11 minute read

Is Exness Allowed in India? Review Broker 2025

from Exness Blog

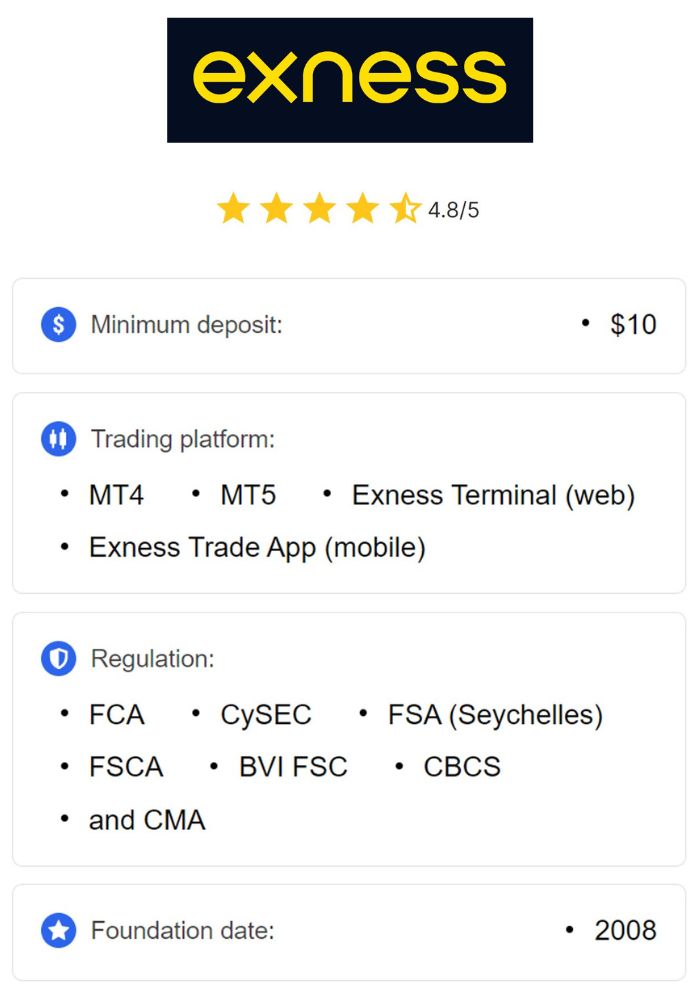

Overview of Exness

Company Background

Exness, established in 2008, has grown into a globally recognized forex and CFD trading platform. Headquartered in Cyprus, Exness operates in numerous countries, offering a range of financial instruments. It is known for its transparency, user-friendly platforms, and exceptional customer service.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

With millions of active users worldwide, Exness has gained a reputation for providing traders with competitive conditions, such as low spreads, high leverage, and advanced tools. The platform prioritizes security and compliance, ensuring that client funds are protected under stringent international standards.

Services Offered by Exness

Exness offers an extensive array of services, including forex trading, CFDs on indices, commodities, stocks, and cryptocurrencies. The platform provides traders with access to MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary trading platform, which are equipped with advanced charting tools and indicators.

Other key features include:

Flexible account types for beginners and professionals.

Real-time market analysis tools.

24/7 multilingual customer support.

These services make Exness a versatile platform for traders of all experience levels.

Regulatory Environment in India

Overview of Financial Regulations

India’s financial markets are tightly regulated to ensure stability and protect investors. The key authorities overseeing these markets are the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). Both institutions enforce strict guidelines on forex trading and related activities.

Forex trading in India is limited to currency pairs that include the Indian Rupee (INR). This restriction is intended to prevent capital flight and maintain control over cross-border transactions.

Role of the Securities and Exchange Board of India (SEBI)

SEBI is India’s primary regulatory authority for securities and financial markets. It ensures that brokers and trading platforms operate within a framework designed to promote transparency and protect investors.

Trading platforms offering forex services in India must be SEBI-registered. While Exness is not directly regulated by SEBI, it complies with international regulatory standards, which ensures its credibility and reliability in global markets.

Exness Licensing and Regulation

Licenses Held by Exness

Exness is regulated by several top-tier international regulatory bodies, including:

Cyprus Securities and Exchange Commission (CySEC)

Financial Conduct Authority (FCA)

Financial Services Authority (FSA) of Seychelles

These licenses affirm Exness’s commitment to operating under strict financial guidelines, ensuring the safety of client funds and adherence to anti-money laundering protocols.

Comparison with Indian Brokers

Indian brokers operating in the forex market are directly regulated by SEBI and RBI, and they are restricted to trading INR-based currency pairs. Exness, on the other hand, provides access to a broader range of instruments, including global currency pairs, commodities, and cryptocurrencies.

This diversity makes Exness appealing to Indian traders seeking more extensive trading opportunities, though it requires adherence to Indian legal and regulatory guidelines.

Legal Framework for Forex Trading in India

Foreign Exchange Management Act (FEMA)

The Foreign Exchange Management Act (FEMA) governs all foreign exchange transactions in India. FEMA restricts forex trading to INR-paired currencies on SEBI-regulated platforms. Trading other currency pairs is considered a violation of the law unless done through authorized channels.

Indian traders using international platforms like Exness must be cautious to ensure compliance with FEMA guidelines.

Implications for Indian Traders

The legal framework means Indian traders can face penalties if found engaging in unauthorized forex trading. However, many traders still use platforms like Exness by adhering to international trading regulations. They often employ strategies such as trading through non-INR pairs while being mindful of FEMA restrictions.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Accessibility of Exness for Indian Users

Account Registration Process

Registering an account with Exness is straightforward. Indian users can sign up on the official website by providing basic information, verifying their identity, and completing the KYC (Know Your Customer) process. Once verified, users gain access to demo and live trading accounts.

Exness also provides a demo account, allowing users to practice without risking real money. This feature is particularly beneficial for beginners seeking to understand the platform.

Supported Trading Instruments

Exness offers Indian traders access to a wide range of instruments, including:

Forex: Major, minor, and exotic currency pairs.

CFDs: On indices, commodities, and stocks.

Cryptocurrencies: Popular assets like Bitcoin and Ethereum.

These options provide diversification opportunities, enabling traders to hedge risks and explore multiple markets.

Payment Methods Available for Indian Traders

Deposit Options

Exness supports various deposit methods tailored to Indian users, including:

Bank Transfers: Facilitates deposits through local Indian banks.

E-Wallets: Options like Skrill and Neteller for faster transactions.

Cryptocurrencies: Enables funding accounts using Bitcoin and other digital currencies.

These options ensure convenience and flexibility for traders.

Withdrawal Processes

Withdrawals on Exness are seamless, with funds processed quickly through the same channels used for deposits. Indian traders can expect:

Zero withdrawal fees on most methods.

Processing times ranging from instant to a few hours.

The platform’s commitment to efficiency and transparency in fund transfers has been a major factor in its popularity.

Benefits of Using Exness in India

Low Spreads and High Leverage

Exness offers some of the most competitive spreads in the industry, starting from as low as 0.0 pips on certain account types. The platform also provides high leverage options, which enable traders to amplify their positions with minimal capital.

For Indian traders, these conditions are highly advantageous, especially for those operating with limited budgets.

Advanced Trading Platforms

Exness supports industry-leading platforms like MT4 and MT5, along with its own web-based solution. These platforms are equipped with:

Customizable charting tools.

Technical indicators.

Algorithmic trading capabilities.

The availability of mobile apps ensures that traders can manage their accounts and execute trades on the go.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Risks Involved with Exness for Indian Traders

Market Volatility

Forex trading is inherently volatile, with currency prices influenced by global events, economic indicators, and geopolitical developments. This unpredictability means that traders must navigate significant price swings, which can lead to substantial gains or equally significant losses. For Indian traders using Exness, the availability of high leverage amplifies these risks. While leverage can increase potential profits, it also magnifies losses, making risk management essential.

To mitigate these risks, traders should employ stop-loss and take-profit orders. These tools help limit potential losses and secure profits during market fluctuations. Additionally, understanding global economic trends and regularly analyzing market conditions can enable traders to make informed decisions, minimizing exposure to unnecessary risks.

Regulatory Risks

As Exness is not directly regulated by Indian authorities like SEBI or RBI, Indian traders face regulatory uncertainties. Trading forex outside INR-paired currencies could conflict with the Foreign Exchange Management Act (FEMA), potentially leading to penalties if Indian regulations are violated. While Exness adheres to international regulatory standards, the lack of local oversight may create a sense of vulnerability for Indian users.

To address these concerns, traders should stay informed about FEMA guidelines and avoid transactions that could be considered non-compliant. Consulting legal or financial advisors before engaging in forex trading with international platforms like Exness can provide clarity and help traders operate within the boundaries of Indian laws.

Tax Implications for Indian Traders Using Exness

Taxation on Forex Trading

Earnings from forex trading are subject to taxation under Indian law, categorized based on the nature of the trading activity. If trading is sporadic or done as a secondary activity, the profits are often classified as speculative income and taxed at standard individual rates. On the other hand, regular or professional trading may be treated as business income, which involves additional compliance and tax planning.

Traders must maintain accurate records of all transactions, including profits and losses, to facilitate the tax filing process. Proper documentation helps in claiming legitimate deductions and ensures compliance with Indian tax laws. Consulting a tax professional familiar with forex trading regulations is advisable to minimize tax-related challenges.

Reporting Requirements

The Indian Income Tax Act mandates that all forex trading income be disclosed when filing annual tax returns. Failure to report such income can attract scrutiny from tax authorities and lead to penalties or audits. For traders using Exness, especially those earning substantial profits, adherence to reporting norms is crucial.

Additionally, Indian traders with accounts on international platforms like Exness must comply with rules related to foreign asset declarations under the Black Money Act. Declaring these assets during tax filings not only ensures transparency but also protects traders from potential legal consequences.

User Experiences and Reviews

Pros from Trader Feedback

Indian traders frequently commend Exness for its user-friendly interface and advanced trading tools. The platform’s transparent pricing structure, featuring competitive spreads and commission rates, is particularly appealing to cost-conscious traders. Additionally, the efficiency of Exness’s deposit and withdrawal processes has garnered praise, as it allows seamless transactions without excessive delays or fees.

Another advantage is Exness’s multilingual customer support, which includes languages spoken in India. This accessibility ensures that traders receive prompt assistance and can resolve issues efficiently, further enhancing their overall trading experience.

Cons Highlighted by Users

Despite its many strengths, Exness has faced criticism from some users. One common concern is the high leverage offered by the platform, which, while advantageous for experienced traders, can lead to significant losses for beginners who lack proper risk management strategies. This has prompted calls for better educational resources to help traders navigate leverage effectively.

Another issue raised by Indian traders is the regulatory ambiguity surrounding the platform's use. Since Exness is not directly governed by Indian authorities, some users feel uncertain about the long-term legal implications of trading on the platform. These concerns highlight the need for greater transparency and education regarding compliance with Indian regulations.

Alternatives to Exness for Indian Traders

Local Brokerage Firms

For traders seeking platforms fully compliant with Indian regulations, local brokerage firms are a viable alternative. Companies like Zerodha and Angel Broking offer INR-paired forex trading, which is fully regulated by SEBI and RBI. These brokers ensure compliance with FEMA and provide traders with the peace of mind associated with operating within a clear legal framework.

While local brokers may not offer the same diversity of trading instruments as Exness, they excel in providing a secure environment for trading INR-based currency pairs. Additionally, their customer support teams are well-versed in Indian financial regulations, offering valuable assistance to traders.

International Brokers with Indian Operations

Several international brokers, such as IG and Forex.com, operate in India while adhering to local regulations. These platforms provide traders with a broader range of trading instruments than local brokers while ensuring compliance with Indian laws. Such brokers may also offer better educational resources and analytical tools, making them attractive for Indian traders seeking a balanced approach.

The key consideration for traders using these brokers is to verify their SEBI registration and understand their offerings. By doing so, they can enjoy the benefits of global trading platforms without compromising regulatory compliance or security.

Future of Forex Trading in India

Trends in Online Trading

The forex trading landscape in India is evolving rapidly, driven by technological advancements and increased internet penetration. Mobile trading apps, real-time data, and AI-powered analysis tools are making trading more accessible to a broader audience. This democratization of forex trading has led to a surge in participation, particularly among younger, tech-savvy traders.

Moreover, the rise of social trading, where users can follow and replicate the strategies of successful traders, is gaining traction. Platforms offering community-driven tools are likely to see significant growth in the Indian market.

Potential Regulatory Changes

As forex trading gains popularity in India, regulators may revisit existing frameworks to accommodate evolving market dynamics. Potential updates could include expanding the list of permissible currency pairs or introducing new guidelines for trading on international platforms. Such changes would enhance market accessibility while maintaining financial stability.

Indian traders should stay informed about regulatory developments, as these could shape the future of forex trading in the country. By adapting to new policies and leveraging emerging opportunities, traders can position themselves for long-term success in this dynamic market.

Conclusion

Exness is a globally recognized trading platform offering Indian users access to diverse instruments and competitive trading conditions. While it is not directly regulated by SEBI or RBI, its adherence to international standards ensures credibility and reliability. However, Indian traders must navigate regulatory risks and comply with FEMA guidelines to avoid legal issues.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

By understanding the risks, leveraging Exness’s resources, and staying informed about regulatory changes, traders in India can make the most of this platform and explore the dynamic world of forex trading responsibly.

Read more: