14 minute read

Is Exness Safe in India? Is it Legal?

Overview of Exness

Introduction to Exness as a Brokerage

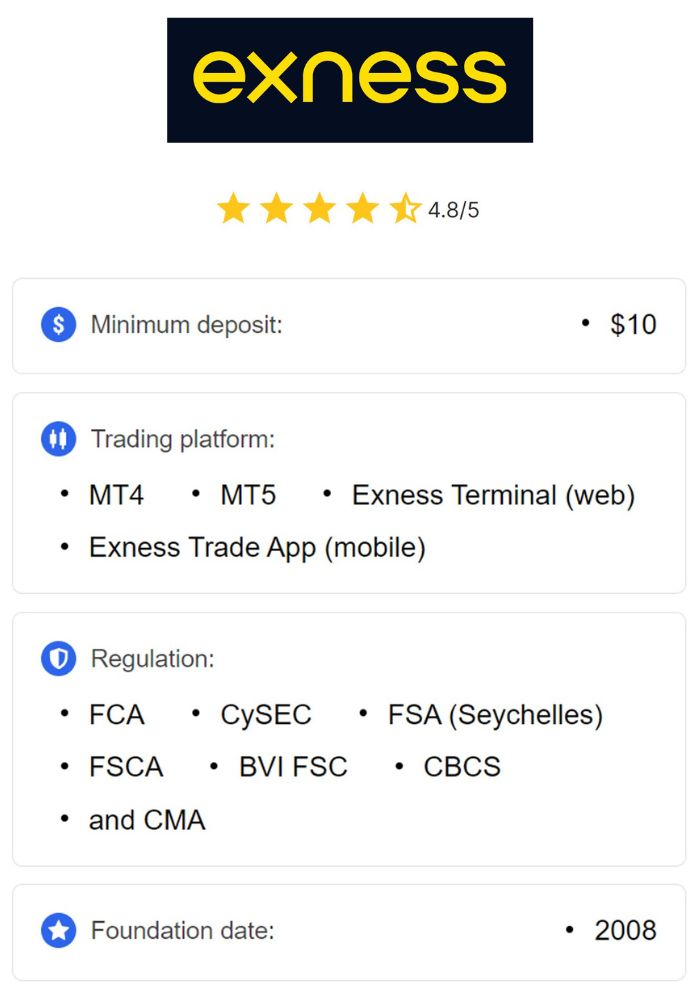

Exness is an international forex and CFD (Contract for Difference) broker that has built a strong reputation in the trading community. Established in 2008, Exness offers a wide range of financial instruments, including currencies, commodities, indices, and cryptocurrencies.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

The broker is known for its innovative trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which provide traders with advanced tools to analyze markets, execute trades, and manage their portfolios. Exness aims to provide a transparent, secure, and efficient trading experience for traders around the world, including those in India.

One of Exness's core principles is offering competitive trading conditions, such as tight spreads, high leverage, and fast execution speeds. These features, combined with its excellent customer service and robust educational resources, make Exness an appealing choice for both beginner and professional traders. Exness also operates across multiple regions, with a strong focus on providing local support to its users and adapting to market needs in each country it serves.

History and Reputation of Exness

Exness has been a prominent player in the global trading industry for over a decade. The company was founded with the goal of offering a better, more transparent trading experience than many other brokers in the market. Over the years, Exness has grown into one of the leading forex brokers globally, known for its commitment to regulatory compliance, client protection, and cutting-edge technology.

The company has expanded its operations to numerous countries, providing services to millions of traders worldwide. Exness is widely respected for its customer-centric approach and for maintaining high standards in terms of financial integrity and security. The broker holds multiple regulatory licenses and follows strict operational guidelines, which further enhance its reputation for trustworthiness and reliability. Exness's dedication to transparency and its ability to adapt to evolving market conditions have cemented its status as a respected broker in the financial services industry.

Regulatory Status of Exness

Licensing Authorities Governing Exness

Exness operates under the oversight of several respected regulatory authorities in different regions. These licenses ensure that Exness adheres to strict operational and financial standards, which is crucial for protecting traders' interests. The most notable licensing authorities for Exness include:

The Financial Conduct Authority (FCA) in the United Kingdom – One of the most recognized and respected financial regulatory bodies globally. FCA regulation ensures that Exness operates in a transparent, secure, and ethical manner.

Cyprus Securities and Exchange Commission (CySEC) – This regulatory body provides oversight to Exness, ensuring that it follows European Union financial regulations.

The Financial Services Commission (FSC) in Mauritius – This license ensures that Exness operates according to the financial laws of Mauritius.

The South African Financial Sector Conduct Authority (FSCA) – Exness is also regulated in South Africa, where the FSCA ensures that Exness complies with local financial regulations.

Despite not being directly regulated by Indian authorities such as the Securities and Exchange Board of India (SEBI), Exness operates under global regulations that ensure high standards of security and customer protection. Traders can be confident that Exness follows rigorous compliance requirements to protect both their funds and personal information.

Comparison with Other International Brokers

Compared to many other international brokers, Exness stands out for its extensive range of licenses from top-tier regulatory bodies around the world. Many brokers may be licensed in just one jurisdiction, while Exness holds multiple licenses in different regions, providing a robust framework for operations. This gives Exness a competitive edge in terms of trust and reliability, as clients know that their broker is held accountable to multiple regulatory authorities.

Furthermore, Exness's commitment to transparency and regulatory compliance distinguishes it from some other brokers that may not be as forthcoming with their regulatory status. While some traders in India may be cautious due to the absence of regulation by Indian authorities, Exness's global licenses provide sufficient assurance of its operational integrity.

Exness Operations in India

Availability of Exness Services in the Indian Market

Exness has expanded its operations to numerous countries, including India. The broker offers its services to Indian traders who wish to access global financial markets. While Exness is not directly regulated by the Securities and Exchange Board of India (SEBI), it remains a popular choice among Indian traders due to its secure trading platforms, competitive pricing, and excellent customer support. Exness supports Indian traders by providing access to several local payment methods, making it easier for users in India to deposit and withdraw funds.

Despite the regulatory restrictions on forex trading imposed by Indian authorities, Exness provides traders in India with the ability to trade on international markets, including currency pairs, commodities, and even cryptocurrencies. Indian traders, however, need to be aware of the legal implications when trading with an offshore broker like Exness and should consider the risks involved in trading with foreign brokers.

Account Types Offered to Indian Traders

Exness offers a range of account types to cater to traders with different levels of experience and trading preferences. Indian traders can choose from several options, including:

Standard Accounts – Ideal for beginner traders, these accounts offer a low minimum deposit requirement and provide access to basic trading tools.

Professional Accounts – These accounts are geared toward experienced traders and offer tighter spreads, better leverage options, and lower commissions.

Islamic Accounts – Exness also offers accounts that comply with Sharia law, allowing traders who follow Islamic principles to engage in forex trading without incurring interest-based fees.

Each account type offers a variety of features to suit the unique needs of Indian traders, from novice to experienced professionals. This flexibility ensures that Exness can cater to a wide demographic of traders in India.

Safety and Security Measures

Client Fund Protection Policies

Exness prioritizes the safety of client funds and employs strict policies to protect traders' capital. Client funds are kept in segregated accounts, separate from the company's operational funds, which ensures that traders’ money is safe even in the unlikely event of company insolvency. This practice is a common standard in the industry and is enforced by the regulatory authorities under which Exness operates.

Moreover, Exness is part of compensation schemes in certain regions, such as the Cyprus Investor Compensation Fund, which provides additional protection to clients if the broker fails to meet its financial obligations. These measures ensure that Indian traders can feel confident in the security of their funds when trading with Exness.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Data Encryption and Cybersecurity Measures

Exness takes cybersecurity seriously and employs state-of-the-art encryption technologies to protect users' data. The broker uses SSL encryption to secure communications between traders' devices and the Exness platform, ensuring that sensitive information, such as account details and personal data, is kept private and protected from unauthorized access.

Additionally, Exness adheres to the highest standards of cybersecurity and constantly monitors its systems for potential security breaches. The company regularly updates its protocols to protect against cyber-attacks and other online threats. This commitment to safeguarding client information makes Exness a reliable and secure broker for traders in India.

Legality of Trading with Exness in India

Understanding India's Foreign Exchange Regulations

India has strict regulations governing forex trading, which are overseen by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). Indian residents are generally prohibited from participating in forex trading on offshore platforms that are not regulated by Indian authorities. However, certain forms of forex trading, such as trading in Indian Rupee (INR) pairs or trading on SEBI-approved platforms, are allowed.

While Exness is not regulated by SEBI, it operates under several high-tier international licenses, ensuring compliance with global standards. Indian traders must be cautious and understand the legal restrictions when trading with an offshore broker like Exness. However, for non-resident Indians (NRIs) or individuals who reside outside India, Exness remains a legal and safe platform for trading.

Legal Implications for Indian Traders

Indian traders who wish to trade on Exness should be aware of the potential legal implications. While Exness itself does not violate Indian law, trading on foreign forex platforms without regulatory oversight from SEBI may expose traders to legal risks. Indian traders are advised to carefully review the regulations governing forex trading in India and consult with legal advisors if necessary.

It is important for traders to ensure that they comply with India's Foreign Exchange Management Act (FEMA), which regulates foreign currency transactions. While there are restrictions on forex trading, many traders still choose to use offshore brokers like Exness, accepting the associated risks. Understanding the legal landscape is crucial for Indian traders to make informed decisions.

User Experience and Feedback

Reviews from Indian Traders

Exness has received positive feedback from many Indian traders who appreciate the broker's ease of use, competitive spreads, and reliable customer support. Traders have praised the broker's user-friendly platform, which allows them to execute trades quickly and efficiently. Additionally, the wide range of available trading instruments, such as forex pairs, commodities, and cryptocurrencies, makes Exness a versatile option for Indian traders.

Furthermore, Exness's commitment to transparency and customer service has contributed to its positive reputation in India. Indian traders also appreciate the local payment methods provided by Exness, which make deposits and withdrawals hassle-free. Overall, Exness is seen as a trustworthy broker by Indian traders who value high-quality service and competitive trading conditions.

Common Concerns Raised by Users

While most reviews are positive, some Indian traders have expressed concerns about the lack of direct regulation from Indian authorities like SEBI. This has raised questions regarding the legal risks of trading with Exness. Additionally, the verification process required for opening an account has been a point of contention for some users, with a few traders finding it time-consuming and inconvenient.

However, many traders understand that these concerns are part of the process of ensuring security and compliance with global standards. Despite these issues, Exness's overall reputation remains strong in the Indian market, with many traders opting to use its services despite the regulatory complexities.

Customer Support and Resources

Types of Customer Support Available

Exness provides excellent customer support to Indian traders, offering multiple channels of communication, including live chat, email, and phone support. The support team is available 24/5, ensuring that traders can get assistance whenever they need it. Indian traders can communicate in several languages, including Hindi, which enhances the support experience for local users.

Exness's customer support team is known for being responsive and helpful, addressing traders' queries quickly and professionally. The broker also provides a comprehensive FAQ section and other self-help resources, allowing traders to find answers to common questions without needing to contact support.

Educational Resources for Indian Traders

Exness offers a wide range of educational resources tailored to the needs of Indian traders. These include video tutorials, webinars, market analysis, and articles that cover various aspects of trading, from basic strategies to advanced techniques. The educational materials are available in multiple languages, including Hindi, making them accessible to a wider audience in India.

The broker's commitment to trader education is reflected in its user-friendly resources that help Indian traders improve their trading skills. Whether you're a beginner or an experienced trader, Exness provides tools to enhance your trading knowledge and improve your overall performance in the market.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Trading Conditions on Exness

Spreads and Commissions for Indian Users

Exness offers competitive spreads and commissions for Indian traders, depending on the account type chosen. The Standard Accounts typically offer wider spreads but no commission fees, which makes them a good option for beginners. Professional accounts, on the other hand, provide tighter spreads but charge a small commission per trade.

Traders in India can benefit from the low-cost trading environment that Exness offers, particularly for those who are active traders or prefer to execute large volumes of trades. The broker's competitive pricing structure helps Indian traders maximize their potential profits while minimizing trading costs.

Leverage Options and Risk Management

Exness provides high leverage options for Indian traders, up to 1:2000, depending on the account type. This allows traders to control larger positions with a relatively small investment. However, high leverage also comes with increased risk, and traders are advised to use proper risk management strategies to protect their capital.

Exness offers a range of risk management tools, including stop-loss orders, take-profit orders, and negative balance protection. These tools help traders minimize their losses and protect their investments, ensuring a safer trading experience.

Payment Methods for Indian Traders

Deposit and Withdrawal Options Available

Exness offers a wide range of deposit and withdrawal options for Indian traders, including bank transfers, credit/debit cards, and e-wallets like Skrill and Neteller. The broker ensures fast and secure payment processing, allowing traders to fund their accounts or withdraw profits without unnecessary delays.

Indian traders can also use local payment methods like UPI (Unified Payments Interface) and IMPS (Immediate Payment Service), making transactions faster and more convenient. Exness ensures that all payment methods are safe and compliant with local regulations, providing traders with peace of mind when conducting financial transactions.

Currency Conversion Fees and Processes

When making deposits or withdrawals in Indian Rupees (INR), traders may be subject to currency conversion fees depending on the method used. Exness charges minimal conversion fees, but traders should be aware of potential charges imposed by their payment providers.

The process of converting currencies is streamlined and efficient, with Exness offering competitive exchange rates for traders in India. However, it’s essential to consider these fees when calculating overall trading costs, as currency conversion can impact profits, particularly for traders making frequent deposits and withdrawals.

Comparison with Other Brokers in India

Key Differentiators of Exness

Exness differentiates itself from other brokers operating in India through its global regulatory licenses, which ensure a high level of security and transparency for traders. Unlike some local brokers, Exness provides a range of advanced trading platforms, such as MetaTrader 4 and MetaTrader 5, and offers a wide array of financial instruments, including commodities, forex, and cryptocurrencies.

The broker also stands out for its competitive spreads, high leverage options, and 24/5 customer support, which are highly valued by traders in India. Moreover, Exness offers local payment methods, making deposits and withdrawals easier for Indian traders.

Pros and Cons When Compared to Local Brokers

When compared to local brokers in India, Exness offers several advantages, such as access to a broader range of trading instruments and the ability to trade on international markets. However, it may not be as familiar to Indian traders due to its lack of direct regulation by SEBI. Local brokers, on the other hand, are regulated by SEBI and offer services that are more tailored to the Indian market.

While Exness offers competitive pricing and advanced platforms, some traders may prefer local brokers for reasons related to regulation and familiarity with Indian trading conditions. Ultimately, choosing between Exness and local brokers depends on the individual trader's preferences and priorities.

Risks Associated with Forex Trading

Market Volatility and Its Impact

Forex trading is inherently volatile, and traders in India must be prepared for significant fluctuations in currency prices. While high volatility can present opportunities for profit, it also increases the risk of losses. Traders must employ sound risk management strategies to protect their capital and avoid large losses during periods of high market volatility.

Exness provides a range of tools to help traders manage risk, but it is essential for traders to understand the market dynamics and stay informed about global economic events that may affect currency prices.

Importance of Risk Management Strategies

Effective risk management is essential for success in forex trading. Exness offers various tools, such as stop-loss and take-profit orders, that can help traders limit their exposure to risk. Traders are encouraged to use these tools, along with careful position sizing and leverage control, to manage their trades and minimize potential losses.

Proper risk management strategies are crucial, particularly in the volatile forex market. By using Exness's risk management features and maintaining a disciplined trading approach, Indian traders can protect their investments and increase their chances of success.

Conclusion on Exness Safety and Legality in India

In conclusion, Exness is a safe and legal platform for traders in India, offering a range of regulatory protections, competitive trading conditions, and secure payment methods. While the broker is not directly regulated by Indian authorities, its global licenses from top-tier regulators, such as the FCA and CySEC, provide a strong foundation of security and trust.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Indian traders who wish to trade with Exness should be aware of the legal restrictions on forex trading in India and ensure they comply with the country’s regulations. Despite these considerations, Exness remains a reputable and reliable choice for traders in India who are looking to access global markets while benefiting from competitive trading conditions and advanced tools.

Read more: