8 minute read

Is Exness Regulated in Uganda? Is it Legal?

Introduction to Exness

Overview of Exness Company

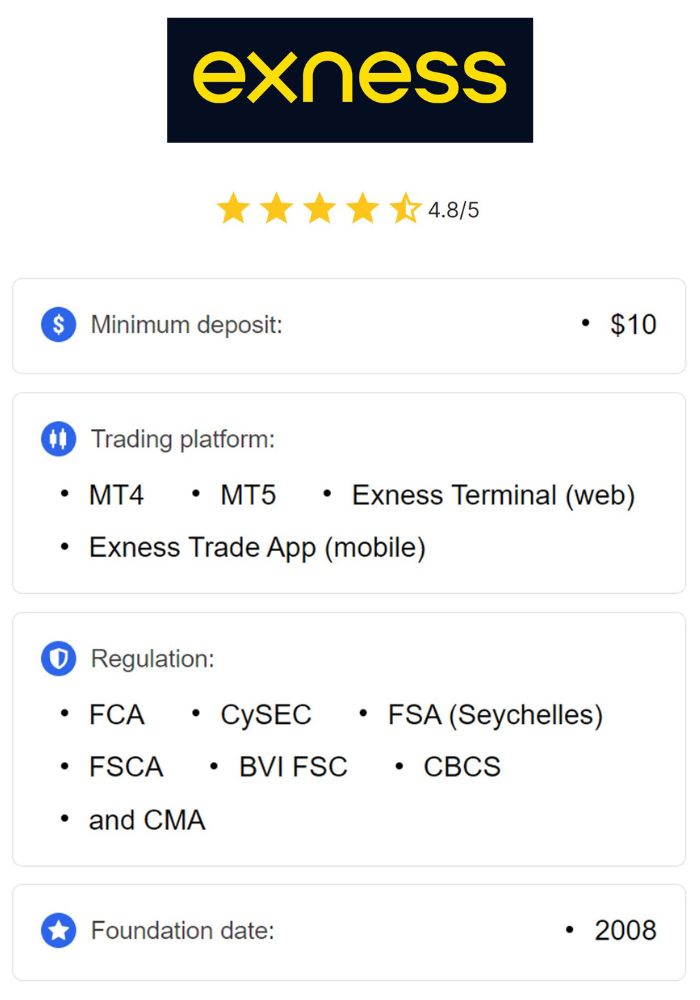

Exness is a globally recognized forex and financial trading broker that has established its presence across multiple markets worldwide. Founded in 2008, Exness provides traders with access to various financial instruments, including forex, commodities, indices, and cryptocurrencies. Its commitment to delivering a seamless trading experience has earned it a reputable standing among both retail and professional traders.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

With its headquarters in Limassol, Cyprus, Exness operates under the jurisdiction of multiple regulatory authorities, ensuring that its operations meet the highest standards of transparency and security. The broker’s global reach and customer-focused approach make it an attractive choice for traders, including those in Uganda.

Services Offered by Exness

Exness offers a wide array of services tailored to the needs of diverse traders. The broker provides access to the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, known for their advanced charting tools, algorithmic trading capabilities, and user-friendly interfaces.

In addition to trading platforms, Exness offers competitive spreads, high leverage options, and a variety of account types, including Standard, Pro, and Islamic accounts. The broker also ensures fast deposit and withdrawal processes, with support for local and international payment methods. Educational resources, market analysis tools, and 24/7 customer support further enhance the trading experience for its clients.

Understanding Regulation in Financial Markets

Importance of Regulation for Forex Brokers

Regulation is a critical factor in the forex industry as it safeguards traders from fraudulent practices and ensures the integrity of financial markets. Regulated brokers are required to adhere to strict compliance standards, which include segregating client funds, maintaining transparency, and conducting regular audits.

For traders in Uganda, partnering with a regulated broker like Exness provides peace of mind. Regulatory oversight ensures that the broker operates ethically, and traders can seek legal recourse in case of disputes or malpractices.

Factors Contributing to a Broker's Credibility

A broker's credibility is determined by several factors, including its regulatory status, financial transparency, and customer feedback. Brokers licensed by reputable regulatory authorities such as the FCA (Financial Conduct Authority) or CySEC (Cyprus Securities and Exchange Commission) are more likely to be trustworthy.

Additionally, a strong track record, comprehensive risk management protocols, and a commitment to client education contribute to a broker’s reputation. Exness meets these criteria, making it a preferred choice for traders worldwide.

Current Regulatory Framework in Uganda

Overview of Financial Regulations in Uganda

Uganda’s financial sector is regulated by the Bank of Uganda (BoU) and the Capital Markets Authority (CMA). These bodies are tasked with ensuring the stability and integrity of the financial system, including oversight of forex trading activities.

The CMA plays a significant role in regulating capital markets, issuing licenses to brokers, and ensuring compliance with financial laws. While forex trading is not explicitly banned in Uganda, traders are encouraged to work with regulated brokers to avoid potential risks.

Role of the Capital Markets Authority (CMA)

The CMA is responsible for fostering a transparent and efficient financial market in Uganda. It regulates the activities of brokers, investment firms, and other market participants to protect investors and promote economic growth.

For forex traders, the CMA ensures that brokers meet specific criteria, such as capital adequacy and operational transparency. Ugandan traders must verify whether a broker is recognized by the CMA before engaging in trading activities.

Is Exness Regulated in Uganda?

Licensing Status of Exness in Uganda

Exness is not directly regulated by the Capital Markets Authority (CMA) in Uganda. However, it operates under licenses from globally reputable regulatory authorities such as CySEC and the FCA. These licenses ensure that Exness adheres to strict international compliance standards, even though it lacks a local license.

While this may raise concerns for some traders, Exness’s robust regulatory framework provides a level of safety and reliability that is often sufficient for Ugandan clients seeking a trusted broker.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Regulatory Authorities Involved

Exness is regulated by several high-profile entities, including:

CySEC (Cyprus Securities and Exchange Commission)

FCA (Financial Conduct Authority, UK)

FSCA (Financial Sector Conduct Authority, South Africa)

These regulatory bodies ensure that Exness complies with global standards for financial integrity, fund protection, and fair trading practices. While not regulated locally in Uganda, Exness’s international oversight makes it a credible choice for traders.

Legal Aspects of Trading with Exness

Contracts and Terms of Service

When trading with Exness, clients must agree to the broker’s terms of service, which outline the rules governing the trading relationship. These contracts are designed to protect both the trader and the broker, ensuring transparency and clarity.

Traders in Uganda should carefully review these agreements to understand their rights and obligations. Exness provides its terms of service in a clear and accessible format, making it easy for clients to make informed decisions.

Compliance with Ugandan Laws

Although Exness is not locally regulated in Uganda, it complies with international legal standards. Ugandan traders using Exness should ensure that their trading activities align with local financial regulations to avoid legal complications.

It is advisable for traders to consult legal or financial experts to navigate the complexities of forex trading laws in Uganda.

User Experience: Trading with Exness in Uganda

Account Types Available for Ugandan Traders

Exness offers multiple account types to cater to the diverse needs of traders. These include:

Standard Accounts: Ideal for beginners with low minimum deposits and flexible trading conditions.

Pro Accounts: Designed for experienced traders, offering tighter spreads and faster execution.

Islamic Accounts: Compliant with Sharia law, featuring no swap fees.

Ugandan traders can choose an account type based on their trading goals and expertise. The availability of demo accounts further allows users to practice before committing real funds.

Deposit and Withdrawal Options

Exness supports a variety of payment methods, including local bank transfers, mobile money services, and international e-wallets like Skrill and Neteller. This ensures seamless transactions for Ugandan traders.

Deposits are processed instantly in most cases, while withdrawals are completed within a few hours. The broker’s commitment to fast and secure transactions enhances the trading experience for its clients.

Risks Associated with Unregulated Brokers

Potential Losses and Fraudulent Activities

Trading with unregulated brokers exposes traders to the risk of fraudulent activities, such as mismanagement of funds or unethical trading practices. Unregulated brokers often lack accountability, making it difficult for traders to recover losses in case of disputes.

Exness, being a regulated broker, mitigates these risks through stringent compliance measures and transparent operations, providing a safer alternative for Ugandan traders.

Impact on Trader Rights and Protections

Unregulated brokers may not adhere to fair trading practices, leaving traders vulnerable to exploitation. In contrast, regulated brokers like Exness are required to prioritize client protection through fund segregation, regular audits, and dispute resolution mechanisms.

Choosing a regulated broker ensures that traders’ rights are upheld, minimizing the risk of financial harm.

Benefits of Choosing a Regulated Broker

Enhanced Security for Funds

Regulated brokers are mandated to segregate client funds from company assets, ensuring that traders’ money is protected even in the event of the broker’s insolvency. Exness complies with these requirements, offering additional security for its clients.

Furthermore, Exness undergoes regular audits by independent firms, reinforcing its commitment to financial transparency and trustworthiness.

Transparent Trading Practices

Transparency is a hallmark of regulated brokers. Exness provides detailed information about its trading conditions, fees, and policies, enabling traders to make informed decisions.

By partnering with a regulated broker like Exness, Ugandan traders can trade with confidence, knowing that their broker operates with integrity.

Alternatives to Exness for Ugandan Traders

Recommended Regulated Brokers

While Exness is a trusted broker, Ugandan traders may also consider alternatives like XM, HotForex, and IC Markets, which are similarly regulated and offer competitive trading conditions.

Each broker has its strengths, and traders should evaluate their features, fees, and services to choose the one that best meets their needs.

Comparison of Features and Fees

Exness stands out for its high leverage options, low spreads, and advanced trading platforms. However, other brokers may provide unique features, such as educational programs or localized services, that cater specifically to Ugandan traders.

Conducting a thorough comparison of brokers can help traders identify the best option for their trading goals.

Conclusion

Exness is a safe and reliable choice for Ugandan traders, offering a robust regulatory framework, advanced trading platforms, and exceptional customer support. While it is not directly regulated by the CMA, its international licenses ensure compliance with global standards of transparency and security.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Trading with Exness is legal in Uganda, provided traders adhere to local financial laws. By choosing Exness, traders can access competitive trading conditions, secure transactions, and a wealth of resources to succeed in the forex market.

Read more: