10 minute read

How to Open a Forex Account in Bangladesh

If you are interested in the world of trading, particularly in forex trading, understanding how to open a forex account in Bangladesh is crucial for your journey. Forex trading offers immense opportunities for profit and financial independence, but it also requires a keen understanding of the market and the necessary procedures to get started.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

In this article, we will provide an extensive guide on how to open a forex account in Bangladesh, covering everything from finding the right broker to the documentation needed and the various types of accounts available. We will delve into the regulatory environment, trading platforms, and tips for successful trading, ensuring that you have all the information necessary to embark on your forex trading journey.

Understanding Forex Trading

Before diving into how to open a forex account in Bangladesh, it's essential to grasp the basic principles of forex trading and its significance in the global financial landscape.

What is Forex Trading?

Forex, or foreign exchange, refers to the global marketplace where currencies are traded against one another. It operates 24 hours a day, five days a week, allowing traders from around the world to engage in currency trading at any time.

Forex trading involves buying one currency while simultaneously selling another, with the aim of profiting from fluctuations in exchange rates. As the largest financial market globally, forex trading boasts a daily turnover exceeding trillions of dollars, making it an attractive avenue for both individual and institutional investors.

The appeal of forex trading lies in its accessibility, liquidity, and potential for high returns. However, it also presents considerable risks, demanding a thorough understanding of market dynamics and sound trading strategies.

The Importance of Forex Trading in Bangladesh

In recent years, there has been a rising interest in forex trading among Bangladeshi investors. This growth can be attributed to several factors, including increased internet access, globalization, and the potential for high returns on investments.

Forex trading allows Bangladeshi traders to diversify their investment portfolios and take advantage of global economic movements. As the country continues to integrate into the global economy, an increasing number of individuals and businesses recognize the importance of forex trading as a means of capitalizing on international currency fluctuations.

Additionally, forex trading provides a platform for Bangladeshi traders to hedge against domestic currency depreciation, thereby safeguarding their investments and savings against inflationary pressures.

Key Terms to Know

Becoming familiar with key terminology associated with forex trading is vital for any prospective trader. Some of the most important terms include:

Pips: The smallest price movement in a currency pair.

Leverage: A mechanism that allows traders to control larger positions with a smaller amount of capital.

Spread: The difference between the bid and ask price of a currency pair.

Lot Size: The size of a trade, usually expressed in units of currency.

Familiarity with these terms will not only enhance your understanding of the forex market but also empower you to make informed trading decisions.

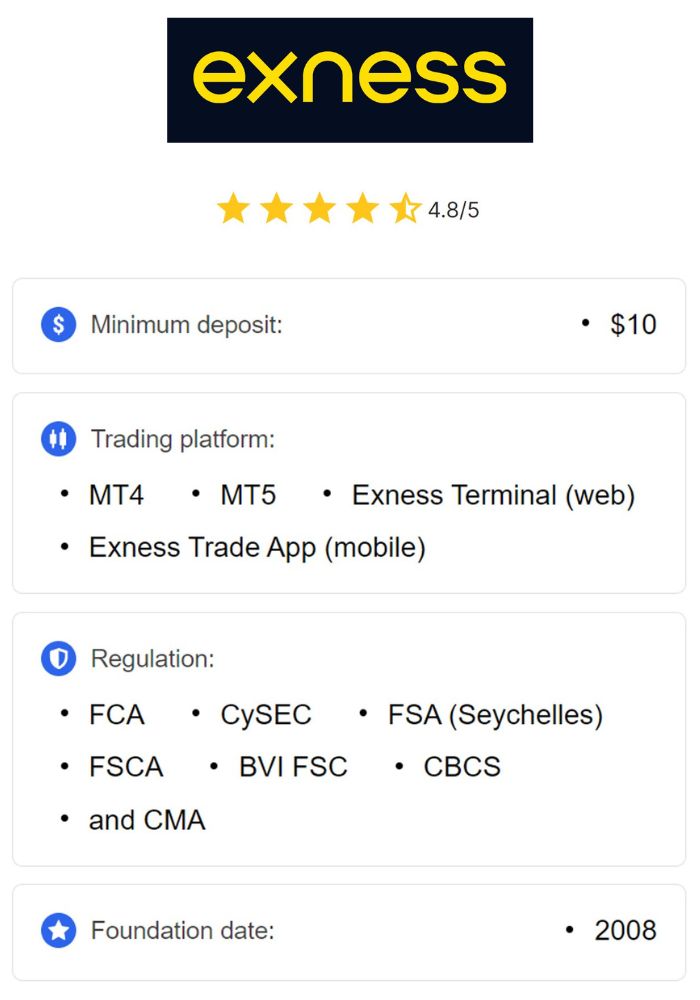

Choosing the Right Forex Broker

Selecting the right forex broker is perhaps the most critical step in the process of how to open a forex account in Bangladesh. A reputable broker ensures a smooth trading experience, offering competitive spreads, reliable execution, and excellent customer support.

Types of Forex Brokers

Understanding the different types of brokers available can help you determine which one aligns best with your trading style and preferences.

Market Makers: These brokers set the prices for currency pairs and take the opposite side of trades. Market makers often offer fixed spreads and may be more accessible for beginners due to their simplified trading processes. However, they may have conflicts of interest since they profit from traders' losses.

ECN Brokers: Electronic Communication Network (ECN) brokers connect traders directly to other market participants, providing access to real market prices. They typically charge variable spreads and offer greater transparency, making them suitable for experienced traders who prefer direct market access.

STP Brokers: Straight Through Processing (STP) brokers route orders directly to liquidity providers without dealing desk intervention. They combine features of both ECN and market maker models, offering competitive pricing and faster order execution.

Choosing the right broker depends on your trading goals, risk tolerance, and level of experience.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Regulatory Framework in Bangladesh

When selecting a forex broker, it is crucial to ensure that the broker adheres to regulatory standards to protect your investments. In Bangladesh, the primary regulatory authority overseeing forex trading is the Bangladesh Bank, which sets guidelines and regulations to promote financial stability and safeguard consumers.

Make sure to choose a broker that is regulated by a credible financial authority to minimize risks associated with fraud and malpractice. Conducting thorough research into the broker’s licensing and regulatory compliance is essential before opening an account.

Comparing Features and Fees

Once you've narrowed down your options based on broker types and regulatory compliance, you should compare the features and fees associated with each broker. Pay attention to the following key aspects:

Trading Platforms: Ensure that the broker offers a user-friendly trading platform that suits your trading style. Popular platforms like MetaTrader 4 and MetaTrader 5 provide powerful tools for analysis and automation.

Spreads and Commissions: Compare spread levels and commissions charged by different brokers, as these costs can significantly impact your overall profitability.

Deposit and Withdrawal Methods: Assess the availability of convenient deposit and withdrawal methods for Bangladeshi traders, including local bank transfers, e-wallets, and credit/debit cards.

A comprehensive evaluation of these features will help you select a broker that offers the best combination of value and reliability.

Opening Your Forex Account

Now that you understand the basics of forex trading and have chosen a suitable broker, it’s time to learn about the actual process of how to open a forex account in Bangladesh. The steps involved may vary slightly depending on the broker you choose, but the fundamental principles remain consistent.

Documentation Required

Before starting the registration process, gather the necessary documents required by your chosen broker. Commonly required documents include:

Proof of Identity: This can be a government-issued ID, passport, or driver's license. The document must clearly display your name, photograph, and date of birth.

Proof of Address: You may need to submit a utility bill, bank statement, or rental agreement that shows your current residential address. This document should be dated within the last three months.

Tax Identification Number: Some brokers may require your tax identification number for verification purposes.

Ensure that all documents are valid and legible to avoid any delays in the account approval process.

Registration Process

With the necessary documents ready, you can proceed to register your forex account. Follow these general steps:

Visit the Broker's Website: Navigate to the official website of your chosen broker and locate the "Open Account" or “Register” button.

Fill Out the Application Form: Complete the online application form with accurate personal details, including your name, email address, phone number, and residential address. Be honest and precise, as discrepancies can lead to account rejection.

Submit Required Documents: Upload scanned copies of your proof of identity and address as part of the verification process.

Account Type Selection: Choose the type of trading account you wish to open. Many brokers offer various account options, including standard accounts, mini accounts, and demo accounts for practice.

Initial Deposit: Depending on the broker, you may need to make an initial deposit to fund your trading account. Review the minimum deposit requirements and available payment methods.

Once you've completed these steps, your broker will review your application and verify your documents. Upon successful verification, you will receive your account login credentials via email.

Setting Up Your Trading Platform

After opening your forex account, the next step is to download and set up the trading platform provided by your broker. Most brokers offer popular platforms like MetaTrader 4 and MetaTrader 5, which are known for their robust features and user-friendly interfaces.

To set up your trading platform, follow these steps:

Download the Platform: Visit the broker's website or the respective app store to download the trading platform compatible with your device.

Install the Software: Follow the installation instructions provided, ensuring that you install the software correctly.

Log In to Your Account: Use the credentials sent to your email after account approval to log in to the trading platform.

Explore the Interface: Familiarize yourself with the platform's layout, tools, and features. Learn how to place trades, set stop-loss and take-profit levels, and conduct technical analysis.

Setting up your trading platform efficiently will enhance your trading experience and enable you to execute trades effectively.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Trading Strategies and Risk Management

Once you have successfully opened a forex account and set up your trading platform, the next crucial aspect to focus on is developing effective trading strategies and implementing robust risk management practices.

Developing a Trading Strategy

Having a well-defined trading strategy is essential for achieving consistent profits in the forex market. A trading strategy outlines your approach to entering and exiting trades, as well as managing your capital. Here are some commonly used trading strategies:

Scalping: This short-term strategy involves making multiple quick trades to capture small price movements. Scalpers rely on technical analysis and rapid execution to seize opportunities.

Day Trading: Day traders open and close positions within the same trading day, aiming to benefit from intraday market fluctuations. This strategy requires continuous monitoring of the market and a strong understanding of technical indicators.

Swing Trading: Swing traders hold positions for several days or weeks, capitalizing on medium-term trends. This strategy allows for more relaxed trading, as traders do not need to monitor the market constantly.

Position Trading: Position traders take a long-term view and hold trades for weeks, months, or even years. This strategy relies on fundamental analysis and macroeconomic trends rather than short-term price movements.

Choose a trading strategy that aligns with your personality, risk tolerance, and time commitment.

Implementing Risk Management Techniques

Effective risk management is vital for preserving your trading capital and minimizing losses. Here are some key risk management techniques:

Set Stop-Loss Orders: Always use stop-loss orders to limit potential losses on each trade. A stop-loss order automatically closes your position when the price reaches a specified level, preventing further losses.

Calculate Position Size: Determine the appropriate position size for each trade based on your account balance and risk tolerance. Avoid risking more than a small percentage of your capital on a single trade.

Diversification: Diversifying your trading portfolio by trading multiple currency pairs can help reduce overall risk. Avoid putting all your capital into one trade or asset class.

Stay Informed: Keep abreast of global economic news and events that may impact currency markets. Being informed allows you to adapt your trading strategy accordingly.

By implementing these risk management techniques, you can navigate the volatile forex market with greater confidence and resilience.

Conclusion

Opening a forex account in Bangladesh marks the beginning of an exciting journey into the world of trading. By understanding the fundamentals of forex trading, choosing the right broker, and navigating the account opening process, you will be well-equipped to take on the challenges and opportunities presented by the forex market.

Remember to develop a solid trading strategy and implement effective risk management practices to enhance your chances of success. As you gain experience in the market, continue to refine your skills and expand your knowledge to become a proficient forex trader.

With dedication, discipline, and a commitment to learning, you can unlock the potential of forex trading and work towards achieving your financial goals. Happy trading!

Read more: