14 minute read

Which Exness Account is Best For Scalping?

When it comes to trading in the fast-paced world of forex, many traders seek strategies that allow them to capture quick profits from small price movements. One popular approach is scalping, which involves executing numerous trades over a short period. This article addresses the question: Which Exness Account is Best For Scalping? By examining the various account types offered by Exness, we aim to help traders determine the most suitable option for their scalping strategies.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Understanding Scalping in Forex Trading

Before diving into the specifics of Exness accounts, it’s essential to grasp what scalping entails in the realm of forex trading.

Definition of Scalping

Scalping refers to a trading strategy where traders look to profit from minor fluctuations in currency prices within brief timeframes. Unlike traditional trading methods that might focus on longer-term trends or substantial price changes, scalpers are attuned to minute shifts that can occur in seconds or minutes. The goal is to accumulate numerous small profits throughout the day rather than relying on one or two significant trades.

The essence of scalping lies in speed and precision. Traders often employ advanced tools and techniques to identify entry and exit points swiftly. This high-frequency trading style requires a keen understanding of market dynamics, as well as an ability to act quickly on emerging opportunities.

Key Characteristics of Scalping

Scalping is characterized by several defining features:

High Frequency: Scalpers often execute dozens, if not hundreds, of trades during a single trading session. They thrive on volatility and liquidity, aiming to capitalize on transient price movements.

Short Holding Periods: Each trade is held for only moments, with the intention of closing positions quickly to secure small gains. This necessitates a rapid execution platform and a clear-cut exit plan.

Small Profit Targets: Rather than aspiring for large wins from individual trades, scalpers focus on accumulating many tiny profits. A successful scalper perceives gains measured in pips rather than dollars.

Technical Analysis Focus: To pinpoint the best entry and exit points, scalpers rely heavily on technical analysis. They utilize charts, indicators, and patterns to make trading decisions.

Need for Low Latency and Fast Execution: In scalping, even a fraction of a second can significantly impact profitability. Thus, swift execution and minimal latency are paramount to avoid slippage—where the actual execution differs from the intended entry price.

Overview of Exness Broker

Exness has carved a niche in the online trading landscape since its inception, offering competitive conditions tailored for various trading styles, including scalping.

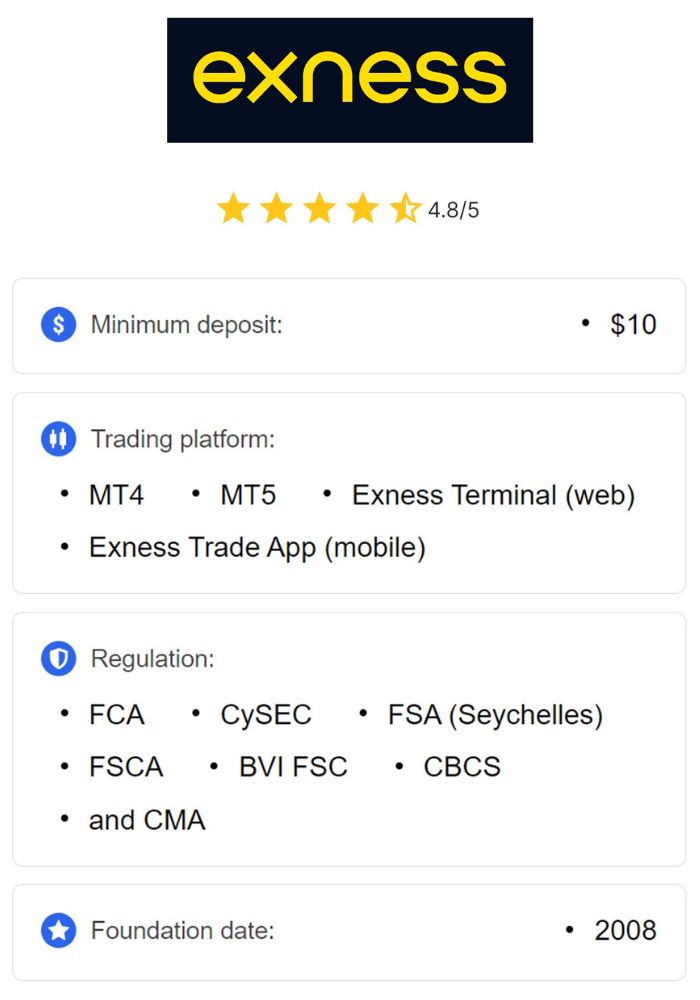

History and Reputation

Founded in 2008, Exness has rapidly evolved into a leading forex broker, attracting millions of clients globally. Its reputation is bolstered by providing competitive trading conditions, a wide array of trading instruments, and user-friendly platforms. Additionally, Exness emphasizes customer service, ensuring traders have access to support whenever needed.

The broker's transparent operating model and commitment to responsible trading practices have established it as a trustworthy choice among forex enthusiasts. Whether you're a novice trader or a seasoned pro, Exness presents options that cater to your needs while maintaining a firm stance on ethical trading.

Regulatory Environment

Operating under the oversight of reputable financial authorities, including the Cyprus Securities and Exchange Commission (CySEC) and the Financial Commission, Exness ensures compliance with international standards for client fund protection and transparency. Regulation adds a layer of trust, assuring traders that their funds are safe and that the broker operates ethically.

Choosing a regulated broker like Exness also means that clients benefit from protections such as negative balance protection and guaranteed stop-loss orders. These factors contribute to a more secure trading environment, especially critical for those engaging in high-frequency strategies like scalping.

Types of Exness Accounts

Exness provides a diverse range of account types designed to accommodate varying preferences and trading styles.

Standard Account

The Standard account is the introductory offering at Exness, catering primarily to beginners. It allows traders to access numerous currency pairs, commodities, indices, and more without any minimum deposit requirement.

While the Standard account offers variable spreads starting from 1.0 pip, it may not be ideal for aggressive scalping strategies due to the wider spreads. However, it remains an excellent option for those who are just entering the forex market or prefer a simpler trading approach.

1️⃣ Open Exness Standard MT4 Account

2️⃣ Open Exness Standard MT5 Account

Pro Account

For traders who prioritize tighter spreads and improved execution, the Pro account is a more sophisticated alternative. With floating spreads beginning from 0.2 pips, this account type suits those who engage in frequent trading, offering better cost efficiency.

The Pro account is better positioned for scalping compared to the Standard account. The reduced spread enhances the potential for capturing smaller price movements efficiently, making it an attractive option for intermediate traders seeking to refine their strategies.

Zero Account

Arguably one of the most appealing options for scalpers, the Zero account features ultra-low spreads starting from 0 pips, combined with a fixed commission structure. This combination allows traders to maintain cost transparency and predictability regarding trading expenses.

The Zero account is tailored specifically for traders focused on minimizing costs while maximizing execution speed. Given its characteristics, it stands out as an ideal choice for aggressive scalpers who seek to maximize their profit margins.

1️⃣ Open Exness Zero MT4 Account

2️⃣ Open Exness Zero MT5 Account

Raw Spread Account

The Raw Spread account provides access to interbank spreads with complete transparency by charging a fixed commission per lot. This account type is designed for traders who demand the tightest spreads available for their strategies.

As scalping tends to involve frequent trading, the clarity provided by the Raw Spread account makes it an appealing choice for experienced traders and algorithmic trading systems alike. Scalpers benefit from the pure pricing model and can fine-tune their trading strategies with ease.

1️⃣ Open Exness Raw Spread MT4 Account

2️⃣ Open Exness Raw Spread MT5 Account

Features to Consider for Scalping Accounts

When determining the best Exness account for scalping, certain features must be taken into consideration.

Spreads and Commissions

Spreads are a core component of trading costs, particularly for scalpers who transact multiple times. Narrow spreads minimize the cost incurred when entering and exiting positions frequently, impacting overall profitability.

Exness offers various account types with both fixed and floating spreads. For scalpers, focusing on accounts that provide tighter spreads is crucial to ensure that trading costs do not erode the small profits being targeted.

Execution Speed

Execution speed is vital in the world of scalping. Delays in order execution can lead to missed opportunities and unintended losses. When selecting an account with Exness, traders should assess the platform's performance in terms of latency, as faster execution can significantly enhance trading outcomes.

Exness is known for its fast execution speeds, but specific accounts, particularly the Zero and Raw Spread accounts, might offer advantages in latency. Ensuring that the chosen account supports efficient execution is paramount for capturing fleeting market opportunities.

Leverage Options

Leverage enables traders to control larger positions with a smaller margin, which can amplify returns for scalpers. However, higher leverage also increases exposure to risk. Exness provides competitive leverage options, allowing traders to tailor their risk profiles according to their trading strategies.

Understanding the implications of leverage and selecting appropriate levels is essential for successful scalping, as excessive leverage can lead to significant losses.

Trading Platforms Available

The trading platform is the interface through which traders interact with the markets. Scalpers typically prefer platforms equipped with customizable charts, advanced technical indicators, and one-click trading capabilities for rapid execution.

Exness supports both MetaTrader 4 and MetaTrader 5, which are renowned for their versatility and functionality. These platforms equip traders with the necessary tools for technical analysis, allowing for efficient scalping strategies.

Analysis of Exness Standard Account

Examining the specific features of the Exness Standard account provides insights into its suitability for scalping.

Spreads and Costs

The Standard account offers variable spreads starting from 1.0 pip. While this may suffice for casual traders, those engaged in aggressive scalping should be wary, as wider spreads can diminish profit margins on quick trades.

Additionally, the absence of a commission structure can appeal to some traders, but the broader spreads may ultimately result in higher trading costs for those who frequently enter and exit positions.

Suitability for Scalping

While technically feasible to implement scalping strategies using the Standard account, it may not be the optimal choice for serious scalpers. The relatively wider spreads can overshadow the small profits targeted by scalpers, making it challenging to achieve consistent gains. Thus, beginners might want to start here before transitioning to more specialized accounts.

Pros and Cons

Pros:

Accessible entry point for newcomers

A broad selection of instruments available

Flexibility to experiment with different trading strategies

Cons:

Wider spreads compared to other account types

Potentially higher trading costs due to increased spread width

Analysis of Exness Pro Account

The Pro account offers a compelling alternative for those interested in scalping.

Spreads and Costs

Pro account holders benefit from floating spreads starting from 0.2 pips. This tighter spread translates to lower costs per trade, enhancing the likelihood of successfully capturing smaller price changes.

The Pro account includes a variable commission structure; thus, while the costs remain competitive, it is essential for scalpers to monitor these fees based on their trading frequency.

Suitability for Scalping

Compared to the Standard account, the Pro account is more suitable for scalping due to its tighter spreads and improved execution speed. Experienced scalpers will appreciate the enhanced opportunity to capture quick profits from minor fluctuations, though occasional price volatility may still impact overall profitability.

Pros and Cons

Pros:

Tighter spreads than the Standard account

Faster execution and advanced order types available

Better suited for more experienced scalpers

Cons:

Floating spreads may not suit all trading strategies

Could become less economical during periods of market fluctuation

Analysis of Exness Zero Account

Delving into the Zero account, we find features specifically designed for scalping success.

Spreads and Costs

The standout feature of the Zero account is its ultra-low spreads, which can begin from 0 pips. Coupled with a fixed commission per lot, this structure provides absolute transparency regarding trading costs.

For scalpers aiming to minimize costs while maximizing performance, the Zero account is exceptionally advantageous. The ability to clearly understand the total cost of each trade aids in effective strategy planning.

Suitability for Scalping

The Zero account is arguably the best option for scalping strategies. The combination of extremely tight spreads and transparent commission structures creates an optimal trading environment. Scalpers can efficiently gauge their trading costs and refine their strategies accordingly.

Pros and Cons

Pros:

Extremely tight spreads, enhancing profitability potential

Fixed commission structure for predictable trading costs

Fast order execution perfect for scalping and automated trading

Cons:

Commission structure may not favor occasional traders

If spreads widen during volatile conditions, total costs could escalate

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Analysis of Exness Raw Spread Account

Finally, we arrive at the Raw Spread account, another appealing option for skilled scalpers.

Spreads and Costs

The Raw Spread account boasts access to some of the tightest raw spreads available in the market. This account type charges a fixed commission per lot, allowing traders to enjoy a clear understanding of their costs.

Such transparency is crucial for scalpers, as it facilitates precise calculations of profitability and risk.

Suitability for Scalping

Given its access to close-to-interbank spreads, the Raw Spread account is tailored for experienced scalpers. It offers the highest level of control over trading costs, which is vital for success in high-frequency trading scenarios.

The account’s characteristics ensure that scalpers can implement their strategies effectively, capitalizing on minute price movements with minimal friction.

Pros and Cons

Pros:

Exceptionally tight raw spreads, maximizing profit potential

Highest level of transparency in pricing structure

Ideal for expert scalpers and algorithmic trading strategies

Cons:

Market fluctuations may lead to temporary wider spreads

Primarily suited for experienced traders who understand the risks involved

Comparing the Scalping Capabilities of Each Account

With a deeper understanding of each Exness account, we can now compare their respective capabilities for scalping.

Speed of Trade Execution

All Exness accounts generally offer rapid execution speeds, but the Zero and Raw Spread accounts tend to shine brighter in this area. Their low-latency environments promote seamless trading experiences, critical for capturing fleeting market opportunities.

Scalpers need to consider that even minor delays can significantly affect their profitability, making fast execution a non-negotiable factor in their account selection process.

Cost Efficiency

Cost efficiency is vital for scalpers. The Zero and Raw Spread accounts stand out as the most financially viable options. Their combination of tight spreads and clear commission structures minimizes trading costs, allowing scalpers to maintain healthy profit margins.

The Pro account follows closely behind, with slightly wider spreads but still favorable terms for frequent trading.

Overall Performance

Based on the combination of spreads, commissions, and execution speeds, the Zero and Raw Spread accounts typically offer the best overall performance for scalpers. They create an optimal environment for consistently capturing small price movements while keeping costs under control.

Ultimately, the account type selected by a trader will depend on their specific trading strategies and personal preferences.

Choosing the Right Exness Account for Your Scalping Strategy

Now that we've examined the various Exness accounts in detail, it's essential to consider which account aligns best with your scalping strategy.

Factors to Consider Based on Trading Style

Trading Frequency: If you anticipate executing a high volume of trades, it is wise to choose either the Zero or Raw Spread account for their superior cost control and transparency.

Risk Tolerance: Scalping inherently carries higher risks due to its fast-paced nature. Assessing your risk profile will guide your decision on leverage options and account type.

Trading Experience: Scalping is not suited for novice traders. Those new to trading should start with the Standard or Pro account. Once comfortable, they can transition to the more specialized Zero or Raw Spread accounts.

Assessing Risk Management Needs

Effective risk management is critical in scalping strategies, particularly given the rapid pace of trading. Understanding how much capital you are willing to put at risk and the level of leverage that aligns with your risk tolerance is imperative.

Tips for Successful Scalping with Exness

Implementing successful scalping strategies involves a combination of careful planning and disciplined execution.

Importance of a Reliable Internet Connection

An unstable internet connection can spell disaster for scalpers. Given the rapidity of trades, having a reliable internet connection is fundamental. Invest in quality broadband and consider backup solutions to ensure connectivity during critical trading hours.

Utilizing Technical Analysis Tools

To effectively navigate the complexities of the forex market, scalpers should leverage technical analysis tools. Platforms like MetaTrader 4 and 5, offered by Exness, provide ample resources, including customizable charts and technical indicators, to aid in decision-making.

Personalizing your trading setup with indicators that align with your strategy will enhance your ability to identify optimal entry and exit points.

Common Mistakes to Avoid When Scalping

Even experienced traders can fall prey to missteps when scalping. Avoiding these common pitfalls can improve your chances of long-term success.

Overtrading and Emotional Decision Making

One of the main challenges in scalping is the temptation to overtrade. Due to the fast-paced environment, traders can easily become emotional, reacting impulsively to market fluctuations. Establishing strict trading rules and maintaining discipline will help prevent these issues.

Focus on a well-defined trading plan that outlines the number of trades you intend to make, along with criteria for entry and exit points.

Ignoring Market Conditions

Market conditions play a significant role in successful scalping. Ignoring economic news releases or geopolitical events can lead to unexpected volatility and losses. Stay informed about market developments and adjust your strategies accordingly.

Incorporation of a comprehensive news calendar into your trading routine will allow you to anticipate potential impacts on your trading environment.

Conclusion

In conclusion, when pondering which Exness account is best for scalping, it's evident that both the Zero and Raw Spread accounts present the most favorable conditions for high-frequency traders. Each account type has its advantages and disadvantages, and the ultimate decision will depend on individual trading styles, experience, and risk tolerance.

Regardless of the chosen account, successful scalping demands rigorous planning, disciplined execution, and an unwavering commitment to ongoing learning. As the forex market continues to evolve, the adaptability and development of a personalized trading strategy will remain key drivers of success for scalpers navigating this dynamic environment.

Read more: