14 minute read

London session forex time in Kenya

Introduction to Forex Trading

Definition of Forex Trading

Forex trading, short for foreign exchange trading, is the process of buying and selling currencies in the global marketplace. This market operates 24 hours a day, five days a week, making it the largest financial market in the world with a daily trading volume exceeding $6 trillion. Forex trading involves the simultaneous exchange of one currency for another, typically traded in pairs, such as EUR/USD or GBP/JPY. Traders engage in forex trading for various reasons, including speculation on currency price movements, hedging against potential losses in other investments, and facilitating international trade transactions.

Top 4 Best Forex Brokers in Kenya

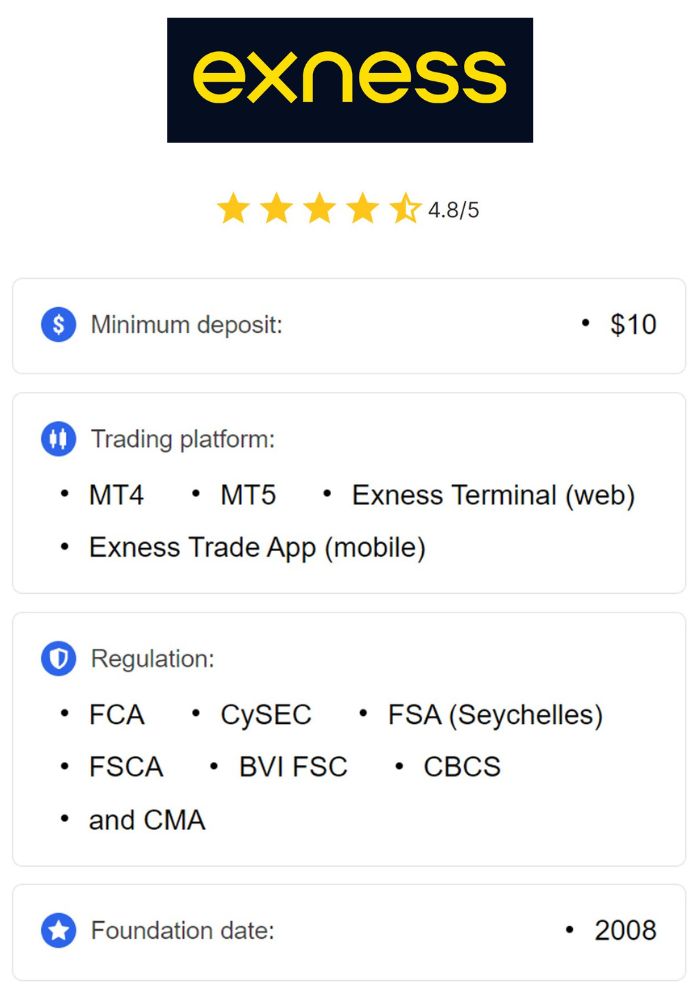

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ Avatrade: Open An Account or Visit Brokers 💯

3️⃣ JustMarkets: Open An Account or Visit Brokers ✅

4️⃣ Quotex: Open An Account or Visit Brokers 🌐

The forex market is decentralized, meaning that it doesn't have a centralized exchange. Instead, trading occurs over-the-counter (OTC), where participants interact through electronic networks. The market's high liquidity, flexibility, and accessibility make it appealing to both institutional investors and individual retail traders.

Importance of Forex Market Timing

Understanding the timing of forex trading sessions is crucial for traders looking to maximize their profit potential. Each trading session is characterized by different levels of activity, liquidity, and volatility, influenced by the global economic calendar and market events. Forex trading sessions include the Sydney, Tokyo, London, and New York sessions, with each session offering unique trading opportunities.

Timing plays a significant role in a trader's success. By being aware of when specific currency pairs are most active and volatile, traders can align their strategies to take advantage of favorable market conditions. This knowledge allows them to optimize their trading activities, manage risks more effectively, and ultimately increase their chances of achieving successful trades.

Overview of Forex Sessions

Major Forex Trading Sessions

The forex market operates in four primary trading sessions, each tied to major financial centers around the world:

Sydney Session: The Sydney session is the first to open, typically starting at 10 PM EAT (East Africa Time) and ending at 7 AM EAT. This session usually experiences lower trading volumes and volatility compared to others.

Tokyo Session: Following Sydney, the Tokyo session runs from 1 AM to 10 AM EAT. It is characterized by increased activity, especially in pairs involving the Japanese yen (JPY). This session can see price movements influenced by economic reports released during this time.

London Session: The London session is one of the most significant trading sessions, operating from 11 AM to 8 PM EAT. It is known for high liquidity and volatility, largely due to the overlap with the Tokyo session and the subsequent opening of the New York session.

New York Session: This session runs from 4 PM to 1 AM EAT, overlapping with the end of the London session. The New York session is marked by substantial trading activity, especially influenced by U.S. economic data releases.

Characteristics of Each Trading Session

Each forex trading session has its own distinct characteristics that can impact traders' strategies:

Sydney Session: This session is relatively quieter, with fewer traders participating. As a result, there may be limited volatility and smaller price movements. However, it can be an excellent time for position building and setting up trades for more active sessions later in the day.

Tokyo Session: The Tokyo session marks the beginning of increased activity as Asian traders come online. Currency pairs involving the JPY often experience significant trading volume, and traders should watch for news releases from Japan and nearby countries that could influence market behavior.

London Session: The London session is the most active and liquid trading period. With numerous economic reports released during this session, traders often see significant volatility and sharp price movements. This is an ideal time for traders to engage with major currency pairs, as many global financial institutions are active.

New York Session: The New York session also provides substantial opportunities due to high trading volume and volatility. The overlap with the London session amplifies market movements, and traders should be prepared for increased price action during economic news releases.

Benefits of Knowing Trading Times

Understanding the timing of each trading session can yield numerous benefits for traders:

Informed Decision-Making: By knowing when the most active trading hours occur, traders can plan their strategies accordingly, focusing their efforts during peak times when market movements are most pronounced.

Enhanced Profit Potential: Traders can take advantage of the increased volatility during session overlaps, such as between the London and New York sessions, where substantial price movements can occur.

Risk Management: Being aware of session timings can help traders implement better risk management strategies. They can avoid trading during low-volume periods that may lead to erratic price movements and higher spreads.

The London Forex Session Explained

Timing of the London Session

The London forex session begins at 11 AM EAT and concludes at 8 PM EAT. This time frame coincides with the latter part of the Tokyo session and overlaps with the opening of the New York session, creating a prime trading opportunity. Kenyan traders should ensure they adjust their trading schedules accordingly to capture the heightened activity and liquidity during these hours.

Significance of the London Session in Forex Trading

The London session is often regarded as one of the most crucial trading periods in the forex market due to several factors:

High Liquidity: The London session sees the highest volume of trading activity, with many financial institutions, banks, and retail traders participating. This high liquidity results in tighter spreads and improved execution of trades.

Impact on Currency Prices: Many of the world's most traded currencies, including the Euro, British Pound, and Swiss Franc, experience significant price movements during the London session, influenced by various economic reports and market sentiment.

Economic Releases: Numerous important economic indicators, such as GDP reports, employment figures, and central bank announcements, are released during this session, leading to increased market volatility. Traders must stay informed about these releases to anticipate potential price shifts.

Key Currency Pairs Traded During This Session

During the London session, several currency pairs are particularly active, including:

EUR/USD: The Euro against the U.S. dollar is the most traded currency pair globally and often experiences significant movements during the London session due to European economic data.

GBP/USD: The British Pound against the U.S. dollar is another major pair that sees high volatility as traders react to economic news from the UK and the U.S.

USD/CHF: The U.S. dollar against the Swiss Franc can also experience notable trading activity, influenced by economic reports from Switzerland and market sentiment.

AUD/USD: The Australian dollar vs. the U.S. dollar can be influenced by commodity price changes and economic indicators, making it relevant during the London session.

Understanding which currency pairs are most active during the London session can enhance trading strategies and decision-making for Kenyan traders.

Impact of the London Session on Kenyan Traders

Time Zone Differences Between Kenya and London

Kenya operates on East Africa Time (EAT), which is UTC+3, while London operates on Greenwich Mean Time (GMT) or British Summer Time (BST) during Daylight Saving Time. This results in a significant time difference that traders must consider:

Standard Time: When London is on GMT (typically late October to late March), Kenya is 3 hours ahead. For example, when it is 11 AM in London, it is 2 PM in Nairobi.

Daylight Saving Time: During BST (late March to late October), Kenya is 2 hours ahead of London. This means that when it is 11 AM in London, it is 1 PM in Nairobi.

Understanding these time differences is essential for Kenyan traders to effectively plan their trading strategies around the London session.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Optimal Trading Hours for Kenyan Forex Traders

For Kenyan traders, the optimal trading hours during the London session are crucial for maximizing trading potential. Traders should focus on the following aspects:

Active Market Times: Engaging in trading activities when both the London and New York sessions overlap can yield the best opportunities due to increased volatility and liquidity.

Economic News Releases: Traders should align their trading schedules with major economic news releases during the London session, which can lead to sharp price movements. Planning trades around these releases can significantly impact profitability.

Challenges Faced by Kenyan Traders During the London Session

Despite the advantages of trading during the London session, Kenyan traders may encounter certain challenges:

Internet Connectivity Issues: Inconsistent internet connectivity can hinder trading activities, especially during peak trading hours. It is vital for traders to invest in a reliable internet service to ensure seamless trading.

Currency Conversion Costs: Many brokers require deposits and withdrawals in USD or other major currencies, which can lead to additional conversion costs for Kenyan traders. Being mindful of these fees can help manage overall trading expenses.

Strategies for Trading During the London Session

Scalping Techniques

Scalping is a popular trading strategy that involves making quick trades to capture small price movements. During the London session, scalpers can benefit from high liquidity and volatility. Here are some techniques:

Identifying Quick Opportunities: Scalpers should focus on major currency pairs, using technical indicators such as Moving Averages and Bollinger Bands to identify entry and exit points quickly.

Managing Risk: Due to the fast-paced nature of scalping, setting strict stop-loss orders is essential to minimize potential losses.

Day Trading Strategies

Day trading involves opening and closing positions within the same trading day. Successful day traders during the London session should consider:

Monitoring Economic Indicators: Traders should keep track of economic reports released during the session, as these can impact market movements significantly.

Utilizing Technical Analysis: Employing chart patterns and indicators to identify potential trends can assist day traders in making informed decisions.

Position Trading Considerations

Position trading involves holding trades over longer periods, usually days or weeks. For traders who prefer this strategy during the London session:

Focus on Long-Term Trends: Position traders should analyze longer timeframes, considering broader market trends and significant economic events that may impact their trades.

Risk Management: Setting appropriate stop-loss levels is crucial to protect against sudden market reversals, especially during volatile trading periods.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Tools and Resources for Kenyan Traders

Trading Platforms and Software

Choosing the right trading platform is vital for success. Popular platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5) provide robust features for traders, including:

Advanced Charting Tools: These platforms offer extensive charting capabilities, allowing traders to analyze price movements and implement their trading strategies effectively.

Technical Indicators: Traders can access a wide range of technical indicators to assist with analysis and decision-making during the London session.

Automated Trading: Both platforms support automated trading through Expert Advisors (EAs), allowing traders to set predefined criteria for executing trades.

Economic Calendars and News Sources

Staying informed about economic events is crucial for traders looking to capitalize on market movements during the London session. Economic calendars provide schedules for important announcements that may affect currency prices. Websites such as Forex Factory and Investing.com offer detailed calendars, helping traders plan their strategies around key events.

Additionally, subscribing to financial news services like Bloomberg or Reuters can provide real-time updates on market conditions and economic developments, allowing traders to react quickly to changing circumstances.

Community Forums and Support Groups

Joining trading communities can be highly beneficial for Kenyan traders. Engaging with experienced traders through forums, social media groups, and local meetups can provide valuable insights, trading tips, and emotional support. These platforms often feature discussions on market trends, strategies, and personal experiences, enriching traders' knowledge and skills.

Analyzing Market Trends During the London Session

Technical Analysis Techniques

Technical analysis is an essential part of trading during the London session. Traders can use various techniques to analyze price movements, including:

Chart Patterns: Recognizing patterns such as head and shoulders, flags, and triangles can help traders predict potential price movements.

Support and Resistance Levels: Identifying key support and resistance levels allows traders to set appropriate entry and exit points.

Fundamental Analysis Insights

Fundamental analysis involves evaluating economic indicators, news releases, and geopolitical events that may impact currency prices. Traders should focus on:

Understanding Economic Data: Analyzing economic reports, such as GDP growth rates and employment figures, can provide insights into market sentiment and trends.

Monitoring Central Bank Announcements: Traders should pay attention to central bank meetings and statements, as these can significantly influence currency valuations.

Combining Analysis Methods for Better Results

Successful traders often use a combination of technical and fundamental analysis to inform their trading decisions. By integrating insights from both analysis methods, traders can develop a comprehensive understanding of market conditions and enhance their trading strategies.

Risk Management in Forex Trading

Importance of Risk Management

Effective risk management is crucial for all forex traders, particularly during volatile periods like the London session. Implementing risk management strategies helps protect capital and ensure long-term trading success. Traders should:

Determine Risk Tolerance: Understanding personal risk tolerance levels can guide traders in deciding how much capital to allocate to each trade.

Diversify Trading Positions: Diversification can help spread risk across multiple trades and currency pairs, reducing the impact of any single loss.

Setting Stop-Loss and Take-Profit Levels

Setting appropriate stop-loss and take-profit levels is vital in managing risk. Stop-loss orders help limit potential losses, while take-profit orders secure profits when price targets are reached. Traders should:

Use Technical Levels for Stop-Loss Orders: Placing stop-loss orders just beyond key support or resistance levels can protect against unexpected market movements.

Adjust Take-Profit Levels Based on Market Conditions: Traders should remain flexible, adjusting their take-profit targets based on market volatility and conditions.

Managing Leverage Effectively

Leverage can amplify both profits and losses, making it essential for traders to use it wisely. Traders should:

Understand Leverage Ratios: Knowing how leverage works and its potential impact on margin can help traders manage their exposure effectively.

Keep Leverage in Check: Using lower leverage ratios can reduce the risk of margin calls and unexpected losses, particularly during high-volatility trading sessions.

Psychological Aspects of Trading in the London Session

Dealing with Pressure and Stress

Trading during the London session can be exhilarating, but it can also be stressful. Managing pressure is crucial for maintaining focus and making sound trading decisions. Strategies to cope with trading stress include:

Establishing a Routine: Having a consistent trading routine can help traders feel more in control and prepared for market fluctuations.

Taking Breaks: Step away from the trading screen periodically to prevent burnout and maintain mental clarity.

Maintaining Discipline and Patience

Successful trading requires discipline and patience. Traders should stick to their trading plans and strategies, avoiding impulsive decisions driven by emotions. This involves:

Setting Clear Goals: Defining specific, measurable, and achievable trading goals can provide direction and motivation.

Keeping a Trading Journal: Documenting trades and emotions can help traders identify patterns and improve their decision-making processes.

Developing a Trader's Mindset

Adopting a positive and resilient mindset is essential for long-term trading success. Traders should focus on:

Learning from Mistakes: Instead of dwelling on losses, traders should analyze what went wrong and use these lessons to improve future performance.

Staying Adaptable: The forex market is dynamic, so traders must be willing to adapt their strategies based on changing market conditions.

Common Mistakes to Avoid During the London Session

Lack of Preparation

Entering the market without sufficient preparation can lead to poor trading decisions. Traders should:

Prepare for the Session: Review economic calendars, analyze charts, and plan trades before the London session begins.

Stay Informed: Keeping up with market news and developments is essential for making informed decisions.

Ignoring Economic Reports

Economic data releases can significantly impact currency prices. Traders should:

Monitor Scheduled Releases: Pay attention to economic reports scheduled during the London session and adjust trading strategies accordingly.

Analyze Impact: Understand how specific reports can influence market sentiment and price movements.

Overtrading and Emotional Decisions

Overtrading and letting emotions dictate trading decisions can lead to significant losses. Traders should:

Set Limits: Establish maximum trade limits to avoid overexposure during volatile market conditions.

Stick to the Plan: Follow predefined trading plans and avoid impulsive decisions based on short-term market fluctuations.

Conclusion

In conclusion, understanding the London session forex time in Kenya is vital for traders looking to capitalize on the opportunities presented during this active trading period. By grasping the timing of the session, its significance, and the strategies that work best, traders can enhance their trading performance.

Moreover, utilizing the right tools, staying informed about market trends, and implementing effective risk management strategies are essential for success. As traders continue to learn and adapt, they can navigate the forex market confidently and effectively, taking advantage of the high liquidity and volatility that the London session offers. With dedication and discipline, Kenyan traders can maximize their potential and achieve their trading goals during this critical market session.

Read more: