13 minute read

How much is the minimum deposit in Exness?

Understanding Exness as a Trading Platform

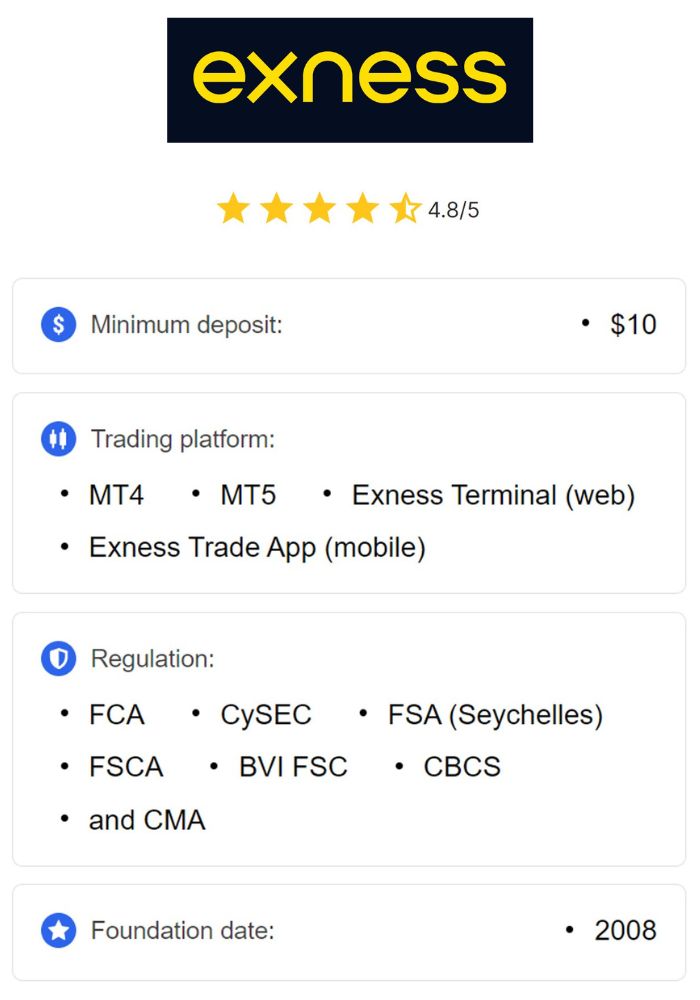

Overview of Exness

Exness is a well-established online trading platform known for its competitive trading conditions and wide array of financial instruments. Founded in 2008, Exness is regulated by leading authorities such as the FCA and CySEC, which gives traders confidence in its reliability and transparency. The platform supports various asset classes, including forex, commodities, cryptocurrencies, indices, and stocks, catering to diverse trading needs. With advanced tools, low spreads, and high leverage options, Exness has gained popularity among traders worldwide.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Exness offers several account types suited to both beginner and experienced traders, as well as a mobile application, Exness Go, for trading on the go. This flexibility in platform and account options makes Exness a competitive choice for those looking to enter the trading market, whether they’re day traders, swing traders, or long-term investors.

Key Features of Exness

Exness offers numerous features to improve the trading experience, including a low minimum deposit requirement, advanced charting tools, and multiple account types. Other key features include:

Multiple Payment Options: Exness supports bank transfers, credit/debit cards, and e-wallets, making deposits and withdrawals convenient for users across the globe.

Low Spreads and Competitive Fees: Exness offers some of the most competitive spreads in the industry, allowing traders to keep trading costs low.

High Leverage: With leverage options up to 1:2000 on some account types, Exness enables traders to maximize their capital and take on larger positions.

Real-Time Trading Tools: Exness provides users with up-to-date news, market analysis, and a range of technical indicators to support informed decision-making.

These features make Exness a desirable choice, particularly for those looking for a low-cost, flexible trading platform.

Importance of Minimum Deposit

What is Minimum Deposit?

