17 minute read

Exness vs Pepperstone Compared: Which is better?

from Exness

by Exness Blog

In the quest for the ideal online trading platform, many traders often find themselves asking, "Exness vs Pepperstone compared: which is better?" Both brokers have built a solid reputation in the trading community, but their features and offerings can vary significantly. This article aims to provide an in-depth comparison of these two platforms, covering everything from regulation and safety to fees and customer support.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Introduction to Online Trading Platforms

The digital landscape has transformed the way we engage with financial markets, creating a plethora of opportunities for individual investors. Online trading platforms like Exness vs Pepperstone serve as gateways to global markets, enabling traders to buy and sell various assets with ease. However, the sheer number of available options can overwhelm new and experienced traders alike. Therefore, it becomes crucial to evaluate the strengths and weaknesses of each broker to make an informed decision that aligns with your trading style and objectives.

In this comprehensive analysis, we will explore the key aspects of both Exness vs Pepperstone, comparing features such as account types, trading instruments, costs, leverage, platforms, and customer support. By the end of this article, you should have a clearer understanding of which platform could be more suitable for your trading needs.

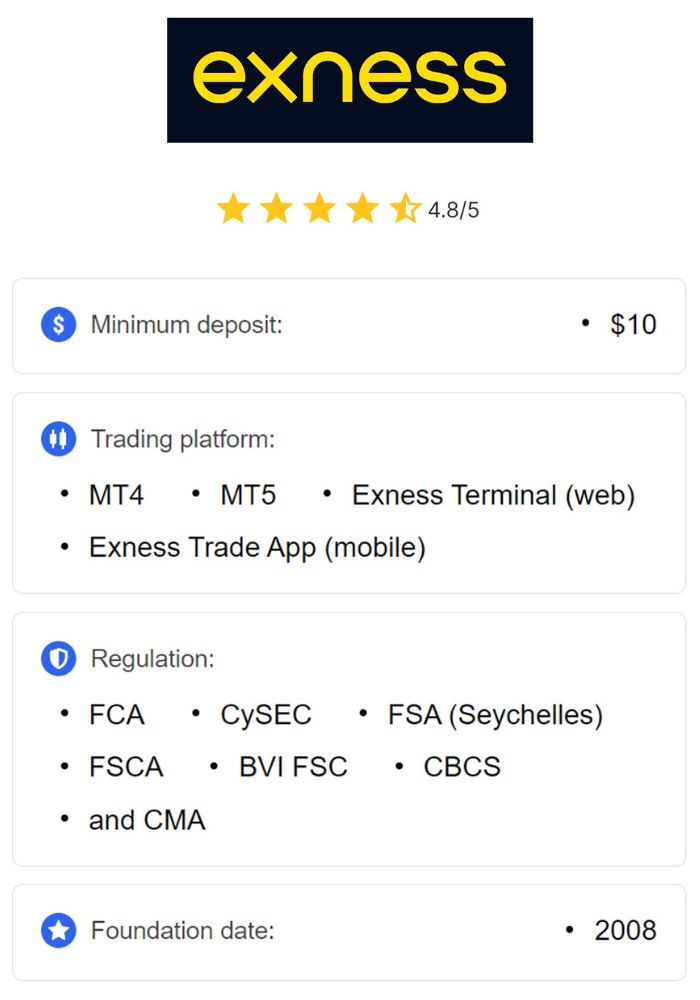

Overview of Exness

Founded in 2008, Exness has rapidly grown to become one of the most popular brokerage firms globally. The broker is well-known for its competitive trading conditions, which include tight spreads, high execution speeds, and an extensive array of trading instruments.

Exness focuses on catering to a diverse clientele, ranging from novice traders to seasoned professionals. Their user-friendly interface, educational materials, and account types make it easy for anyone to start trading. With a dedicated emphasis on client satisfaction, Exness has managed to establish a strong global presence, attracting a diverse client base.

Overview of Pepperstone

Established in 2010, Pepperstone has made a name for itself in the online trading space, particularly appealing to experienced traders. Known for its reliability and superior execution quality, the broker offers a wide range of trading instruments, including Forex, CFDs, commodities, and indices.

Pepperstone's commitment to providing an exceptional trading experience has earned it a loyal following among active traders. The platform emphasizes transparency and efficiency, making it an attractive option for anyone looking to optimize their trading strategies.

Regulation and Safety

When considering any online broker, ensuring the safety of your funds is paramount. Regulatory oversight provides assurance that a broker operates within established guidelines designed to protect traders. In this section, we will examine the regulatory frameworks governing both Exness vs Pepperstone, as well as compare their safety features.

Regulatory Bodies for Exness

Exness operates under multiple reputable regulatory bodies, which enhances trust among its users. The primary regulators overseeing Exness include:

CySEC (Cyprus Securities and Exchange Commission): Licensed under license number 178/12.

FCA (Financial Conduct Authority): Regulated under FCA register number 730729.

FSC (Financial Services Commission) of Mauritius: Licensed under license number GB20025731.

This multi-regulatory approach indicates Exness's dedication to compliance, ensuring that they adhere to stringent financial practices and uphold client protection protocols.

Regulatory Bodies for Pepperstone

Pepperstone is also regulated by several notable authorities, providing traders with additional layers of security. These include:

FCA (Financial Conduct Authority): Registered under FCA register number 544511.

ASIC (Australian Securities and Investments Commission): Licensed under ASIC license number 392866.

FSA (Financial Services Authority) of Seychelles: Licensed under FSA register number SD028.

Similar to Exness, Pepperstone’s comprehensive regulatory framework reflects its commitment to maintaining transparency and safeguarding client funds.

Comparison of Safety Features

Both Exness vs Pepperstone exhibit a strong commitment to ensuring client safety through their respective regulatory frameworks. Key safety features include:

Segregated Accounts: Both brokers utilize segregated accounts for client funds, ensuring that client money is kept separate from the broker's operational funds. This minimizes the risk of loss in the event of insolvency.

Negative Balance Protection: Both platforms offer negative balance protection, safeguarding clients from incurring debt beyond their initial investment, even during volatile market conditions.

Two-Factor Authentication (2FA): Exness offers an optional advanced security feature known as Two-Factor Authentication, requiring a generated code in addition to the password for account access. This extra layer of security is a beneficial option for those concerned with protecting their accounts.

Overall, both Exness vs Pepperstone present robust measures to ensure client safety, giving traders peace of mind when choosing either platform.

Account Types Offered

A diverse selection of account types is essential for accommodating different trading styles and levels of experience. Understanding the accounts offered by Exness vs Pepperstone can help you choose the one that best suits your needs.

Exness Account Types

Exness offers an impressive variety of account types tailored to accommodate diverse trader preferences. Some key account types include:

Standard Account: Provides competitive spreads and a flexible trading environment suitable for both beginners and experienced traders.

Cent Account: Designed for novices or those who prefer trading with smaller amounts. This account type uses the cent currency, allowing traders to practice and gain experience with minimal risk.

Raw Spread Account: Geared towards professional traders, this account type prioritizes ultra-low spreads and grants access to a high level of market transparency. A commission fee applies per lot traded.

Pro Account: Similar to the Raw Spread account, the Pro account is intended for experienced traders seeking superior execution speed and ultra-tight spreads.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Pepperstone Account Types

Pepperstone offers a simpler yet effective selection of account types, which includes:

Standard Account: Encompasses necessary features for most retail traders, offering competitive spreads and prompt execution.

Razor Account: Specifically designed for traders who prioritize tight spreads and faster execution. This account type involves a commission fee per lot and is especially favored by scalpers and high-frequency traders.

Which Account Type Suits Your Needs?

Choosing the right account type depends on your trading experience and strategy. For beginners, Exness's Cent Account shines as it allows them to trade small amounts while honing their skills. On the other hand, experienced traders looking for the best possible pricing and execution speed may find success with either Pepperstone's Razor account or Exness's Raw Spread or Pro accounts.

Ultimately, the decision will hinge on your specific trading strategy, frequency of trading, and preference for raw pricing versus wider spreads without added commissions.

Trading Instruments

The range of available trading instruments is crucial when selecting a broker. Let’s delve into what Exness vs Pepperstone bring to the table in terms of trading assets.

Available Forex Pairs

Both Exness vs Pepperstone provide extensive access to Forex markets, offering a plethora of currency pairs suitable for diverse trading strategies.

Major Forex Pairs: Commonly traded pairs like EUR/USD, GBP/USD, and USD/JPY are available on both platforms, typically characterized by competitive spreads.

Minor Forex Pairs: Traders can also access pairs not involving the US Dollar, such as EUR/GBP and AUD/JPY, further diversifying their trading choices.

Exotic Forex Pairs: Less frequently traded currency pairs associated with emerging markets, such as USD/MXN and USD/ZAR, are available, particularly on Exness.

CFDs and Other Assets

Beyond Forex, both brokers offer a broad spectrum of asset classes through CFDs (Contracts for Difference), enabling traders to capitalize on various market movements:

Indices: Access to global stock indices like the Dow Jones, FTSE 100, and DAX allows traders to profit from broader market trends.

Commodities: Popular commodities like Gold, Silver, Oil, and Natural Gas can be traded, providing opportunities for diversification and risk management.

Metals and Energies: Both platforms facilitate trading on precious metals and energy sources, allowing traders to engage in different sectors of the economy.

Cryptocurrencies: A growing interest in cryptocurrencies has led both brokers to offer trading on popular digital currencies like Bitcoin, Ethereum, and Litecoin.

While both brokers provide a similar range of trading instruments, Exness stands out for its diverse array of Forex pairs, including some exotic options that may not be as readily available elsewhere. Conversely, Pepperstone excels in providing tools and resources that cater specifically to active, experienced traders.

Trading Costs and Fees

Understanding the cost of trading is vital for maximizing profitability. Let’s break down the trading costs associated with Exness vs Pepperstone, focusing on spreads, commission structures, and other related fees.

Spreads Comparison

Spreads represent the difference between the bid and ask prices of a particular asset, acting as a significant factor in trading costs.

Exness: Generally offers very competitive spreads, especially in the Raw Spread and Pro accounts. Even the Standard account provides attractive spreads, ensuring appeal for traders at all experience levels.

Pepperstone: Similarly, Pepperstone showcases extremely competitive spreads, particularly for traders utilizing the Razor account. Its Standard account also offers favorable spreads suitable for various trading styles.

It's important to note that the specific spreads may vary depending on the asset being traded and prevailing market liquidity conditions.

Commission Structures

Commission structures vary between the accounts on both platforms:

Exness: While the Standard and Cent accounts do not involve explicit commission fees, the Raw Spread and Pro accounts incorporate a commission charge per lot traded.

Pepperstone: The Razor account similarly entails a commission per lot traded, while the Standard account does not involve any additional commission fees.

Other Associated Fees

Both brokers may implement various fees that traders should be aware of:

Inactivity Fees: Applicable for accounts that remain dormant over extended periods.

Withdrawal Fees: Fees may apply when withdrawing funds from your trading account, varying based on withdrawal method.

Overnight Swap Fees: When holding positions overnight, traders may incur fees due to interest rate differences between the two currencies involved in the pair.

Conversion Fees: If your trading account and deposit method use different currencies, conversion fees may apply.

It is advisable to consult the specific fee schedules provided by each broker before opening an account, ensuring a clear understanding of all applicable charges.

Leverage Options

Leverage can significantly amplify trading potential but also brings inherent risks. Let's explore the leverage options available at Exness vs Pepperstone.

Leverage Availability at Exness

Exness offers attractive leverage ratios, allowing traders to enhance their positions significantly. The maximum leverage can reach up to 1:2000, depending on the account type and asset class. This flexibility enables traders to control larger positions while committing only a portion of their capital.

Leverage Availability at Pepperstone

Pepperstone also provides competitive leverage options, generally offering up to 1:500 on Forex trading. Like Exness, the exact leverage available may vary based on the account type and the specific trading instrument.

Risks and Benefits of High Leverage

While high leverage can enhance profitability, it's essential to recognize the associated risks. Increased leverage magnifies both profits and losses, demanding disciplined risk management practices. Traders must carefully consider their risk tolerance and employ effective strategies to mitigate potential downsides.

Trading Platforms and Tools

The trading platform's functionality and usability can greatly influence a trader's experience. In this section, we will examine the features of the trading platforms offered by Exness vs Pepperstone.

Exness Trading Platform Features

Exness provides users with a robust trading platform featuring:

MetaTrader 4 & 5: Both platforms are widely recognized for their advanced charting capabilities, customizable indicators, and automated trading options.

User-Friendly Interface: The platform boasts an intuitive design, making it accessible for traders of all experience levels.

Mobile Trading: Exness offers mobile applications compatible with Android and iOS devices, enabling traders to manage their accounts on the go.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Pepperstone Trading Platform Features

Pepperstone also leverages popular trading platforms, emphasizing seamless trading experiences:

MetaTrader 4 & 5: Like Exness, Pepperstone supports both MT4 and MT5, providing traders with powerful analytical tools, expert advisors, and a user-friendly interface.

cTrader: In addition to MT4 and MT5, Pepperstone offers cTrader, a platform renowned for its advanced charting functionality and intuitive design, appealing to algorithmic traders.

Web Trading: Both platforms can be accessed via web browsers, eliminating the need for software installation and allowing for convenient trading from any device.

User Experience and Interface Comparison

When it comes to user experience, both Exness vs Pepperstone excel in delivering straightforward and efficient interfaces. However, personal preferences may dictate which platform feels more intuitive.

Exness tends to cater to beginners with its simple navigation and user-friendly design. On the other hand, Pepperstone's advanced trading features may attract more experienced traders looking for additional tools and resources.

Ultimately, both platforms offer reliable solutions for traders, enabling them to execute trades and analyze market trends effectively.

Customer Support Services

Effective customer support can greatly impact a trader’s experience, especially when issues arise. Let's explore the customer support channels offered by Exness vs Pepperstone.

Exness Customer Support Channels

Exness prides itself on providing responsive customer support, with multiple channels available:

Live Chat: Immediate assistance is available through live chat on their website, facilitating quick problem resolution.

Email Support: Traders can reach out via email for non-urgent inquiries or detailed support requirements.

Phone Support: Exness also offers phone support in multiple languages, ensuring personalized assistance based on client needs.

Pepperstone Customer Support Channels

Pepperstone also emphasizes responsive customer service, featuring:

Live Chat: Quick access to support agents through live chat ensures that traders receive timely assistance.

Email Support: Like Exness, Pepperstone provides email support for less urgent inquiries.

Phone Support: Phone support is available in various languages, catering to a diverse client base.

Responsiveness and Quality of Support

Both Exness vs Pepperstone boast good reputations for responsiveness and quality of support. User feedback usually highlights the helpfulness and professionalism of support staff. However, response times may vary depending on the complexity of the issue and the volume of incoming requests.

Educational Resources and Tools

Education plays a pivotal role in trading success, especially for inexperienced traders. In this section, we will assess the educational materials offered by Exness vs Pepperstone.

Exness Educational Materials

Exness offers a wealth of educational resources aimed at enhancing traders' knowledge and skills:

Webinars: Regularly scheduled webinars cover various trading topics, enabling clients to learn from industry experts.

Video Tutorials: Video content addressing trading strategies and platform functionalities aids independent learning.

Articles and Guides: Comprehensive articles and guides simplify complex concepts, making them accessible for traders at all experience levels.

Pepperstone Educational Materials

Pepperstone also provides a range of educational tools, including:

Trading Guides: Detailed trading guides cover fundamental and technical analysis, risk management, and other critical subjects.

Webinars and Videos: Similar to Exness, Pepperstone offers webinars and video tutorials to facilitate learning.

Market Analysis: Daily market analysis reports keep traders informed about market trends and economic events, aiding in decision-making.

Importance of Education in Trading Success

Access to educational resources can significantly impact a trader's journey. Well-informed traders are more likely to develop sound trading strategies and maintain discipline during market fluctuations. Both Exness vs Pepperstone demonstrate a commitment to fostering trader education, indicating their focus on long-term client success.

Deposit and Withdrawal Methods

Methodologies for depositing and withdrawing funds can affect your trading experience. In this section, we will review the payment methods available at Exness vs Pepperstone.

Payment Methods Available at Exness

Exness provides a variety of deposit and withdrawal options, catering to client preferences:

Credit/Debit Cards: Major brands like Visa and Mastercard are accepted, offering convenience for instant deposits.

E-Wallets: Popular e-wallet services such as Skrill, Neteller, and WebMoney allow for swift fund transfers.

Bank Transfers: Traditional bank transfers are also an option, though processing times may vary.

Payment Methods Available at Pepperstone

Pepperstone offers similar deposit and withdrawal options, including:

Credit/Debit Cards: Accepts major credit and debit cards for quick deposits.

E-Wallets: Compatible with various e-wallet services, enhancing the flexibility of transactions.

Bank Transfers: Available, although processing times may be longer compared to other methods.

Processing Times and Fees

Processing times and fees for deposits and withdrawals can vary depending on the chosen method:

Deposits: Typically instant for e-wallets and card payments, while bank transfers may take some time to process.

Withdrawals: Processing times may vary based on method, with e-wallet withdrawals generally quicker than bank transfers.

Both brokers strive to minimize transaction fees, but it's essential to check specific details regarding fees for each method before making a choice.

User Reviews and Reputation

User feedback can provide invaluable insights into a broker's reliability. Let’s analyze the user reviews for both Exness vs Pepperstone to gauge their overall reputation.

Exness User Feedback

Feedback for Exness tends to highlight its user-friendly platform, excellent customer support, and competitive trading conditions. Many traders appreciate the educational resources offered, which contribute to enhanced trading skills. However, some users mention occasional delays in withdrawals, suggesting variances in service quality at peak times.

Pepperstone User Feedback

Pepperstone generally receives positive reviews for its fast execution speeds, low spreads, and reliability. Users often commend the platform’s sophisticated tools and features, beneficial for experienced traders. Some traders express a desire for more educational resources, noting that while the platform excels in execution, the educational aspect could be further developed.

Overall Reputation in the Industry

Both Exness vs Pepperstone have cultivated strong reputations within the trading community. Their commitment to transparency, regulatory compliance, and client satisfaction resonates positively with users, helping them stand out as reputable choices among online brokers.

Pros and Cons of Exness

To summarize our findings, let’s discuss the advantages and disadvantages of using Exness as your trading platform.

Advantages of Using Exness

Diverse Account Types: Offers a variety of account types catering to different trader needs and experience levels.

Educational Resources: Extensive educational materials support traders in enhancing their skills.

Competitive Spreads: Attractively low spreads across various account types improve trading profitability.

Robust Regulatory Oversight: Multiple regulatory licenses enhance safety and client trust.

Disadvantages of Using Exness

Withdrawal Delays: Some users report inconsistent withdrawal processing times during peak periods.

Limited Market Research: While educational materials exist, more in-depth market research could be beneficial for traders.

Pros and Cons of Pepperstone

Next, let’s evaluate the advantages and disadvantages of choosing Pepperstone for your trading endeavors.

Advantages of Using Pepperstone

Fast Execution Speeds: Renowned for its execution quality, allowing traders to capitalize on market opportunities quickly.

Low Spreads: Particularly favorable for active traders and scalpers, ensuring cost-effective trading.

Multiple Trading Platforms: Variety of platforms, including cTrader, caters to different trading styles.

Strong Regulatory Framework: Multiple licenses assure traders of the broker's legitimacy and adherence to best practices.

Disadvantages of Using Pepperstone

Limited Educational Resources: Compared to Exness, educational offerings could be expanded to assist less experienced traders.

Fees on Certain Accounts: Commission-based accounts may discourage some traders who prefer commission-free alternatives.

Overall Performance Comparison

After evaluating various factors, it’s time to compare the overall performance of Exness vs Pepperstone across key areas.

Execution Speed and Reliability

Both Exness vs Pepperstone are known for their fast execution speeds, but Pepperstone often edges ahead in this area due to advanced technology and infrastructure designed for high-frequency trading.

Market Analysis Tools

Exness offers a robust suite of educational tools, making it easier for traders to gain insights into market trends. However, Pepperstone provides sophisticated trading tools, particularly advantageous for experienced traders focused on technical analysis.

Trading Experience Evaluation

While both platforms deliver a solid trading experience, Exness shines in accessibility and educational resources, making it more appealing for newcomers. In contrast, Pepperstone attracts experienced traders looking for advanced features and lower trading costs.

Conclusion: Choosing the Right Broker

As we’ve seen throughout this article, both Exness vs Pepperstone bring unique strengths to the online trading arena. Ultimately, the decision regarding which platform is better hinges on individual trading needs and preferences.

If you are a beginner looking for a user-friendly platform with robust educational resources, Exness might be the ideal choice for you. Conversely, if you are an experienced trader seeking low spreads and advanced features, Pepperstone may better suit your trading style.

In summary, whether you lean towards Exness or Pepperstone, comprehensively evaluating your own trading goals and preferences is critical. Consider aspects such as account types, trading instruments, fees, and available support when making your final choice. Remember, the best broker is the one that aligns harmoniously with your trading strategy and ambition.

Read more: