26 minute read

How to trade XAUUSD in India, A Comprehensive Guide

Understanding XAUUSD Trading

What is XAUUSD?

XAUUSD represents the trading pair for gold (XAU) priced in U.S. dollars (USD). In Forex markets, XAUUSD allows traders to speculate on gold’s price movement against the dollar, making it a popular asset among those interested in precious metals. Gold has long been viewed as a stable store of value and a hedge against inflation, providing security to investors in times of economic uncertainty. With XAUUSD, traders can engage in both long and short positions, profiting from rising or falling gold prices, depending on their predictions of the market.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

This pairing offers a unique opportunity for Forex traders to diversify beyond traditional currency pairs. Given gold’s status as a globally recognized asset, its price often reflects global economic conditions, geopolitical events, and market sentiment. As a result, XAUUSD trading attracts a wide range of traders, from beginners to experienced investors looking to balance their portfolios and safeguard against currency volatility.

Importance of Gold Trading in Financial Markets

Gold holds a unique position in financial markets, acting as both a commodity and a safe-haven asset. When inflation rises or economic instability looms, investors frequently turn to gold, boosting demand and, consequently, its price. This trend makes XAUUSD a favored choice among traders who want to protect their assets against inflationary pressures. Additionally, gold prices tend to rise when the dollar weakens, providing a hedge for dollar-based assets. Understanding this relationship is crucial for traders who want to capitalize on both economic downturns and periods of currency depreciation.

Trading XAUUSD can also offer insights into broader financial trends, as its price movements often mirror global economic health. Central banks worldwide hold reserves in gold, which adds a layer of complexity to its price dynamics. By studying XAUUSD, traders can better anticipate market responses to geopolitical shifts and major economic reports, enhancing their overall trading strategies.

Benefits of Trading XAUUSD

Trading XAUUSD comes with several benefits, especially for those looking to diversify their portfolios and hedge against risk. One key advantage is liquidity; gold is one of the most traded commodities globally, providing ample opportunities for entry and exit without significant price slippage. Additionally, gold's historical price stability compared to other assets attracts risk-averse traders. By trading XAUUSD, investors can engage in a relatively stable market while still capitalizing on volatility when economic or geopolitical tensions arise.

Another advantage of XAUUSD trading is its accessibility in Forex markets, allowing traders to trade around the clock. Unlike physical gold, XAUUSD can be traded with minimal initial capital, thanks to leverage options available with most brokers. This ease of access combined with its robust market provides traders with a balanced mix of stability and profit potential, making XAUUSD a valuable addition to any trading strategy.

Market Analysis for XAUUSD

Fundamental Analysis

Fundamental analysis in XAUUSD trading involves examining macroeconomic indicators, central bank policies, and geopolitical events that can affect gold prices. Economic reports like inflation data, GDP growth rates, and employment figures are critical, as they impact both the dollar and gold demand. When inflation rates rise, gold typically becomes more attractive as a hedge, driving its price higher. Similarly, central bank decisions on interest rates, particularly from the Federal Reserve, play a pivotal role. Higher interest rates often boost the dollar but may lower gold’s appeal, leading to fluctuations in XAUUSD.

Geopolitical tensions also influence gold prices, as investors often seek the stability of gold during crises. Political uncertainty, trade wars, and regional conflicts can create demand for gold as a safe-haven asset. Fundamental analysis helps traders predict these shifts, allowing them to make more informed decisions on whether to buy or sell XAUUSD based on the larger economic picture.

Technical Analysis

Technical analysis focuses on historical price data and chart patterns to predict future movements in XAUUSD. Traders often use indicators like moving averages, Relative Strength Index (RSI), and Bollinger Bands to identify trends and potential reversal points. Chart patterns like double tops, head and shoulders, or triangles also provide signals that can guide trading decisions. For instance, if the XAUUSD chart shows a breakout from a resistance level, traders may interpret it as a bullish signal and prepare to enter long positions.

Technical analysis is essential for short-term traders, as it helps identify entry and exit points based on price action rather than underlying economic conditions. By mastering technical tools, traders can make quicker decisions, optimizing their strategy to align with gold’s price volatility, especially during times of heightened market activity.

Sentiment Analysis

Sentiment analysis involves gauging market sentiment, or the general mood of traders, to predict XAUUSD movements. This approach considers factors like market news, trader positioning, and sentiment indexes to determine if the majority of the market is bullish or bearish on gold. For example, if sentiment indicates that most traders are optimistic about gold’s performance, it may signal an uptrend for XAUUSD. Conversely, widespread pessimism could suggest a downtrend.

Sentiment analysis is valuable as it provides a snapshot of collective trader psychology, offering a potential early indication of trend reversals. Tools like the Commitment of Traders (COT) report can show whether institutional investors are buying or selling gold, giving individual traders insight into likely price movements. Combining sentiment analysis with technical and fundamental analysis creates a well-rounded strategy, enhancing trading outcomes.

Choosing the Right Broker

Key Criteria for Selecting a Broker

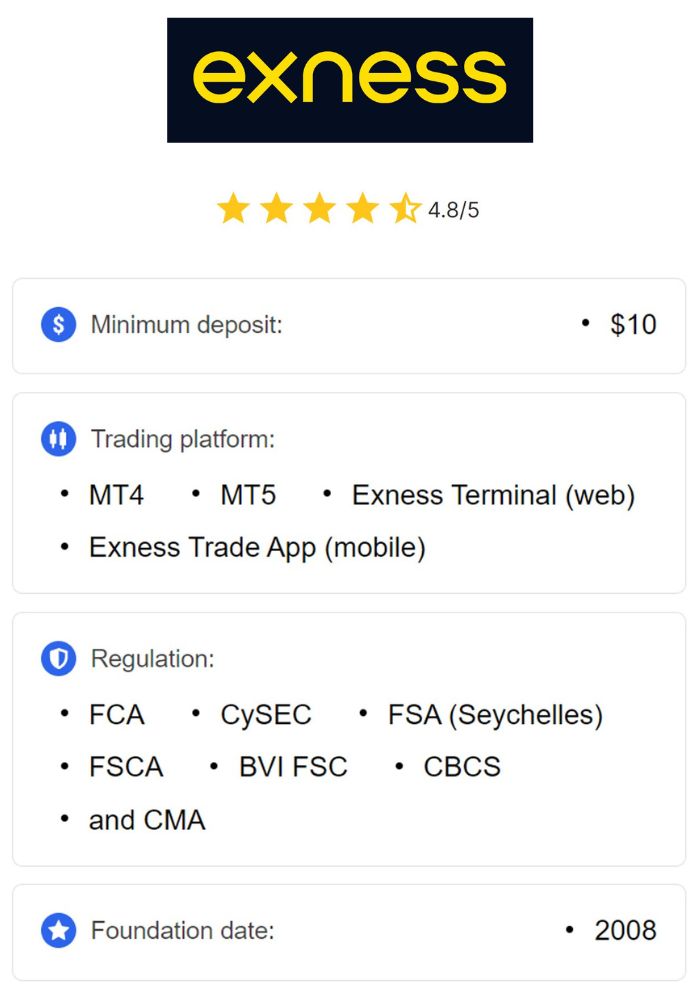

Choosing a reliable broker is essential for successful XAUUSD trading. Key criteria include regulatory compliance, trading fees, platform quality, and customer support. In India, it’s crucial to select a broker regulated by respected financial authorities to ensure fund security and fair trading practices. Additionally, low spreads and commissions are vital, as they reduce transaction costs, allowing traders to maximize profitability on each trade. Reliable customer support is also a priority, as it ensures prompt assistance in case of account or technical issues.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

A suitable broker should offer advanced tools, multiple trading platforms, and access to educational resources. Many brokers provide platforms like MetaTrader 4 or MetaTrader 5, which support automated trading and advanced charting tools, enhancing the overall trading experience. By carefully evaluating brokers based on these factors, traders can select a provider that meets their unique requirements and risk tolerance.

Regulated Brokers in India

In India, trading XAUUSD requires partnering with brokers regulated by trusted financial authorities, such as the Securities and Exchange Board of India (SEBI). Working with a regulated broker ensures that client funds are protected, and trading conditions are transparent. Some international brokers also operate in India and are regulated by global bodies like the FCA or CySEC, making them trustworthy choices for Indian traders. SEBI regulates the Forex market to prevent fraud and safeguard investor interests, so checking a broker’s regulatory status is crucial before opening an account.

Moreover, Indian traders should consider brokers that comply with the Reserve Bank of India’s (RBI) guidelines. Ensuring that a broker follows RBI regulations helps prevent potential legal issues, as certain types of foreign exchange trading are restricted in India. Working with regulated brokers who respect these guidelines provides a safe, compliant environment for XAUUSD trading.

Comparing Broker Fees and Spreads

Fees and spreads can vary significantly among brokers, impacting the overall profitability of XAUUSD trades. Brokers typically earn through spreads (the difference between buy and sell prices) or commission fees, which can add up over time, especially for high-frequency traders. Traders should compare spreads for XAUUSD, as even a slight difference in spread size can influence trading costs, especially when using larger lot sizes or engaging in multiple trades.

In addition to spreads, some brokers may charge overnight swap fees, account maintenance fees, or withdrawal fees, which should be considered when choosing a broker. Reviewing the full fee structure allows traders to select a cost-effective broker that aligns with their trading volume and strategy, maximizing returns on XAUUSD trades.

Opening a Trading Account

Types of Trading Accounts

When opening a trading account for XAUUSD in India, it’s important to understand the different account types available. Most brokers offer a variety of accounts designed to suit various trading needs, such as Standard, Pro, or Zero Spread Accounts. Standard accounts generally provide variable spreads and no commission, making them suitable for beginners who prefer a straightforward fee structure. Pro accounts often cater to more experienced traders, offering tighter spreads and sometimes requiring a higher initial deposit. For those who wish to minimize spread costs, Zero Spread Accounts may be an ideal option, though they often come with a commission per trade.

Each account type has its own advantages, so traders should carefully consider their strategy and experience level before choosing. Beginners may find standard accounts more accessible, while active traders who focus on high-frequency strategies like scalping may benefit from zero spread accounts. By evaluating the types of accounts on offer, traders can choose one that aligns with their goals and budget, setting themselves up for a smoother trading experience.

Documentation Required

To open a trading account in India, brokers typically require a few standard documents to verify the trader’s identity and financial standing. These documents often include government-issued identification, such as an Aadhaar card or passport, to confirm the trader’s identity. Additionally, proof of address, like a utility bill or bank statement, is generally needed to meet Know Your Customer (KYC) requirements. Some brokers may also request financial documents, such as bank statements or income proof, to assess the trader’s financial background, especially if leverage is involved.

Proper documentation ensures compliance with both regulatory requirements and broker policies, safeguarding traders’ funds and personal information. For Indian traders, having these documents ready can streamline the account opening process. Ensuring all documents are valid and updated also helps prevent delays, allowing traders to start trading XAUUSD sooner.

Steps to Open an Account

Opening an account to trade XAUUSD in India is a straightforward process. First, traders must select a broker that offers XAUUSD trading, ensuring that it is regulated and meets the criteria discussed earlier. After choosing a broker, the trader can proceed with registration by providing personal details such as name, contact information, and preferred account type. Most brokers offer online registration forms that simplify the initial steps, allowing traders to complete the application from the comfort of their homes.

After completing the form, traders are typically required to upload the necessary documentation. Once the broker verifies these documents, the account is approved, and the trader can make an initial deposit. With funds in the account, the trader can access the XAUUSD market, using the broker’s platform to execute trades. This straightforward process enables traders to start trading efficiently while ensuring that all regulatory checks are in place.

Understanding Leverage and Margin

What is Leverage?

Leverage is a powerful tool in Forex and commodities trading, allowing traders to open larger positions with a smaller initial investment. When trading XAUUSD, leverage enables traders to control a large quantity of gold with only a fraction of the actual cost. For example, a leverage ratio of 1:100 allows a trader to open a position worth $10,000 with just $100 in their trading account. Leverage amplifies both potential profits and losses, making it a double-edged sword that requires careful management.

In India, leverage ratios offered by brokers may vary based on regulatory restrictions, broker policies, and the trader’s experience level. While high leverage can enhance profit opportunities, it also increases the risk of substantial losses, particularly in volatile markets. Therefore, traders should understand how leverage works and assess their risk tolerance before using it in XAUUSD trading.

Margin Requirements for XAUUSD

Margin refers to the amount of capital that a trader must have in their account to open a leveraged position. For XAUUSD trades, brokers often require a certain percentage of the trade’s value as a margin. For instance, with a 1% margin requirement, a trader needs $100 to control a $10,000 position. This requirement acts as collateral, protecting the broker in case of adverse market movements. Understanding margin requirements is crucial for managing trades effectively, as insufficient funds can lead to margin calls, where the broker requests additional funds to maintain the position.

Margin requirements can differ among brokers, so traders should check these details before initiating trades. Higher leverage results in lower margin requirements, but it also comes with increased risk. Keeping track of margin levels and maintaining adequate funds in the account ensures that traders can avoid forced liquidation, enabling them to trade XAUUSD without unexpected interruptions.

Risks Associated with High Leverage

While leverage can increase potential gains, it also introduces significant risks. High leverage magnifies both profits and losses, meaning that a small unfavorable price movement in XAUUSD can lead to substantial losses. For example, a 1% decrease in the gold price could wipe out a significant portion of the trader’s capital if the trade is highly leveraged. This risk is particularly relevant in volatile markets, where price fluctuations are frequent and often unpredictable. New traders may find it difficult to manage these rapid changes, potentially resulting in larger losses than initially anticipated.

To mitigate the risks associated with high leverage, traders should consider implementing stop-loss orders and using only a portion of their account balance for each trade. Proper risk management strategies, such as limiting the amount of leverage used, can help protect capital while still allowing traders to benefit from the flexibility leverage offers. Understanding the risks and rewards of leverage ensures that traders approach XAUUSD with a balanced and strategic perspective.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Trading Platforms for XAUUSD

Popular Trading Platforms Available in India

Several trading platforms are widely used in India for XAUUSD trading, with MetaTrader 4 (MT4) and MetaTrader 5 (MT5) among the most popular choices. These platforms provide a user-friendly interface, advanced charting tools, and support for automated trading strategies, making them ideal for both beginners and experienced traders. MetaTrader platforms are known for their stability and ease of use, allowing traders to analyze markets and execute trades efficiently. They also offer a wide range of indicators and chart types, catering to various trading styles and technical analysis needs.

Other platforms like cTrader and TradingView are also available, offering unique features such as enhanced order execution and advanced charting capabilities. Choosing the right platform depends on individual preferences and the specific features a trader values. For XAUUSD trading, selecting a platform with comprehensive tools and reliable execution can improve trading accuracy and efficiency, especially in fast-moving markets.

Features to Look for in a Trading Platform

When selecting a platform for XAUUSD trading, traders should consider key features like charting capabilities, execution speed, and user interface. A good platform should offer real-time charting and technical indicators, enabling traders to analyze market trends accurately. Fast and reliable execution is essential for seizing trading opportunities, especially in volatile markets where delays can lead to missed profits or unexpected losses. Platforms with mobile versions also add flexibility, allowing traders to monitor and manage their positions on the go.

Another important feature is compatibility with Expert Advisors (EAs) or trading bots, which automate trading strategies. Platforms like MT4 and MT5 support EAs, providing an advantage for traders who want to implement algorithmic strategies. By choosing a platform with robust features tailored to their needs, traders can maximize their chances of success in the XAUUSD market.

Developing a Trading Strategy

Day Trading vs. Swing Trading

When trading XAUUSD, traders often choose between two main strategies: day trading and swing trading. Day trading involves opening and closing positions within the same day, capitalizing on short-term price fluctuations. This strategy is popular for XAUUSD due to gold's high liquidity and frequent price movements, allowing traders to make multiple trades per day. Day traders rely heavily on technical analysis, using indicators like moving averages, RSI, and support and resistance levels to time their trades accurately. This approach requires discipline and quick decision-making, as well as a strong understanding of market trends.

In contrast, swing trading involves holding positions for several days or even weeks to capture larger price movements. Swing traders typically use a mix of technical and fundamental analysis to identify trends and market sentiment. They might hold positions through minor fluctuations, focusing on long-term trends rather than day-to-day volatility. For XAUUSD, swing trading allows traders to capitalize on broader price trends influenced by economic events or geopolitical tensions. Each strategy has its advantages, so traders should consider their risk tolerance, time commitment, and market knowledge before choosing between day and swing trading.

Setting Up a Trading Plan

A well-defined trading plan is essential for successful XAUUSD trading, as it outlines the trader's goals, strategy, and risk management approach. The first step in creating a trading plan is to establish clear objectives, such as a target profit percentage or a maximum acceptable loss per trade. Setting realistic goals helps traders remain focused and prevents impulsive decisions. Additionally, a trading plan should include entry and exit criteria, such as the indicators or patterns that will trigger a buy or sell decision. For example, a trader might set a rule to enter an XAUUSD trade only when the RSI indicates an oversold condition.

Risk management is another crucial component of a trading plan, particularly for highly leveraged trades like XAUUSD. By defining stop-loss and take-profit levels, traders can minimize losses and lock in profits. Regularly reviewing and adjusting the trading plan based on market performance can also help traders refine their strategies, allowing them to adapt to changing market conditions and improve overall success.

Risk Management Techniques

Risk management is critical in XAUUSD trading, as it helps protect capital and prevent significant losses. One fundamental technique is the use of stop-loss orders, which automatically close a position if the market moves unfavorably by a certain amount. This tool is especially valuable in volatile markets like gold, where prices can shift suddenly. Take-profit orders are also essential, as they secure profits by closing trades once they reach a specified price target. Together, stop-loss and take-profit orders enable traders to manage their risk effectively.

Another important risk management technique is position sizing, which involves determining the appropriate amount to trade based on the trader's account size and risk tolerance. For instance, many traders adhere to the 1% rule, risking only 1% of their account balance on a single trade. This approach reduces the impact of any single loss, ensuring that the trader's capital is preserved for future opportunities. By implementing these techniques, traders can trade XAUUSD more confidently and maintain a balanced approach to risk.

Analyzing Economic Indicators

Key Economic Reports Impacting Gold Prices

Several economic indicators have a significant impact on XAUUSD prices, with inflation data, GDP growth, and unemployment rates being among the most influential. For instance, higher inflation often increases gold's appeal as a hedge, leading to a rise in XAUUSD prices. Conversely, low inflation can reduce demand for gold, causing prices to fall. GDP growth rates also affect XAUUSD, as strong economic performance can strengthen the U.S. dollar, making gold less attractive. Economic reports like these offer traders insight into potential gold price trends, helping them anticipate market movements.

Employment data, particularly the U.S. Non-Farm Payroll report, is another key indicator. Strong job growth suggests a healthy economy, which could strengthen the dollar and reduce XAUUSD prices. Weak employment figures, however, may prompt investors to shift to gold as a safe haven, pushing prices higher. By closely monitoring these reports, traders can make more informed decisions on when to enter or exit XAUUSD positions, aligning their strategy with broader economic trends.

Central Bank Policies and Their Effects

Central bank policies, especially those from the U.S. Federal Reserve, significantly impact XAUUSD. Interest rate decisions, for instance, play a major role in determining gold's attractiveness as an investment. When central banks raise interest rates, the opportunity cost of holding gold increases, as investors may prefer interest-bearing assets, leading to a potential drop in XAUUSD prices. Conversely, lower interest rates can boost gold demand, as it becomes a more appealing asset relative to bonds and other fixed-income investments.

Quantitative easing (QE) policies, where central banks inject liquidity into the economy, can also impact XAUUSD by devaluing the currency. As more money enters the economy, inflationary pressures often rise, increasing gold’s attractiveness as a hedge against currency devaluation. Understanding these policies and their implications enables traders to predict XAUUSD trends more effectively, aligning their strategies with central bank actions.

Technical Tools for Trading

Chart Patterns and Indicators

Technical analysis relies heavily on chart patterns and indicators to predict future price movements. For XAUUSD, common chart patterns include double tops, head and shoulders, and triangles, each signaling potential trend reversals or continuations. Recognizing these patterns allows traders to anticipate price direction and position themselves accordingly. Additionally, indicators like the Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI) offer insights into momentum and trend strength, helping traders decide when to enter or exit trades.

The use of technical indicators can help refine entry and exit points, reducing the likelihood of false signals. By combining multiple indicators, traders can cross-check their analyses, making more confident and data-driven decisions. Chart patterns and indicators, when used together, provide a comprehensive framework for analyzing XAUUSD price action, allowing traders to capitalize on market opportunities with increased precision.

Using Moving Averages

Moving averages are among the most widely used technical indicators in XAUUSD trading, helping to smooth out price data and identify trends. The Simple Moving Average (SMA) and the Exponential Moving Average (EMA) are popular choices, with the EMA giving more weight to recent price data, making it more responsive to market changes. Traders often use moving average crossovers to identify trend reversals; for instance, when a short-term moving average crosses above a long-term moving average, it may signal a buying opportunity.

Moving averages are also valuable for setting dynamic support and resistance levels. In XAUUSD trading, prices often bounce off moving average lines, providing traders with potential entry or exit points. By combining moving averages with other indicators, traders can strengthen their analysis and make better-informed decisions, enhancing the overall effectiveness of their strategy.

Psychology of Trading

Managing Emotions While Trading

Trading XAUUSD, like any financial asset, involves dealing with volatility, which can lead to intense emotional reactions. The ability to manage emotions effectively is crucial for maintaining a clear and logical approach to trading. When markets fluctuate, fear and greed can drive impulsive decisions, often leading to losses. For example, a trader might panic during a price drop and exit prematurely, or become overly optimistic during an uptrend and overlook warning signs. Maintaining emotional discipline allows traders to stick to their strategies, ensuring that decisions are based on data rather than fleeting emotions.

One effective way to manage emotions is by following a structured trading plan and setting predefined risk limits. This reduces the temptation to make impulsive decisions, as traders have already outlined their strategy and risk management rules. Additionally, taking breaks, practicing mindfulness, and keeping a trading journal to reflect on emotional responses can help traders recognize and mitigate psychological triggers. Developing strong emotional resilience is essential for success in the long term, as it promotes consistency and reduces the influence of market-induced stress.

The Importance of Discipline in Trading

Discipline is a foundational trait for successful XAUUSD trading, as it helps traders stay focused on their goals and follow their strategies without deviation. Many traders face challenges in maintaining discipline, especially during volatile market conditions where emotions can easily cloud judgment. Sticking to a defined strategy, rather than making impulsive decisions based on short-term market movements, is key. Traders who lack discipline may abandon their strategies mid-trade or increase their risk exposure, both of which can lead to significant losses.

Establishing a routine, setting achievable goals, and adhering to a risk management plan are essential steps in developing trading discipline. Reviewing trades regularly and learning from mistakes also help reinforce disciplined behavior, allowing traders to refine their approach over time. Discipline ensures that traders maintain control over their actions, enabling them to make calculated decisions and reduce the impact of external factors on their trading performance.

Legal Considerations in India

Regulatory Framework for Forex Trading

In India, Forex trading is regulated by the Securities and Exchange Board of India (SEBI) and the Reserve Bank of India (RBI), with specific rules governing permissible currencies and trading practices. Indian residents are allowed to trade Forex with currency pairs that include the Indian Rupee (INR) through exchanges like the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE). Trading foreign currency pairs that do not include the INR, such as XAUUSD, is restricted for Indian residents through onshore brokers; however, some traders use international brokers to access XAUUSD markets, though this can carry additional regulatory risks.

It’s crucial for Indian traders to stay informed about the legalities surrounding XAUUSD trading. Engaging with regulated brokers that follow compliance requirements and operate within legal boundaries helps ensure a safe trading experience. Traders should also monitor regulatory updates, as the rules regarding Forex trading in India can evolve. By understanding the regulatory framework, traders can make informed decisions, avoiding potential legal issues and ensuring that their trading activities comply with Indian law.

Tax Implications on Trading Profits

Profits from trading XAUUSD in India are subject to taxation, and traders must account for these obligations to remain compliant with tax regulations. Trading income, particularly from speculative activities like Forex, is usually treated as business income or capital gains, depending on the trader's frequency and intent. For intraday trades, profits are typically considered speculative business income and taxed accordingly, while long-term trades may fall under capital gains, subject to different tax rates.

Indian traders should keep detailed records of their trades, including dates, amounts, and profits or losses, to facilitate accurate tax reporting. Consulting with a tax professional can also be beneficial, as they can provide guidance on reporting trading income and maximizing tax efficiency. Understanding the tax implications of trading XAUUSD helps traders avoid penalties and stay compliant, enabling them to manage their finances effectively while focusing on trading.

Common Mistakes to Avoid

Over-Leveraging Your Trades

One of the most common mistakes traders make when trading XAUUSD is over-leveraging, which involves using excessive leverage to open larger positions than their account can reasonably support. While leverage can amplify profits, it also magnifies losses, increasing the risk of wiping out an account. Over-leveraged trades are particularly dangerous in volatile markets like XAUUSD, where price swings can lead to significant losses if trades move against the trader. To avoid over-leveraging, traders should use only a portion of their available leverage, ensuring that their positions remain within manageable risk levels.

Implementing a risk management plan and sticking to a reasonable leverage ratio can protect traders from the dangers of over-leveraging. By limiting exposure and carefully calculating position sizes, traders can prevent the stress and financial strain associated with large, over-leveraged trades. This disciplined approach enables traders to navigate the XAUUSD market with greater stability and control.

Ignoring Market News and Events

Another common pitfall for XAUUSD traders is disregarding market news and events, which can lead to unexpected losses. Gold prices are influenced by a variety of factors, including economic data releases, central bank policies, and geopolitical events. Ignoring these events can leave traders unprepared for sudden price shifts, potentially impacting their positions. For example, a major central bank announcement can cause substantial price volatility in XAUUSD, affecting traders who are unaware of the event's timing or implications.

To stay informed, traders should incorporate economic calendars and news sources into their routine, tracking key events that impact gold prices. This awareness enables traders to anticipate potential volatility and adjust their strategies accordingly. Staying updated on market news not only improves decision-making but also helps traders avoid surprises, supporting more consistent and informed trading practices.

Resources for Continued Learning

Recommended Books on Trading

Books provide valuable insights into trading strategies, psychology, and technical analysis, making them excellent resources for XAUUSD traders seeking to deepen their knowledge. Classics like "Technical Analysis of the Financial Markets" by John Murphy offer foundational knowledge on charting techniques, essential for analyzing XAUUSD. For a focus on trading psychology, "Trading in the Zone" by Mark Douglas provides strategies for developing the mental resilience needed for successful trading. Books like "The New Trading for a Living" by Dr. Alexander Elder also cover essential aspects, from risk management to technical indicators, equipping traders with tools for making informed decisions.

Reading widely allows traders to learn from seasoned professionals and understand the principles that underpin successful trading. As they gain knowledge, traders can refine their skills and adapt proven techniques to fit their unique trading styles. Consistent learning through books can also inspire traders to develop a deeper understanding of market dynamics, enhancing their overall approach to XAUUSD trading.

Online Courses and Webinars

Online courses and webinars offer interactive learning experiences, allowing traders to gain practical knowledge on trading XAUUSD. Many brokers and financial platforms provide free and paid courses covering topics like fundamental analysis, technical tools, and trading psychology. Platforms such as Udemy and Coursera host comprehensive trading courses suitable for beginners and advanced traders alike. These courses often include hands-on exercises, allowing traders to apply concepts directly and develop a real-world understanding of trading.

Webinars, often hosted by industry experts, provide insights into current market conditions and emerging trading strategies. They are particularly useful for staying updated on recent trends and learning new techniques applicable to XAUUSD. By participating in these online learning resources, traders can continually improve their skills, stay informed about market developments, and network with other traders, building a solid foundation for long-term success.

Conclusion

Trading XAUUSD in India presents numerous opportunities for traders who wish to diversify their portfolios and hedge against economic volatility. By understanding the essentials—from choosing the right broker and trading platform to managing leverage and analyzing economic indicators—traders can build a robust foundation for success. Developing a clear trading strategy and managing emotions are also crucial for navigating the complexities of the XAUUSD market. Additionally, keeping up with regulatory guidelines, tax obligations, and resources for continued learning supports a well-rounded and compliant trading journey.

Whether a trader prefers day trading or swing trading, a disciplined approach combined with knowledge of technical tools and market analysis can lead to more profitable trades. With a commitment to risk management and continuous improvement, traders can leverage the unique characteristics of XAUUSD trading to achieve their financial goals effectively.

Read more:

10 Best Zero Spread Forex Brokers in India