A minimum deposit is the smallest amount of money a trader needs to fund their account to start trading on a platform. This deposit amount often varies depending on the broker and the type of account chosen. For new traders, minimum deposits provide an accessible entry point into the trading world without the need to invest large sums initially.

Why Minimum Deposit Matters for Traders

The minimum deposit requirement is an essential factor, especially for beginners who may not want to risk large sums in the market initially. A lower minimum deposit allows new traders to test the platform, explore different trading tools, and practice their strategies with limited financial risk. For experienced traders, minimum deposits can influence their choice of broker as it impacts their cash flow management and trading strategy.

A low minimum deposit also reflects the broker’s accessibility and approachability, making platforms like Exness appealing to traders of all experience levels. Additionally, lower minimum deposits can be beneficial for traders who want to diversify their investments across multiple accounts or platforms.

Minimum Deposit Requirements at Exness

Different Account Types Offered

Exness provides several account types tailored to meet the needs of various trading styles and experience levels. Each account type comes with different features, including varying minimum deposits, spreads, and leverage options. The primary account types include:

Standard Account: Suitable for most traders, including beginners, with access to essential trading features.

Professional Accounts: These include Raw Spread, Zero, and Pro accounts, designed for experienced traders needing lower spreads and additional features.

Cent Account: Ideal for beginners looking to trade with smaller amounts, as it allows trading with cents rather than whole currency units.

Minimum Deposit for Standard Accounts

The minimum deposit for Exness’s Standard Account is typically quite low, often starting at $1, although this may vary by region and payment method. This low entry barrier makes the Standard Account highly accessible, enabling new traders to enter the market without significant financial commitment. This account type offers competitive spreads and a range of trading instruments, making it ideal for beginners and intermediate traders alike.

Minimum Deposit for Professional Accounts

Professional accounts on Exness, including the Raw Spread, Zero, and Pro accounts, usually have higher minimum deposit requirements due to the advanced features they offer. These accounts start with minimum deposits ranging from $200 to $500, depending on the account type. In return, professional account holders receive lower spreads and other premium features suited to high-volume trading.

Professional accounts are designed for traders who require precise execution, tighter spreads, and more flexible leverage. Although the minimum deposit is higher, these accounts are more cost-effective for frequent traders looking to minimize trading costs.

Minimum Deposit for Cent Accounts

The Cent Account is tailored for beginners who prefer to trade with smaller amounts. This account type allows traders to deposit as little as $1, trading in smaller units (cents) instead of whole dollars. The Cent Account is an excellent choice for those new to trading, enabling them to practice and develop strategies with minimal risk. Although profits and losses are smaller on this account, it provides a low-stakes environment for learning the basics of trading.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Factors Influencing Minimum Deposit Amounts

Account Type Selection

The minimum deposit amount on Exness depends significantly on the type of account chosen. Exness offers multiple account types to cater to different levels of trading experience and investment needs. For example:

Standard Accounts often have lower minimum deposit requirements, which makes them ideal for beginner traders or those looking to start with a smaller capital.

Professional Accounts (such as Raw Spread, Zero, and Pro accounts) are generally geared toward more experienced traders who require advanced features, lower spreads, and higher leverage. Due to these added benefits, these accounts typically require a higher minimum deposit.

By choosing an account type based on their trading goals and financial resources, traders can ensure they meet the minimum deposit requirements effectively.

Payment Method Variations

The payment method a trader chooses can also impact the minimum deposit amount on Exness. Different payment methods may have varying processing times, fees, and minimum deposit requirements:

Bank Transfers: Bank transfers often have higher minimum deposit requirements compared to other methods. Processing times can also be longer, sometimes taking up to a few business days, depending on the bank.

E-Wallets: Popular e-wallet options such as Skrill, Neteller, and WebMoney generally offer lower minimum deposit requirements and faster processing times. These are often favored by traders who want instant deposits.

Credit and Debit Cards: Cards are widely accepted and typically allow for smaller minimum deposits, providing convenience and accessibility. However, traders should be aware of any potential fees from their card providers.

Understanding the variations across payment methods allows traders to select the most suitable option based on their deposit amount and preference for transaction speed.

Regulatory Considerations

Exness is regulated by various financial authorities worldwide, such as the Financial Conduct Authority (FCA) in the UK and CySEC in Cyprus. These regulations may affect minimum deposit requirements depending on the region, as certain jurisdictions impose minimum standards for the protection of retail traders.

For instance, in regions where regulations are more stringent, brokers may be required to set higher minimum deposits to ensure that traders are adequately capitalized. Additionally, regulatory standards may vary for different account types or client classifications, such as retail versus professional clients. Exness adheres to these standards, ensuring compliance while also keeping entry requirements accessible for traders globally.

Payment Methods for Depositing Funds

Bank Transfer Options

Bank transfers are a reliable and secure way to deposit funds into an Exness account. This method is especially popular among traders who prefer direct bank transactions. Bank transfers are generally safe but may involve longer processing times compared to other methods. Additionally, some banks impose their own fees on transfers, which could affect the net amount deposited into the trading account.

To make a deposit via bank transfer, traders need to initiate the transaction from their bank account, following Exness’s instructions for account details and payment reference. Processing times for bank transfers can vary, but they usually take one to five business days.

E-Wallet Services

E-wallets like Skrill, Neteller, and WebMoney are commonly used on Exness due to their speed and convenience. These digital wallets allow for instant deposits with lower minimum deposit requirements, making them attractive to traders who want fast access to their trading capital.

With e-wallets, traders can fund their accounts within minutes, avoiding the delays commonly associated with traditional banking systems. This method is also popular among traders who prioritize low transaction costs, as e-wallets generally have minimal fees for deposits and withdrawals.

Credit and Debit Card Payments

Credit and debit cards are widely accepted on Exness, providing another fast and convenient option for funding accounts. Deposits made via cards are usually processed instantly, enabling traders to begin trading without delay. This payment method also has relatively low minimum deposit requirements, making it accessible for most traders.

When using a credit or debit card, traders should be aware of any fees their card provider might impose, although Exness itself typically does not charge additional fees for card deposits. Additionally, card payments offer added security features, such as two-factor authentication, to protect against unauthorized transactions.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Comparing Exness Minimum Deposit with Other Brokers

Industry Standards

In the online trading industry, minimum deposit requirements vary widely among brokers. While some brokers set minimum deposits as low as $1 to attract beginner traders, others may require $100 or even $500, particularly for accounts that offer premium features. Exness stands out with its low minimum deposit requirement on Standard and Cent accounts, which often start at just $1, making it accessible for traders with limited initial capital.

By keeping minimum deposit requirements low, Exness aligns itself with industry trends favoring accessible entry points. This allows the platform to compete effectively with other brokers and attract a broader range of clients, including beginners and traders from regions with lower income levels.

Advantages of Lower Minimum Deposits

Lower minimum deposits come with several benefits for traders, especially those new to the trading world:

Reduced Financial Risk: Lower deposits mean traders can enter the market without risking large sums of money, making it a safer way to learn and gain experience.

Accessible for Beginners: A low entry barrier enables beginner traders to experiment with live trading, allowing them to practice strategies and understand market dynamics with real funds.

Flexibility: Traders can start with smaller amounts and gradually increase their capital as they gain confidence and experience in trading.

Multiple Accounts: Lower minimum deposits allow traders to open multiple accounts to test different trading strategies or diversify their investments.

By offering low minimum deposits, Exness supports these advantages, making its platform inclusive and flexible.

How to Make a Deposit at Exness

Step-by-Step Guide to Deposit Funds

Making a deposit on Exness is straightforward and user-friendly. Here’s a step-by-step guide to help traders get started:

Log in to Your Exness Account: Access your Exness account via the website or mobile app.

Go to the Deposit Section: Once logged in, navigate to the “Deposit” option on the dashboard.

Select Payment Method: Choose your preferred deposit method, such as bank transfer, e-wallet, or credit/debit card.

Specify the Deposit Amount: Enter the amount you wish to deposit, ensuring it meets the minimum deposit requirement for your account type.

Confirm Payment: Follow the on-screen prompts to complete the payment through your selected method.

Check Account Balance: Once the transaction is processed, your deposit should reflect in your account balance, usually within minutes for e-wallets and cards or up to a few days for bank transfers.

Common Issues Faced During Deposits

While deposits on Exness are generally smooth, some traders may encounter issues, such as:

Delayed Processing Times: Bank transfers can take several days to process, causing delays in account funding.

Payment Declines: Credit or debit card deposits may be declined by the card issuer due to security protocols or insufficient funds.

Regional Restrictions: Certain payment methods may not be available in specific regions, limiting options for some traders.

Currency Conversion Fees: Deposits made in currencies other than the account’s base currency may incur conversion fees, impacting the final amount deposited.

In case of any issues, traders are encouraged to contact Exness support for assistance, ensuring a smooth deposit experience.

Withdrawal Policies Related to Minimum Deposits

Withdrawal Process Explained

Exness offers a simple and secure withdrawal process. Traders can initiate withdrawals through the Exness app or website by selecting their preferred withdrawal method. Here’s a brief overview of the withdrawal steps:

Log in to Your Account: Access the withdrawal option in your account dashboard.

Choose Withdrawal Method: Select a method that’s available for withdrawals, typically the same method used for deposits.

Specify Amount: Enter the amount you wish to withdraw, ensuring it meets the minimum withdrawal requirement.

Confirm Transaction: Follow prompts to confirm the withdrawal request.

Processing Time: Withdrawals to e-wallets are often instant, while bank transfers and card withdrawals may take up to five business days.

Exness prioritizes security, ensuring that funds are transferred safely to the trader’s account.

Minimum Withdrawal Limits

Just like with deposits, Exness has minimum withdrawal requirements based on the withdrawal method chosen. For example:

E-wallets: Typically, e-wallets have lower minimum withdrawal limits, making them convenient for smaller withdrawals.

Bank Transfers and Cards: These methods might have higher minimum withdrawal requirements and longer processing times.

Understanding minimum withdrawal limits helps traders plan their withdrawals more effectively, whether they’re taking profits or reallocating funds.

Customer Support and Assistance

Availability of Help Resources

Exness provides a variety of support resources to assist traders, including a detailed FAQ section, educational articles, and video tutorials. These resources cover common questions about deposits, withdrawals, trading strategies, and account management, ensuring that traders can find answers to their questions quickly and independently.

For more in-depth support, Exness offers live webinars and trading courses to help traders improve their skills and knowledge.

Contacting Exness Support

For issues that require direct assistance, Exness offers multiple support channels, including live chat, phone support, and email. The support team is available 24/7 in multiple languages, ensuring that traders from around the world can get help whenever needed. Exness’s responsive and knowledgeable support staff is praised by users, particularly for handling account issues, payment concerns, and technical assistance efficiently.

Conclusion

Exness’s low minimum deposit requirements make it an attractive choice for traders at all levels. With options starting as low as $1 for Standard and Cent accounts, Exness ensures accessibility for beginners while also providing professional accounts for experienced traders willing to meet higher minimum deposits for premium features. The platform’s wide range of payment options, strong regulatory compliance, and comprehensive support services further enhance its appeal.

By keeping minimum deposit amounts low and offering a variety of account types, Exness stands out as a flexible and beginner-friendly platform. Whether you’re new to trading or a seasoned trader looking for a reliable broker, Exness provides an accessible entry point with the tools and resources to support your trading journey.

Read more: