12 minute read

Is Exness Regulated in South Africa? Review Broker

from Exness

by Exness_Blog

When it comes to trading in the forex and financial markets, one of the most crucial factors that traders consider is the legitimacy and regulation of the broker they choose. Exness, a leading online broker, has made a name for itself globally, but for traders in South Africa, an important question arises: Is Exness regulated in South Africa? In this article, we will explore the company's background, regulatory standing, its compliance with South African laws, and the importance of trading with a regulated broker.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Overview of Exness

Background of the Company

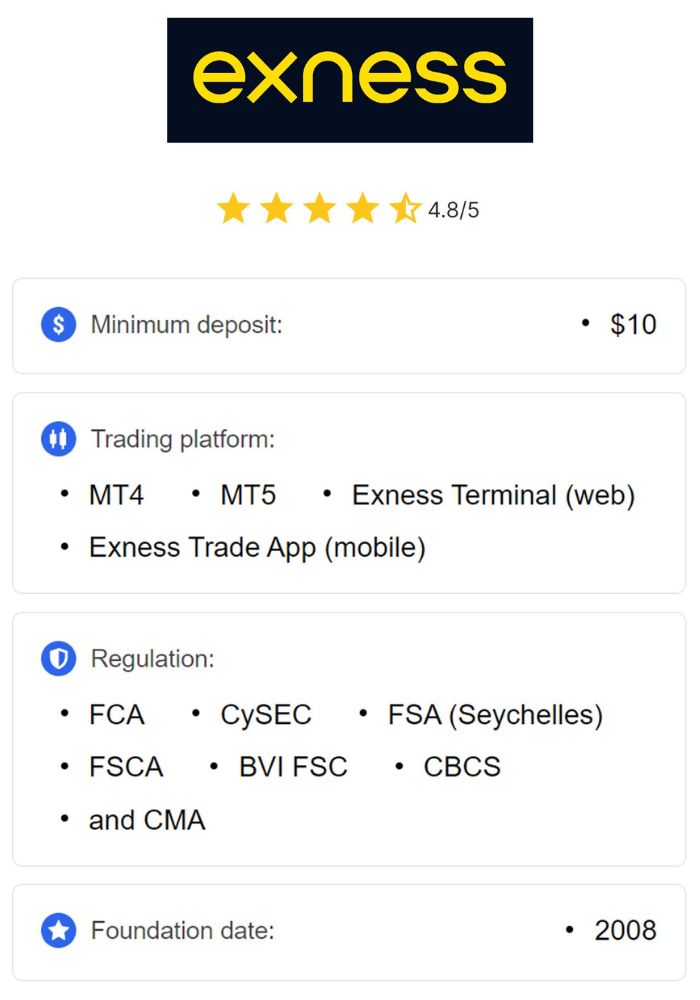

Exness was founded in 2008 and quickly became one of the most prominent forex and CFD brokers globally. Headquartered in Cyprus, the company offers a wide range of trading services to clients around the world. Known for its commitment to transparency and customer service, Exness provides a stable and reliable platform for trading in various financial markets. Over the years, Exness has built a reputation for low spreads, high leverage, and a seamless trading experience for both beginners and professionals.

Exness has expanded its operations beyond Europe, offering services to traders in regions including Asia, Africa, and Latin America. Its platform is user-friendly, making it accessible to a diverse range of traders. Additionally, Exness ensures a high level of customer support and offers educational resources to help clients improve their trading skills.

Services Offered by Exness

Exness offers a wide range of services designed to meet the needs of traders of all experience levels. It provides access to more than 100 financial instruments, including currency pairs, commodities, indices, and cryptocurrencies. The broker offers competitive spreads and reliable liquidity, enabling traders to execute trades efficiently.

In terms of account types, Exness caters to a broad range of traders by offering Standard, Mini, Cent, and ECN accounts. This flexibility ensures that traders can find an account that suits their trading style and risk tolerance. Additionally, Exness offers several educational materials, from articles to webinars, helping traders develop their skills and better understand the market dynamics.

Understanding Regulation in Financial Markets

Importance of Regulation for Forex Brokers

Regulation is vital in the forex industry because it ensures that brokers follow ethical business practices and comply with legal requirements designed to protect traders. Regulatory bodies impose strict standards that brokers must adhere to, including keeping client funds in segregated accounts and providing transparency in trade execution. These rules help minimize the risk of fraud and financial mismanagement.

For traders, dealing with a regulated broker offers peace of mind, knowing that their funds are safeguarded. It also provides a level of assurance that the broker is monitored and held accountable for its actions. Trading with a regulated broker ensures that traders are dealing with a reliable and trustworthy institution.

Regulatory Bodies in South Africa

In South Africa, financial markets, including forex and CFDs, are regulated by the Financial Sector Conduct Authority (FSCA). The FSCA is responsible for ensuring that financial services providers operate transparently and fairly, protecting both consumers and investors. The FSCA regulates forex brokers to ensure they comply with industry standards, providing a safe environment for traders.

Additionally, the South African Reserve Bank (SARB) also plays a role in regulating financial markets. While its primary focus is on the country’s monetary policy, it works alongside the FSCA to ensure the overall stability of South Africa's financial system. This collaboration creates a robust regulatory framework for financial activities, including forex trading.

Exness and Global Regulations

Regulatory Status in Different Countries

Exness is regulated by several leading financial authorities globally, including the Cyprus Securities and Exchange Commission (CySEC), which is a major regulatory body in the European Union. The broker also holds licenses from the UK's Financial Conduct Authority (FCA), one of the most respected financial regulators in the world. Exness’s ability to comply with various regulatory standards in different regions demonstrates its commitment to providing a secure and transparent trading environment.

Other than Europe and the UK, Exness operates in several other regions with regulatory approval, including the Seychelles Financial Services Authority (FSA). By complying with multiple global regulatory frameworks, Exness ensures that it meets high standards of legal and financial compliance, offering traders a secure environment to execute their trades.

Comparison with Other Forex Brokers

When compared to other forex brokers, Exness stands out for its range of regulatory licenses and its commitment to complying with local laws in various regions. Brokers such as IG Group and Pepperstone also hold multiple regulatory licenses from top-tier authorities like the FCA and ASIC. However, Exness’s ability to secure multiple licenses, especially in emerging markets, shows its broad appeal and its effort to meet the demands of traders globally.

What sets Exness apart is its flexibility and transparency. While some brokers claim to be regulated in certain jurisdictions, Exness publicly shares the details of the licenses it holds and is transparent about its regulatory standing. This level of openness makes it a trusted name in the forex industry, especially for traders who prioritize regulation.

Exness Regulation in South Africa

Current Regulatory Framework in South Africa

In South Africa, forex brokers must comply with the regulations set by the Financial Sector Conduct Authority (FSCA) to legally operate in the country. The FSCA monitors and enforces laws designed to protect traders and investors, ensuring that brokers adhere to high standards of conduct. For traders in South Africa, the FSCA’s oversight ensures that brokers are legitimate and trustworthy, with strict rules in place to protect their investments.

At present, Exness is not directly regulated by the FSCA, which means that it does not currently hold an FSCA license for operations in South Africa. However, the broker is authorized in other regions, including Cyprus and the UK, and adheres to strict international standards that ensure traders’ protection. South African traders can still trade with Exness, but they should understand that the broker does not operate under the jurisdiction of the FSCA.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Exness's Compliance with South African Laws

Although Exness is not regulated by the FSCA, it still complies with global regulations that ensure fair and transparent trading practices. Exness operates under the regulatory frameworks of the Cyprus Securities and Exchange Commission (CySEC), FCA, and other top-tier regulators. This compliance demonstrates Exness’s commitment to maintaining high standards of trading practices and fund safety.

For South African traders, the lack of direct FSCA regulation means they should exercise caution when trading. While Exness offers a secure trading environment globally, it is important for South African traders to be aware of the regulatory status and understand the potential risks involved when trading with an unregulated broker in their country.

Exness's Licensing and Registration

Types of Licenses Held by Exness

Exness is licensed and regulated by several financial authorities globally, providing it with credibility and reassurance for traders worldwide. In addition to its CySEC and FCA licenses, Exness also holds licenses from the Seychelles Financial Services Authority (FSA) and the Financial Services Commission of Mauritius (FSC). These licenses are a testament to Exness’s compliance with the financial regulations of multiple jurisdictions, which further supports its reputation as a trustworthy and reliable broker.

Exness’s licenses allow it to offer services to clients across different regions, including Europe, Asia, and Africa. The company’s ability to meet the regulatory standards of various financial authorities ensures that traders can trust Exness with their funds, knowing that the broker operates under strict legal oversight.

Implications of Licensing for Traders

The licenses Exness holds ensure that it meets the regulatory standards required by global authorities, offering traders peace of mind. When a broker is licensed, it is required to follow specific guidelines that protect clients’ funds, maintain transparency in trading practices, and ensure that all operations are fair and above board. For traders, this means that their funds are safer and that they have access to legal recourse in case of disputes.

For South African traders, however, the absence of an FSCA license may imply some risks. While Exness adheres to strict international regulations, traders should be aware that they do not have the direct protection provided by the FSCA. Thus, South African traders should fully understand these risks before proceeding with trading on the platform.

Benefits of Trading with a Regulated Broker

Protection of Funds

One of the key benefits of trading with a regulated broker like Exness is the protection of traders' funds. Regulatory bodies require brokers to hold clients' funds in segregated accounts, ensuring that client funds are separate from the company’s operating funds. This safeguards traders’ investments in case the broker faces financial difficulties or bankruptcy.

In addition to this, regulated brokers are required to participate in compensation schemes or have insurance policies in place to protect clients from unforeseen events. This adds another layer of security for traders who are looking to protect their investments.

Transparency and Trustworthiness

Regulated brokers are held accountable to the authorities overseeing them. This ensures a high level of transparency in their operations. A regulated broker like Exness is required to provide transparent reporting and adhere to strict auditing processes. This level of transparency builds trust among traders, ensuring that their trades are executed fairly and without any hidden fees.

Moreover, regulatory bodies conduct regular checks and audits on licensed brokers to ensure that they are operating within the guidelines set by the relevant authorities. This oversight contributes to the overall trustworthiness of regulated brokers like Exness.

Risks of Trading with Unregulated Brokers

Potential Losses and Scams

Unregulated brokers pose significant risks to traders. Without regulatory oversight, brokers may engage in unethical practices such as misusing client funds, manipulating market conditions, or delaying withdrawals. These risks can lead to significant financial losses for traders who do not carefully choose their brokers.

Traders who choose to trade with unregulated brokers expose themselves to the possibility of fraud and other financial misconduct. As there is no governing body to protect traders in case of disputes, traders may find it difficult or impossible to recover their funds or resolve issues with the broker.

Legal Consequences for Traders

In addition to the risks of financial loss, trading with unregulated brokers can also result in legal consequences. Many unregulated brokers operate outside the boundaries of established laws and may not comply with local regulations. As a result, traders may face legal issues, including difficulties in withdrawing funds or dealing with fraud.

Traders who use unregulated brokers may also find themselves unprotected under the law, leaving them vulnerable to scams and other illegal activities. This is why it is essential to choose a regulated broker like Exness, even if they do not hold local licenses in specific regions like South Africa.

User Experience and Reputation

Trader Reviews and Feedback

Trader reviews play a crucial role in assessing the reputation of any broker. Exness generally receives positive feedback for its user-friendly interface, responsive customer support, and competitive spreads. Many traders appreciate the transparency provided by Exness, particularly when it comes to executing trades and managing their accounts.

However, there are occasional complaints, particularly related to Exness’s limited regulation in certain countries. South African traders should be mindful of this when considering whether Exness meets their individual needs. Despite this, the overall sentiment towards Exness is generally positive, as it continues to offer reliable services.

Industry Awards and Recognition

Exness has received several industry awards and recognitions for its exceptional services, including awards for best forex broker and excellence in customer service. These awards reflect the high level of professionalism and commitment Exness has to its clients.

Industry recognition, especially from prestigious bodies, further solidifies Exness's standing as a reputable broker. While it may not yet hold an FSCA license, the company's strong global regulatory compliance and positive industry recognition make it a trusted broker for many international traders.

Steps to Verify Regulation Status

How to Check a Broker's Regulatory License

To verify a broker's regulatory license, traders can visit the official websites of the relevant financial authorities, such as the FSCA, FCA, or CySEC. On these websites, traders can search for the broker’s name to confirm whether the broker is properly licensed and authorized to operate in their jurisdiction.

It is always advisable to check multiple sources and ensure that the broker holds licenses from reputable and trustworthy authorities. A legitimate, regulated broker will provide all necessary details about their licenses and registration information on their website.

Resources for Traders Seeking Information

Traders can access several resources to check the regulatory status of a broker. Websites like Investopedia, Forex Peace Army, and forums dedicated to forex trading provide in-depth reviews and insights into brokers' regulatory compliance. Additionally, directly contacting the financial authority in the broker's region of operation can clarify any doubts about its legitimacy.

For South African traders, checking with the FSCA can provide crucial information regarding whether a broker is regulated within South Africa and if it complies with local laws.

Conclusion

Exness is a globally recognized broker that offers a variety of services to traders worldwide. Although Exness is regulated in several countries, including Cyprus and the UK, it does not hold a direct license from the FSCA to operate in South Africa. Traders in South Africa can still use Exness for trading, but they should be aware of the potential risks and ensure they fully understand the regulatory status of the broker before proceeding.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

While Exness offers a secure and reliable trading environment globally, South African traders should carefully consider the lack of FSCA regulation when choosing to trade with the broker. As always, it’s essential for traders to be diligent and prioritize safety when choosing a forex broker.

Read more: