8 minute read

Exness vs Deriv Comparison: Which is better?

When it comes to trading in the financial markets, choosing the right broker can significantly impact your success. Among the many options available, Exness vs Deriv Comparison: Which is better? emerges as a crucial question for traders looking to optimize their trading experience. Both brokers offer unique features and services tailored to different traders' needs. In this article, we will conduct an in-depth analysis of Exness vs Deriv, examining various aspects such as account types, trading platforms, fees, customer support, and more. By the end, you should have a clearer understanding of which broker might suit your trading style and preferences.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Overview of Exness vs Deriv

Understanding what each broker offers is vital in determining which one is better suited for individual traders. This section provides an overview of both Exness vs Deriv, including their backgrounds and core values.

Exness: A Comprehensive Introduction

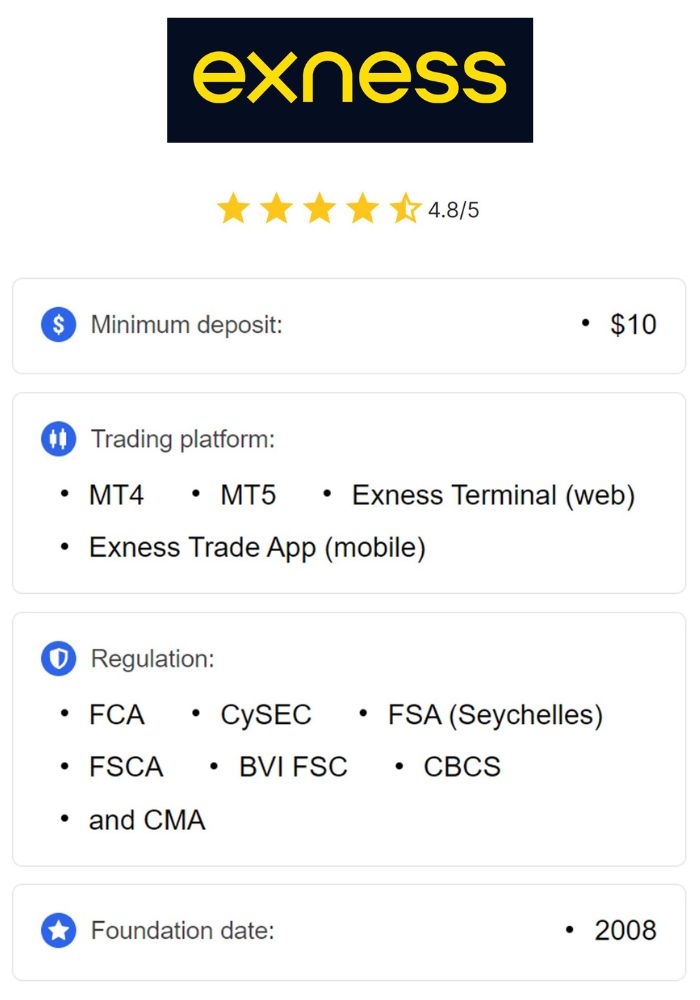

Exness was founded in 2008 and has since grown into a reputable global broker known for its user-friendly interface and robust trading conditions.

The company focuses on providing a transparent trading environment with competitive spreads, no restrictions on trading strategies, and rapid order execution. Its regulatory compliance ensures that clients’ funds are well-protected, contributing to its reputation as a reliable broker.

One of the standout features of Exness is its commitment to client education. The broker offers numerous educational resources, webinars, and market analysis, making it easier for novice traders to navigate the complexities of the financial markets.

Deriv: An Insight into Its Operations

Deriv, established in 1999 under the brand name Binary.com, has evolved into a prominent online trading platform providing a wide range of financial instruments. It offers a diverse selection of trading options, including binary options, CFDs, and forex.

Known for its innovative trading technology, Deriv continuously updates its offerings to meet the changing needs of traders. Their platforms, such as DTrader, DBot, and DMarket, provide flexibility and accessibility, catering to both beginner and experienced traders.

Additionally, Deriv emphasizes the importance of security and regulation, ensuring that clients have peace of mind while trading. They offer varied account types to accommodate different trading styles and risk appetites.

Account Types and Trading Conditions

The choice of account type can greatly influence a trader's experience, especially regarding leverage, spreads, and available instruments. Here we delve into the account offerings from both Exness vs Deriv, helping you to assess which may be a better fit.

Exness Account Offerings

Exness provides several types of trading accounts designed to cater to various trading experience levels and objectives.

At Exness, traders can choose between multiple account types, including Standard, Pro, and Zero accounts. Each account type varies in terms of minimum deposit, spread, and commission structure.

For instance, the Standard account offers fixed spreads and is ideal for beginners looking for simplicity and ease of use. On the other hand, the Pro account caters to more experienced traders who require tighter spreads and faster execution. The Zero account stands out by offering spreads as low as zero pips but involves a small commission per trade.

Furthermore, Exness allows traders to open accounts in multiple base currencies, enhancing flexibility and reducing conversion fees.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Deriv Account Structures

Deriv also presents several account types, each tailored to accommodate different trading styles and preferences.

With options like the Derived account and the Smart account, traders can select the most suitable structure based on their experience. The Derived account facilitates binary options trading, whereas the Smart account is geared towards CFD trading.

A notable feature of Deriv is its ability to allow traders to switch between accounts seamlessly, enabling them to adjust their trading strategies without having to create new profiles.

In practice, each account type at Deriv offers varying levels of risk exposure, margin requirements, and asset availability, allowing traders to find a personalized approach to their trading journey.

Trading Platforms and Tools

The platform used for trading can significantly affect performance, as it serves as the gateway to the financial markets. In this section, we'll explore the trading platforms offered by Exness vs Deriv, assessing their features and usability.

Exness Trading Platforms

Exness supports multiple trading platforms, catering to various trader preferences and styles.

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are the flagship platforms offered by Exness. Widely recognized in the industry, these platforms offer extensive functionalities, including advanced charting tools, technical indicators, and automated trading capabilities through Expert Advisors.

Moreover, Exness provides a web-based trading platform, allowing users to access their accounts without downloading software. This is particularly beneficial for traders who prefer flexibility and convenience.

Mobile trading apps further enhance accessibility, letting traders monitor their positions and make trades on-the-go. With a focus on user experience, Exness ensures that its platforms are intuitive and easy to navigate.

Deriv Trading Solutions

Deriv excels in offering a diverse range of trading platforms, each designed for specific trading styles and instruments.

The DTrader platform is user-friendly and particularly suited for newcomers to the trading world. It encompasses various trading options, including forex, cryptocurrencies, and indices, enabling traders to quickly adapt and explore different markets.

DBot is another innovative offering from Deriv, allowing traders to automate their trading strategies. By utilizing bots, traders can execute trades based on predetermined criteria, promoting efficiency and eliminating emotional decision-making.

For those interested in the derivatives market, the DMT5 platform, a modified version of MT5, offers comprehensive tools for analysis and trading. It grants access to a wide range of assets, promoting diversification across portfolios.

Ultimately, the versatility of Deriv's platforms appeals to traders seeking customization and distinct trading experiences.

Fees and Commissions

Fees and commissions can eat into a trader's profits, so it's essential to understand the cost structures associated with each broker. This section compares the fee structures of Exness vs Deriv, offering insights into their competitiveness.

Exness Fee Structure

Exness prides itself on transparency in its fee structure, presenting its pricing clearly to avoid hidden charges.

The broker typically offers tight spreads, favoring those traders who actively engage in high-frequency trading. Variable spreads are available, depending on the account type selected. Notably, the Zero account provides the advantage of zero spreads but incurs a commission per trade.

Moreover, Exness does not charge withdrawal fees, which is often a concern for traders. However, it’s important to be aware of potential charges imposed by payment processors, depending on the chosen withdrawal method.

Another attractive feature is the absence of inactivity fees, allowing traders to maintain accounts without the pressure of being penalized for periods of inactivity.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Deriv Fees and Charges

Deriv adopts a similarly transparent approach to its fee structure, offering competitive prices across its various account types.

Traders can expect spread-based pricing, which varies according to the asset class and account type. Importantly, Deriv does not impose withdrawal fees either, although, like Exness, users should stay informed about any charges levied by payment providers.

Additionally, Deriv does not enforce inactivity fees, providing a flexible trading environment for users who may not trade consistently.

In conclusion, both brokers offer competitive fee structures, making either option viable for cost-conscious traders.

Customer Support and Education

Effective support can make a significant difference in a trader's overall experience, especially for those who are still learning the ropes. This section discusses the customer support services and educational resources offered by Exness vs Deriv.

Exness Customer Service and Learning Resources

Exness takes customer support seriously and provides multiple channels for traders to reach out. Users can contact support via live chat, email, or phone, with responses typically prompt and helpful.

The knowledge base available on the Exness website contains a wealth of information, ranging from basic operational guides to more advanced trading strategies. Furthermore, the presence of webinars and tutorial videos enhances the learning experience, equipping traders with the skills necessary for success.

Exness goes the extra mile by hosting regular educational events, fostering a sense of community among traders and encouraging collaboration and knowledge-sharing.

Deriv Support Services and Educational Tools

Similarly, Deriv offers comprehensive customer support, with representatives available through live chat, email, and telephone. The efficiency and responsiveness of their support team have earned praise from users, contributing to positive trading experiences.

Educational resources on the Deriv platform include articles, tutorials, and webinars covering a variety of topics. The emphasis on ongoing education highlights Deriv's commitment to empowering traders along their journey.

Deriv also hosts trading competitions and forums, creating opportunities for traders to connect, learn from one another, and share insights, enriching their overall trading experience.

Conclusion

In summary, the Exness vs Deriv Comparison: Which is better? ultimately depends on individual trading needs and preferences.

Exness excels with its transparent fee structures, user-friendly platforms, and dedication to client education. It is particularly appealing to retail traders seeking a supportive environment to develop their trading skills.

On the other hand, Deriv stands out with its innovative trading platforms, diverse account offerings, and strong customer support. The flexibility provided by its range of trading options makes it an excellent choice for both novices and seasoned traders alike.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Both brokers offer unique advantages, and potential traders should evaluate their goals and preferences before making a final decision. Regardless of which broker you choose, conducting thorough research, staying informed, and continually improving your trading skills will pave the way for success in the financial markets.

Read more: