14 minute read

Exness Review Pakistan: Legit, Safe, Is a good broker?

from Exness Blog

In the dynamic world of forex trading, finding a reliable broker is paramount for success. This article delves deep into an extensive Exness Review Pakistan evaluating whether this broker meets the expectations and standards of traders in Pakistan.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Introduction to Exness

Navigating through the vast landscape of Forex trading can be daunting, especially when choosing a broker that aligns with your trading goals. Exness has emerged as a prominent player in the market, providing traders with various services and features designed to enhance their trading experience. Understanding its functionalities can help traders make informed decisions.

Overview of the Broker

Exness is a global brokerage firm offering a broad range of financial instruments, including forex, commodities, indices, and cryptocurrencies. The platform aims to cater to both novice and experienced traders by providing user-friendly interfaces and advanced trading tools.

The core mission of Exness is to empower traders by providing them with the necessary tools and resources while ensuring a safe and secure trading environment. With its emphasis on transparency and client satisfaction, Exness stands out as one of the preferred choices among traders worldwide.

Company History and Background

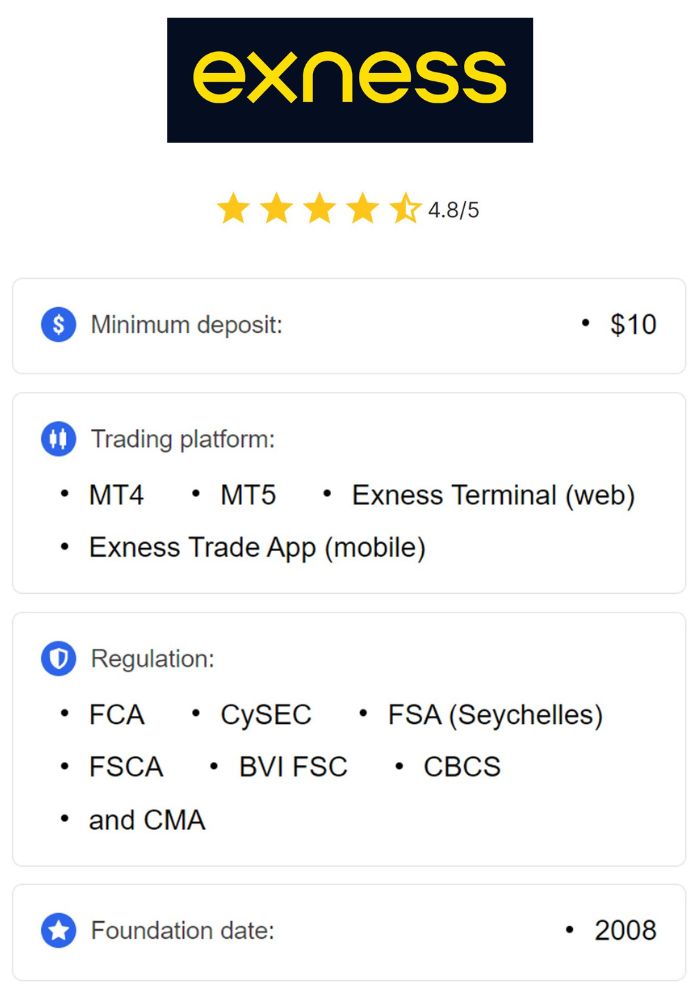

Founded in 2008, Exness started its journey with a commitment to provide seamless trading experiences. Over the years, it has established itself as a trusted broker, evolving its services and adapting to the ever-changing financial landscape. The company was co-founded by a group of financial experts who sought to create a platform that would democratize access to trading.

As the business grew, Exness expanded its operations globally, establishing offices in multiple regions and gaining recognition for its innovative approach. The company's focus on technology and customer service has contributed significantly to its reputation and trustworthiness in the industry.

Regulation and Licensing

One of the crucial aspects that potential traders must consider is regulation. A well-regulated broker usually indicates a level of safety and security for clients. In this section, we will explore the regulatory framework that governs Exness.

Regulatory Authorities Governing Exness

Exness operates under multiple regulatory authorities, which enhances its credibility and reliability. Depending on the region, Exness holds licenses from institutions such as the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and others.

These regulatory bodies ensure that Exness adheres to strict guidelines and practices, providing a layer of protection for traders. The oversight from these authorities not only fosters a transparent trading environment but also reinforces trader confidence.

Importance of Regulation in Forex Trading

Regulation is a fundamental pillar in the forex trading arena. It serves as a safeguard for traders, ensuring that brokers operate fairly and ethically. When a broker is regulated, it means they are subject to audits and compliance checks, which can prevent fraudulent activities.

Moreover, regulated brokers often have mechanisms in place to protect client funds, such as segregated accounts, which further bolsters the safety of investors’ assets. For traders in Pakistan, engaging with a regulated broker like Exness reduces the risks associated with trading and instills greater confidence in their trading journey.

Safety Measures

Safety measures play a vital role in ensuring a secure trading experience. Below we will look into the protective measures that Exness has implemented.

Client Fund Protection Policies

Exness prioritizes the security of client funds by employing robust protection policies. One of the most critical policies is the segregation of client funds. This practice involves keeping clients' deposits in separate accounts, distinct from the company's operational funds.

This separation guarantees that, in the event of any financial difficulties faced by the broker, client funds remain safe and accessible. Additionally, Exness participates in compensation schemes that provide further reassurance to traders regarding the safety of their investments.

Data Security and Privacy Protocols

Data security is another area where Exness excels. The broker employs cutting-edge encryption technologies to safeguard personal and financial information. Ensuring that sensitive data is protected from unauthorized access is crucial, particularly in an era where cyber threats are increasingly prevalent.

Furthermore, Exness adheres to strict privacy policies, ensuring that client information is not shared without consent. Transparency in how data is handled establishes a sense of trust between Exness and its clients.

Account Types Offered by Exness

Exness caters to a diverse clientele by offering various account types suited to different trading styles and preferences. This flexibility helps traders choose accounts that fit their individual needs.

Standard Accounts vs. Professional Accounts

Exness provides two main categories of accounts: standard accounts and professional accounts.

Standard accounts are ideal for beginners and casual traders. They offer competitive spreads and no commissions, making them accessible for those new to trading. Traders can start with a minimal deposit, allowing them to familiarize themselves with the trading environment without significant financial risk.

Professional accounts, on the other hand, are tailored for experienced traders who require advanced features and tools. These accounts typically come with tighter spreads and increased leverage options, providing a more robust trading experience. Understanding the differences between these account types is essential for traders to maximize their trading potential.

Islamic Accounts for Muslim Traders

Exness recognizes the needs of Muslim traders by offering Islamic accounts. These accounts are compliant with Sharia law, meaning they do not involve interest or swap rates, which are prohibited in Islam.

Muslim traders can enjoy similar benefits to other account types while adhering to their religious beliefs. Providing these specialized accounts demonstrates Exness's commitment to inclusivity and catering to diverse trader demographics.

Trading Platforms

A broker’s trading platform is the primary interface through which traders execute trades and manage their accounts. Exness offers robust platforms that are compatible with various devices and operating systems.

MetaTrader 4 and MetaTrader 5 Features

Exness supports the widely recognized MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, both of which are popular among traders worldwide.

MT4 is renowned for its user-friendly interface, making it suitable for beginners. It offers a range of technical analysis tools, customizable charts, and automated trading capabilities via Expert Advisors (EAs).

MT5, the successor to MT4, incorporates additional features, including more advanced charting tools, enhanced order types, and the ability to trade multiple asset classes beyond forex. The choice between these platforms depends on traders’ preferences and experience levels.

Mobile Trading Options and Accessibility

Exness understands the importance of accessibility in today’s fast-paced trading environment. Both MT4 and MT5 offer mobile applications that enable traders to monitor their accounts and execute trades on the go.

The mobile apps retain many features of the desktop versions, ensuring that traders can perform analyses and make informed decisions regardless of their location. This level of convenience is particularly beneficial for those who may not always have access to a computer.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Trading Instruments Available

Traders benefit from a wide array of trading instruments offered by Exness. Understanding what is available can help traders diversify their portfolios effectively.

Forex Pairs Offered

Exness specializes in forex trading and provides access to numerous currency pairs, including major, minor, and exotic pairs. This variety allows traders to explore different markets and find opportunities that suit their strategies.

Major currency pairs, such as EUR/USD and USD/JPY, typically exhibit high liquidity and lower spreads, making them attractive for day trading. Meanwhile, minor and exotic pairs can present unique trading opportunities, albeit with potentially higher volatility.

CFDs on Stocks, Indices, and Commodities

In addition to forex trading, Exness offers Contracts for Difference (CFDs) on various instruments, including stocks, indices, and commodities. This diversity enables traders to capitalize on price movements across different markets without owning the underlying assets.

Trading CFDs allows for flexibility and enhances risk management strategies. For example, traders can hedge against positions or speculate on price movements across various sectors, enhancing their overall trading experience.

Spreads and Commissions

Understanding the cost of trading is essential for managing profitability and risk. In this section, we delve into the spreads and commissions charged by Exness.

Understanding Spread Types

Exness offers different types of spreads depending on the account type chosen by the trader. Typically, there are two main types of spreads: fixed and variable.

Fixed spreads remain constant regardless of market fluctuations, providing predictability for traders. Variable spreads fluctuate based on market conditions, which can lead to lower trading costs during periods of high liquidity. By understanding spread types, traders can select accounts that align with their trading strategies.

Comparison of Spreads with Other Brokers

When assessing the competitiveness of a broker, it's important to compare spreads with other brokers in the industry. Exness is known for offering competitive spreads, particularly on its professional accounts.

For traders, lower spreads can significantly impact profitability, especially for those who engage in frequent trading. Comparing spreads with other brokers can guide traders in making informed decisions about their trading partnerships.

Leverage Options

Leverage is a powerful tool that can magnify gains; however, it can also increase risks. Understanding how leveraging works is vital for responsible trading.

Explanation of Leverage and Margin

Leverage allows traders to control larger positions with a relatively small amount of capital. For instance, with a leverage ratio of 1:200, a trader can control $20,000 worth of assets with just $100 in their account.

Margin is the amount required to open and maintain leveraged positions. While leverage can enhance profits, it also amplifies losses, underscoring the importance of risk management strategies.

Risks Associated with High Leverage

High leverage can be tempting, but it comes with substantial risks. Traders must recognize that while potential returns can be significant, so too can losses.

Utilizing lower leverage can mitigate risks, allowing traders to withstand market fluctuations better. Education on prudent risk management practices is crucial for anyone looking to trade with leverage effectively.

Deposit and Withdrawal Methods

Efficient deposit and withdrawal processes are paramount for traders seeking a hassle-free trading experience. Exness provides a variety of payment options, catering specifically to Pakistani traders.

Available Payment Options in Pakistan

Exness offers several deposit and withdrawal methods, including bank transfers, credit/debit cards, and e-wallets. Popular e-wallet options include Skrill and Neteller, which facilitate quick transactions.

The availability of multiple payment options enhances accessibility for Pakistani traders, ensuring that they can fund their accounts and withdraw earnings conveniently.

Speed and Fees for Transactions

Transaction speed and fees are critical factors that traders should consider. Exness prides itself on providing rapid deposit and withdrawal processes, frequently processing transactions instantly or within a short timeframe.

Most deposit methods are free of charge, while withdrawal fees are minimal, making Exness an attractive option for those concerned about transaction costs. Understanding the specifics of each method is essential for effective financial planning.

Customer Support Services

Accessible and efficient customer support is essential for resolving issues and enhancing the overall trading experience. Exness offers several avenues for traders to seek assistance.

Availability of Customer Support

Exness boasts a dedicated customer support team available 24/7 to assist traders with inquiries and concerns. The multilingual support team caters to a global clientele, including traders from Pakistan.

Whether through live chat, email, or phone support, traders can expect timely responses to their questions, enabling them to focus more on trading rather than troubleshooting.

Quality of Assistance Provided

Beyond availability, the quality of support is equally vital. Exness is known for its knowledgeable and friendly support staff, who are equipped to address a range of issues, from technical problems to account inquiries.

Positive feedback from traders highlights the effectiveness of Exness’s customer support, reinforcing the broker’s commitment to client satisfaction.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Educational Resources

For traders, continuous learning is key to success in the forex market. Exness invests in educational resources that enhance traders’ knowledge and skills.

Trading Tutorials and Webinars

Exness provides a wealth of educational materials, including tutorials, articles, and webinars covering various trading topics. These resources cater to traders at all levels, from beginners seeking foundational knowledge to experienced traders looking to hone specific skills.

Webinars hosted by expert analysts allow participants to engage in real-time discussions, ask questions, and receive valuable insights. This commitment to education empowers traders and assists them in making more informed decisions.

Market Analysis and Research Tools

Market analysis plays a crucial role in successful trading, and Exness supports traders with comprehensive research tools. Access to daily market updates, technical analysis reports, and economic calendars equips traders with the information needed to navigate the markets effectively.

By utilizing these analytical tools, traders can stay informed about market trends and developments, thereby enhancing their trading strategies and outcomes.

User Experience and Interface

A user-friendly interface can significantly enhance the trading experience. Exness ensures that its trading platforms are intuitively designed and easy to navigate.

Navigating the Trading Platform

Both the MT4 and MT5 platforms feature straightforward navigation, allowing traders to access essential tools, charts, and account information effortlessly. The layout is organized intuitively, which is especially beneficial for new traders who may be overwhelmed by complex interfaces.

Additionally, the platforms facilitate quick execution of trades, ensuring that traders can respond to market movements promptly.

Customization Options for Traders

Customization plays a significant role in tailoring the trading experience. Exness allows traders to personalize their trading dashboards, charts, and tools according to their preferences.

This level of customization not only enhances comfort but also enables traders to optimize their workflows, ultimately leading to improved performance. Personalizing the trading interface is crucial for fostering an efficient and enjoyable trading atmosphere.

Pros and Cons of Choosing Exness

Evaluating the advantages and disadvantages of any broker is essential for making informed decisions. Below, we summarize the pros and cons of choosing Exness.

Advantages of Trading with Exness

Exness offers several benefits that make it an appealing choice for traders. Key advantages include:

Regulatory Compliance: With licenses from reputable authorities, Exness provides a secure trading environment.

Diverse Account Types: Traders can choose from various account types, catering to different skill levels and trading styles.

Robust Educational Resources: The broker invests heavily in educating its clients, ensuring they have the tools and knowledge to succeed.

Competitive Spreads and Low Fees: Exness is known for its favorable trading costs, which can enhance profitability.

Potential Drawbacks to Consider

While Exness has many strengths, some potential drawbacks warrant consideration:

Limited Research Tools: Although Exness offers basic analytical tools, some competitors provide more sophisticated research options.

Withdrawal Times May Vary: While many transactions are processed quickly, some withdrawal methods may take longer than anticipated.

High Leverage Risks: The availability of high leverage can entice inexperienced traders, leading to potential significant losses if not managed properly.

User Reviews and Feedback

User reviews provide insight into the overall sentiment surrounding a broker. Analyzing feedback from Pakistani traders can help prospective clients gauge the broker's performance.

Insights from Pakistani Traders

Many Pakistani traders commend Exness for its user-friendly platform, responsive customer support, and competitive trading conditions. The extensive educational resources provided by Exness are also highlighted as significant advantages.

Traders appreciate the variety of payment methods available, noting the ease of funding accounts and withdrawing profits. Overall, the consensus reveals a generally positive experience among Exness users in Pakistan.

Common Complaints and Praises

While feedback is predominantly favorable, common complaints include occasional delays in withdrawals, particularly with certain payment methods. Some traders have also expressed a desire for more advanced research tools to aid in decision-making.

Conversely, praises often center around the broker’s regulatory compliance, low fees, and dedication to education. The exceptional customer support experience received by many traders further enhances Exness’s reputation.

Conclusion

In conclusion, the Exness Review Pakistan presents a compelling case for this broker as a safe and reliable choice for traders in Pakistan. With its robust regulatory framework, diverse account offerings, competitive trading conditions, and strong educational resources, Exness stands out as a notable player in the forex market.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

However, potential traders should carefully consider their individual needs and conduct thorough research before committing to any broker. Awareness of both the advantages and disadvantages can empower traders to make informed decisions, maximizing their chances of success in the complex world of forex trading.

Read more: