13 minute read

How much can i make with $10 in forex?

from Exness Blog

Understanding Forex Trading Basics

What is Forex Trading?

Forex trading, or foreign exchange trading, involves the simultaneous buying of one currency and selling of another. It is a decentralized global market where currencies are traded against each other in pairs, such as EUR/USD (Euro to US Dollar) or USD/JPY (US Dollar to Japanese Yen). This market operates 24 hours a day, five days a week, making it accessible to traders around the world. The primary goal of forex trading is to profit from the fluctuations in currency exchange rates, which can be influenced by various factors including economic data, geopolitical events, and market sentiment.

Top 4 Best Forex Brokers

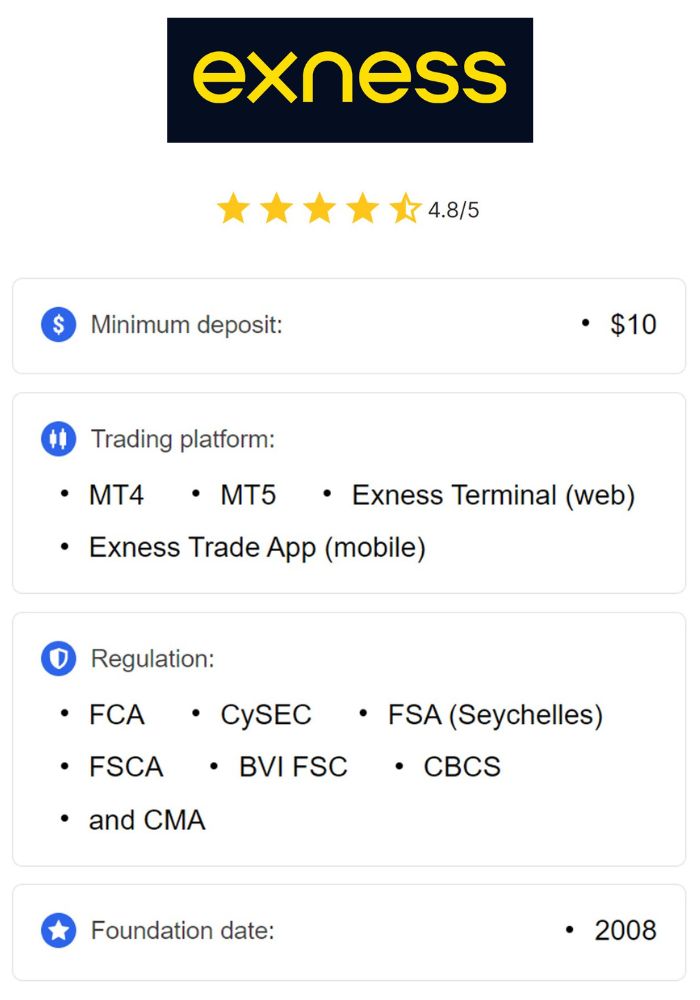

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ Avatrade: Open An Account or Visit Brokers 💯

3️⃣ JustMarkets: Open An Account or Visit Brokers ✅

4️⃣ Quotex: Open An Account or Visit Brokers 🌐

Forex trading offers immense liquidity, meaning traders can enter and exit positions quickly and with minimal price impact. With over $6 trillion traded daily, it is the largest financial market in the world, attracting a wide range of participants from individual retail traders to large financial institutions.

Currency Pairs and Their Importance

In forex trading, currencies are always quoted in pairs, where one currency is the base currency and the other is the quote currency. The value of a currency pair reflects how much of the quote currency is needed to purchase one unit of the base currency. For example, in the pair EUR/USD, the Euro is the base currency, and the USD is the quote currency. If the pair is quoted at 1.20, it means that 1 Euro is equal to 1.20 US Dollars.

Understanding currency pairs is crucial for traders as it helps them make informed decisions based on economic indicators, political events, and technical analysis. Different pairs have different characteristics, including volatility, liquidity, and spread, which can significantly impact trading strategies and outcomes.

The Role of Leverage in Forex

Leverage is a key feature in forex trading that allows traders to control larger positions with a smaller amount of capital. For instance, if a broker offers 100:1 leverage, a trader can control a $10,000 position with only $100 of their own money. While leverage can significantly amplify profits, it also increases the risk of substantial losses.

For example, if you were to invest $10 and used 100:1 leverage, you could theoretically control $1,000 worth of currency. If your trade moves in your favor, your profits can be substantial; however, if the trade goes against you, losses can quickly exceed your initial investment. Understanding how to use leverage responsibly is crucial for long-term success in forex trading.

Setting Up Your Forex Account

Choosing a Forex Broker

Before you can begin trading with $10, it's essential to select a reliable forex broker. Look for brokers that are well-regulated, offer competitive spreads, low fees, and provide a user-friendly trading platform. It’s advisable to read reviews from other traders to gauge the broker’s reputation. Ensure the broker supports small accounts, allowing you to start trading with your $10 investment. Some brokers may have specific accounts tailored for beginners or those looking to trade with low capital.

Minimum Deposit Requirements

Most forex brokers have minimum deposit requirements that dictate how much capital you need to start trading. Some brokers allow you to open a trading account with as little as $10, while others may require a higher minimum deposit. When starting with a small investment, look for brokers that offer micro or cent accounts, which enable you to trade smaller lot sizes and manage your risk effectively.

Account Types: Standard vs. Micro Accounts

Forex brokers typically offer various account types, including standard accounts and micro accounts. A micro account is particularly beneficial for new traders as it allows trading in smaller lot sizes (1,000 units) and minimizes risk. In contrast, a standard account usually requires a higher minimum deposit and allows for larger lot sizes (100,000 units).

With a $10 investment, opting for a micro account is often the best choice, as it enables you to manage your risk while gaining valuable trading experience. This account type is well-suited for beginners who want to practice their skills without exposing themselves to significant financial risk.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

The Power of Leverage in Forex

How Leverage Works

Leverage in forex trading refers to the ability to control a large position with a relatively small amount of capital. Essentially, it allows traders to magnify their potential profits (and losses) by borrowing funds from their broker. For instance, if a broker offers a leverage ratio of 100:1, this means that for every $1 of your own capital, you can control a position worth $100. This is particularly advantageous for traders with limited capital, such as those starting with a small investment of $10.

The leverage ratio can vary depending on the broker, the trader's experience, and regulatory guidelines. In most cases, higher leverage is available for major currency pairs compared to more volatile or exotic pairs. Understanding how leverage works is crucial for traders, as it can significantly affect both potential earnings and the risk of incurring losses.

Risks Associated with High Leverage

While leverage can enhance potential profits, it also amplifies the risks associated with trading. The higher the leverage used, the smaller the price movement needed to result in a margin call or complete loss of capital. For example, if you have a $10 account and use 100:1 leverage, a 1% adverse move in the market (which equates to a $10 loss) would wipe out your entire investment.

It is essential for traders to be aware of their risk tolerance and to manage leverage carefully. Overleveraging can lead to significant financial loss, which is why establishing a robust risk management strategy is crucial when using leverage in forex trading.

Calculating Potential Earnings Using Leverage

To illustrate the power of leverage, let's consider a practical example. Assume you start with a $10 investment in your trading account and choose to trade a currency pair using 100:1 leverage. This means you can control a position size of $1,000.

If the market moves in your favor by 50 pips and you are trading a micro lot (1,000 units), where each pip is worth $0.10, your profit would be:

Profit=Pip Movement×Pip Value=50×0.10=$5.00

In this scenario, a $10 investment could yield a $5 profit with the use of leverage. However, if the market moves against you by the same amount, you would incur a loss of $5, which is half of your initial investment. Therefore, it is crucial to calculate potential earnings and losses carefully when trading with leverage.

Trading Strategies for Small Investments

Day Trading vs. Swing Trading

Day trading involves making multiple trades within a single day, taking advantage of small price movements in highly liquid markets. This strategy requires constant monitoring of market conditions and quick decision-making skills. For beginners with a $10 investment, day trading can be risky due to the rapid fluctuations in prices and the potential for emotional trading decisions.

On the other hand, swing trading allows traders to hold positions for several days or weeks, capturing larger price movements. This strategy may be more suitable for those who cannot dedicate significant time to monitoring the markets but still want to take advantage of market trends. With a small investment, swing trading can provide more opportunities to profit without the pressure of immediate decision-making.

Scalping: Quick Profits with Small Capital

Scalping is a trading technique that involves making numerous trades throughout the day to profit from small price changes. Scalpers typically hold positions for a few seconds to a few minutes, aiming to take advantage of small fluctuations in the market. For traders starting with a small amount, scalping can be a viable strategy, as it allows them to accumulate profits quickly without needing to risk large amounts of capital.

However, successful scalping requires a strong understanding of market dynamics, quick execution of trades, and effective risk management. It is crucial for scalpers to have access to fast and reliable trading platforms that enable them to execute trades with minimal delays.

Risk Management Strategies

Implementing effective risk management strategies is vital for all traders, especially those with limited capital. A fundamental principle of risk management is to never risk more than a small percentage of your total trading capital on a single trade—commonly recommended as 1% to 2%. This approach helps ensure that even a series of losses won’t deplete your account.

Additionally, using stop-loss orders can help protect your capital by automatically closing a position at a predetermined price level to limit potential losses. Traders should also consider diversifying their trades across different currency pairs to spread risk. This practice minimizes the impact of adverse movements in any single trade and enhances overall portfolio stability.

Understanding Pips and Lot Sizes

What is a Pip?

A pip, which stands for "percentage in point," is the smallest price movement that a currency pair can make based on market convention. In most currency pairs, a pip is equal to 0.0001, meaning that if the EUR/USD pair moves from 1.1200 to 1.1201, it has moved one pip. Understanding pips is essential for calculating profits and losses in forex trading.

Each currency pair has its own pip value, which is crucial for determining potential earnings or losses on a trade. For traders starting with a small investment, knowing how pips work and their value in different currency pairs is fundamental to making informed trading decisions.

Different Lot Sizes Explained

Forex trading typically involves trading in specific lot sizes. The three main types of lot sizes are:

Standard Lot: This represents 100,000 units of the base currency.

Mini Lot: This represents 10,000 units of the base currency.

Micro Lot: This represents 1,000 units of the base currency.

For traders with a $10 investment, micro lots are the most appropriate choice, as they allow for smaller trades and lower risk. Trading in micro lots can help manage risk effectively while gaining exposure to the forex market.

Impact of Lot Size on Earnings

The lot size you choose has a direct impact on your potential earnings and losses. For example, if you trade a micro lot and the pip value is $0.10, a movement of 10 pips would result in a profit or loss of $1.00. Therefore, understanding the relationship between lot sizes and pip values is essential for managing your expectations and determining potential profit or loss on any trade.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Potential Earnings with $10 Investment

Realistic Expectations in Forex Trading

While the potential for profits exists, it's crucial to set realistic expectations, particularly when starting with a small investment of $10. Many factors can influence your earnings, including market conditions, trading strategies, and risk management techniques. New traders should understand that substantial profits may take time and require experience to achieve.

Scenarios of Gains and Losses

Let’s examine a few scenarios to illustrate potential earnings with a $10 investment in forex trading:

Scenario A: If you trade a micro lot with a pip value of $0.10 and manage to gain 50 pips, your profit would be: Profit = Pip Movement × Pip Value = 50× 0.10 = $5.00

Scenario B: If the trade goes against you by 50 pips, your loss would be: Loss = 50 × 0.10= $ 5.00

These scenarios highlight the variability in trading outcomes and the importance of risk management and having realistic expectations.

The Effect of Market Volatility

Market volatility can significantly impact potential earnings in forex trading. High volatility can lead to larger price swings, providing opportunities for significant gains. However, it can also increase the risk of substantial losses. Understanding market conditions and staying informed about economic events is crucial for navigating volatility effectively.

Factors Influencing Profitability in Forex

Economic Indicators and News Events

Economic indicators, such as GDP growth, employment data, and inflation rates, play a significant role in influencing currency movements. Traders must stay informed about these indicators and how they can affect their chosen trading pairs. Additionally, major news events, such as central bank announcements or geopolitical developments, can lead to significant price fluctuations.

Technical Analysis Tools

Technical analysis involves studying historical price movements and market trends to make informed trading decisions. Traders often use various tools, such as charts, indicators, and trend lines, to identify potential trading opportunities. Learning how to interpret these tools can enhance a trader’s ability to capitalize on market movements effectively.

Psychological Factors in Trading Decisions

Trading psychology plays a critical role in decision-making. Emotions such as fear, greed, and impatience can lead to poor trading choices. Successful traders develop mental discipline and a well-defined trading plan to navigate the psychological challenges of the forex market.

Common Pitfalls for New Traders

Emotional Trading and Its Consequences

New traders often let emotions dictate their trading decisions, leading to impulsive actions that can result in losses. Emotional trading can manifest as overtrading, revenge trading, or holding onto losing positions. Recognizing and managing these emotions is essential for long-term success.

Overleveraging and Margin Calls

While leverage can amplify profits, it can also lead to significant losses. New traders may be tempted to use high leverage to maximize potential earnings, but this approach can result in margin calls and the forced closure of positions. It’s vital to use leverage judiciously and understand its implications on your trading account.

Lack of a Trading Plan

A well-structured trading plan is crucial for success in forex trading. Many beginners enter trades without a clear plan, leading to inconsistent results and missed opportunities. Developing a comprehensive trading strategy that outlines entry and exit points, risk management techniques, and profit targets is essential for achieving trading success.

Case Studies: Real-Life Examples

Success Stories with Small Investments

Many traders have successfully navigated the forex market starting with small investments. For example, some traders have reported turning a $10 investment into a profitable account through disciplined trading and effective risk management. These success stories often highlight the importance of education, practice, and the ability to adapt to changing market conditions.

Lessons Learned from Failed Trades

While success stories are inspiring, learning from failures is equally important. Traders who have experienced losses often emphasize the need for proper risk management, emotional control, and a solid trading plan. Analyzing past mistakes can help traders avoid making the same errors in the future.

Comparing Different Trading Strategies

Exploring various trading strategies and their outcomes can provide valuable insights. For instance, some traders may find success with scalping, while others may prefer swing trading or day trading. Understanding the strengths and weaknesses of different strategies allows traders to find the approach that best suits their personality and trading style.

Conclusion: Making the Most of Your $10 Investment in Forex

In conclusion, forex trading offers the potential for significant profits, even with a small investment of $10. However, success in this market requires a solid understanding of trading fundamentals, effective risk management, and a disciplined approach. By leveraging educational resources, practicing with demo accounts, and staying informed about market trends, traders can navigate the forex market more effectively.

With the right strategies and mindset, turning a small investment into a profitable trading account is possible. As you embark on your forex trading journey, remember to set realistic expectations, continuously learn from your experiences, and adapt your approach based on market conditions. Ultimately, the key to success lies in persistence, education, and a commitment to honing your trading skills.

Read more: