and build trust among clients. Regulated brokers are held accountable by authorities and must adhere to strict guidelines that safeguard traders’ interests and promote fair trading practices.

Importance of Regulation for Traders and Brokers

Regulation is crucial for maintaining the integrity of financial markets. For traders, choosing a regulated broker means trading in a safer environment where funds are protected, and there is recourse in case of disputes. Regulated brokers are required to keep client funds separate from their operational funds, undergo regular audits, and provide transparent information about fees and trading conditions.

For brokers, regulation enhances credibility, attracting more clients who seek secure and transparent trading conditions. Regulated brokers, like Exness, follow standards designed to prevent fraud, mismanagement, and manipulation, creating a trustworthy environment for traders.

The Role of SEBI in India

Overview of the Securities and Exchange Board of India (SEBI)

The Securities and Exchange Board of India (SEBI) is India’s primary regulatory authority for the securities and financial markets. Established in 1988 and granted statutory powers in 1992, SEBI is responsible for regulating and promoting fair practices in the Indian securities market. Its main objective is to protect investor interests, maintain transparency, and ensure that financial markets operate in a secure and stable manner.

SEBI oversees a broad range of entities, including stock exchanges, investment firms, asset management companies, and brokers operating within India. It enforces strict guidelines to promote investor confidence and mitigate risks associated with fraudulent practices and market manipulation.

Functions and Responsibilities of SEBI

SEBI’s primary responsibilities include:

Protecting Investors: SEBI ensures investor protection by enforcing regulations on disclosure, fraud prevention, and fair trading practices.

Regulating Market Participants: SEBI sets standards for brokers, asset managers, and other financial entities to ensure that they operate transparently and ethically.

Promoting Market Development: By introducing new products and fostering innovation, SEBI contributes to the growth of the financial market in India.

Monitoring and Enforcement: SEBI has the authority to investigate, penalize, and suspend entities that violate regulations, helping maintain market integrity.

Through these responsibilities, SEBI aims to create a stable financial market environment that benefits both investors and financial institutions.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Current Regulatory Status of Exness

Global Regulatory Bodies Overseeing Exness

Exness is regulated by several well-known global regulatory authorities, which oversee its operations and ensure compliance with international standards. Key regulators include:

Financial Conduct Authority (FCA): Based in the UK, the FCA is one of the most respected regulatory authorities. It enforces stringent rules on transparency, client fund protection, and operational ethics.

Cyprus Securities and Exchange Commission (CySEC): CySEC regulates Exness’s European operations, ensuring that the broker follows European Union financial laws, including the protection of client funds and transparent trading practices.

Financial Sector Conduct Authority (FSCA): In South Africa, Exness is regulated by the FSCA, providing assurance to African clients of compliance with local financial standards.

These global regulators require Exness to maintain strict financial standards, such as segregating client funds, performing regular audits, and ensuring fair trading practices. However, Exness is not regulated by SEBI in India, as it does not have a local license to operate within Indian jurisdiction directly.

Specific Regulatory Framework for Exness

Exness operates under a regulatory framework designed to protect clients and uphold international financial standards. This framework includes:

Client Fund Segregation: Exness keeps client funds in separate accounts, protecting them from operational risks.

Negative Balance Protection: Traders on Exness cannot lose more than their account balance, a key risk management feature.

Regular Audits: Exness undergoes frequent audits by third parties to ensure compliance with financial regulations.

These standards contribute to Exness’s reputation as a reliable broker globally, even though it lacks specific regulation under SEBI in India.

Is Exness Regulated by SEBI?

Direct Response to the Question

No, Exness is not regulated by the Securities and Exchange Board of India (SEBI). SEBI, as India’s primary financial regulatory authority, oversees the activities of financial institutions operating within India. Since Exness is an international broker regulated by global authorities like the Financial Conduct Authority (FCA) in the UK, Cyprus Securities and Exchange Commission (CySEC), and the Financial Sector Conduct Authority (FSCA) in South Africa, it does not hold a specific SEBI license. This means that while Exness adheres to rigorous international standards of financial security and transparency, it does not fall under SEBI’s regulatory framework within India.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Reasons for Lack of SEBI Regulation

The absence of SEBI regulation for Exness can be attributed to several key factors:

India’s Forex Trading Regulations: SEBI imposes strict guidelines regarding forex trading in India, particularly when it involves foreign currency pairs that do not include the Indian Rupee (INR). Indian regulations limit the trading of forex pairs to those involving INR (such as USD/INR, EUR/INR) on recognized Indian exchanges, which restricts international brokers from offering their full range of forex products directly to Indian residents.

Exness’s International Operations: Exness primarily operates as a global broker, serving clients in multiple regions under various international regulatory authorities. Its business model does not focus on obtaining specific licenses in every individual country. Instead, Exness relies on established global licenses, which cover its operations across various jurisdictions and ensure compliance with high international standards.

SEBI’s Focus on Domestic Brokers: SEBI regulates brokers within India that offer trading services primarily in INR-denominated assets or that comply with India’s regulatory requirements. As Exness offers a broader range of international financial instruments, including forex pairs that do not involve INR, it is not registered with SEBI and is not bound by its jurisdiction.

For these reasons, Exness remains unregulated by SEBI, though it continues to operate under trusted international regulatory bodies, providing traders with a regulated and transparent environment.

Implications of Exness Not Being Regulated by SEBI

Impact on Indian Traders

The lack of SEBI regulation for Exness has specific implications for Indian traders considering using the platform:

Limited Regulatory Recourse: Since SEBI does not regulate Exness, Indian traders have limited options for legal recourse through Indian authorities if disputes arise. SEBI cannot intervene in issues involving Exness as it lacks jurisdiction over international brokers.

Currency Transfer Restrictions: Indian forex regulations, overseen by the Reserve Bank of India (RBI) and SEBI, impose restrictions on fund transfers related to forex trading, particularly involving international brokers. This could affect Indian traders’ ability to deposit and withdraw funds on platforms not regulated by SEBI.

Increased Due Diligence: Without SEBI oversight, Indian traders may need to exercise additional caution and perform due diligence when trading with Exness. This includes verifying Exness’s licenses with global authorities like the FCA and CySEC, which regulate the broker’s operations in other regions.

Risks Involved in Trading with Unregulated Brokers

While Exness is regulated by reputable international bodies, trading with a broker not regulated by SEBI presents certain risks for Indian traders:

No Local Investor Protection: SEBI-regulated brokers are required to adhere to investor protection measures specific to Indian traders, such as capital requirements and transparent fund handling. Exness, though regulated internationally, may not provide the same level of protection tailored to Indian market conditions.

Regulatory Uncertainty: Changes in India’s regulatory landscape could impact the accessibility of foreign forex brokers. Indian traders using Exness should stay informed about evolving policies to ensure compliance with local regulations.

Potential for Delayed Resolution: In cases of disputes with unregulated brokers, resolution processes may take longer and may require international legal procedures, which can be more complex than those handled by SEBI within India.

For these reasons, Indian traders should be aware of the implications of choosing a broker not regulated by SEBI and consider the potential impact on their trading experience.

Comparison with Other Forex Brokers

Regulation of Leading Forex Brokers in India

In India, SEBI regulates brokers that provide forex trading services on currency pairs involving the INR. These SEBI-regulated brokers offer limited forex options (such as USD/INR, EUR/INR) but ensure a high level of security and legal recourse for Indian traders. Some leading SEBI-regulated brokers include:

Zerodha: A popular Indian brokerage known for its comprehensive trading services, including limited forex options that comply with SEBI’s regulations.

Angel Broking: Offers a range of trading options, including SEBI-compliant forex pairs, making it a secure option for Indian traders.

ICICI Direct: Provides forex services within the regulatory framework set by SEBI, ensuring compliance with Indian financial laws.

These SEBI-regulated brokers provide a level of security that aligns with India’s regulatory standards but may offer fewer forex options compared to international brokers like Exness.

Advantages of Choosing a Regulated Broker

Choosing a SEBI-regulated broker offers several benefits for Indian traders:

Enhanced Security: SEBI-regulated brokers adhere to strict standards, including fund segregation and capital adequacy, protecting client funds.

Legal Recourse: If disputes arise, Indian traders have access to SEBI’s dispute resolution channels, providing an added layer of protection.

Compliance with Local Regulations: SEBI-regulated brokers operate within the legal framework of India, reducing the risk of regulatory challenges and ensuring smoother transactions.

These advantages make SEBI-regulated brokers an appealing choice for traders seeking security and compliance within India, though they may face limitations in available trading instruments compared to international brokers.

How to Verify a Broker's Regulation

Steps to Check Regulatory Status

To verify the regulatory status of any broker, including Exness, follow these steps:

Visit the Broker’s Website: Most regulated brokers, like Exness, display their licenses and regulatory information on their website, typically in sections like “About Us” or “Legal Information.”

Check Regulatory Authority Websites: Visit the official websites of the regulatory bodies (such as FCA, CySEC, FSCA) to confirm the broker’s license details. Exness provides its license numbers, which you can verify on these regulatory sites.

Look for Registration Numbers: Compare the license or registration number displayed on the broker’s website with the information available on the regulatory authority’s website to ensure authenticity.

Importance of Due Diligence Before Trading

Conducting due diligence before trading with a broker, especially one not regulated by SEBI, is essential. This process includes verifying licenses, reading user reviews, and understanding the broker’s regulatory standing. By performing thorough checks, traders can reduce the risk of falling victim to fraudulent or unreliable brokers and ensure a safer trading experience.

Due diligence is particularly important for Indian traders using international brokers like Exness, as it provides reassurance regarding the broker’s commitment to transparency and ethical practices.

Alternatives for Indian Traders

Regulated Forex Brokers Available in India

For Indian traders who prefer to trade within the scope of SEBI regulations, several domestic brokers offer forex trading options that comply with Indian laws. Some popular alternatives include:

Zerodha: Known for its secure trading environment and user-friendly platform, Zerodha offers forex trading on INR pairs, making it a regulated and reliable option.

ICICI Direct: This brokerage provides SEBI-compliant forex trading along with a broad range of financial products, ensuring a safe trading environment.

HDFC Securities: HDFC Securities offers forex trading services within SEBI’s regulatory framework, allowing Indian traders to access currency trading with local legal protections.

These brokers ensure compliance with SEBI guidelines, providing a secure environment for Indian traders who prioritize regulatory oversight.

Criteria for Selecting a Reliable Broker

When choosing a broker, Indian traders should consider the following criteria:

Regulatory Compliance: Prefer brokers regulated by SEBI or other trusted global authorities.

Fund Security: Ensure the broker uses fund segregation to protect client deposits.

Customer Support: Look for brokers with responsive customer service that can assist with account management, trading issues, and dispute resolution.

Transparent Fees and Costs: Choose brokers that offer clear and upfront information about fees, commissions, and spreads.

Selecting a broker based on these criteria helps Indian traders make informed decisions, ensuring a secure and reliable trading experience.

Conclusion

While Exness is not regulated by SEBI, it operates under several respected international regulatory bodies, including the FCA, CySEC, and FSCA. This provides assurance of high standards of transparency and security, although Indian traders may need to exercise additional caution when trading with an international broker not regulated by SEBI.

For Indian traders, choosing a SEBI-regulated broker offers enhanced legal protections and compliance with local regulations. However, for those who seek broader forex options and international trading conditions, Exness remains a viable option, given its robust global regulatory standing.

Understanding the regulatory framework, assessing potential risks, and conducting due diligence are essential steps for Indian traders. By evaluating their needs and preferences, Indian traders can make informed choices that align with their trading goals and ensure a secure and regulated trading experience, whether through Exness or a SEBI-regulated alternative.

Read more: