12 minute read

Is Exness Regulated in Dubai? Review Broker

Introduction to Exness

Overview of Exness as a Broker

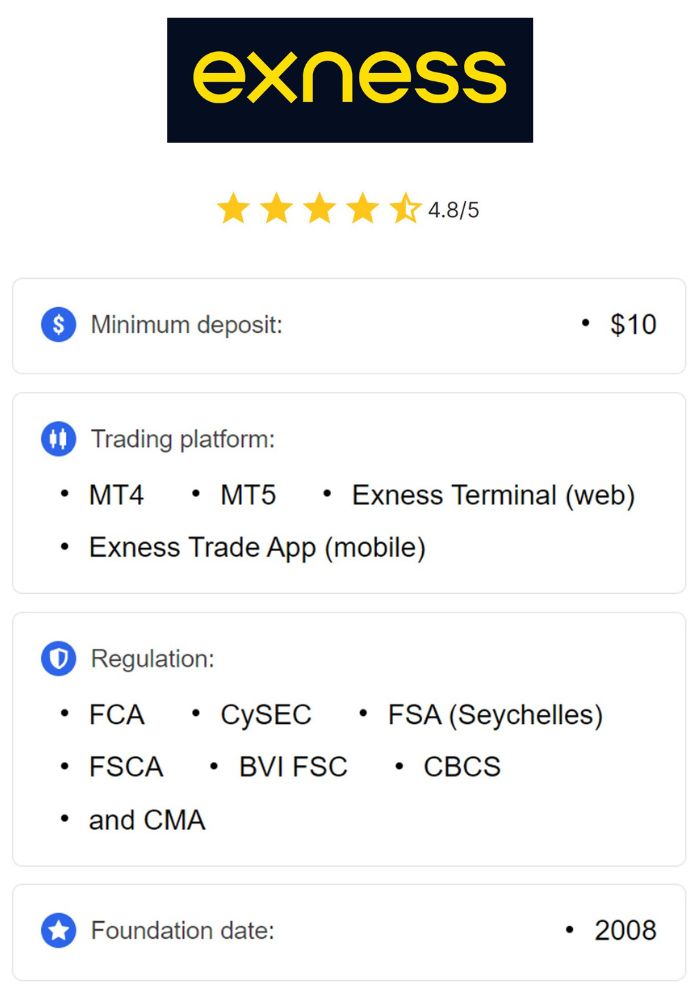

Exness is a prominent name in the forex and CFD trading industry, established in 2008. The broker has gained a reputation for offering transparent, efficient, and secure trading services to millions of traders globally. Known for its state-of-the-art technology, Exness emphasizes customer satisfaction by providing excellent trading conditions, including competitive spreads, instant order execution, and a wide range of financial instruments.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Operating across multiple jurisdictions, Exness caters to both retail and institutional traders. The broker's commitment to maintaining a high standard of service and compliance has positioned it as a preferred choice for traders worldwide. Whether you are a beginner or an experienced trader, Exness offers tailored solutions to meet varying trading needs.

Services Offered by Exness

Exness provides access to a broad array of trading instruments, including forex, precious metals, cryptocurrencies, indices, and commodities. Its platforms, such as MetaTrader 4 and MetaTrader 5, are equipped with advanced charting tools, automated trading features, and user-friendly interfaces.

Beyond trading platforms, Exness offers additional services, including multilingual customer support, a range of account types, and a comprehensive knowledge base with educational resources. The broker also prioritizes transparency in its operations, ensuring traders have access to detailed reports and financial data to support informed decision-making.

Understanding Regulation in Forex Trading

Importance of Regulation for Forex Brokers

Regulation plays a critical role in ensuring the safety and fairness of financial markets. For forex brokers, being regulated means adhering to strict rules and guidelines set by financial authorities. These regulations are designed to protect traders from unethical practices, such as fraud, manipulation, and mismanagement of funds.

Traders benefit significantly from choosing regulated brokers as these entities are required to maintain segregated accounts for client funds, ensuring that traders’ money is not used for operational purposes. Regulation also enforces transparency and accountability, helping traders trust the broker's operations and financial integrity.

Common Regulatory Authorities in Forex Trading

Several regulatory bodies oversee the activities of forex brokers worldwide. Some of the most recognized authorities include:

Financial Conduct Authority (FCA) in the UK

Cyprus Securities and Exchange Commission (CySEC) in Cyprus

Australian Securities and Investments Commission (ASIC) in Australia

Dubai Financial Services Authority (DFSA) in the UAE

These organizations ensure brokers comply with financial laws, implement anti-money laundering measures, and protect clients’ rights. A broker regulated by a reputable authority demonstrates a strong commitment to ethical trading practices.

Exness and Its Global Presence

Exness's Operations in Different Regions

Exness has established a robust presence in multiple regions, including Europe, Asia, the Middle East, and Africa. The broker operates under licenses issued by various regulatory bodies, such as CySEC, FCA, and FSCA, depending on the region of operation.

In the Middle East, Exness has made significant inroads, catering to traders in countries like the UAE and Saudi Arabia. The broker’s ability to adapt to local market conditions and regulatory requirements has contributed to its global success. Each jurisdiction’s regulatory framework shapes the broker's services to ensure compliance and trader protection.

The Role of Regulatory Bodies in Each Region

The regulatory bodies overseeing Exness ensure it operates transparently and ethically within their jurisdictions. For instance, CySEC mandates regular audits and requires brokers to participate in compensation schemes to protect traders in case of insolvency.

In Dubai and the broader UAE region, the DFSA and other local regulators ensure that brokers comply with local financial laws and standards. Such oversight helps Exness provide safe trading environments while maintaining its reputation as a trustworthy broker.

The Regulatory Landscape in Dubai

Overview of Financial Regulation in Dubai

Dubai is a major financial hub in the Middle East, attracting traders and investors from across the globe. Its regulatory environment is well-developed, with a focus on ensuring market integrity and investor protection. Forex trading is legally permitted in Dubai, provided brokers comply with the guidelines set by relevant authorities.

The emirate's financial regulation aligns with global standards, making it an attractive destination for forex brokers seeking to establish operations in a secure and transparent market. Dubai’s commitment to maintaining a regulated financial ecosystem ensures the safety of traders and investors alike.

Key Regulatory Authorities in the UAE

The Dubai Financial Services Authority (DFSA) is the primary regulator overseeing financial activities within the Dubai International Financial Centre (DIFC). The DFSA enforces strict compliance measures to ensure brokers operate transparently and ethically.

In addition to the DFSA, the UAE Central Bank plays a significant role in supervising financial institutions, including those involved in forex trading. These entities work together to create a secure trading environment for residents and international traders in Dubai.

Is Exness Regulated in Dubai?

Current Status of Exness’s Licensing in Dubai

Exness operates in Dubai under the oversight of international regulatory bodies, although it does not currently hold a DFSA license specific to the Dubai International Financial Centre. Instead, it leverages licenses from globally recognized authorities like CySEC and FCA, which are widely respected for their stringent regulatory standards.

Traders in Dubai can access Exness’s services with confidence, knowing the broker complies with international laws and maintains high standards of transparency and security. While Exness’s global licenses do not replace a DFSA license, they offer comparable levels of trader protection and regulatory compliance.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Comparisons with Other Regulated Brokers in Dubai

When compared to brokers directly regulated by the DFSA, Exness stands out for its competitive trading conditions, including tight spreads and high leverage options. However, brokers with a DFSA license may offer additional reassurance to traders seeking local regulatory oversight.

For traders prioritizing international standards and flexible trading options, Exness remains a strong contender. Its track record of ethical practices and robust global regulatory framework makes it a trusted choice even in competitive markets like Dubai.

Benefits of Choosing a Regulated Broker

Enhanced Security for Traders

Choosing a regulated broker like Exness provides a higher level of security for traders' funds and personal information. Regulatory bodies, such as the FCA, CySEC, and others, require brokers to keep client funds in segregated accounts, ensuring that traders' money is protected even if the broker faces financial difficulties. This means that traders' funds are not used for operational purposes, reducing the risk of losing money due to the broker’s financial issues.

Moreover, regulated brokers must comply with strict reporting and auditing standards, which further enhances transparency. Traders can easily access detailed information regarding the broker's financial health, transaction history, and compliance practices, allowing them to make informed decisions about their investments.

Lower Risk of Fraud and Misconduct

Regulation ensures that brokers adhere to a set of ethical standards that protect traders from potential fraud or misconduct. Regulated brokers must undergo regular audits and inspections to ensure they are not engaging in practices such as market manipulation or misappropriating clients' funds.

Traders can have confidence that regulated brokers will operate fairly and transparently. For example, regulatory bodies require brokers to provide fair pricing and execute trades promptly without delay or manipulation. The stringent oversight ensures that any wrongdoing is swiftly addressed, giving traders peace of mind when trading.

Consequences of Trading with Unregulated Brokers

Potential Risks Involved

Trading with unregulated brokers carries significant risks, as there are no guarantees regarding the protection of traders’ funds. Without regulatory oversight, brokers can engage in unfair practices, such as misleading clients, executing trades at unfavorable prices, or even absconding with client funds.

Unregulated brokers are often not required to maintain segregated accounts for client funds, meaning traders may risk losing all of their money if the broker faces financial troubles. Additionally, there is no recourse for traders in case of disputes, as unregulated brokers are not bound by the same legal frameworks as regulated ones. This makes it crucial for traders to thoroughly vet brokers before engaging in any trading activities.

Legal Implications for Traders

In some jurisdictions, trading with unregulated brokers can have legal consequences for traders. For example, in Dubai, while forex trading itself is legal, the lack of regulatory oversight for brokers can expose traders to legal risks, such as being unable to claim compensation in case of a dispute.

Furthermore, unregulated brokers may operate under questionable legal frameworks that are not recognized by global authorities, which could put traders in a vulnerable position. Traders could also face issues with the tax authorities if they are trading with an unregulated broker that does not comply with local financial regulations.

How to Verify the Regulation Status of a Broker

Steps to Check the Licensing Information

Verifying the regulation status of a broker is relatively straightforward and should always be the first step before opening an account. One of the easiest ways to do so is by visiting the official website of the broker. Most regulated brokers prominently display their licenses and regulatory status on their homepage or in the "About Us" section.

Traders can also check the official websites of the regulatory bodies to verify the broker’s registration. For instance, the Financial Conduct Authority (FCA) provides an online registry where users can search for the licensing status of brokers operating in the UK. Similarly, the CySEC and DFSA have online platforms to check the registration status of forex brokers under their jurisdiction.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Resources for Finding Regulatory Information

Several resources are available to help traders verify the regulation status of a broker. Websites such as the FCA's register, the CySEC's public register, and the DFSA's licensing directory offer detailed information on brokers’ regulatory status.

Moreover, there are independent websites and online forums where traders share information about brokers and their regulation status. These platforms can provide additional insights into the broker's reputation, operational practices, and adherence to financial regulations. It is important to cross-reference information from multiple sources to ensure a broker’s legitimacy.

Exness’s Reputation in the Trading Community

Customer Reviews and Feedback

Exness has a strong reputation in the trading community, with many customers praising its transparency, competitive spreads, and user-friendly platforms. Traders consistently highlight the broker’s commitment to excellent customer service, particularly its fast withdrawal processes and responsive support team. Positive feedback from users around the world reflects Exness's high level of trustworthiness and its dedication to maintaining a secure trading environment.

However, as with any broker, there are occasional negative reviews. Some traders mention issues with the platform or delays during periods of high volatility. Still, these reviews are relatively rare, and the overall sentiment remains positive due to Exness's adherence to international regulatory standards and its transparent approach to trading.

Awards and Recognitions Received

Exness has earned several accolades and recognitions over the years, which reflect its commitment to providing quality service. These include awards for best forex broker, best customer service, and best trading conditions in various regions. Exness’s consistent performance in industry rankings serves as a testament to its credibility and reliability.

The broker’s accolades from reputable industry bodies further validate its standing as a trusted and respected player in the forex and CFD markets. These awards also highlight Exness's ability to meet the diverse needs of traders, from beginners to professional investors.

Comparing Exness with Other Brokers in Dubai

Features of Competitor Brokers

In Dubai, several other forex brokers are also well-regulated and offer competitive trading conditions. These brokers, such as IG Group, Saxo Bank, and Alpari, provide similar services, including tight spreads, various account types, and access to multiple financial instruments. However, each broker has unique features, such as the availability of different trading platforms, educational resources, and commission structures.

Some brokers may specialize in offering services to specific markets, such as stocks or commodities, while others may focus on providing high leverage and low trading costs. Traders in Dubai are fortunate to have a variety of well-regulated brokers to choose from, each with its own strengths and weaknesses.

Regulatory Compliance of Competitors

Most brokers operating in Dubai are required to comply with local regulations, either from the Dubai Financial Services Authority (DFSA) or other recognized international bodies. Brokers like IG and Saxo Bank are regulated by authorities such as the FCA, ensuring high levels of security and compliance with international financial standards.

While Exness is not directly regulated by the DFSA, its licenses from respected authorities such as CySEC and the FCA offer comparable levels of protection to traders in Dubai. Nonetheless, traders should compare the regulatory frameworks of each broker to choose one that best meets their preferences for safety, compliance, and trading conditions.

Future of Regulation in Dubai’s Forex Market

Trends Impacting Regulation

The regulatory landscape for forex brokers in Dubai is continuously evolving as the region seeks to enhance its reputation as a global financial hub. The UAE government has introduced various measures aimed at improving transparency and boosting investor confidence, which includes expanding the regulatory framework to cover new financial products and services, including cryptocurrencies and CFDs.

Additionally, as more traders from around the world seek to enter the Middle Eastern markets, the demand for better regulatory oversight is growing. The introduction of more stringent regulatory measures could potentially lead to further growth in the forex sector, offering more protection for traders and ensuring fairer trading practices.

Predictions for Upcoming Changes

In the coming years, we may see increased regulation in Dubai's forex market, particularly as the financial sector continues to grow and attract foreign investors. This may include more stringent licensing requirements, improved risk management protocols, and stronger consumer protection laws.

Furthermore, the DFSA may adopt more robust international standards for brokers operating in the region, aligning its practices with other leading global regulatory bodies. These changes would likely benefit both traders and brokers, ensuring a safer and more transparent trading environment in Dubai.

Conclusion

Exness is a well-regulated broker with licenses from reputable authorities such as CySEC, FCA, and others, which offer robust protection to traders in Dubai. While Exness is not directly regulated by the DFSA, its regulatory status ensures that it complies with international standards and provides a secure trading environment.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

For traders in Dubai, Exness represents a solid option for those looking for a trustworthy broker with competitive trading conditions and access to a wide range of financial instruments. However, it’s essential for traders to compare the broker’s offerings with other regulated brokers in the region to ensure they choose the one that best suits their trading needs.

Ultimately, Exness’s commitment to transparency, security, and compliance makes it a legitimate and reliable broker for traders in Dubai.

Read more: