14 minute read

Gold forex trading time in India

from Exness India

by Exness_India

Gold forex trading time in India is a crucial consideration for traders seeking to capitalize on the fluctuations of gold prices in the foreign exchange market. Understanding when to trade can significantly impact profitability, expose traders to various risks, and enhance their overall trading experience. In this article, we will explore the intricate world of forex trading, the significance of timing, especially regarding gold trading in India's unique market context, and much more.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Understanding Forex Trading

Forex trading, short for foreign exchange trading, involves buying and selling currencies in a dynamic marketplace with the goal of making a profit. Traders engage in this decentralized global market, where currencies are traded over-the-counter, meaning transactions occur directly between parties rather than through an exchange.

Definition of Forex Trading

At its core, forex trading revolves around the conversion of one currency into another at an agreed price. This process occurs 24 hours a day, five days a week, providing traders with ample opportunities to engage in the market. The primary objective is to profit from fluctuations in currency values, which can be influenced by economic indicators, geopolitical events, and market sentiment.

The forex market is characterized by high liquidity and volatility, making it an attractive option for both novice and seasoned traders. Unlike traditional stock markets that operate within set hours, forex trading allows for continuous activity, enabling traders to respond quickly to emerging trends and events.

The Role of Gold in Forex Markets

Gold holds a unique position in the realm of forex trading. Often viewed as a safe-haven asset, gold tends to retain its value during times of economic uncertainty or inflation. As such, investors and traders often turn to gold as a hedge against currency fluctuations, making it an essential component of forex trading strategies.

In the forex market, gold is typically quoted in relation to major currencies, most commonly the US dollar (XAU/USD). Traders monitor gold prices closely, as movements can provide insights into broader market trends, risk appetite, and economic conditions. Understanding how gold interacts with currency pairs is vital for successful trading, particularly in the Indian market.

Key Terminology in Forex Trading

To navigate the complexities of forex trading, it's essential to familiarize oneself with key terminology:

Pips: A pip represents the smallest price movement in a currency pair. For example, if the EUR/USD moves from 1.1050 to 1.1051, it has moved one pip.

Leverage: Leverage allows traders to control larger positions with a smaller amount of capital. While it can amplify profits, it also increases the potential for significant losses.

Spread: The spread is the difference between the bid price and the ask price of a currency pair. It represents the cost of trading and can vary depending on market conditions.

Understanding these terms empowers traders to make informed decisions and manage their trades effectively in the fast-paced world of forex.

Importance of Timing in Forex Trading

Timing is a critical factor in forex trading, as it can greatly influence the outcome of trades. The ability to identify the best moments to enter and exit positions can determine a trader's success or failure.

Market Hours Overview

The forex market operates 24 hours a day across different global financial centers, allowing traders to participate at virtually any time. However, not all trading hours carry the same level of activity or liquidity.

The forex market is divided into four main trading sessions: Sydney, Tokyo, London, and New York. Each session brings varying degrees of volatility and potential trading opportunities. Understanding the characteristics of each session helps traders optimize their strategies.

The Sydney session marks the beginning of the trading day, followed by Tokyo, which sees increased activity due to Asian market participation. The London session is considered the most active, with a high volume of trading, while the New York session offers opportunities tied to US economic data releases.

Impact of Timing on Profitability

The timing of trades can significantly affect profitability. Traders who execute their orders during high-volatility periods may benefit from substantial price movements, leading to increased profit potential. Conversely, trading during low-volatility periods may result in limited price action and stagnant positions.

Additionally, being aware of key economic announcements or geopolitical events can help traders position themselves strategically. For instance, significant news releases affecting interest rates, employment figures, or inflation can trigger market reactions that present trading opportunities.

Psychological Factors Influencing Trade Timing

Beyond technical aspects, emotional factors play a role in determining trade timing. Fear and greed can cloud judgment, leading to impulsive trading decisions. Traders must cultivate discipline and patience, waiting for optimal conditions rather than succumbing to the urge to act hastily.

Maintaining a trading journal can aid traders in identifying patterns in their behavior and refining their approach to timing. By reflecting on past trades and analyzing outcomes, aspiring traders can develop greater self-awareness and improve their decision-making skills.

Gold Trading in the Indian Market

India has a rich historical connection to gold, deeply ingrained in cultural practices, traditions, and economic frameworks. Understanding this context is paramount for anyone looking to trade gold in the Indian forex market.

Historical Context of Gold Trading in India

Gold has held significance in India for centuries, serving as a symbol of wealth, status, and prosperity. It is commonly gifted during weddings, festivals, and religious ceremonies, underscoring its cultural importance. The demand for gold in India is among the highest globally, driven by both consumer preferences and investment motives.

Over time, gold trading evolved alongside economic developments and regulatory changes. The introduction of gold exchange-traded funds (ETFs) and digital trading platforms has made investing in gold more accessible to a broader audience.

Current Trends in Gold Forex Trading

As globalization shapes financial markets, Indian traders increasingly participate in gold forex trading. With advancements in technology and online trading platforms, access to gold trading has expanded significantly.

Traders can now take advantage of real-time pricing data, advanced charting tools, and educational resources to enhance their trading strategies. Additionally, the growing popularity of international gold benchmarks influences pricing dynamics in the Indian market.

Regulatory Framework Governing Gold Trading in India

The regulatory landscape governing gold trading in India is overseen by the Reserve Bank of India (RBI) and other relevant authorities. These regulations aim to ensure transparency, protect investors, and maintain market integrity.

Traders should stay informed about regulatory changes impacting gold trading, including tax implications, import duties, and compliance requirements. Understanding these regulations is essential for successful navigation of the Indian gold forex market.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Best Times to Trade Gold Forex in India

Identifying the best times to trade gold forex in India involves analyzing global market sessions, understanding overlapping trading hours, and recognizing local holidays that may impact trading activity.

Analyzing Major Global Market Sessions

As previously mentioned, the forex market comprises distinct trading sessions corresponding to major financial centers. Each session presents unique trading opportunities, influenced by localized economic events and market sentiment.

Traders should pay close attention to the London and New York sessions, as they account for a significant portion of daily trading volume. Active trading during these periods can lead to increased volatility and more favorable conditions for gold forex trading.

Overlapping Trading Hours and Their Significance

Overlapping hours between major trading sessions can create heightened market activity and liquidity. For instance, the overlap between the London and New York sessions is often regarded as the most lucrative time for traders.

During these overlapping hours, traders can witness increased trading volumes, resulting in sharper price movements and better spreads. Identifying these overlaps can help traders time their entries and exits more effectively.

Local Holidays and Market Closures

Local holidays and market closures can impact the overall trading environment in India. It's essential for traders to remain informed about Indian holidays that may coincide with major global trading sessions, as these can lead to reduced market activity and liquidity.

Planning trades around these holidays ensures traders are prepared for potential market gaps or unexpected price movements. Awareness of both local and global calendar events can enhance trading strategies and decision-making processes.

Factors Affecting Gold Prices

Numerous factors contribute to the fluctuating prices of gold in the forex market. Understanding these influences is crucial for traders aiming to predict price movements and develop effective strategies.

Economic Indicators and Their Influence

Key economic indicators, such as inflation rates, interest rates, and unemployment data, can significantly impact gold prices. When inflation rises or economic instability looms, investors often flock to gold as a safe haven, driving up demand and prices.

Conversely, periods of economic growth may diminish gold's appeal as a safe asset. Traders must stay attuned to economic reports, central bank policies, and macroeconomic trends to anticipate potential movements in gold prices.

Geopolitical Events and Market Reactions

Geopolitical events, ranging from conflicts to trade disputes, can trigger significant reactions in gold prices. Heightened tensions often lead to increased demand for gold as a protective measure against uncertainty.

Traders should closely monitor global news events, assessing their potential impact on the market. Swift responses to geopolitical developments can create profitable trading opportunities in the volatile environment of forex trading.

Currency Fluctuations and Gold Valuation

Gold is typically priced in U.S. dollars, meaning fluctuations in the value of the dollar can directly influence gold prices. A weaker dollar generally leads to higher gold prices, while a stronger dollar may suppress them.

Understanding the correlation between currency values and gold is essential for developing comprehensive trading strategies. Continuous analysis of currency dynamics enables traders to position themselves effectively based on anticipated price movements.

Tools and Strategies for Successful Gold Trading

A robust trading strategy is essential for success in the gold forex market. Leveraging various tools and techniques can enhance traders' abilities to make informed decisions and capitalize on market opportunities.

Technical Analysis Tools for Gold Trading

Technical analysis provides traders with valuable insights into historical price movements, helping to forecast future trends. Popular tools include trend lines, moving averages, and oscillators that assist in identifying entry and exit points.

Traders can utilize chart patterns, such as head and shoulders or triangles, to gauge potential reversals or continuations. By combining technical indicators with price action analysis, traders can create well-rounded strategies that adapt to changing market conditions.

Fundamental Analysis Considerations

While technical analysis focuses on historical price patterns, fundamental analysis examines economic and geopolitical factors influencing gold prices. Monitoring economic reports and central bank statements can inform trading decisions and provide context for price movements.

Traders should also assess market sentiment and investor behavior, as these psychological elements can drive price fluctuations. Understanding the broader economic landscape allows traders to make more informed predictions regarding gold price trends.

Developing a Trading Strategy

A well-defined trading strategy is essential for consistent profitability. Traders should establish clear goals, risk tolerance levels, and predefined entry and exit points based on analysis.

Backtesting strategies against historical data can provide insights into their effectiveness and potential improvements. Regularly reviewing and adjusting trading strategies ensures adaptability in the ever-evolving forex market.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Risks Associated with Gold Forex Trading

While trading gold forex presents opportunities, it also carries inherent risks. Understanding these risks is crucial for effective risk management and long-term success.

Market Volatility and Unexpected Price Movements

Gold prices can experience sudden and significant fluctuations, driven by market sentiment, economic news, and geopolitical events. These rapid price movements can lead to increased risk for traders, especially those employing high leverage.

Traders must remain vigilant in monitoring market conditions and adapting their strategies accordingly. Implementing stop-loss orders and setting risk-reward ratios can help mitigate potential losses during volatile periods.

Leverage Risk in Forex Trading

Leverage amplifies both potential returns and risks in forex trading. While it enables traders to control larger positions with a smaller capital outlay, it also increases the likelihood of significant losses.

Traders should exercise caution when utilizing leverage, ensuring they fully understand its implications on their trading accounts. Adopting a disciplined approach to leverage management is essential for maintaining a sustainable trading strategy.

Managing Emotional and Psychological Risks

Emotional factors can significantly impact trading decisions, often leading to impulsive actions or deviations from established strategies. Fear, greed, and anxiety can cloud judgment, resulting in costly mistakes.

Traders should prioritize emotional discipline, establishing routines for managing stress and maintaining focus. Techniques such as mindfulness, visualization, and regular breaks can help traders cultivate a mindset conducive to successful trading.

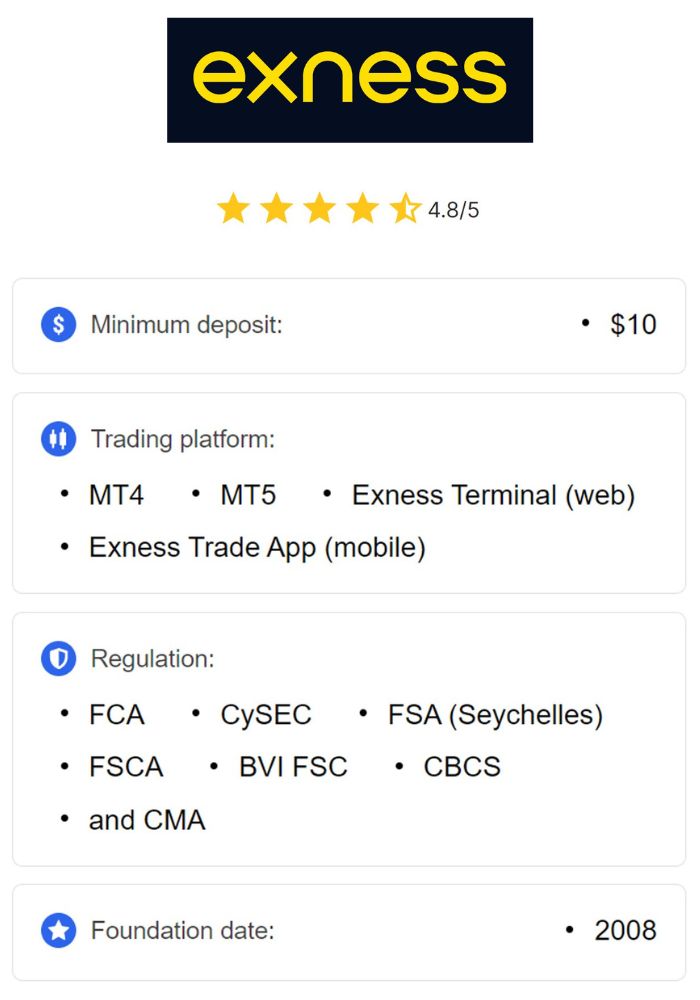

Choosing a Broker for Gold Forex Trading

Selecting a reliable broker is a crucial step for traders venturing into gold forex trading. The right broker can provide the necessary support, tools, and resources to navigate the complex market effectively.

Key Features to Look for in a Broker

When evaluating brokers, traders should consider several key features, including:

Regulation: Ensure the broker is regulated by reputable authorities, providing a layer of security and accountability.

Trading Platform: A user-friendly interface with advanced charting tools and order execution capabilities is essential for efficient trading.

Customer Support: Quality customer service can greatly enhance the trading experience, allowing for quick resolution of issues and inquiries.

By carefully assessing these features, traders can find a broker that aligns with their individual needs and trading goals.

Comparing Fees and Commissions

Understanding the fee structure of a broker is critical for managing trading costs. Brokers may charge spreads, commissions, or overnight financing fees, all of which can impact overall profitability.

Traders should compare fees across multiple brokers to find competitive rates that align with their trading strategies. Transparency regarding costs is vital for maintaining clarity in the trading process.

Importance of Regulation and Security

Choosing a broker regulated by recognized authorities ensures protection against fraud and malpractice. Regulatory oversight promotes fair trading practices and provides recourse in case of disputes.

Traders should prioritize brokers with strong security measures in place, safeguarding personal information and funds. Researching a broker's reputation and track record can provide valuable insights into their reliability and trustworthiness.

Educational Resources for Aspiring Traders

Continuous learning and skill development are essential for successful trading in the forex market. Numerous educational resources are available to help aspiring traders enhance their knowledge and expertise.

Online Courses and Webinars

Many platforms offer online courses and webinars designed to educate traders on various aspects of forex trading, including gold trading strategies. These interactive sessions provide valuable insights from experienced traders and industry experts.

Traders can benefit from structured learning experiences, covering topics such as technical analysis, risk management, and market psychology. Participating in live discussions fosters engagement and allows for real-time question-and-answer interactions.

Recommended Books and Articles

An extensive library of books and articles exists for traders seeking to deepen their understanding of forex and gold trading. Classic texts by authors like Alexander Elder, John J. Murphy, and Van K. Tharp offer timeless insights into market dynamics.

Regularly reading articles from reputable financial publications helps traders stay updated on current trends, economic developments, and emerging strategies. Committing to ongoing education is vital for sustained success in forex trading.

Community Forums and Support Groups

Engaging with fellow traders through community forums and support groups can provide emotional support and valuable networking opportunities. Online platforms enable traders to share experiences, strategies, and insights, fostering camaraderie within the trading community.

Participating in discussions and seeking feedback can accelerate the learning process, offering diverse perspectives on market analysis and trading techniques. Connecting with like-minded individuals creates a supportive environment for sharing knowledge and honing skills.

Conclusion

Navigating the world of gold forex trading in India requires a nuanced understanding of market dynamics, timing, and risk management. By grasping the intricacies of forex trading, recognizing the significance of gold, and implementing effective strategies, traders can position themselves for success.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

In conclusion, mastering the gold forex trading time in India is instrumental for aspiring traders. By staying informed, continuously learning, and honing their skills, traders can unlock the potential of the forex market and achieve their financial goals.

Read more: