14 minute read

Is Exness legal in India? Review Broker

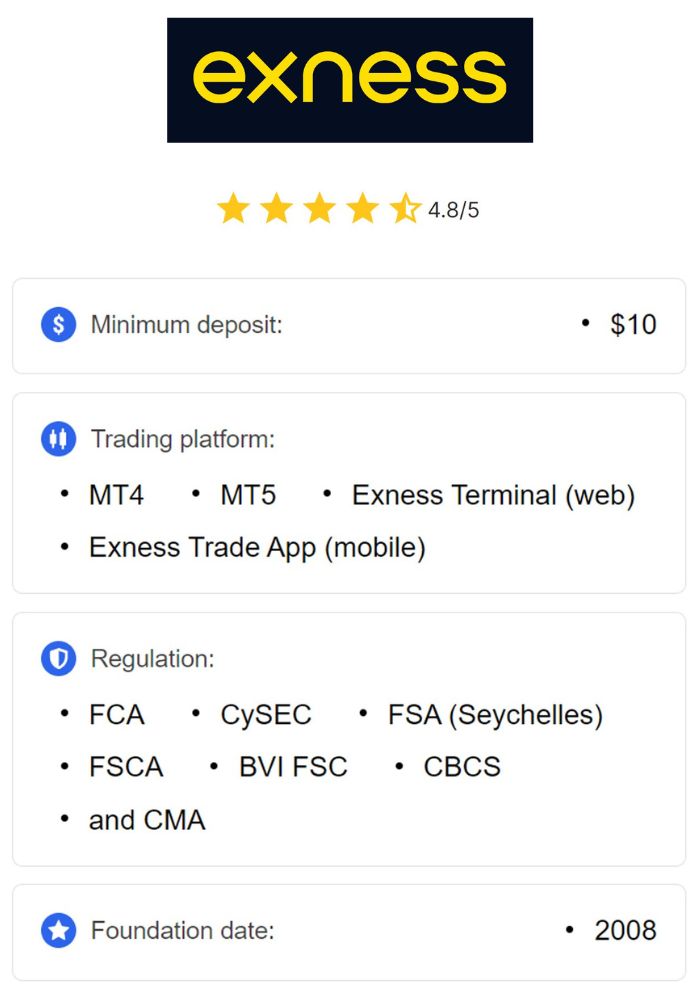

Overview of Exness

Introduction to Exness as a Forex Broker

Founded in 2008, Exness is a well-established online forex and CFD trading broker that has gained popularity worldwide. Headquartered in Cyprus, Exness operates globally, offering access to forex, commodities, indices, and cryptocurrencies through Contracts for Difference (CFDs). Known for its competitive pricing, advanced trading technology, and commitment to transparency, Exness serves millions of clients across multiple continents, including Asia, Europe, and the Middle East.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Exness’s mission is to provide a secure and flexible trading environment that meets the needs of both beginners and experienced traders. The broker offers several account types with various features tailored to different trading styles and financial goals. This adaptability, combined with a strong emphasis on customer satisfaction and innovative tools, has made Exness a popular choice among traders globally.

Services Offered by Exness

Exness provides a range of trading services and products that appeal to a diverse clientele:

Forex Trading: Exness offers over 100 currency pairs, allowing traders to engage in the world’s largest financial market.

CFDs on Various Assets: In addition to forex, Exness allows traders to trade CFDs on commodities (e.g., gold, oil), indices, stocks, and cryptocurrencies, providing opportunities for diversification.

Advanced Trading Platforms: Exness supports MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary mobile app, giving traders access to sophisticated analysis tools and a seamless trading experience.

Leverage Options: The broker offers leverage up to 1:2000 on some accounts, giving traders flexibility in position sizing.

Educational Resources: Exness provides webinars, tutorials, and market analysis to help traders improve their knowledge and skills.

These features make Exness a comprehensive trading platform suited for traders of all levels, providing ample opportunities for those in India interested in exploring the forex and CFD markets.

Global Presence and Regulatory Compliance

Exness operates under multiple regulatory licenses from respected financial authorities, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Financial Sector Conduct Authority (FSCA) in South Africa. These licenses require Exness to maintain high standards of client fund protection, transparency, and ethical trading practices.

Exness’s global regulatory compliance ensures that it operates legally and provides a secure trading environment for clients worldwide. For Indian traders, Exness’s adherence to international regulatory standards is an essential factor when considering its legitimacy and reliability.

Understanding Legality in Forex Trading

Definition of Legality in Forex Trading

Forex trading legality can vary significantly by country and is influenced by factors such as regulatory standards, trading instruments allowed, and restrictions on currency pairs. In India, legality specifically pertains to compliance with regulations set by Indian authorities, including whether Indian residents can participate in forex trading through international brokers like Exness.

Forex trading in India is regulated primarily through government authorities, which impose certain restrictions to control capital flow and protect retail investors. Legally, forex trading must occur within certain guidelines, and brokers need to be approved by Indian regulatory bodies to operate in India. For Indian residents, participating in forex trading with a foreign broker depends on the broker’s compliance with these regulations.

Importance of Regulation for Brokers

Regulation plays a crucial role in the forex industry as it ensures brokers operate fairly, transparently, and with client protection measures in place. Regulated brokers are held accountable for their practices, and they must comply with standards such as client fund segregation, periodic audits, and transparent trading conditions. This regulatory oversight minimizes the risk of fraud and provides traders with a safer trading environment.

For Indian traders, working with a regulated broker like Exness, which adheres to international standards, adds a layer of security. Traders can be more confident that their funds are protected and that the broker adheres to ethical trading practices.

Current Legal Framework for Forex Trading in India

Governing Authorities in India

In India, forex trading is regulated by several governmental and financial institutions, including the Reserve Bank of India (RBI), the Securities and Exchange Board of India (SEBI), and the Foreign Exchange Management Act (FEMA). These authorities oversee currency trading to ensure that it aligns with India’s economic policies and capital flow regulations.

The RBI, as the country’s central bank, sets guidelines on foreign exchange transactions and controls which currency pairs can be traded legally. SEBI, the regulatory body for securities, also has a role in overseeing forex trading practices within India, ensuring that brokers and traders comply with regulations.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Relevant Laws and Regulations

Forex trading regulations in India are influenced by FEMA, which places specific restrictions on the currencies that Indian residents can trade. Under FEMA guidelines, Indian residents are only allowed to trade currency pairs that involve the Indian rupee (INR), such as USD/INR, EUR/INR, GBP/INR, and JPY/INR, on Indian exchanges like the NSE and BSE. Additionally, forex trading must be conducted through SEBI-regulated brokers.

Trading through international brokers, particularly those offering cross-currency pairs (such as EUR/USD or GBP/JPY) without involving the INR, is restricted for Indian residents. These restrictions make it essential for Indian traders to understand the legal framework and the risks associated with trading forex on foreign platforms.

Restrictions on Forex Trading for Indian Residents

Due to these regulations, Indian residents face limitations on the type of forex trading they can legally engage in. Trading in cross-currency pairs is only permissible for Indian citizens through authorized brokers within India’s regulatory framework, and any trading outside these guidelines can potentially be seen as a violation of FEMA regulations.

While Exness and other international brokers accept Indian clients, trading with them for cross-currency pairs can be legally ambiguous. Indian residents should carefully consider the legal implications and understand the risks of trading with an international broker not explicitly authorized by SEBI or RBI.

Exness’ Regulatory Status

Licenses Held by Exness

Exness operates under several licenses, including those from the FCA (UK), CySEC (Cyprus), and FSCA (South Africa). These regulatory bodies are well-respected globally, and their oversight requires Exness to adhere to stringent standards for client fund protection, trading transparency, and operational integrity. These licenses confirm Exness’s legitimacy as a globally regulated broker, providing assurance to its international clients.

While Exness is not regulated directly by SEBI or RBI in India, its compliance with international regulations from top-tier authorities provides a level of security for Indian traders who choose to work with the broker. It is essential, however, for Indian clients to weigh these considerations against the legal restrictions placed by Indian authorities on forex trading.

Comparison with Other Brokers

Compared to other international brokers, Exness has a strong regulatory foundation, which enhances its credibility in the market. Many brokers operate under one or two licenses, while Exness holds multiple licenses from top regulatory bodies. This multi-regulatory approach increases the level of trust for clients who prioritize safety, especially in regions like India, where forex trading regulations are strict.

By maintaining these licenses, Exness positions itself as a reputable choice compared to unregulated or lightly regulated brokers, which may pose higher risks to clients in India.

Assessing the Security of Funds with Exness

Client Fund Protection Measures

Exness employs several measures to protect client funds, in line with its regulatory requirements. These include fund segregation, which ensures that client funds are kept separate from the broker’s operating funds. This practice protects traders’ assets, even in the unlikely event of the broker’s financial instability.

Exness also offers negative balance protection, which prevents traders from losing more than their account balance. This feature is especially beneficial for traders in high-leverage markets like forex, as it limits their risk exposure and provides a safeguard against unexpected market volatility.

Segregation of Client Accounts

The segregation of client accounts is a critical aspect of fund security. By keeping client funds separate from operational accounts, Exness minimizes the risk of fund mismanagement. Additionally, Exness undergoes regular audits to ensure compliance with regulatory standards and maintain transparency in its operations.

This approach provides Indian clients with peace of mind, knowing that Exness prioritizes fund protection and follows international best practices.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

User Experiences with Exness in India

Testimonials from Indian Traders

Indian traders have shared a range of experiences with Exness, with many testimonials highlighting the broker’s ease of use, transparency, and competitive trading conditions. Numerous traders in India appreciate Exness’s low spreads and fast execution speeds, which are essential for successful trading, especially in volatile markets like forex and cryptocurrencies. Exness’s multi-platform support, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and the Exness mobile app, has also received positive feedback from Indian traders who value the flexibility to trade on various devices.

Furthermore, Exness offers 24/7 customer support, which has been especially beneficial for Indian users who may need assistance with account issues or trading queries at any time of the day. The customer service team has been praised for being responsive, knowledgeable, and efficient in resolving queries, creating a positive experience for both new and seasoned traders in India.

For beginners, Exness’s educational resources—such as tutorials, webinars, and articles—are also valuable assets. Many novice traders in India have reported that these resources helped them build foundational knowledge, develop trading strategies, and understand market trends, allowing them to approach trading with more confidence.

Common Issues Faced by Indian Users

While Exness is generally well-regarded among Indian traders, some users have noted certain challenges. One common issue is the regulatory ambiguity surrounding forex trading in India, particularly when trading cross-currency pairs like EUR/USD or GBP/JPY. Since Indian regulations restrict forex trading to INR-based pairs, Indian traders must be cautious when engaging in cross-currency trading on an international platform like Exness. This regulatory gray area has led some traders to feel uncertain about the legality of their trading activities.

Another concern raised by Indian users is the absence of the Indian Rupee (INR) as a base currency option on Exness. As a result, traders often need to convert their funds from INR to USD, EUR, or another supported currency, which can lead to currency conversion fees and potentially impact profitability. Traders managing smaller accounts have reported that these fees can add up, slightly increasing their trading costs.

In addition, some Indian traders have experienced transaction delays when using certain payment methods. While Exness supports popular options such as credit/debit cards, e-wallets, and bank transfers, local banking restrictions and third-party processing times can occasionally cause delays in deposits or withdrawals. Although Exness processes transactions efficiently on its end, these external factors can sometimes slow down the process, causing inconvenience for traders who need immediate access to their funds.

Pros and Cons of Trading with Exness in India

Advantages of Using Exness for Indian Traders

Low Trading Costs: Exness is known for its low spreads and minimal fees, making it a cost-effective choice for Indian traders. With commission-free trading on standard accounts and tight spreads on major currency pairs, Exness allows traders to manage their costs effectively.

Regulation and Security: While Exness is not regulated by SEBI or RBI, it holds licenses from reputable international authorities like the FCA, CySEC, and FSCA. These licenses provide a level of safety and compliance, as Exness adheres to stringent standards in fund protection and transparency.

Diverse Trading Instruments: Exness offers a wide range of trading instruments, including forex, commodities, indices, stocks, and cryptocurrencies. This diversity allows Indian traders to create varied portfolios and explore different markets, providing opportunities for diversification and risk management.

Advanced Platforms and Tools: With MetaTrader 4, MetaTrader 5, and Exness’s proprietary mobile app, traders have access to top-tier trading tools, charting capabilities, and automated trading options. These platforms cater to both beginner and advanced traders, offering flexibility and convenience.

Educational Resources: Exness provides comprehensive educational content, including articles, webinars, and tutorials, which are beneficial for beginners. Indian traders can use these resources to enhance their skills, understand market dynamics, and make informed trading decisions.

24/7 Customer Support: Exness’s customer service team is available around the clock, which is especially valuable for Indian traders. The support team’s responsiveness and expertise help ensure that traders can resolve issues quickly and continue trading smoothly.

Disadvantages and Risks Involved

Regulatory Ambiguity: Forex trading in India is limited to INR-based currency pairs on exchanges regulated by SEBI. Trading cross-currency pairs with an international broker like Exness can be legally ambiguous for Indian residents. While Exness accepts Indian clients, traders need to be aware of potential regulatory risks.

No INR Base Currency: Exness does not support the Indian Rupee (INR) as a base currency, which means that Indian traders need to convert funds into USD, EUR, or another currency. Currency conversion fees can add to trading costs, especially for those with smaller accounts or frequent transactions.

Possible Transaction Delays: Although Exness provides fast deposit and withdrawal options, some Indian users have reported delays due to local banking restrictions and third-party processing times. These delays can be inconvenient for traders who require immediate access to funds.

High Leverage Risks: Exness offers leverage up to 1:2000, which, while attractive for maximizing profits, also increases the potential for significant losses. High leverage is particularly risky for beginners, as it can amplify losses in volatile markets. Traders in India should carefully manage leverage and utilize Exness’s risk management tools to protect their capital.

Potential Currency Conversion Costs: Since Exness does not offer INR as a base currency, Indian traders may incur currency conversion fees when depositing or withdrawing funds in foreign currencies. Over time, these fees can affect profitability, particularly for traders with frequent transactions.

Alternatives to Exness for Indian Traders

Other Regulated Forex Brokers

For Indian traders looking to explore options beyond Exness, several other international brokers also accept Indian clients and offer competitive features. Some of these brokers include:

IC Markets: IC Markets is known for its low spreads, fast execution speeds, and support for both MetaTrader and cTrader platforms. It is regulated by the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC), providing a secure environment for Indian traders.

FXTM (ForexTime): FXTM is a global broker regulated by multiple authorities, including CySEC and the Financial Conduct Authority (FCA). FXTM offers a variety of account types, competitive spreads, and a strong educational program, making it an attractive option for beginners and advanced traders alike.

OctaFX: OctaFX is another international broker with a strong presence in Asia, including India. Known for its low-cost trading, promotions, and reliable customer support, OctaFX is regulated by CySEC and offers access to forex, commodities, and indices.

FBS: FBS is a popular broker in Asia and is known for its low minimum deposit requirements and user-friendly platform. FBS is regulated by IFSC and CySEC, providing a degree of security for Indian clients. The broker also offers high leverage options, competitive spreads, and frequent bonuses, making it appealing to Indian traders.

Comparing Features and Benefits

When choosing an alternative broker, Indian traders should consider several factors, such as:

Regulation and Security: Working with a broker that is regulated by well-known authorities (e.g., CySEC, FCA, ASIC) provides additional peace of mind.

Trading Costs: Comparing spreads, commissions, and currency conversion fees is essential, as these costs impact overall profitability.

Platform and Tools: Traders should look for brokers offering robust trading platforms like MetaTrader 4, MetaTrader 5, or cTrader, along with advanced charting and analysis tools.

Customer Support: A responsive and accessible customer support team is vital for traders who may need assistance with their accounts or technical issues.

Educational Resources: For beginners, brokers that offer comprehensive educational content—such as webinars, tutorials, and market analysis—can help accelerate the learning process.

Indian traders should carefully evaluate these aspects to find a broker that aligns with their trading style, financial goals, and regulatory preferences.

Conclusion: Final Thoughts on Exness’ Legality in India

Exness is a reputable, globally regulated broker that offers a range of services and a secure trading environment for clients worldwide, including India. Although Exness is not directly regulated by SEBI or RBI, it holds licenses from respected authorities like the FCA, CySEC, and FSCA, ensuring adherence to high standards of client fund protection, transparency, and fair trading practices.

While Exness accepts Indian clients and provides access to numerous trading instruments and platforms, Indian traders should be mindful of the legal limitations surrounding forex trading in India. Specifically, the restrictions on cross-currency trading for Indian residents under FEMA guidelines create a gray area that traders must consider when using international brokers.

For those willing to trade within these limitations, Exness remains an attractive option, given its low fees, diverse asset offerings, and advanced tools. However, traders should approach high leverage with caution, be mindful of currency conversion costs, and consider the regulatory implications of trading with an international broker.

Ultimately, the legality of forex trading with Exness in India depends on the trader’s understanding of local regulations, the choice of currency pairs, and individual risk tolerance. As the regulatory environment for forex trading continues to evolve, Indian traders must stay informed and choose brokers that provide transparency, security, and a strong commitment to client protection.