15 minute read

Is Exness a ECN broker? Review Broker

Understanding ECN Brokers

Definition of ECN Brokers

ECN (Electronic Communication Network) brokers provide traders with direct access to the market by connecting them to a network of liquidity providers, such as major banks and financial institutions. These brokers do not create or control the prices themselves, but instead, they aggregate and transmit the prices from multiple liquidity providers to traders. This means that the prices presented to traders are based purely on market forces without manipulation, making the trading environment highly transparent.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

In an ECN setup, brokers make their revenue by charging a commission per trade rather than marking up the spread, which is the difference between the bid and ask price. This fee structure ensures that traders pay only for the execution of their orders, not for the spread adjustments made by the broker. ECN brokers generally offer access to the best available prices, ensuring that the trader gets the most competitive pricing possible, particularly during times of high liquidity.

How ECN Trading Works

In ECN trading, when a trader places a buy or sell order, it is sent directly to the liquidity providers through the ECN platform. These liquidity providers can include major banks, hedge funds, and other institutional traders. The system aggregates all available buy and sell orders, matching them with the best prices available. The main benefit of this system is that traders’ orders are not passed through a dealing desk, and therefore there are no conflicts of interest between the broker and the trader.

Orders are executed directly at the best available price, ensuring minimal slippage and reducing the chances of price manipulation. In contrast to market makers who may act as counterparties to traders’ positions, ECN brokers simply match buy and sell orders and facilitate the transaction, making the process highly transparent and efficient. The presence of multiple liquidity providers ensures that the market price is determined by supply and demand forces, resulting in tighter spreads.

Benefits of Using ECN Brokers

ECN brokers offer several key benefits that make them highly attractive to traders. One of the most significant advantages is transparency. Since prices come directly from liquidity providers, traders can see the real-time market price without any manipulation or adjustments from the broker. This transparency also minimizes the chances of brokers using practices such as "requotes," which is when a broker changes the price of a trade after the trader has already placed an order.

Another major benefit is the lower cost of trading. ECN brokers typically offer lower spreads, especially during periods of high liquidity. In some cases, the spreads can even be as low as 0.0 pips, which is particularly beneficial for scalpers and day traders who rely on small price movements to profit. Although ECN brokers charge a commission on each trade, the total cost of trading can still be lower compared to brokers who mark up their spreads.

Overview of Exness

Company Background and History

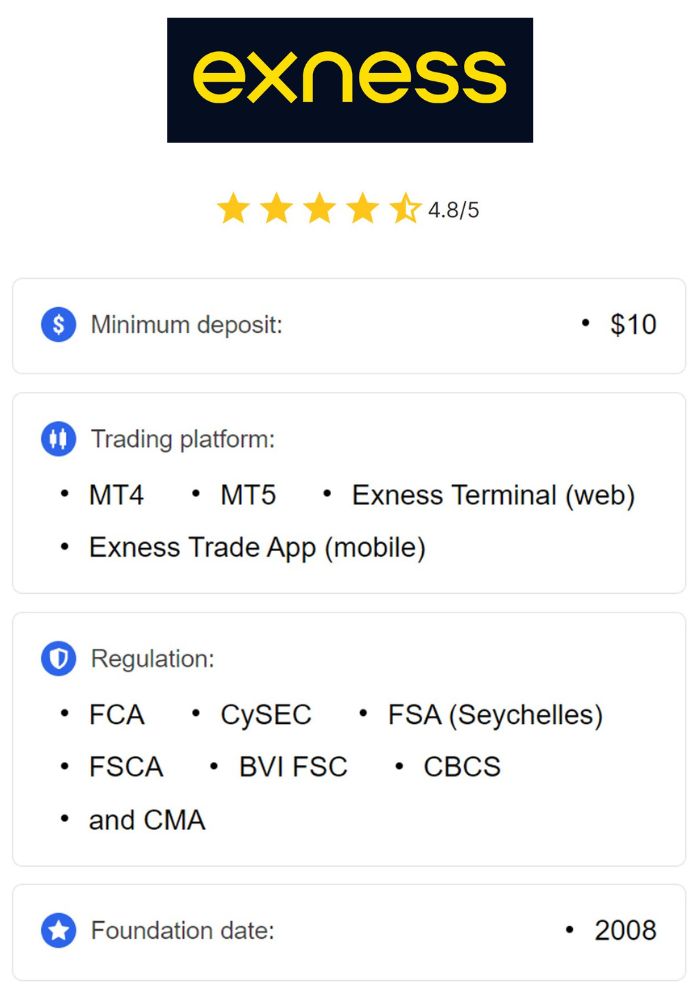

Exness was founded in 2008 and has since become a leading name in the online trading industry. The company provides a wide range of trading services, including forex, commodities, and cryptocurrencies, to retail traders around the world. Over the years, Exness has earned a reputation for its transparency, reliability, and excellent customer support. The company has also developed a global presence, serving traders in more than 180 countries.

Exness's growth can be attributed to its commitment to providing high-quality trading conditions and an advanced technological platform. The company has focused on building a robust and secure environment for traders, offering a user-friendly experience and ensuring that its clients can trade with confidence. With its headquarters in Cyprus and regulatory oversight from multiple jurisdictions, Exness has become one of the most trusted brokers in the industry.

Regulation and Licensing

Exness is regulated by several top-tier financial authorities around the world. The company holds licenses from prominent regulators such as the UK’s Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), and the South African Financial Sector Conduct Authority (FSCA). These licenses ensure that Exness adheres to strict financial standards, providing an additional layer of security and trust for its clients.

Regulatory compliance is a critical factor when choosing a broker, as it helps ensure that the broker operates fairly and transparently. Exness’s global regulatory presence is a testament to its commitment to providing a secure trading environment. Clients can trade with confidence knowing that the broker is subject to regular audits and must comply with the financial laws and regulations of the jurisdictions in which it operates.

Types of Accounts Offered by Exness

Exness offers a variety of account types to cater to different types of traders, each with unique features and benefits. The most common account types include the Standard Account, which is ideal for beginners, and the Pro Account, which offers tighter spreads and higher leverage. For traders looking for raw market spreads, Exness provides an ECN Account, where traders can access the best prices available in the market, typically with a fixed commission per trade.

Additionally, Exness offers Zero Accounts, which also provide tight spreads but with slightly higher commissions. This account type is designed for traders who want to access competitive spreads without paying a mark-up on the price. Each account type comes with its own set of advantages, and traders can select the one that best suits their trading style and experience level.

Characteristics of Exness Trading

Spreads and Commissions

Exness offers competitive spreads that vary depending on the account type and the liquidity of the asset being traded. For example, traders using the ECN account can access spreads as low as 0.0 pips, especially during periods of high market liquidity. However, it is important to note that ECN traders are charged a commission on each trade, which helps maintain transparency and ensures that traders are paying for the execution of their orders.

For other account types, such as the Standard Account, Exness does not charge a commission but instead offers wider spreads. These spreads are generally competitive within the industry, providing traders with the flexibility to choose between a commission-based or spread-based pricing model depending on their trading preferences. The ability to select between different account types allows traders to tailor their trading experience to their individual needs.

Leverage Options Available

Exness provides traders with a range of leverage options, which can go up to a maximum of 1:2000 depending on the account type and asset being traded. This high leverage allows traders to control larger positions with relatively small capital, which can be advantageous for short-term traders looking to take advantage of small price movements. However, while high leverage increases the potential for profits, it also increases the risk of significant losses.

Exness also offers flexible leverage options, allowing traders to choose the level of leverage that aligns with their risk tolerance and trading strategy. Lower leverage is typically recommended for novice traders or those who prefer a more conservative approach, while experienced traders may use higher leverage to maximize potential returns on smaller price movements.

Execution Speed and Technology

Exness prides itself on offering fast execution speeds, which is essential for both retail traders and institutional clients. The company uses advanced technology and low-latency trading systems to ensure that orders are executed in real time, with minimal slippage. This is particularly important for ECN traders, who require the fastest execution to take advantage of market opportunities.

With the use of sophisticated algorithms and high-speed connectivity to liquidity providers, Exness ensures that orders are filled at the best possible price without delays. For traders, this means that they can enter and exit the market with minimal disruption, resulting in a smoother and more efficient trading experience.

Exness as an ECN Broker

Is Exness Fully ECN?

While Exness offers an ECN account that provides direct access to market liquidity and raw spreads, it does not operate as a fully ECN broker across all account types. Exness’s ECN accounts offer the benefits of direct market access, including tight spreads and fast execution. However, the broker also offers standard and pro accounts that have different pricing models, which may involve spread markups or additional commissions.

Therefore, Exness can be classified as offering ECN-style trading for certain accounts, but not exclusively as a full ECN broker across all of its offerings. Traders seeking raw market spreads and transparent pricing can choose the ECN account, but they may need to consider the other account types if they prefer different trading conditions.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Comparison with Other ECN Brokers

Compared to other fully ECN brokers, Exness offers competitive spreads and execution speeds. Many ECN brokers offer raw spreads without any markups, but they often charge a commission on every trade. Exness follows this model for its ECN accounts but also provides lower commissions and better execution speeds than some other brokers in the industry. This makes Exness a strong choice for traders looking for ECN-style trading conditions.

However, when comparing Exness with other ECN brokers, it’s essential to consider the range of account types available. While other brokers may offer only ECN accounts, Exness provides additional account types that can appeal to traders with different needs. This flexibility may be particularly beneficial for traders who are new to forex trading or who prefer more traditional account structures.

Customer Feedback on Exness Execution

Customer feedback on Exness’s execution is generally positive. Traders report that execution speeds are fast, with minimal slippage, especially on ECN accounts where raw spreads are offered. Many traders appreciate the transparency and competitive pricing that Exness provides, especially for those who prefer direct market access.

However, some traders have raised concerns about issues like account verification delays or the availability of customer support in certain regions. Overall, Exness has maintained a strong reputation for its execution quality, and most customer feedback indicates satisfaction with the platform’s overall performance.

Advantages of Trading with Exness

User-Friendly Trading Platforms

Exness offers a user-friendly trading experience through its advanced trading platforms. The broker supports popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are known for their ease of use and robust features. Traders can access these platforms on both desktop and mobile devices, ensuring they can trade on-the-go with ease.

In addition to the standard platforms, Exness also offers a proprietary mobile app that provides an intuitive interface for monitoring trades and managing accounts. This is particularly useful for traders who need quick access to their accounts and the markets, without the need for complex software setups.

Range of Market Instruments

Exness provides a diverse range of trading instruments, including forex, commodities, indices, cryptocurrencies, and more. This variety allows traders to diversify their portfolios and explore different asset classes, depending on their risk tolerance and investment goals. The broker offers competitive spreads on a wide range of instruments, and traders can access markets 24/7, especially with crypto trading.

The wide range of available instruments makes Exness an appealing choice for traders looking for a one-stop platform for all their trading needs. Whether you are interested in forex, commodities, or emerging markets like cryptocurrencies, Exness offers the tools to trade a variety of asset classes.

Educational Resources for Traders

Exness provides a comprehensive suite of educational resources to support traders at all levels. The broker offers online courses, webinars, and educational articles that cover a wide range of topics, from basic trading principles to advanced strategies. These resources are designed to help traders improve their skills and increase their chances of success in the markets.

For novice traders, Exness also offers demo accounts that allow them to practice trading without risking real money. This provides a safe environment to learn and test different strategies before transitioning to live trading. The broker’s commitment to educating its clients ensures that traders have the tools and knowledge they need to succeed.

Disadvantages of Trading with Exness

Potential Issues with Withdrawals

Some traders have reported issues with withdrawals at Exness, particularly in terms of processing times. While the company generally offers a wide range of withdrawal methods, some traders have experienced delays or difficulties when requesting withdrawals, especially during peak times. It is important to review Exness’s withdrawal policies and ensure that you are familiar with the process to avoid potential delays.

Despite these concerns, many traders report that the majority of withdrawals are processed quickly, especially for accounts that have been properly verified. Exness’s payment processing system is generally efficient, but it is always best to be aware of any potential issues that may arise.

Limited Availability in Certain Regions

Exness is not available in all regions due to regulatory restrictions. While it operates in over 180 countries, there are some regions where Exness does not offer its services. This limitation can be a downside for traders in countries where Exness is not licensed or regulated. If you are located in a restricted region, it may be necessary to explore alternative brokers that offer similar services.

However, Exness has expanded its reach over the years and continues to grow its global presence. It is constantly working to obtain new licenses and expand its offerings to traders in various jurisdictions.

Customer Support Challenges

Some traders have raised concerns about the quality of customer support provided by Exness, particularly in regions with limited language options or support hours. While Exness does offer multilingual support through live chat, email, and phone, some customers report slower response times during peak hours.

Despite these concerns, many users find Exness’s customer service to be generally responsive and helpful. The company’s support team is well-trained and able to resolve most issues efficiently, but response times may vary depending on the complexity of the inquiry.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Comparing Exness with Traditional Brokers

Execution Models Explained

Exness uses an ECN-style execution model for certain account types, which is different from the traditional market maker model. In a market maker model, the broker acts as the counterparty to the trader’s position, meaning that they essentially "take the other side" of the trade. This can create conflicts of interest.

In contrast, ECN brokers, including Exness, match buy and sell orders directly with liquidity providers, ensuring that prices are set by the market. This results in a more transparent and efficient execution process, with minimal interference from the broker.

Pricing Structure Differences

The pricing structure of Exness varies depending on the account type. In an ECN account, traders have access to raw spreads, which are the actual market spreads without any markup. However, they are charged a commission on each trade to cover the cost of execution.

Traditional brokers, on the other hand, may offer wider spreads but do not charge a commission. This pricing model is simpler, but it may result in higher costs for traders, especially those who engage in frequent trading. The decision between an ECN or traditional broker depends on a trader’s strategy and preference for spreads versus commission-based pricing.

Trading Conditions: ECN vs. Market Maker

When comparing ECN brokers like Exness with traditional market makers, the main difference lies in the execution speed, spread type, and pricing model. ECN brokers provide more transparency and faster execution speeds, while market makers typically offer wider spreads but without commissions.

For traders who prioritize fast execution and raw market spreads, Exness’s ECN accounts are the better choice. On the other hand, traders who prefer simplicity and do not mind wider spreads might opt for a traditional market maker broker.

Customer Experiences and Reviews

Positive Testimonials from Exness Users

Many Exness users report positive experiences, particularly with the broker’s fast execution and competitive spreads. Traders appreciate the user-friendly platform and variety of account options, allowing them to choose the best conditions for their trading needs. Additionally, Exness’s strong regulatory standing gives traders confidence in the broker’s reliability.

Many customers also commend Exness’s educational resources, which help both new and experienced traders improve their skills. The demo accounts, in particular, are a feature that traders find valuable when they are just starting out.

Negative Feedback and Concerns

While Exness generally enjoys a strong reputation, some users have raised concerns regarding withdrawal delays and customer support responsiveness. Traders in certain regions have mentioned difficulties with account verification or the processing of withdrawal requests.

However, these complaints are often isolated cases, and the majority of traders report positive experiences with the overall service. Exness has worked on improving its support services over time and has taken steps to resolve these issues.

Overall Customer Satisfaction Ratings

Exness enjoys high customer satisfaction ratings, with many traders praising the broker for its competitive pricing, advanced technology, and reliable execution speeds. Traders generally appreciate the range of account types available and the transparency of the pricing structure. While there are some criticisms, the overall consensus is that Exness provides a solid and trustworthy trading experience.

Conclusion

In conclusion, Exness can be classified as offering ECN-style trading on certain account types, particularly its ECN account, which provides raw spreads and fast execution speeds. While not a fully ECN broker across all accounts, Exness offers competitive conditions that appeal to both novice and experienced traders. With a strong regulatory framework, educational resources, and a range of account options, Exness continues to be a popular choice among traders worldwide.

However, potential traders should consider the broker’s limitations, such as its withdrawal processing times and customer support challenges, when making their decision. Overall, Exness offers a reliable and transparent trading environment that can suit various trading strategies.

Read more: