7 minute read

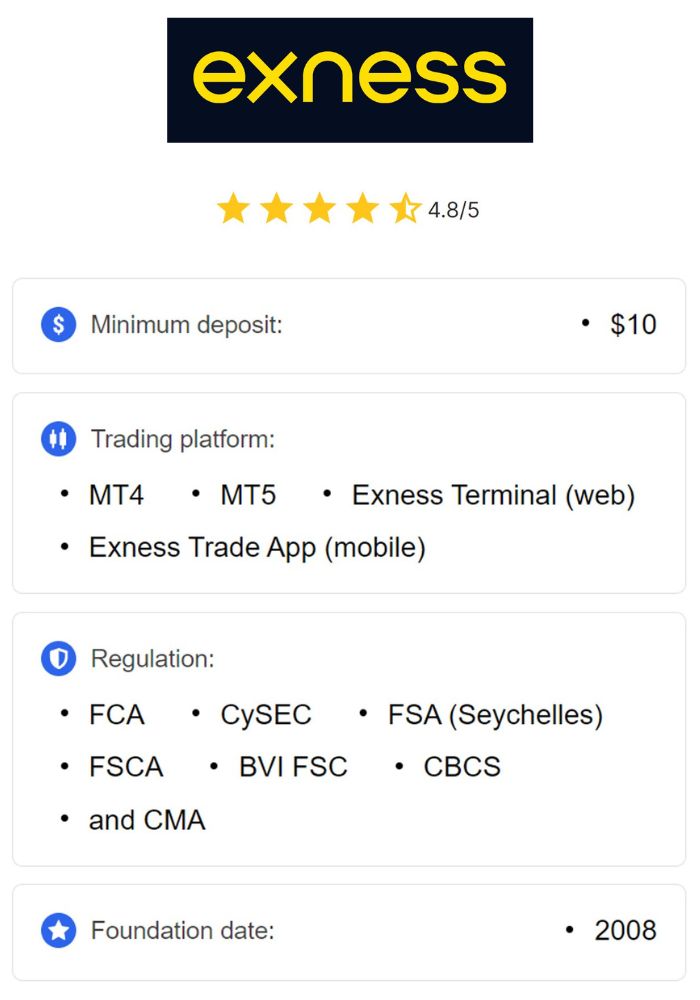

Is Exness Regulated and Licensed? Review Broker 2025

When it comes to trading in the financial markets, the question of regulation and licensing is paramount for investors. Is Exness regulated and licensed? This query often arises among traders who seek assurance that their chosen broker operates under strict regulatory frameworks designed to protect their interests. In this article, we will delve into the various aspects of Exness's regulatory status, examining its licenses, the jurisdictions in which it operates, and the implications these have for both novice and experienced traders.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Understanding Regulatory Frameworks in Forex Trading

Regulatory bodies play a crucial role in maintaining market integrity and protecting traders from potential fraud. Understanding these frameworks is essential when considering whether to engage with a broker like Exness.

The Role of Regulatory Bodies

Regulatory bodies are organizations tasked with overseeing financial markets to ensure they operate transparently and fairly. Their responsibilities include enforcing compliance with laws, monitoring market activities, and providing oversight to protect traders and investors. Some of the most recognized regulatory authorities include:

Financial Conduct Authority (FCA): Based in the UK, the FCA oversees brokers and ensures they meet specific standards of conduct.

Cyprus Securities and Exchange Commission (CySEC): CySEC regulates financial services firms in Cyprus and plays a significant role in the European Union.

Australian Securities and Investments Commission (ASIC): ASIC is responsible for regulating financial service providers in Australia, ensuring investor protection.

Each of these bodies has distinct guidelines that brokers must adhere to in order to operate legally within their jurisdictions.

Importance of Regulation for Traders

The importance of regulation cannot be overstated. When traders choose a regulated broker, they benefit from several protections, including:

Segregation of Funds: Regulated brokers are often required to keep client funds in separate accounts, reducing the risk of loss due to broker insolvency.

Transparency Requirements: Brokers must regularly report their financial standings and practices, allowing traders to make informed decisions.

Dispute Resolution Mechanisms: Many regulatory bodies provide mechanisms for resolving disputes between brokers and clients, offering additional peace of mind.

Given these factors, understanding whether Exness is regulated is critical to ensuring the safety of one’s investments.

Exness's Regulatory Landscape

Exness operates in multiple regions with varying degrees of regulatory oversight. As a global broker, it holds several licenses that affirm its commitment to adhering to industry standards. However, not all licenses carry the same weight or protective measures. This section will explore the specific regulations that Exness operates under and what they mean for traders.

Exness Licenses and Regulations

In this section, we will take a closer look at the different licenses held by Exness and the significance of each.

Exness and the Financial Conduct Authority (FCA)

The Financial Conduct Authority plays a pivotal role in the UK financial services sector. Exness is regulated by the FCA, which is one of the most respected regulatory bodies globally.

Being regulated by the FCA implies that Exness must comply with stringent requirements concerning capital adequacy, transparency, and client fund protection. The FCA mandates that brokers segregate client funds from company operating funds, which protects traders against potential financial mishaps.

Moreover, the FCA enforces regular audits and compliance checks on Exness. Consequently, traders can rest assured that they are working with a broker that adheres to high ethical standards.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Exness and the Cyprus Securities and Exchange Commission (CySEC)

In addition to its FCA regulation, Exness is also licensed by the Cyprus Securities and Exchange Commission. This regulation allows Exness to operate within the European Union under the Markets in Financial Instruments Directive II (MiFID II).

CySEC regulation offers several benefits to traders, such as:

Investor Compensation Fund (ICF): This fund protects clients in case of broker insolvency, providing further security for traders.

Tighter Compliance: Operating under CySEC requires Exness to conform to rigorous compliance standards, ensuring ongoing scrutiny of its operations.

By holding a license from CySEC, Exness demonstrates its commitment to maintaining high standards in customer protection and operational integrity within the European market.

Exness and Other Regulatory Authorities

Exness is also regulated by other global entities, enhancing its credibility. These may include licenses from authorities in regions like Australia and South Africa. Each source of regulation adds an extra layer of credibility to Exness as a trustworthy trading platform.

Traders should consider the level of regulation applicable to their respective countries. A broker may be heavily regulated in one jurisdiction while having fewer obligations in another. By understanding these nuances, traders can make informed decisions about where to allocate their resources.

Implications of Exness's Regulatory Status

The regulatory landscape surrounding Exness carries significant implications for traders. In this section, we will explore how Exness's regulatory status affects trader experiences, risks, and overall confidence in using their services.

Enhanced Trust and Security

One of the most immediate implications of Exness being regulated by reputable authorities, such as the FCA and CySEC, is the enhanced trust and security it offers to clients. When a broker operates under strict regulatory conditions, traders feel more secure knowing that there are safeguards in place to protect their investments.

Trust is a cornerstone of any financial relationship, and Exness's multiple licenses help cultivate a sense of security among traders, which may lead to increased trading activity. With confidence in their broker, traders are likely to engage more actively in the markets, leading to a more fulfilling trading experience.

Risk Management and Trade Confidence

Another important aspect of being regulated is the requirement for brokers to implement effective risk management practices. Regulatory bodies often mandate that brokers maintain certain levels of capital reserves and adhere to risk management protocols, fostering a safer trading environment.

For traders, this means that they can feel more confident in executing trades without fear of sudden market disruptions caused by a broker's mismanagement. Knowing that Exness is subject to rigorous scrutiny helps traders focus on their strategies rather than worrying about the integrity of their broker.

Access to Better Trading Conditions and Tools

Regulation often translates to better trading conditions and tools offered by brokers. Regulatory compliance demands that brokers provide transparent fee structures, adhere to fair trade execution practices, and maintain adequate liquidity for trading.

Exness, as a regulated entity, must uphold these standards, giving traders access to competitive spreads, reliable trading platforms, and a wide range of trading instruments. This competitive edge can significantly enhance overall trading performance.

While regulatory compliance can create an environment conducive to successful trading, it's important for traders not to become complacent. Continuous education and vigilance remain essential for navigating the complexities of the financial markets.

Conclusion

In conclusion, addressing the question, is Exness regulated and licensed? sheds light on the exceptional measures taken by the broker to ensure transparency, security, and compliance. Through its licensing with esteemed authorities like the FCA and CySEC, Exness demonstrates a commitment to safeguarding trader interests, promoting trust, and fostering a healthier trading ecosystem.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Understanding the various regulatory frameworks governing brokers like Exness is crucial for traders seeking to navigate the complex world of financial markets confidently. By engaging with a well-regulated broker, traders can harness better trading conditions and ultimately work towards achieving their investment goals.

As the landscape of online trading continues to evolve, staying informed about regulatory changes and developments remains vital. Armed with knowledge and insight, traders can make sound decisions, paving the way for a successful trading journey with Exness or any other regulated broker.

Read more: