22 minute read

Exness vs FxPro Comparison: Which is better?

In the world of online trading, choosing the right broker can make a significant difference in your trading success. The Exness vs FxPro Comparison: Which is better? debate has garnered attention from traders seeking to find their ideal partner in financial markets. Each platform boasts unique features, regulatory compliance, and diverse trading options that cater to various trader preferences. In this article, we will thoroughly examine both brokers across multiple key aspects to help you make an informed decision.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Introduction to Exness vs FxPro

Understanding the nuances of Exness vs FxPro is essential for traders aiming to select the most suitable broker for their needs. This introduction will give you a brief overview of both platforms, highlighting their core offerings and market positions.

Overview of Exness

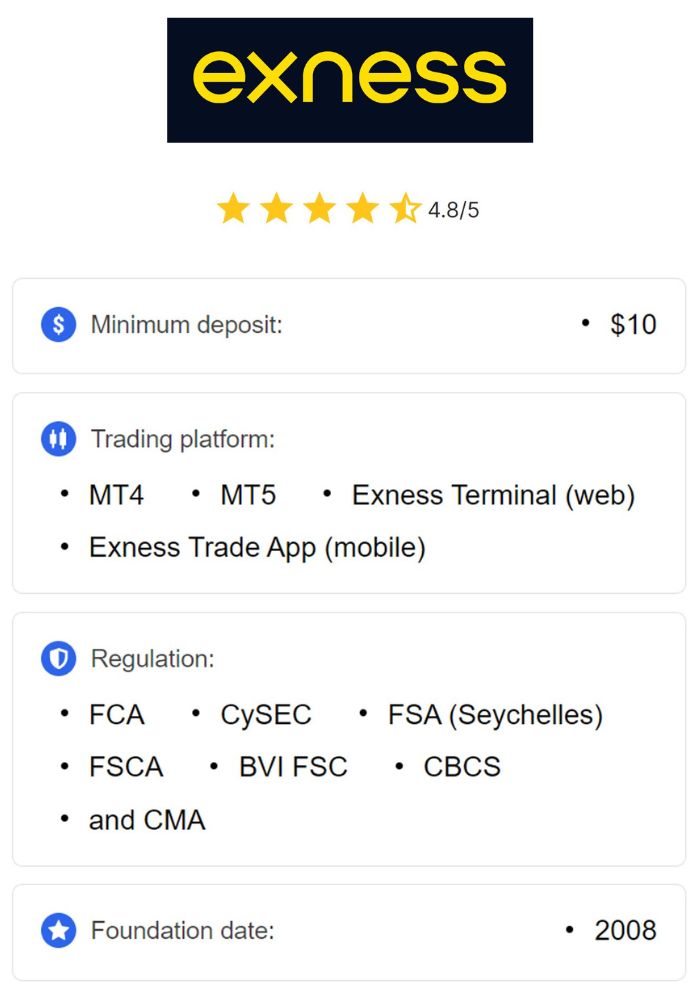

Exness was established in 2008 and has grown into one of the leading forex and CFD brokers on a global scale. With its mission to provide a seamless trading experience, Exness offers a wide range of trading instruments, competitive spreads, and flexible account types. Equipped with advanced technology and a user-friendly interface, Exness caters to both novice and experienced traders alike.

The broker has earned a reputation for its transparent business practices, reliable execution speeds, and extensive customer support. Traders can access a wealth of educational resources and analytical tools, empowering them to make educated trading decisions.

Overview of FxPro

Founded in 2006, FxPro has also become a prominent player in the online trading industry. With a focus on providing excellent trading conditions, this broker offers a broad spectrum of trading instruments, including forex, commodities, indices, and cryptocurrencies. FxPro’s robust trading platforms are designed to facilitate a smooth trading experience for users at all skill levels.

FxPro emphasizes its commitment to transparency and client satisfaction through comprehensive educational resources and dedicated customer service. The broker’s innovative approach allows it to keep pace with the ever-evolving trading landscape, earning recognition among traders globally.

Regulatory Framework

A key consideration when selecting a broker is its regulatory status. Both Exness vs FxPro operate under strict regulatory oversight, ensuring the safety and security of clients' funds. Understanding their respective frameworks will provide insight into their legitimacy and reliability.

Exness Regulatory Compliance

Exness is regulated by several reputable authorities, including the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). These regulatory bodies impose stringent guidelines regarding operational conduct, fund segregation, and client protection measures.

By adhering to these regulations, Exness demonstrates its commitment to maintaining transparency and accountability. Clients can rest assured knowing their funds are held in segregated accounts, providing an additional layer of security. Furthermore, Exness maintains a strong emphasis on ethical trading practices, fostering trust within its trading community.

FxPro Regulatory Standards

Similarly, FxPro operates under the scrutiny of multiple regulatory organizations, including the FCA in the UK, CySEC in Cyprus, and the South African Financial Sector Conduct Authority (FSCA). By obtaining licenses from these distinguished entities, FxPro showcases its dedication to offering a safe and secure trading environment.

Regulatory compliance ensures that FxPro follows best practices in terms of capital adequacy, risk management, and client fund protection. Traders can be confident that their investments are safeguarded under the watchful eye of reputable regulators, reinforcing FxPro's credibility in the market.

Trading Platforms Offered

The trading platform plays a crucial role in a trader's overall experience, affecting everything from execution speed to available tools. In this section, we'll compare the trading platforms offered by Exness vs FxPro to determine which provides a superior experience.

Exness Trading Platforms

Exness provides users with a choice between the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. Both platforms offer a range of advanced trading features, including customizable charts, technical indicators, and automated trading capabilities through Expert Advisors (EAs).

MT4 is especially favored by forex traders due to its simplicity and extensive functionality. Meanwhile, MT5 offers additional features like depth of market (DOM) analysis, more timeframes, and improved order management. Additionally, Exness has developed its own mobile application, allowing traders to manage their accounts and execute trades on-the-go.

Moreover, Exness ensures that its trading platforms are user-friendly and accessible, enabling both beginner and experienced traders to navigate the interface with ease. The availability of demo accounts further allows users to practice trading strategies without financial risk.

FxPro Platform Features

FxPro stands out with its proprietary trading platform, FxPro Edge, alongside the well-regarded MT4 and MT5 platforms. FxPro Edge is known for its intuitive design, sophisticated charting tools, and a wide variety of indicators. This platform is particularly appealing to traders who appreciate a clean and organized layout paired with powerful trading functionalities.

Additionally, FxPro offers cTrader, another popular option among forex traders. This platform is recognized for its exceptional speed and advanced trading features, making it a great choice for high-frequency traders and scalpers. Regardless of the platform chosen, FxPro ensures that all options provide seamless integration with mobile versions, enabling traders to stay connected and trade from anywhere.

Ultimately, both Exness vs FxPro deliver robust trading platforms that cater to diverse trader preferences. However, FxPro's additional offerings may attract those looking for specialized tools and features.

Account Types Comparison

When it comes to trading accounts, brokers typically offer various options to accommodate different trading strategies and risk appetites. In this section, we will explore the account types available at Exness vs FxPro, helping you identify which broker aligns better with your trading style.

Exness Account Options

Exness offers multiple account types designed to meet the needs of different traders, including Standard, Pro, and Zero accounts. Each account type has distinct features that cater to specific trading preferences.

The Standard account is perfect for beginners, with no minimum deposit requirement and spreads starting from 0.3 pips. This account supports micro-lots, making it accessible for traders with smaller budgets.

The Pro account is tailored for more experienced traders, offering tighter spreads and lower commissions. This account type requires a minimum deposit but provides access to advanced trading tools and features not available to standard account holders.

Lastly, the Zero account offers raw spreads with no commission fees, targeted at professional traders who require precise execution and minimal slippage. Overall, Exness strives to offer flexibility and choice, ensuring traders can select an account that suits their individual needs.

FxPro Account Structures

FxPro similarly presents an array of account types that cater to both retail and professional traders. Accounts include the Forex account, the cTrader account, and the MT4/MT5 accounts.

The Forex account is designed for general trading, featuring variable spreads and the ability to use leverage. It is ideal for traders who prefer a straightforward trading setup without excessive complexity.

The cTrader account, on the other hand, is specifically designed for users who want to take advantage of the advanced capabilities provided by the cTrader platform. With tight spreads and a fully-featured interface, this account is well-suited for active traders.

Lastly, the MT4 and MT5 accounts grant traders access to the respected MetaTrader platforms, accommodating both inexperienced traders and seasoned professionals. Each account type is structured to provide sufficient flexibility for various trading techniques and styles.

In summary, both Exness vs FxPro offer diverse account options, each tailored to specific trading experiences. Depending on personal preferences and trading backgrounds, the right choice will vary from one trader to another.

Spreads and Commissions

The cost of trading is an essential factor in evaluating brokers as it directly impacts profitability. In this section, we will analyze the spreads and commissions associated with both Exness vs FxPro to understand which broker offers a more favorable trading cost structure.

Exness Spread and Commission Overview

Exness prides itself on offering competitive spreads that appeal to a broad audience of traders. The broker provides floating spreads that can begin as low as 0.0 pips for certain account types, such as the Zero account. This feature enables traders to minimize costs while maximizing potential profits.

Commissions at Exness vary depending on the account type. For instance, the Pro account imposes a reasonable commission per traded lot, while the Standard account is commission-free, relying solely on the spread being charged. This structure makes Exness an attractive option for traders who prioritize low trading costs and competitive pricing.

Traders should note that spreads can fluctuate based on market conditions and volatility, but Exness remains committed to transparency regarding its pricing model. Thus, traders can consistently evaluate their trading expenses and make informed decisions.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

FxPro Spread and Commission Details

FxPro also provides competitive spreads across its various account types. Depending on the account selected, traders can expect spreads to start from as low as 0.2 pips. The broker’s commitment to facilitating a cost-effective trading experience is evident through its transparent pricing structures.

While FxPro does charge commissions on certain accounts, such as the cTrader account, the commission rates are generally regarded as fair and competitive compared to industry standards. This flexible approach allows traders to choose an account type based on their trading frequency and style.

It’s important to remember that market conditions can affect spreads and commissions, and traders are encouraged to review the broker’s pricing page regularly for current information. Ultimately, FxPro's pricing framework is designed to provide both value and accessibility for traders of all experience levels.

Leverage and Margin Requirements

Leverage and margin requirements significantly impact a trader's ability to control larger positions with a smaller amount of capital. In this section, we will examine the leverage policies and margin requirements set forth by Exness vs FxPro to assess which broker offers a more advantageous setup.

Exness Leverage Policies

Exness offers high leverage ratios, catering to experienced traders who seek to amplify their trading potential. The maximum leverage available on the Standard account can reach up to 1:2000, while the Pro account may allow leverage as high as 1:400. Such generous leverage enables traders to take significant positions in the market without needing a large capital outlay.

However, it's important for traders to exercise caution when utilizing high leverage, as it carries both increased profit potential and greater risk. Exness emphasizes responsible trading practices, encouraging traders to understand their risk tolerance and employ effective risk management strategies.

Overall, Exness's flexible leverage policies can be beneficial for skilled traders looking to maximize their trading performance.

FxPro Margin Requirements

FxPro's approach to leverage is somewhat conservative compared to Exness. While FxPro does provide leverage options ranging from 1:1 to 1:500, the broker encourages traders to carefully consider their risk exposure before employing high leverage.

By offering moderate leverage ratios, FxPro prioritizes the safety of its traders and promotes sound risk management practices. The margin requirements vary depending on the instrument being traded, so it is crucial for traders to familiarize themselves with these specifications to ensure proper position sizing.

Ultimately, the leverage offerings of both Exness vs FxPro serve different segments of the trading community. While Exness caters to those seeking higher leverage, FxPro focuses on responsible trading through its more conservative approach.

Available Trading Instruments

The range of trading instruments offered by a broker is fundamental in determining the trading opportunities available to clients. In this section, we will compare the trading instruments available at Exness vs FxPro to see which broker provides a broader selection.

Exness Trading Instruments

Exness offers a diverse array of trading instruments across various asset classes, including forex, commodities, cryptocurrencies, indices, and stocks. This extensive selection allows traders to diversify their portfolios and capitalize on market movements across different sectors.

Forex trading is particularly popular at Exness, with hundreds of currency pairs available for trading. Additionally, the broker has expanded its offering to include cryptocurrencies like Bitcoin, Ethereum, and Litecoin, which are increasingly sought after by modern traders.

With a combination of numerous asset classes and trading instruments, Exness positions itself as a versatile broker capable of meeting the demands of different trading styles and strategies.

FxPro Asset Offerings

FxPro also provides an impressive selection of trading instruments, focusing on forex, commodities, shares, indices, and cryptocurrencies. Similar to Exness, FxPro offers a wide variety of currency pairs, enabling traders to explore different market opportunities.

Beyond forex, FxPro has developed a reputation for its robust commodities trading, featuring various options such as gold, silver, and oil. The addition of cryptocurrencies further enhances the broker's suitability for traders looking to invest in emerging digital assets.

By offering a comprehensive range of trading instruments, FxPro demonstrates its commitment to catering to the diverse interests and preferences of its clientele.

Customer Service and Support

An effective customer support system is vital in ensuring a positive trading experience. In this section, we will compare the customer service and support options available at Exness vs FxPro to determine which broker excels in this area.

Exness Customer Support Channels

Exness takes customer support seriously, providing multiple channels for traders to communicate with their support teams. Clients can reach out via live chat, email, or telephone, ensuring that assistance is readily available whenever needed.

Exness also understands the importance of multilingual support, offering services in various languages to accommodate traders from different regions. This commitment to customer care is further reflected in their extensive FAQ section, where traders can find answers to common inquiries.

Moreover, the broker's response times are generally swift, ensuring that traders receive timely assistance to resolve their issues. Overall, Exness places a premium on customer satisfaction, enhancing the overall trading experience.

FxPro Client Assistance Options

FxPro also prioritizes customer service, providing several avenues for support. Users can contact the support team through live chat, email, or phone, similar to Exness. However, FxPro goes a step further by offering dedicated support for different languages, ensuring effective communication with clients around the globe.

Additionally, the broker provides a comprehensive knowledge base and FAQ section, empowering traders to find solutions independently. FxPro’s commitment to delivering high-quality customer service ensures that traders feel supported throughout their trading journey.

Ultimately, both Exness vs FxPro demonstrate competence in customer support, but the availability of multiple language options may give FxPro a slight edge in serving an international clientele.

Educational Resources

Educational resources play a crucial role in helping traders enhance their skills and knowledge. In this section, we will explore the educational offerings of both Exness vs FxPro to identify which broker provides more valuable learning materials.

Exness Educational Tools

Exness offers a variety of educational resources aimed at supporting traders of all experience levels. The broker's website features a dedicated education section, including articles, webinars, and video tutorials covering fundamental and technical analysis, trading strategies, and market psychology.

Additionally, Exness provides free access to trading signals and market insights, allowing traders to make informed decisions. The broker's commitment to enhancing trader education empowers clients to develop their skills and confidence in trading.

Through regular webinars led by experienced market analysts, Exness fosters a sense of community among traders and facilitates knowledge-sharing. As a result, traders can continuously improve their understanding of the financial markets.

FxPro Learning Materials

FxPro equally values trader education, providing a comprehensive suite of learning resources. The broker's education center includes articles, guides, and video content that cover a range of topics relevant to both novice and seasoned traders.

One notable feature is FxPro's economic calendar, which provides traders with essential updates about upcoming events and data releases that could impact the markets. This tool is invaluable for traders seeking to time their trades effectively.

Furthermore, FxPro conducts live webinars and seminars hosted by industry experts, giving participants the opportunity to learn from knowledgeable professionals. This interactive approach helps foster engagement and discussion among traders.

Both Exness vs FxPro emphasize the importance of education in trading, offering valuable resources to enhance trader knowledge. However, the unique offerings of each broker may cater to different learning preferences.

User Experience and Interface

The user experience and interface of a trading platform can significantly influence a trader's effectiveness and comfort level. In this section, we will evaluate the user experience and interface of Exness vs FxPro to discern which broker offers a superior trading environment.

Exness User Interface Evaluation

Exness prides itself on providing a user-friendly interface across its trading platforms. Both MT4 and MT5 offer intuitive navigation, making it easy for traders to locate features and tools. The minimalist design reduces clutter, allowing traders to focus on their strategies rather than navigating complex menus.

Moreover, Exness’s mobile application is seamless, offering a comparable experience to desktop platforms. Traders can effortlessly manage their accounts, execute trades, and access educational resources from their mobile devices, granting convenience for those on the go.

Overall, Exness creates a comfortable trading environment that appeals to beginners while providing the advanced capabilities required by more experienced traders.

FxPro User Experience Insights

FxPro’s trading platforms also prioritize user experience, featuring a clean layout and straightforward navigation. The FxPro Edge platform boasts an integrated design, minimizing distractions and enabling traders to concentrate on market analysis and decision-making.

cTrader, another platform offered by FxPro, is renowned for its exceptional customization options, allowing traders to tailor their dashboard according to their preferences. This flexibility enhances the overall experience, particularly for high-frequency traders who require real-time data at their fingertips.

Both Exness vs FxPro deliver commendable user experiences, although FxPro’s customization options on cTrader may provide an added advantage for those who value personalization.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Deposit and Withdrawal Methods

The ease and variety of deposit and withdrawal methods can greatly affect a trader's experience. In this section, we will compare the payment options available at Exness vs FxPro to determine which broker offers more convenient processes.

Exness Payment Options

Exness supports a wide range of deposit and withdrawal methods, making it simple for traders to fund their accounts. Accepted methods include bank transfers, credit/debit cards, e-wallets, and local payment systems, catering to clients from various regions.

Deposits at Exness are typically processed instantly, while withdrawal requests are usually executed promptly within a short time frame. Furthermore, the broker does not impose deposit or withdrawal fees, enhancing the overall convenience for clients.

Exness also emphasizes the importance of security, utilizing encryption protocols to protect users’ financial information during transactions. This attention to security reinforces customers' confidence when handling their funds.

FxPro Fund Transfer Processes

FxPro also offers a myriad of deposit and withdrawal options, including bank transfers, credit/debit cards, and popular e-wallets. This variety accommodates traders from different countries, ensuring that clients can easily manage their accounts.

Similar to Exness, FxPro strives for speedy processing times for deposits and withdrawals. However, some payment methods may incur fees depending on the provider used, so traders should be aware of any potential charges when selecting their payment method.

Security is paramount at FxPro, and the broker employs advanced encryption technology to safeguard customers’ financial data during transactions. This commitment to security, combined with efficient payment processes, enhances the overall experience for traders managing their funds.

In summary, both Exness vs FxPro provide a range of convenient payment options; however, Exness’s lack of fees for deposits and withdrawals may offer an edge in terms of client convenience.

Security Measures

Ensuring the safety and security of traders' funds is a top priority for reputable brokers. In this section, we will investigate the security measures implemented by Exness vs FxPro to protect their clients.

Exness Security Protocols

Exness prioritizes the security of its clients' funds and personal information. The broker employs robust encryption technology to safeguard sensitive data during online transactions. Additionally, client funds are kept in segregated accounts, ensuring that they are separate from the broker’s operational funds.

Exness also adheres to strict regulatory guidelines, providing an additional layer of protection for traders. Regular audits and compliance checks ensure that the broker maintains high operational standards while safeguarding clients against fraud.

Furthermore, Exness encourages traders to implement two-factor authentication on their accounts, adding another dimension of security to their accounts. Overall, the broker adopts a proactive approach to protecting client funds and information.

FxPro Safety Features

FxPro takes its security protocols seriously, implementing multiple layers of protection for its clients. Like Exness, the broker utilizes encryption technology to protect transaction data and personal details.

Client funds at FxPro are also maintained in segregated accounts, ensuring that traders' money remains secure and is not utilized for the broker's operational activities. This practice adheres to regulatory requirements and reinforces the trustworthiness of the broker.

In line with industry best practices, FxPro regularly undergoes independent audits to ensure compliance with regulatory standards and to maintain a secure trading environment. By actively focusing on security, FxPro aims to provide peace of mind to its clients.

Both Exness vs FxPro exhibit strong commitments to security, employing various measures to protect traders and their funds. However, clients should always remain vigilant and follow recommended best practices for online security.

Research and Analysis Tools

Access to research and analysis tools is essential for traders looking to enhance their market knowledge and make informed decisions. In this section, we will compare the analytical resources offered by Exness vs FxPro to determine which broker provides a more comprehensive toolkit.

Exness Analytical Resources

Exness provides a variety of research and analysis tools to assist traders in assessing market trends and identifying potential opportunities. The broker’s website features an economic calendar, daily market reviews, and detailed reports on key economic indicators.

Additionally, Exness offers access to trading signals and insights from experienced analysts, allowing clients to benefit from expert opinions and market perspectives. The inclusion of technical analysis tools, such as charting software and indicators, enables traders to conduct in-depth evaluations of market conditions.

Overall, Exness’s analytical resources empower traders by providing them with the information necessary to make informed trading decisions.

FxPro Research Tools

FxPro also emphasizes the importance of research and analysis, offering a suite of analytical tools for traders. The broker provides an economic calendar, market news updates, and insightful commentary on key market developments.

FxPro’s platform also integrates various technical analysis tools, allowing traders to create custom indicators and strategies. This level of flexibility enables traders to tailor their analysis to suit their individual preferences, enhancing their ability to make informed decisions.

Additionally, FxPro’s educational materials often touch on analytical methods, helping traders improve their analytical skills over time.

Both Exness vs FxPro offer valuable research and analysis tools, but the degree of flexibility and customization available on FxPro’s platform may appeal more to advanced traders and those focused on technical analysis.

Performance in the Market

The performance of a broker in the market can indicate its reliability and overall standing in the trading community. In this section, we will evaluate the market positions of Exness vs FxPro to determine which broker holds a stronger reputation.

Exness Market Position

Exness has made significant strides since its inception, establishing itself as a trusted name in the online trading industry. With a growing client base and substantial trading volume, Exness has demonstrated its capability to compete with larger players in the market.

The broker’s commitment to transparency and customer satisfaction has garnered positive feedback from traders around the world. By continuously investing in technology and improving its services, Exness has positioned itself as a forward-thinking broker dedicated to enhancing the trading experience.

FxPro Industry Ranking

FxPro has solidified its position as a reputable broker within the online trading sphere. With numerous awards and accolades highlighting its excellence in trading conditions and customer service, FxPro has built a strong reputation among traders and industry professionals alike.

The broker's longstanding presence in the market speaks to its reliability and commitment to maintaining high operational standards. Additionally, FxPro's focus on innovation and responsiveness to market changes contributes positively to its standing in the trading community.

Both Exness vs FxPro have cultivated strong market positions as trusted brokers, but the established history and accolades obtained by FxPro may resonate more with certain traders seeking credibility.

Trader Feedback and Reviews

Reviews and feedback from fellow traders can provide invaluable insights into a broker's quality of service and overall performance. In this section, we will analyze trader feedback on Exness vs FxPro to gauge the perceived strengths and weaknesses of each broker.

Exness User Opinions

Overall, Exness has received favorable reviews from its users, with many praising its competitive spreads, excellent customer service, and user-friendly trading platforms. Traders appreciate the range of educational resources available, indicating that Exness supports the growth and development of its clients.

Some users have mentioned occasional delays in withdrawal processing times, although these instances appear to be infrequent. Despite this, the majority of traders report positive experiences and express satisfaction with the overall trading environment provided by Exness.

Personal anecdotes shared by traders often highlight the broker's transparency and commitment to customer care, contributing to a positive perception of the brand.

FxPro Customer Reviews

FxPro has similarly garnered positive feedback from its clients, particularly for its robust trading platforms, diverse range of instruments, and responsive customer service. Many traders report that the cTrader platform provides exceptional ease of use and advanced analytical capabilities.

While some users have expressed concerns related to commissions on certain account types, overall sentiment reflects satisfaction with the broker's trading conditions and educational offerings. The broker's commitment to transparency and security has also been praised, reinforcing FxPro's reputation as a trustworthy trading partner.

Individual testimonials often highlight successful trading experiences and the broker’s commitment to continuous improvement in service quality.

Both Exness vs FxPro enjoy positive feedback from their respective user bases, reflecting their commitment to providing quality trading services. However, personal experiences may vary based on individual circumstances.

Conclusion and Final Thoughts

In conclusion, the Exness vs FxPro Comparison: Which is better? ultimately depends on individual preferences and trading goals. Both brokers offer competitive advantages and unique features that cater to different types of traders.

Exness shines with its high leverage, transparent pricing structures, and user-friendly platforms. Its commitment to trader education and excellent customer service further enhances its appeal.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

On the other hand, FxPro excels with its diverse range of trading instruments, innovative platforms, and solid performance in the market. The broker's focus on customization and advanced analysis tools may resonate with experienced traders seeking greater flexibility.

In essence, both Exness vs FxPro are reputable brokers that prioritize client satisfaction and strive to provide excellent trading experiences. The best choice for a trader will depend on their individual needs, trading style, and priorities in a brokerage partner.

Read more: