16 minute read

Is forex trading self employment? A Comprehensive Guide

Understanding Forex Trading

Definition of Forex Trading

Forex trading, also known as foreign exchange trading or currency trading, refers to the process of buying and selling currencies in the foreign exchange market with the aim of making a profit. The forex market is the largest and most liquid financial market in the world, with a daily trading volume that exceeds $6 trillion. Unlike stock markets, which have specific operating hours, the forex market operates 24 hours a day, five days a week, allowing traders to execute transactions at any time.

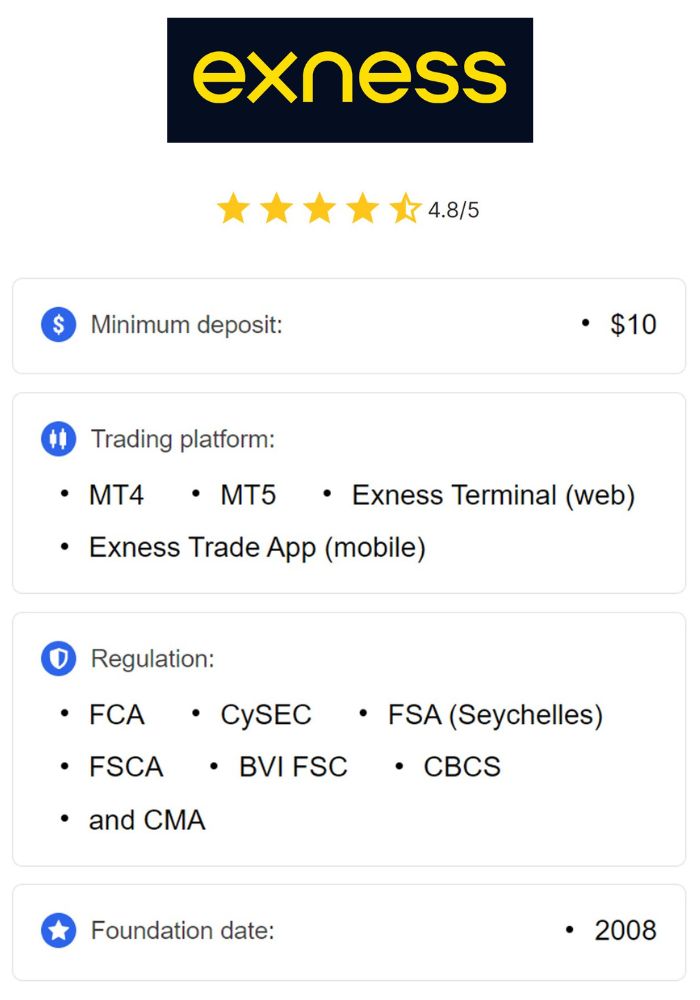

Top 4 Best Forex Brokers

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ Avatrade: Open An Account or Visit Brokers 💯

3️⃣ JustMarkets: Open An Account or Visit Brokers ✅

4️⃣ Quotex: Open An Account or Visit Brokers 🌐

In forex trading, currencies are traded in pairs, such as EUR/USD (Euro/US Dollar) or GBP/JPY (British Pound/Japanese Yen). The exchange rate between the two currencies indicates how much of one currency can be exchanged for another. Traders speculate on the price movements of these currency pairs, aiming to profit from fluctuations in exchange rates.

How Forex Trading Works

Forex trading involves several key components, including market participants, currency pairs, and trading platforms. The primary players in the forex market include:

Retail Traders: Individual investors who trade currencies for personal profit.

Institutional Traders: Large financial institutions, hedge funds, and banks that engage in forex trading on behalf of clients or for proprietary trading purposes.

Brokers: Companies that facilitate trading by providing platforms and services for retail traders to access the forex market.

Traders analyze various factors, including economic indicators, geopolitical events, and market sentiment, to make informed decisions about buying or selling currency pairs. Successful traders often use a combination of technical analysis, which involves analyzing price charts and indicators, and fundamental analysis, which focuses on economic and political factors that influence currency values.

Major Players in the Forex Market

The forex market is composed of various participants, each with distinct roles:

Central Banks: National banks that manage the country’s currency, money supply, and interest rates. They intervene in the forex market to stabilize or influence their currency.

Commercial Banks: Large banks that provide forex services to clients and engage in trading activities on their own accounts.

Hedge Funds: Investment funds that utilize a variety of strategies, including forex trading, to achieve high returns.

Corporations: Companies engaged in international trade that may hedge against currency fluctuations by participating in the forex market.

Understanding the roles of these players helps traders grasp market dynamics and anticipate potential price movements.

Characteristics of Self Employment

Definition of Self Employment

Self-employment refers to the state of working for oneself rather than for an employer. Self-employed individuals operate their own businesses or work as independent contractors, earning income directly from their clients or customers. This arrangement allows for greater flexibility, autonomy, and control over one’s work and income.

Key Traits of Self Employed Individuals

Self-employed individuals typically exhibit several characteristics:

Independence: They have the freedom to make decisions about their work and schedule.

Entrepreneurial Spirit: Many self-employed individuals are driven by the desire to build something of their own and take risks to achieve their goals.

Self-Motivation: Successful self-employed individuals are often self-motivated and disciplined, as they must manage their time and tasks effectively without external oversight.

Adaptability: The ability to adapt to changing circumstances and market conditions is crucial for self-employed individuals, especially in dynamic fields like forex trading.

Legal and Tax Implications

Self-employed individuals are responsible for their own taxes, which can include income tax and self-employment tax. In many countries, self-employed individuals must register their business and obtain necessary licenses. Understanding the legal and tax implications of self-employment is essential for financial compliance and planning.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Comparing Forex Trading to Traditional Employment

Flexibility and Independence

One of the most significant advantages of forex trading is the flexibility it offers compared to traditional employment. In a conventional job, individuals typically adhere to fixed working hours and have to follow organizational protocols and procedures. Forex trading, on the other hand, allows traders to set their own hours and work from anywhere in the world as long as they have a reliable internet connection. This flexibility can be particularly appealing for those who wish to balance personal commitments with their work.

Additionally, traders have the independence to make their own decisions regarding trades, strategies, and risk management. They are not constrained by corporate policies or managerial oversight, which can lead to greater job satisfaction for those who thrive on autonomy. However, this independence also requires a high level of self-discipline and motivation, as the responsibility for success or failure lies solely with the trader.

Income Variability

Forex trading can yield significant profits, but it also comes with the risk of substantial losses. Unlike traditional employment, which typically offers a steady paycheck and predictable income, forex trading can result in volatile earnings. The potential for high returns is attractive, but traders must understand that their income can fluctuate greatly from month to month based on market conditions and trading performance.

For many, this variability can be a double-edged sword. On one hand, the possibility of unlimited earnings can be exhilarating; on the other hand, the pressure to perform can lead to financial stress, particularly for those who rely solely on trading for their livelihood. Unlike a salaried job, where income is generally stable, traders must prepare for both profitable and unprofitable periods.

Work Environment and Structure

In traditional employment, individuals work within a structured environment with set hours, defined roles, and specific tasks. They report to supervisors and often collaborate with colleagues on projects. In contrast, forex traders operate independently and have the freedom to create their own work environments. Some may choose to trade from the comfort of their homes, while others may prefer a dedicated office space.

The lack of structure in forex trading can be liberating for some, allowing them to work at their own pace and in their own style. However, it can also lead to challenges such as distractions at home or difficulties in maintaining a consistent routine. Successful traders often develop their own schedules and processes to establish a sense of structure in their trading activities, balancing flexibility with the need for organization.

Financial Aspects of Forex Trading

Initial Capital Requirements

Getting started in forex trading often requires a relatively low initial investment compared to starting a business or purchasing a franchise. Many brokers offer accounts with low minimum deposit requirements, making it accessible for individuals to begin trading with modest amounts. However, while the barriers to entry are low, having sufficient capital is important to effectively manage risk and take advantage of trading opportunities.

Higher initial capital can provide traders with more flexibility in their trading strategies and allow for greater position sizes. For beginners, it’s crucial to understand that while one can start trading with as little as $100, having more capital can reduce the impact of potential losses and enhance the ability to capitalize on profitable trades.

Profit Potential and Loss Risks

Forex trading presents significant profit potential, especially for skilled traders who can effectively analyze market conditions and execute trades at opportune moments. The use of leverage allows traders to control larger positions than their initial capital would otherwise permit, amplifying both potential profits and potential losses.

It’s essential for traders to approach forex trading with a clear understanding of the risks involved. Losses can occur quickly, and without proper risk management, a trader can find themselves in a precarious financial situation. Successful traders often employ risk management strategies, such as setting stop-loss orders and diversifying their trading portfolio, to mitigate losses and protect their capital.

Managing Trading Expenses

Traders should also be mindful of various expenses associated with forex trading, including spreads, commissions, and fees charged by brokers. Understanding these costs is crucial for determining overall profitability. Brokers often charge a spread, which is the difference between the buying and selling price of a currency pair, and this can significantly impact a trader’s bottom line.

Additionally, some brokers may charge commissions on trades or fees for withdrawals. Being aware of all potential expenses is vital for effective financial planning in forex trading. Maintaining a clear budget and tracking expenses can help traders assess their financial performance and make informed decisions regarding their trading activities.

Skill Requirements for Successful Forex Trading

Technical Analysis Skills

Technical analysis is a crucial skill for forex traders. It involves analyzing price charts and identifying patterns to forecast future price movements. Traders should become familiar with various technical indicators, such as moving averages, RSI (Relative Strength Index), and Fibonacci retracement levels, to make informed trading decisions.

Being proficient in technical analysis allows traders to identify entry and exit points, assess market trends, and develop strategies based on historical price data. Continuous practice and education in technical analysis are essential for traders seeking to enhance their trading skills.

Fundamental Analysis Skills

Fundamental analysis involves assessing economic indicators, news events, and geopolitical factors that can influence currency values. Traders should stay updated on relevant news and reports, such as interest rate decisions, GDP growth, and employment figures, to gauge market sentiment and potential price movements.

Understanding the macroeconomic landscape and its impact on currency pairs enables traders to make informed decisions based on current events. Successful traders often combine both technical and fundamental analysis to develop comprehensive trading strategies.

Risk Management Strategies

Effective risk management is essential for long-term success in forex trading. Traders should develop strategies to minimize losses, such as setting stop-loss orders, diversifying their trading portfolio, and calculating position sizes based on their risk tolerance.

Establishing a solid risk management plan allows traders to protect their capital and reduce the impact of losing trades on their overall performance. Additionally, implementing proper risk management techniques can help traders maintain emotional control during periods of market volatility.

Daily Routine of a Forex Trader

Setting Up a Trading Schedule

A well-structured trading schedule is crucial for maintaining consistency and discipline. Traders should allocate specific times for market analysis, trade execution, and reviewing performance. Having a routine can help traders stay focused and avoid impulsive decisions.

Incorporating time for educational activities, such as reading market analysis reports or participating in webinars, can further enhance a trader's knowledge and skills.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Keeping Up with Market News

Staying informed about market news and economic developments is vital for successful trading. Traders should subscribe to reputable financial news sources, follow economic calendars, and use social media to gather insights on market trends and potential trading opportunities.

Being aware of current events and their potential impact on currency values allows traders to make timely decisions and adjust their strategies accordingly.

Reviewing and Analyzing Trades

Regularly reviewing past trades is an essential part of a trader’s routine. Analyzing successful and unsuccessful trades helps identify strengths and weaknesses in trading strategies. Traders should maintain a trading journal to document their decisions, emotions, and outcomes, which can provide valuable insights for future trading.

Implementing a review process can help traders learn from their experiences and continuously improve their trading performance.

Regulatory Considerations in Forex Trading

Licensing and Regulation of Forex Brokers

Regulatory compliance is a critical aspect of forex trading, ensuring that brokers operate under the laws set forth by financial authorities in their respective countries. The forex market is decentralized, meaning it does not have a central exchange like stock markets; hence, the regulation of brokers is crucial to maintaining market integrity and protecting traders from fraud. Traders should choose brokers that are licensed and regulated by reputable authorities.

In many countries, regulatory bodies oversee the licensing of forex brokers to ensure they meet certain standards and operate transparently. For example, in the United States, brokers are regulated by the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). Similarly, in the UK, the Financial Conduct Authority (FCA) is responsible for regulating financial markets, including forex trading. The level of regulation can vary significantly from one jurisdiction to another, affecting the broker's practices, including how they handle customer funds, leverage limits, and reporting requirements.

Compliance Requirements

Forex traders must also comply with legal and regulatory requirements applicable in their country of residence. This may include tax obligations, such as reporting trading income for taxation, adhering to anti-money laundering (AML) regulations, and following any specific restrictions on trading activities. In some jurisdictions, traders may be required to declare their forex earnings and may face penalties for non-compliance.

Understanding the legal framework is essential for traders to navigate potential pitfalls and avoid legal complications. This knowledge can help traders make informed decisions about their trading practices and ensure they operate within the bounds of the law.

Impact of Regulations on Traders

Regulations can significantly influence various aspects of forex trading, including leverage limits, margin requirements, and the availability of trading instruments. For instance, some regulatory bodies impose strict leverage limits to protect retail traders from taking excessive risks. This can impact a trader's ability to control larger positions in the market and subsequently affect potential profitability.

Additionally, regulations can determine what instruments traders can access. Some brokers may offer a wide range of currency pairs, commodities, indices, and cryptocurrencies, while others may have restrictions based on regulatory guidelines. Staying informed about any changes in regulations that may affect trading strategies and options is essential for traders to adapt accordingly.

Advantages of Being Self-Employed in Forex Trading

Control Over Trading Decisions

One of the most appealing aspects of forex trading is the autonomy it provides. Traders have the freedom to make their own decisions regarding when to trade, which strategies to employ, and how to manage their capital. This level of control allows for a personalized approach to trading, enabling traders to align their trading strategies with their financial goals and risk tolerance.

Self-employment in forex trading means that traders are not beholden to a boss or corporate structure, which can be liberating for many. This independence can lead to higher job satisfaction, as traders can tailor their work environment and schedule to fit their personal lifestyle.

Flexibility in Work Hours

Forex trading offers unmatched flexibility in work hours. Traders can choose to trade at their convenience, allowing them to balance personal commitments and trading activities effectively. The forex market operates 24 hours a day during the weekdays, providing opportunities for traders to enter and exit positions at different times throughout the day.

This flexibility can lead to a better work-life balance, which is essential for maintaining mental well-being. Traders can also take breaks as needed, manage their stress levels, and adjust their trading schedules according to their preferences.

Opportunity for Unlimited Earnings

Unlike traditional employment, where income is often capped, forex trading presents the opportunity for unlimited earnings. Successful traders can generate substantial profits based on their skills, strategies, and market conditions. However, this potential comes with inherent risks, and traders must remain vigilant and disciplined.

The forex market allows for leveraging, which can amplify both potential profits and losses. While leveraging can enhance profit opportunities, it is crucial for traders to use it responsibly and understand the associated risks. Through effective trading strategies and risk management, traders can maximize their earnings while minimizing potential losses.

Challenges Faced by Forex Traders

Emotional and Psychological Strain

Forex trading can be emotionally taxing. The pressure to make profitable trades and manage risks can lead to stress and anxiety. Traders must develop emotional resilience and coping strategies to deal with the psychological challenges associated with trading.

The fast-paced nature of the forex market means that traders must make quick decisions based on market movements and news releases. This can create an environment of high stress, particularly during times of volatility. Developing a solid trading plan, practicing self-discipline, and employing mindfulness techniques can help traders manage their emotions effectively.

Unpredictable Market Conditions

The forex market is influenced by a myriad of factors, making it inherently unpredictable. Economic data releases, geopolitical events, and market sentiment can all impact currency prices. Traders must be prepared for sudden market shifts and volatility, which can affect their trading performance.

Developing adaptable strategies and maintaining a flexible mindset can help traders navigate unforeseen market changes. Being informed about current events and economic indicators can provide traders with insights to anticipate potential market movements.

Isolation and Lack of Support

Many forex traders operate independently, which can lead to feelings of isolation. Unlike traditional employment, where colleagues provide support and camaraderie, traders often work alone. This isolation can be challenging, especially during tough trading periods.

Joining trading communities and networking with other traders can help combat this isolation. Online forums, social media groups, and local trading meetups can provide valuable support, insights, and shared experiences, making the trading journey less solitary.

Building a Career in Forex Trading

Education and Training Resources

Aspiring traders should seek out educational resources to enhance their knowledge and skills. Online courses, webinars, and trading seminars can provide valuable insights into market analysis, trading strategies, and risk management techniques.

Reading books on trading psychology, technical analysis, and fundamental analysis can also be beneficial. Engaging with experienced traders through forums and social media platforms can facilitate learning and foster a supportive environment for growth.

Networking and Community Involvement

Connecting with other traders can provide access to diverse perspectives, strategies, and experiences. Participating in trading communities, attending conferences, and joining local forex clubs can enhance a trader's network and provide opportunities for collaboration.

Building relationships with other traders can lead to mentorship opportunities and a stronger support system. Engaging with the trading community can also keep traders informed about industry trends and best practices.

Long-Term Goals and Career Progression

Developing long-term goals is essential for anyone pursuing a career in forex trading. Traders should set clear objectives regarding their trading performance, risk tolerance, and desired income levels. Having a roadmap for success can help traders stay focused and motivated.

As traders gain experience and knowledge, they can also explore advanced trading strategies and potentially transition into more complex trading activities, such as algorithmic trading or portfolio management. Continuous learning and adaptation are key to progressing in a forex trading career.

Conclusion

In conclusion, forex trading offers a unique and flexible opportunity for individuals seeking self-employment and the potential for substantial earnings. While it comes with inherent risks and challenges, understanding the market, developing effective strategies, and implementing sound risk management practices can lead to success in this dynamic field. By leveraging educational resources, building a supportive network, and staying informed about market trends, aspiring traders can navigate the complexities of forex trading and work toward achieving their financial goals. The path to becoming a successful forex trader is a journey that requires dedication, discipline, and a willingness to learn continuously.

Read more:

Top 10 Biggest forex brokers in the world by volume